AXIS Forex Broker CRM v7.45.0 Update – Enhanced Prop Trading Challenge Controls

The forex industry continues to evolve rapidly, with prop trading gaining strong traction among both forex brokers and modern trading firms. Built with an integrated Prop Challenge module, the AXIS Forex Broker CRM continues to evolve in step — and its latest v7.45.0 update brings targeted upgrades such as Manual Trader Advancement, Max Loss Per Closed Trade Rule, and IBs commission on discounted fees, sharpening risk management, boosting flexibility, and improving commission handling. These enhancements help brokers and prop firms streamline operations, scale faster, and deliver a seamless trading experience for their prop traders and clients.

At its core, this release gives prop trading and brokerage firms greater control over trader evaluation frameworks while aligning commission structures with real-world business needs. Whether you’re running a promotion, managing onboarding, or fine-tuning risk limits, the AXIS Forex CRM provides a smarter way to manage prop trading operations with precision.

Forex CRM Key Function Update

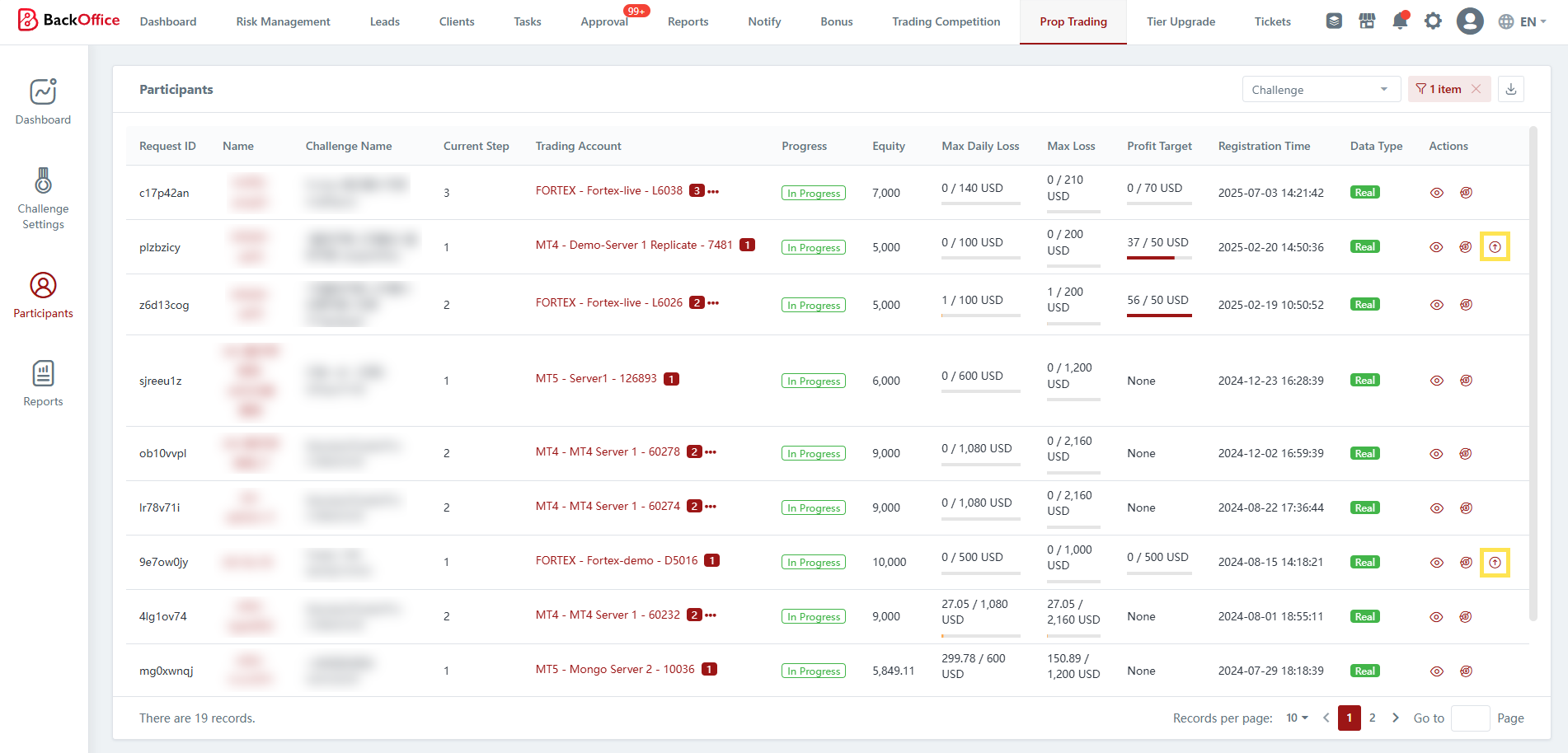

1. Manual Trader Advancement for Flexibility

Every prop trading firm encounters edge cases—traders who show exceptional performance, disputes that require careful judgment, or promising candidates who deserve fast-tracking. With the new Manual Trader Advancement feature, brokers can now move traders forward in the prop challenge process without altering their entire evaluation framework.

This capability empowers brokers to manage traders more effectively, giving them the freedom to recognize talent while maintaining consistent evaluation standards and ensures that high-potential traders are not lost due to rigid rules.

2. Max Loss Per Closed Trade – Stronger Risk Controls

Effective risk management lies at the heart of every successful prop trading operation. The newly added “Max Loss Per Closed Trade” rule introduces a granular way to track and mitigate trader risk. If a trader exceeds the loss threshold on any individual closed trade, they automatically fail the challenge.

This functionality allows brokers and prop firms to control risk in real time, ensuring that high-risk behavior is flagged early without waiting until the end of a trading cycle. This delivers stronger protection against reckless trading while providing client insights into how traders handle loss.

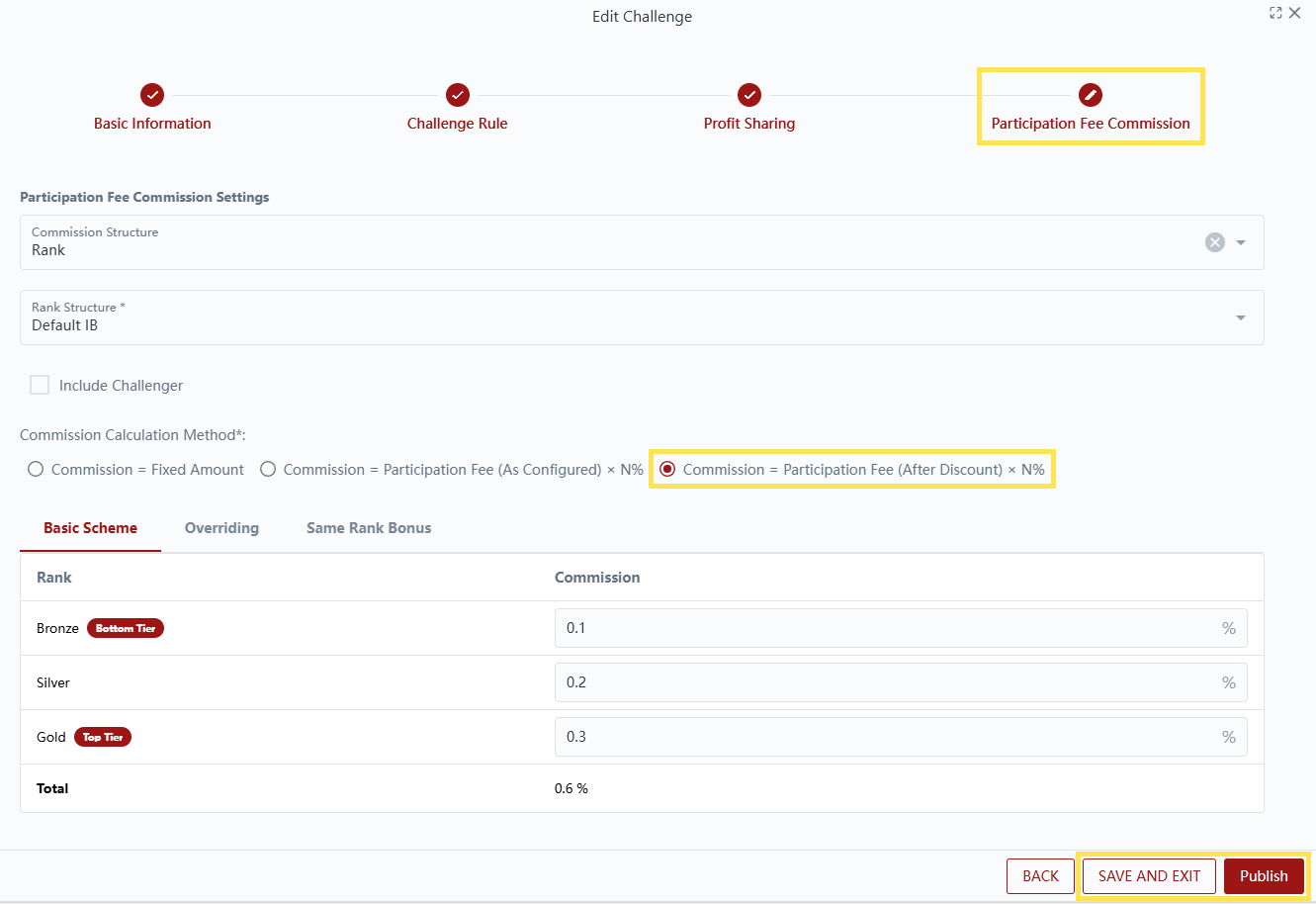

3. IB Commission Alignment with Discounted Fees

Commission accuracy is critical for both IBs (introducing brokers) and affiliates. The v7.45.0 update introduces the ability to calculate IB commissions based on discounted participation fees. This means commissions are tied to the actual amount paid rather than standard fees—ensuring fairer payouts during promotions, custom pricing, or campaigns.

By aligning incentives correctly, brokers can help their IBs and affiliates attract new clients, boost retention, and build stronger long-term partnerships. It’s another example of how the AXIS Forex CRM, with its inbuilt Prop Challenge module, adapts to real business models while eliminating unnecessary discrepancies.

Why These Updates Matter for Forex Brokers and Prop Firms

In today’s highly competitive market, forex brokers and prop firms need more than just a trading platform — they need a complete trading experience that’s engaging, rewarding, and professional. That’s where a robust CRM system comes in, integrating seamlessly with popular platforms like MT4, MT5, cTrader, and Match-Trader, while also supporting social trading, onboarding and compliance workflows, and aggregated liquidity connection through a trusted liquidity provider.

The AXIS Forex Broker CRM isn’t just another CRM solution — it’s a comprehensive Prop Trading ecosystem built around the real needs of forex brokers and proprietary trading firms. With its feature-rich dashboard, FX back-office support, centralized client database, and instant updates, it empowers firms to manage operations efficiently while staying ready to scale.

Streamline Operations with Advanced Forex CRM

Unlike traditional CRM providers, AXIS focuses on customizability, functionality and user experience designed specifically for trading brokers and prop trading firms. The system integrates with popular third-party tools and vendors, ensuring seamless workflows across trading accounts, compliance, and back-office operations.

From turnkey forex solutions to integrations such as Stripe payments and Brokeree Social Trading solutions, the AXIS CRM makes it simple to launch your prop program, manage payouts and provide a modern CRM experience. By leveraging a robust CRM solution, brokers can deliver a smoother onboarding process, improve client retention, and build the foundation for a successful prop trading brand.

The AXIS Forex Broker CRM isn’t just another CRM solution — it’s a comprehensive Prop Trading ecosystem built around the real needs of forex brokers and proprietary trading firms. With its feature-rich dashboard, FX back-office support, centralized client database, and instant updates, it empowers firms to manage operations efficiently while staying ready to scale.

Elevating the Prop Trading Business in 2025

As more FX brokers look to diversify with prop trading business models, choosing the right technology partner is critical. The AXIS CRM for prop not only helps in scaling your venture, but also equips you with the tools to manage traders, configure CPA programs, and gain analytical insights that drive growth. For forex brokerage startups and established firms alike, this CRM for proprietary trading offers the flexibility, scalability, and compliance needed to compete with the top forex and prop brands in 2025. With features that are tailored to the unique needs of brokers, it’s a powerful CRM solution to build lasting growth.Conclusion

The AXIS v7.45.0 update is more than an incremental release—it’s a game-changing upgrade for Prop firms and Forex brokers who want to stay competitive in today’s dynamic market. By combining manual advancement controls, per-trade risk safeguards, and fairer commission structures, it gives brokers the full control they need to operate a successful prop business.

Whether you’re looking to streamline your back office system, integrate seamlessly with a white label trading platform, or unlock client insights with real-time analytics, the AXIS CRM is the CRM solution designed to help you thrive.

About Broctagon Fintech Group

Broctagon Fintech Group is a leading multi-asset liquidity and FX technology provider with over 15 years of global expertise. We empower forex brokers with performance-driven, bespoke solutions — anchored by our flagship AXIS FX CRM, institutional-grade liquidity, and prop-trading solutions. Trusted by 350+ clients in 50+ countries, we deliver the technology that keeps brokerages ahead of the curve.