This month, we rolled out a couple of updates for NEXUS 2.0, our proprietary Liquidity Aggregator Engine, adding to its fleet of functionalities to further empower digital asset exchanges. These updates are community-driven, to ensure continual improvements in terms of industry best practices and user relevancy. In this latest patch, we will cover upgraded features including an all-new monitoring system, price filters, increased decimal range and LMS enhancements.

Straight-Through-Processing (STP) Engine

- Margin Monitoring – Exchanges will receive notifications via SMS and/or slack when their available balances approaches/falls below their pre-set thresholds. This automated monitoring will ensure healthy margin levels are maintained with liquidity providers for uninterrupted STP connectivity.

- Price Screening – New deviation parameters will allow the system to capture and prevent all market pricing irregularities from entering the orderbook. This automated filtering process will prevent abnormalities such as sudden price surges for an enhanced client trading experience.

- Increased Decimal Range – This upgrade now allows orders that fall within an even wider decimal range to enter your orderbook, further enhancing liquidity.

Liquidity Management System (LMS)

Fail-safe Enhancement: Implemented a safeguarding mechanism that increases the accuracy of your Native Token’s pre-set price trajectory regardless of market conditions.

What is NEXUS 2.0?

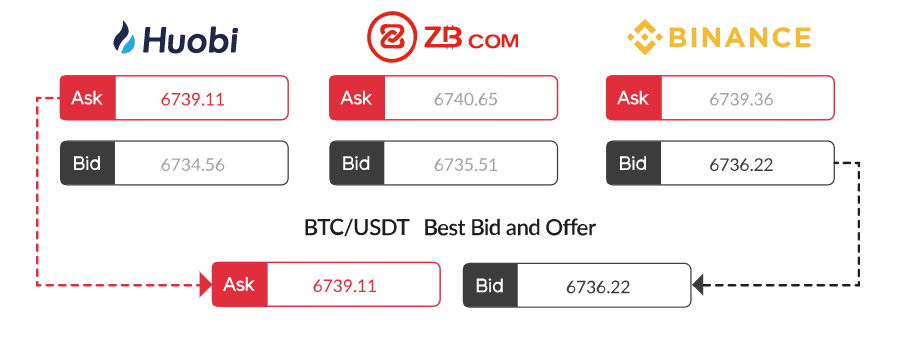

Powered by smart order routing, NEXUS 2.0 bridges the worlds of forex and crypto with its proprietary universal FIX API adaptor that aggregates price quotes from top Digital Asset Exchanges and Prime of Prime (PoP) brokers.

With NEXUS 2.0, elevate your exchange with enhanced charts featuring higher tick frequency, improved market depths of an aggregated order book, consistent best bid/ask pricing quotes and the ability to execute STP orders.

- Aggregate multiple top sources of liquidity into one orderbook

- Achieve consistent real-time best bid best offer price quotes

- Ascend your brand to instantly compete on a global level