Brokerage. Blockchain. Buzz.

Welcome, find all things buzzing on board at Broctagon’s blog! Here you’ll find the latest in blockchain news, exciting event highlights, insightful thought leadership in forex and crypto, and more. Be the first to know all about our events and most innovative tech updates – all in one space.

In our most recent update, we've focused on optimizing essential CRM modules. Key improvements include expedited onboarding with the ability to opt out of email OTP verification during account registration. Furthermore, trading reports are now automatically generated by default, and editing promotional link domains is now a seamless process without the need for recreation. Additionally, we have refined the user interface to enhance navigation and intuitiveness. Discover the details of these updates and enhancements below. Key Function Highlights Disable Email OTP Verification You can now opt for a faster account registration process by disabling email OTP verifications at the time of registration. This allows your clients to swiftly onboard initially and then choose to reinforce security by activating OTP verifications at a later stage. Send Trading Reports by Default Automated delivery of trading reports is now the default option upon trading account creation, eliminating the need for manual activation. Update Domain for Promotional Link You now have the ability to directly edit link domains, removing the hassle for deletion and recreation, thereby saving time and effort. UI Enhancements Client Portal Improvements: Your clients will now enjoy improved access to their User ID and Referral code, making it easier for them to navigate the platform. Client Group & Role Permissions UI Optimization: To streamline user experience, visible "Edit" icons have been implemented, simplifying the process of modifying group and role names and descriptions for improved usability. Sign Up Free Trial Request a Demo

- 27.03.2024

- All

- READ MORE

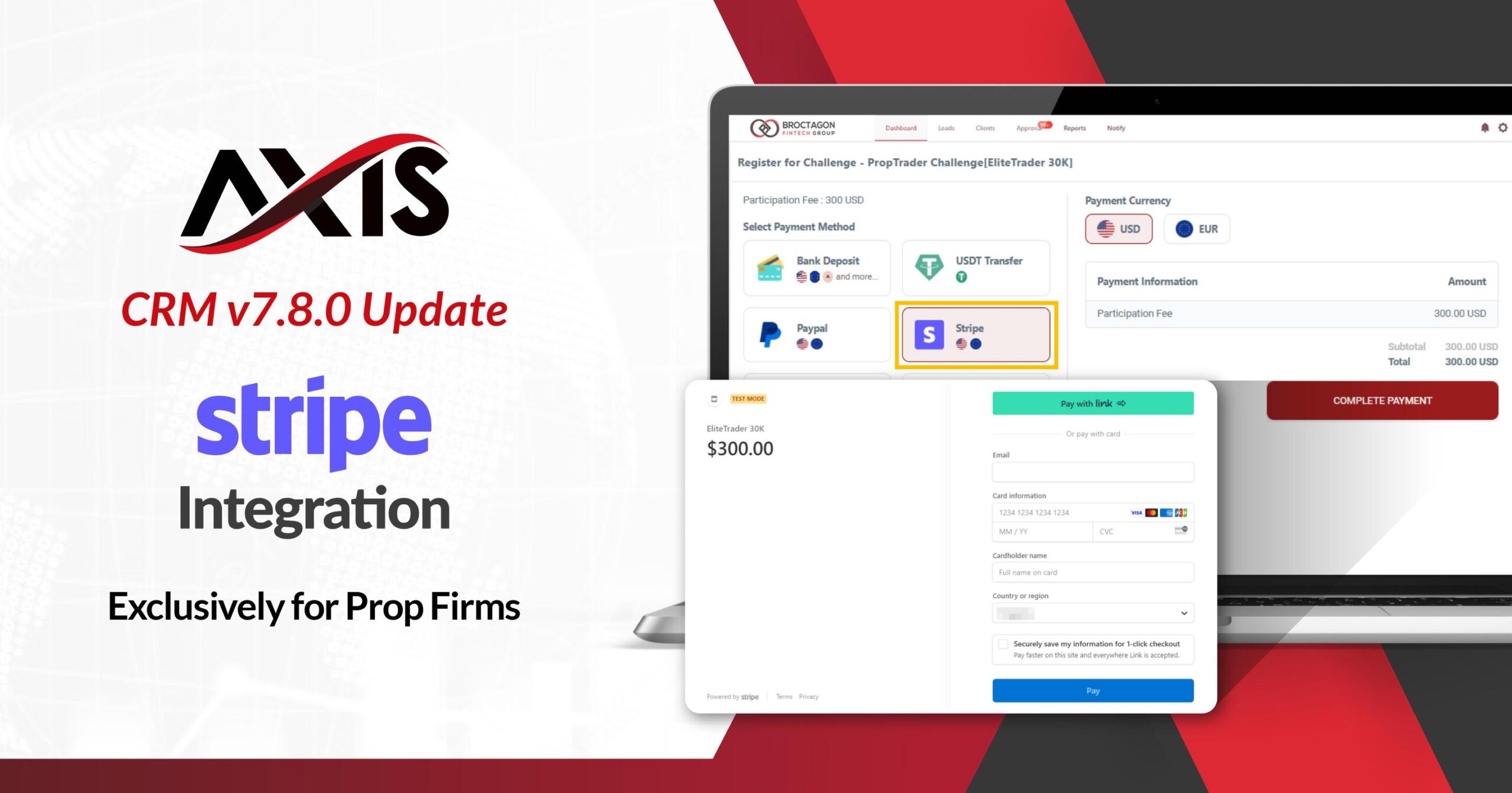

Good news to all Prop Firms! Version 7.8.0, features a full integration with Stripe - a new payment channel addition exclusively for prop trading. Simply enable the feature within your CRM marketplace, register for a Stripe account and you are all set to onboard Prop Challenge participants all from every corner of the globe. Read on for more details on this exciting release. Important: Stripe is exclusively available to Proprietary Trading Firms and is not accessible to FX brokers. Key Function Highlights Trusted Payment Provider Trusted by millions of businesses, from startups to Fortune 500 companies, Stripe is a globally recognized payment solution. By integrating Stripe, you can confidently provide your clients with a trusted and credible payment channel, ensuring the security of funds and peace of mind for all parties involved. Extensive Payment Options Enable your trader's unprecedented convenience with Stripe's extensive array of over 100 payment methods, catering to diverse client preferences. Operating in over 40 countries and supporting hundreds of currencies, Stripe ensures accessibility and seamless transactions worldwide. Enhanced Payment Management Experience real-time updates on payment statuses, empowering you to efficiently review and manage payments, ensuring prop challenge participants are able to purchase related services timely. Sign Up Free Trial Request a Demo

- 13.03.2024

- All

- READ MORE

Broctagon, a leading provider of multi-asset liquidity and comprehensive FX solutions, proudly announces its latest strategic alliance with Tools for Brokers (TFB), an esteemed international technology provider catering to retail brokers, hedge funds, and proprietary trading firms. This pivotal partnership marks a significant step forward in enhancing Broctagon's client experience by facilitating seamless access to liquidity through TFB's cutting-edge Trade Processor liquidity bridge. By integrating Trade Processor into its ecosystem, Broctagon strives to simplify the process of accessing liquidity for all its valued clients. This integration not only simplifies the steps involved but also broadens the scope of aggregated liquidity available to Broctagon's clientele. Consequently, clients can mitigate risks and secure optimal pricing, even amidst atypical market conditions or slowdowns. Broctagon remains committed to delivering unparalleled liquidity solutions and innovative FX services, and this collaboration with Tools for Brokers underscores our unwavering dedication to empowering clients with advanced trading capabilities and seamless access to global markets. At the same time, Broctagon’s award winning liquidity will be made available to all T4B’s users as well. Commenting on the partnership, Don Guo, the CEO at Broctagon, said: “Our collaboration with Tools for Brokers not only improves our routing and delivery of over 1800 financial instruments but also resonates with our core objective of providing innovative solutions tailored to our clients' evolving needs. This partnership solidifies both firms’ dedication to driving client success.” Alexey Kutsenko, the CEO at Tools for Brokers, added: “Broctagon is one of the most reputable and well-known liquidity providers in the sector, so we are very excited about this cooperation. We are confident that their liquidity combined with our technology will provide the most effective product for our clients.” At Broctagon, we recognize the significance of Trade Processor, Tools for Brokers' premier liquidity bridging and gateway solution, in addressing the diverse requirements of retail brokers, proprietary trading firms, and hedge funds. This innovative solution boasts advanced features such as order aggregation and execution, adaptable configuration options, and integrated risk management and reporting functionalities tailored for compliance and internal monitoring purposes. About Broctagon Broctagon Fintech Group is a leading multi-asset liquidity and full-suite FX technology provider headquartered in Singapore. The company specialises in performance-driven and bespoke solutions, serving more than 350 clients worldwide with its flagship SaaS FX CRM, Institutional grade FX & Crypto liquidity as well as White Label trading platform and Prop Trading Challenge technology. With over 15 years of fintech finesse, global offices in 7 countries, and a passionate team of go-getters, Broctagon prides itself on empowering FX businesses to reach the next level through innovation and world-class service. For more information: https://broctagon.com/ Ling Ling [email protected] +6588635428 About Tools for Brokers Tools for Brokers (TFB) is an international technology provider for retail brokers, liquidity providers, prop trading companies, and hedge funds operating on multiple platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), MatchTrader, and cTrader. It offers an ecosystem of solutions centred around the flagship Trade Processor liquidity bridge. It is supported by data analytics, risk management, money management, and a single web-user interface to manage individual TFB plugins all in one place. For more information: https://t4b.com/ Yulia Ogorodnikova [email protected] +447503599088

- 07.03.2024

- Partnerships

- READ MORE

Broctagon, a leading provider of innovative FX technology solutions, is excited to announce its strategic partnership with Stellar Partners, a renowned investment firm boasting a diverse portfolio inclusive of real estate investments, hospitality ventures, private equity endeavours, seed funding initiatives, as well as alternative and opportunistic investments in blockchain and digital assets. Stellar’s strategic approach to investment, coupled with a commitment to maximizing returns and discovering hidden opportunities, aligns seamlessly with the objectives of Prop Trading Challenge firms who seek to unearth talented traders and empowering them with institutional resources for a win-win outcome. "Stellar Partners is excited to partner with Broctagon to provide Proprietary trading firms with capital support to fund the live accounts of their promising traders," said David Wang, Partner at Stellar Partners. “We’ve reaped the rewards as early movers in the crypto space and recognize this rising phenomenon that is prop trading is a natural fit within our investment mandate under alternative opportunities. With the sector's exponential growth and stringent criteria ensuring trader competence before accessing funds, we perceive substantial potential in the FX prop trading domain.” "Our partnership with Stellar Partners marks a new milestone for the prop trading sector, introducing a groundbreaking initiative where successful challenge participants from Proprietary trading firms will receive funding from an investment company with extensive portfolio. This addresses a fundamental authenticity question that has lingered within the industry, casting doubt on whether traders truly receive funding for live trading,” stated Don Guo, CEO at Broctagon. “With Stellar’s involvement, challenge participants onboarded with our Prop solution clients can have that peace of mind knowing that there are ready funds awaiting their success, ushering in a new era of confidence and support.” A Pivotal Moment for Proprietary Trading As part of the collaboration, Stellar Partners will provide capital funding for live trading accounts of traders onboarded with Proprietary Trading Firms utilizing Broctagon’s fully managed proprietary solutions. This is part of Broctagon’s initiative to provide end-to-end turnkey solutions for clients. From trading platforms and CRM equipped with KYC and Payment functions, to multi-asset liquidity and now external live account funding, our clients can truly focus on the success of their traders while leaving the rest of the intricacies to us. For more information about our Prop Solutions, please click here. Or simply click here to schedule a demo. About Broctagon:Broctagon Fintech Group is a leading multi-asset liquidity and full-suite FX technology provider headquartered in Singapore. The company specialises in performance-driven and bespoke solutions, serving more than 350 clients worldwide with its flagship SaaS FX CRM, Institutional grade FX & Crypto liquidity as well as White Label trading platform and Prop Trading Challenge technology. With over 15 years of fintech finesse, global offices in 7 countries, and a passionate team of go-getters, Broctagon prides itself on empowering FX businesses to reach the next level through innovation and world-class service. For more information: https://broctagon.com/ About Stellar Partners: Stellar Partners operates as a global investment firm, specializing in equity, real estate, and opportunistic projects. With a steadfast focus on strategic capital deployment and rigorous due diligence, the company aims to maximize returns for its shareholders. Leveraging the expertise of its seasoned team, Stellar Partners customizes investment strategies that synergize with its diverse portfolio, delivering targeted results across various sectors on a global scale. For more information: https://1stellar.com/

- 05.03.2024

- Partnerships

- READ MORE

Today, Ted Quek, the CTO and co-founder of Broctagon, had the honour of addressing students at Raffles Institution, one of Singapore's premier educational institutions known for nurturing some of the brightest minds and future leaders. Notably, Raffles Institution holds a special place in Singapore's history as the alma mater of the country's founding father, Mr. Lee Kwan Yew. Paying It Forward: Unleashing the Power of IKIGAI Ted's talk centred around the crucial concept of IKIGAI, emphasizing the importance of discovering that unique intersection where one's passion, mission, vocation, and profession converge — a philosophy that resonates deeply with aspiring entrepreneurs. During his session, Ted highlighted the significance of forming a dream team, stressing that success isn't a solitary pursuit but rather about building a tribe — a collective of individuals who share a common vision and unwavering commitment. Together, such teams create a solid foundation upon which businesses can thrive and innovate. Trials and Tribulations Navigating the entrepreneurial journey isn't without its challenges, Ted acknowledged. acknowledged a spectrum of obstacles that entrepreneurs often face, including rejection, loneliness, fear of failure, betrayal, burnout, and constant pressure. These challenges are part and parcel of the entrepreneurial journey, testing one's resilience and determination. However, he underscored that mindset matters, and with the right perspective and strategic approach, entrepreneurs can weather any storm that comes their way. Ted also painted a picture of the win-win magic that unfolds within passionate, aligned teams, where productivity is fuelled by shared enthusiasm and collaboration fosters groundbreaking innovation. A Heart of Gratitude Expressing gratitude and making a positive impact were recurring themes throughout Ted's talk. He urged aspiring entrepreneurs not only to appreciate their clients but also to pay it forward to society, thereby contributing to a collective tapestry of positive change. In contemplating the legacy we leave behind, Ted encouraged the audience to recognize that their actions ripple through time, inspiring others to follow in their footsteps and contribute to a brighter future for generations to come. Ultimately, Ted reminded the audience that as entrepreneurs, they are torchbearers tasked with igniting fires of possibility, sparking dreams, and creating a world brimming with opportunity and optimism. In Ted Quek's words, the journey of entrepreneurship isn't just about building successful businesses; it's about inspiring, igniting, and impacting lives, leaving behind a legacy of meaningful change and empowerment. The Broctagon Culture Ted Quek integrates the principles of resilience, collaboration, and purpose into both life and work. Broctagon's innovation is driven by embracing challenges as opportunities for growth, reflecting Ted's emphasis on maintaining a positive mindset and strategic approach. The company's client relationships are rooted in gratitude, impact, and legacy, exemplifying a commitment to exceptional service and a positive ripple effect in the industry. OrganizersThank you to Santusht Narula and the Raffles Entrepreneur's Network as well as Deon Senturk and the team at Slashie for making this session possible.

- 29.02.2024

- All

- READ MORE

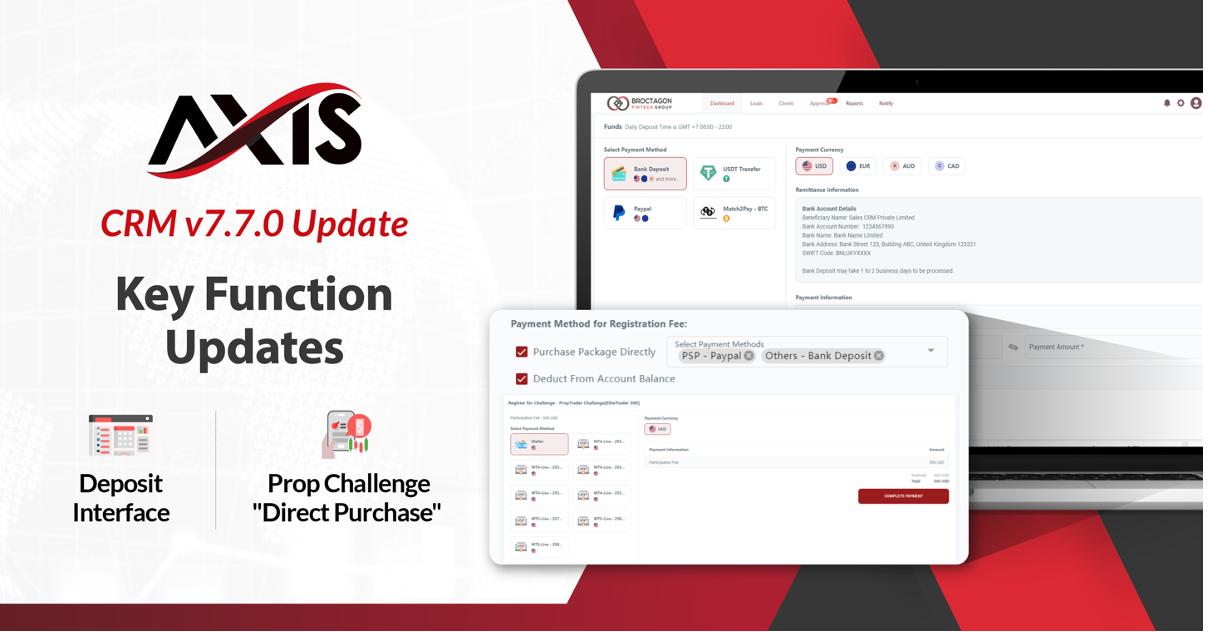

This new release spots a deposit interface overhaul, introducing intuitive icons on a streamlined single page for easy navigation. In addition, your clients can now directly purchase a package to participate in challenges, bypassing the need for an initial e-wallet deposit. These enhancements promise a smoother user experience. Additionally, we've optimized the MT4 comprehensive report extension and trading server display, further enhancing the overall functionality of our CRM. Key Function Highlights: 1. New Deposit Interface Enhanced VisualsNewly introduced visual elements enhances clarity and intuitiveness for users. Clients can now quickly identify their preferred deposit method at a glance. Single Page NavigationWith the deposit process optimized into a one-page format, clients can now navigate through each step seamlessly. This reduces complexity and ensures that all necessary details are presented cohesively, providing clients a clear overview of their entire deposit action. 2. Direct Purchase of Prop Packages Instant Prop Challenge Participation The introduction of a direct purchase function allows for faster and easier challenge access, greatly improving client conversion. Flexible Payment MethodsEnjoy full autonomy in configuring the permissible payment methods for each challenge package, meeting the diverse preferences of your target audience. 3. Additional Enhancements Improved MT4 Comprehensive Report Extension Building upon existing functionalities, the enhanced MT4 comprehensive report extension now includes referral data alongside downlines of specific clients, offering you deeper insights. Additionally, this update introduces further functions to enrich the user experience and analytical capabilities. Customizable Trading Server DisplayThe ability to customize trading server names provides you with greater flexibility and control over your platform's branding and presentation. Read here to find out more Sign Up Free Trial Request a Demo

- 26.02.2024

- All

- READ MORE

This major release brings a host of updates to our Prop Trading System, elevating experiences for both end users and administrators. Now, Prop Firms can effortlessly calculate and distribute profit sharing not only to challengers but IB/referrals as well, offering a powerful incentive to attract more participants. Furthermore, the challenge setup process has been refined for enhanced intuitiveness and flexibility, such as assigning challenges based on client groups, non-disruptive challenge terminations and more. Dive in to explore the full spectrum of improvements! 1. Revamped Challenge Setup Process Streamlined Step-by-Step Setup Experience a redesigned Challenge setup process, featuring a clear and intuitive progress bar providing real-time updates on remaining steps. Flexible Display Configuration Take control of your clients' experience by prioritizing which menu to show first: "My Challenge" or "Challenge Details." It's your call whether to have your clients jump right in to choosing packages or to first have an overview of the challenge. 2. Profit Sharing Distribution Profit Sharing Configuration Unlock unprecedented convenience by configuring profit sharing within the system, designed to distribute rewards seamlessly to both challengers and referrals, ensuring a hassle-fee process and timely payouts for all recipients. Flexible Distribution Methods Choose between automated distribution for administrative efficiency or manual distribution for greater control, incorporating a review step before profits are distributed. Adjustable Settlement Frequency Customize your profit-sharing distribution frequency to align with your business strategies and goals. 3. Dynamic Challenge Allocation Across Client Groups Tailored Challenges for Specific Client Groups Assign distinct challenges and packages to different client groups, ensuring a more targeted and customized approach to enhance your client conversion and retention. Non-Disruptive Experience on Live Clients The challenge assignment process emphasizes a seamless transition, guaranteeing that no challenge participant is impacted, thereby ensuring business continuity and and ongoing client engagement. 4. Smart-Switch Challenge Termination Process Seamless Challenge Termination Markets are dynamic and now, you can easily update your challenge configurations accordingly. The smart-switch feature will remove the older challenge preventing further signups while showcasing your new challenge with updated conditions. Non-Disruptive Experience for Live Clients Smart-switch intelligently handles the challenge termination process, ensuring that current participants of the older challenges are not affected, allowing them to proceed until completion. Participants in the older challenge will continue to track their progress, while new participants will enroll in the updated challenge seamlessly. 5. Advanced Notification Management Prop Trading Notification Tab Introducing a specialized Notifications Tab designed to filter all Prop-related requests and tasks, enhancing focus and efficiency. Personalized Congratulatory Email to Challengers Celebrate your challengers' successes with added flair. Now, when challengers successfully progress to the next level, they will automatically receive a congratulatory email from you, including a timestamp on the achieved milestone. You can further customize the email to embed a "Success" certificate as added recognition to your clients. Read here to find out more Sign Up Free Trial Request a Demo

- 21.02.2024

- All

- READ MORE

In this update, we’re thrilled to introduce an extension to our IB commission payout module. Now, alongside volume, spread, and profit-based payouts, you can reward your IBs based on commissions configured on your trading platform. Any commissions charged within your MT4, MT5, cTrader, Sirix and ZeroX are synchronized in real-time with the CRM, allowing you to distribute a percentage of these trading platform commissions directly to your IBs. This robust feature not only provides the flexibility to transform a direct platform commission into a multi-tiered reward system, but also ignites synergies for growth and collaboration within your IB network. Additionally, system popup notifications are now extended to your clients as well! Your clients no longer need to sift through emails for updates. The enhanced notification function sends automatic pop-up notifications within the CRM, promptly informing clients about request updates such as approvals or rejections. Stay connected and streamline client interactions effortlessly. Platform Trading Commission-Based IB Payout Model 1. Simple and Direct Configuration This innovative model allows you to extract the pre-set trading platform commissions and further customize it to be distributed by percentages across multiple levels, allowing brokers a straightforward approach to creating an effective IB reward structure. 2. Real-Time Synchronization of Trading Commissions The commissions configured on your trading platforms—MT4, MT5, cTrader, Sirix, and ZeroX—are now synchronized in real time with the CRM. This facilitates prompt payout distribution to your IBs based on the percentage of trading platform commissions you have set. 3. Enhanced Reporting Reports have been further refined with added commission details, providing a clear overview of charged commissions and the corresponding amounts paid to IBs. This optimization simplifies tracking and enhances transparency in your financial transactions. System Pop-Up Notifications to Clients 1. Enhanced Convenience Elevate the client experience with unparalleled convenience. Your clients no longer have to sift through emails; they can receive updates directly from the CRM, ensuring prompt and hassle-free communication. 2. Customizable Templates Tailor pop-up notifications to your preferences. Enjoy the flexibility of customizable pop-up templates, aligning notifications with your corporate branding for a cohesive client engagement. 3. Smart Language Preferences Experience intuitive and seamless communication as the CRM intelligently sends notifications in your client's preferred default language. Stay connected effortlessly with language preferences that prioritize your client's experience. Read here to find out more. Sign Up Free Trial Request a Demo

- 24.01.2024

- All

- READ MORE

We're back from the electrifying iFX Expo Dubai 2024, held in the heart of this dynamic city! The financial world converged on this dynamic event, and Broctagon was proud to be in the midst of it all. The expo, which took place from January 16-18, was a whirlwind of excitement and opportunity at the Dubai World Trade Centre. From reconnecting with familiar faces to forging new connections, the energy was infectious. The Welcome Party set the stage for an unforgettable experience and presented a fantastic opportunity to catch up over drinks with industry leaders, clients, and partners. Against the backdrop of the iconic Dubai skyline, we raised our glasses to the promising days ahead. For those who were there, you know what a fantastic night it was! And of course, we made sure to extend an invitation to everyone to visit Broctagon at Booth 130 during the expo. A Powerful Combination of Prop Solutions and World Class Liquidity Day 1 kicked off with a bang as the expo halls filled up rapidly with eager attendees. The Broctagon Team was ready to showcase our latest offerings and solutions tailored to meet the diverse needs of our clients. Whether it's crafting bespoke liquidity solutions spanning FX, shares, cryptocurrencies, and futures, or delving into the realm of fully managed Prop Trading, we left no stone unturned in demonstrating how we can help our partners stay ahead of the curve with our fully integrated solutions suite. The response from the crowd was overwhelming, and we couldn't be more thankful for the enthusiasm and support shown by both old friends and new acquaintances. Your satisfaction and trust in Broctagon fuel our drive for innovation, and we're committed to delivering nothing short of excellence in all that we do. Onward To the Next Adventure: Traders Fair Thailand 2024 As the curtains draw to a close on the iFX Expo Dubai 2024, we're already gearing up for the next adventure. Mark your calendars for the Traders Fair Thailand in Bangkok on 3rd Feb! We can’t wait to meet you in the bustling city of Bangkok to share our perfect blend of international expertise and localized Thai support. In closing, a heartfelt thank you to Dubai, the iFX Expo team, and everyone who made this event a resounding success. Until we meet again, let's keep pushing the boundaries and charting the course to success together. For now, its busy time again with the string of new prop firms and liquidity setups on the horizon. Missed Us at iFX? We are Online 24/7 Couldn't make it to iFX Expo Dubai 2024? No problem at all! You can easily schedule an online meeting with our specialists at your convenience. Fully ManagedProp Solutions Learn More Multi Asset Liquidity Learn More FX Broker CRM Learn More

- 19.01.2024

- All

- READ MORE

Broctagon, a leading provider of multi-asset liquidity and comprehensive FX solutions, proudly announces its latest strategic alliance with Tools for Brokers (TFB), an esteemed international technology provider catering to retail brokers, hedge funds, and proprietary trading firms. This pivotal partnership marks a significant step forward in enhancing Broctagon's client experience by facilitating seamless access to liquidity through TFB's cutting-edge Trade Processor liquidity bridge. By integrating Trade Processor into its ecosystem, Broctagon strives to simplify the process of accessing liquidity for all its valued clients. This integration not only simplifies the steps involved but also broadens the scope of aggregated liquidity available to Broctagon's clientele. Consequently, clients can mitigate risks and secure optimal pricing, even amidst atypical market conditions or slowdowns. Broctagon remains committed to delivering unparalleled liquidity solutions and innovative FX services, and this collaboration with Tools for Brokers underscores our unwavering dedication to empowering clients with advanced trading capabilities and seamless access to global markets. At the same time, Broctagon’s award winning liquidity will be made available to all T4B’s users as well. Commenting on the partnership, Don Guo, the CEO at Broctagon, said: “Our collaboration with Tools for Brokers not only improves our routing and delivery of over 1800 financial instruments but also resonates with our core objective of providing innovative solutions tailored to our clients' evolving needs. This partnership solidifies both firms’ dedication to driving client success.” Alexey Kutsenko, the CEO at Tools for Brokers, added: “Broctagon is one of the most reputable and well-known liquidity providers in the sector, so we are very excited about this cooperation. We are confident that their liquidity combined with our technology will provide the most effective product for our clients.” At Broctagon, we recognize the significance of Trade Processor, Tools for Brokers' premier liquidity bridging and gateway solution, in addressing the diverse requirements of retail brokers, proprietary trading firms, and hedge funds. This innovative solution boasts advanced features such as order aggregation and execution, adaptable configuration options, and integrated risk management and reporting functionalities tailored for compliance and internal monitoring purposes. About Broctagon Broctagon Fintech Group is a leading multi-asset liquidity and full-suite FX technology provider headquartered in Singapore. The company specialises in performance-driven and bespoke solutions, serving more than 350 clients worldwide with its flagship SaaS FX CRM, Institutional grade FX & Crypto liquidity as well as White Label trading platform and Prop Trading Challenge technology. With over 15 years of fintech finesse, global offices in 7 countries, and a passionate team of go-getters, Broctagon prides itself on empowering FX businesses to reach the next level through innovation and world-class service. For more information: https://broctagon.com/ Ling Ling [email protected] +6588635428 About Tools for Brokers Tools for Brokers (TFB) is an international technology provider for retail brokers, liquidity providers, prop trading companies, and hedge funds operating on multiple platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), MatchTrader, and cTrader. It offers an ecosystem of solutions centred around the flagship Trade Processor liquidity bridge. It is supported by data analytics, risk management, money management, and a single web-user interface to manage individual TFB plugins all in one place. For more information: https://t4b.com/ Yulia Ogorodnikova [email protected] +447503599088

- 07.03.2024

- Partnerships

- READ MORE

Broctagon, a leading provider of innovative FX technology solutions, is excited to announce its strategic partnership with Stellar Partners, a renowned investment firm boasting a diverse portfolio inclusive of real estate investments, hospitality ventures, private equity endeavours, seed funding initiatives, as well as alternative and opportunistic investments in blockchain and digital assets. Stellar’s strategic approach to investment, coupled with a commitment to maximizing returns and discovering hidden opportunities, aligns seamlessly with the objectives of Prop Trading Challenge firms who seek to unearth talented traders and empowering them with institutional resources for a win-win outcome. "Stellar Partners is excited to partner with Broctagon to provide Proprietary trading firms with capital support to fund the live accounts of their promising traders," said David Wang, Partner at Stellar Partners. “We’ve reaped the rewards as early movers in the crypto space and recognize this rising phenomenon that is prop trading is a natural fit within our investment mandate under alternative opportunities. With the sector's exponential growth and stringent criteria ensuring trader competence before accessing funds, we perceive substantial potential in the FX prop trading domain.” "Our partnership with Stellar Partners marks a new milestone for the prop trading sector, introducing a groundbreaking initiative where successful challenge participants from Proprietary trading firms will receive funding from an investment company with extensive portfolio. This addresses a fundamental authenticity question that has lingered within the industry, casting doubt on whether traders truly receive funding for live trading,” stated Don Guo, CEO at Broctagon. “With Stellar’s involvement, challenge participants onboarded with our Prop solution clients can have that peace of mind knowing that there are ready funds awaiting their success, ushering in a new era of confidence and support.” A Pivotal Moment for Proprietary Trading As part of the collaboration, Stellar Partners will provide capital funding for live trading accounts of traders onboarded with Proprietary Trading Firms utilizing Broctagon’s fully managed proprietary solutions. This is part of Broctagon’s initiative to provide end-to-end turnkey solutions for clients. From trading platforms and CRM equipped with KYC and Payment functions, to multi-asset liquidity and now external live account funding, our clients can truly focus on the success of their traders while leaving the rest of the intricacies to us. For more information about our Prop Solutions, please click here. Or simply click here to schedule a demo. About Broctagon:Broctagon Fintech Group is a leading multi-asset liquidity and full-suite FX technology provider headquartered in Singapore. The company specialises in performance-driven and bespoke solutions, serving more than 350 clients worldwide with its flagship SaaS FX CRM, Institutional grade FX & Crypto liquidity as well as White Label trading platform and Prop Trading Challenge technology. With over 15 years of fintech finesse, global offices in 7 countries, and a passionate team of go-getters, Broctagon prides itself on empowering FX businesses to reach the next level through innovation and world-class service. For more information: https://broctagon.com/ About Stellar Partners: Stellar Partners operates as a global investment firm, specializing in equity, real estate, and opportunistic projects. With a steadfast focus on strategic capital deployment and rigorous due diligence, the company aims to maximize returns for its shareholders. Leveraging the expertise of its seasoned team, Stellar Partners customizes investment strategies that synergize with its diverse portfolio, delivering targeted results across various sectors on a global scale. For more information: https://1stellar.com/

- 05.03.2024

- Partnerships

- READ MORE

Migrating its Forex CRM to MySQL HeatWave on Oracle Cloud Infrastructure, the Singapore-based ISV increases performance by 30% and reduces cost by 35%. Business Challenges & Goals Broctagon's AXIS Forex CRM equips retail brokerage firms with a solution that integrates multiple trading platforms, enhances trader's journey, optimizes admin operations, and facilitates rapid market expansion with advanced affiliate capabilities, redefining industry standards and expectations. Broctagon began hosting its Forex CRM product on AWS RDS Aurora, with the MySQL database as the foundation, serving each customer with its own cluster. Over time, with a rapid increase in client base and thus data size, the company found that the cost of scaling up for enhanced performance was becoming prohibitive. With the need to improve the performance versus cost ratio, the company decided to migrate the CRM solution to MySQL HeatWave running on Oracle Cloud Infrastructure (OCI). Business Results & Metrics Broctagon achieved better performance and availability with MySQL HeatWave, at a significantly lower cost. This allowed the company to enhance and develop a wider array of microservices for the AXIS FX Broker CRM. Furthermore, after conducting full load stress testing with identical specifications, Broctagon achieved a 30% performance improvement with MySQL HeatWave. When calculating the computing power required to deliver the solution to over 160 brokers and growing, the cost was 35% lower with MySQL HeatWave, allowing Broctagon to pass on these cost savings to brokers. Considering the significant performance increase, Broctagon made the decision to change its architecture to aggregate more transactional and operational data in MySQL HeatWave. MySQL HeatWave substantially enhanced query performance, achieving almost 14X better performance. By leveraging OCI's high availability, Forex Brokers can now start operations within a day. Technical infrastructure for new brokers can now be provisioned within 60 minutes. Leveraging the high performance of MySQL HeatWave, Broctagon provides its CRM users with real-time trading account information and trade history data—syncing data directly from different external sources such as the MetaTrader 4, MetaTrader 5, and cTrader platforms. By offering advanced filters on real-time trading reports, users can customize and rearrange multiple fields on single table reports. Powered by MySQL HeatWave on OCI, the AXIS FX Broker CRM is a fully branded solution for Forex Brokers that can be modified to individual requirements with more than 350 customizable parameters. MySQL HeatWave's analytical capabilities have led Broctagon to create a flexible and configurable risk management dashboard. This dashboard provides alerts, performance tracking analysis, insights into the most and least profitable traders, and many other data-driven features that enable Forex brokers to make more informed decisions to increase their profitability. Further value-added services delivered to its brokerage clients include instant calculation of multiple-tier commissions based on real-time trades, thanks to an in-house Extract-Transform-Load (ETL) program that pulls data from multiple trading platforms and synchronizes it with MySQL HeatWave. The company has found that moving the AXIS FX Broker CRM to MySQL HeatWave has freed developers from heavy administrative work by automating updates, backups, monitoring, and more, channeling focus to the development of new functions that are frequently rolled out. On the technical front, the company is embracing MySQL HeatWave's read/write workload isolation by splitting write operations from certain expensive read operations. This allows for better monitoring of different clients' performance usage and optimizes application design. Why MySQL HeatWave? In search of delivering better performance to clients while staying cost efficient, Broctagon chose MySQL HeatWave after successful load testing, which confirmed an optimal performance-to-cost ratio. Moreover, Broctagon's CRM developments require interaction with one of the most robust foreign exchange trading platforms in the world, which mostly utilizes MySQL as the backend database. Another key factor was Oracle's MySQL Support provided detailed guidance, comprehensive documentation, and assistance in load testing, as well as migrating to OCI, which only took two weeks. Next Steps With MySQL HeatWave offering increased performance and reduced costs for the CRM solution, Broctagon is considering migrating parts of its liquidity and cryptocurrency business to OCI. “If performance continues to be above expectations, we will be moving more workloads to OCI down the line,” said Michael Mai. Looking ahead, Broctagon's roadmap includes leveraging MySQL HeatWave's machine learning (ML) capabilities to help Forex brokers attract and retain traders. For example, HeatWave ML can be trained to provide brokers with useful recommendations based on their trading data. The ML capabilities will also generate ideas for features to increase customer satisfaction and bring in new business, thus enabling Forex Brokers to increase their profit with lower costs. *Credits to Oracle for the original article: https://www.mysql.com/why-mysql/case-studies/broctagon-fintech-migrates-flagship-forex-crm-mysql-heatwave.html

- 11.10.2023

- All

- READ MORE

2022 welcomed roaring new ideation and innovation as the world came back from the 2020 pandemic year, with fintech events around the globe revived in full force again. Broctagon was honoured to be part of many global meetups and sharing unique business insight with friends and partners all over the world once again.

- 30.12.2022

- All

- READ MORE

Broctagon Fintech Group's Asian liquidity arm, Broctagon Prime Markets is now a licensed digital financial service provider under the Labuan International Business and Financial Centre (Labuan IBFC), Malaysia. This licence is a testament to Broctagon's excellence in digital asset liquidity, highlighting the regulatory emphasis and compliance to the AML/CFT and market conduct requirements of DFS businesses.

- 29.12.2022

- Broprime Markets

- READ MORE

CEX.IO, a global ecosystem of products and services that connects people and businesses to the cryptocurrency economy and decentralized finance, is the latest participant to join the inter-exchange liquidity network known as the WorldBook™.

- 23.03.2022

- Partnerships

- READ MORE

Broctagon Fintech Group was recently awarded 'Best Crypto Liquidity Solutions' at the Crypto Expo Dubai 2022, as a recognition for our newly-upgraded product, the NEXUS 2.0 Crypto Liquidity Hub. Held at Dubai Festival City from 16 -17 March, more than 100+ crypto companies gathered at the premier cryptocurrency event.

- 18.03.2022

- Awards

- READ MORE

Broctagon participated in this year's Finance Magnates London Summit. Hot on the heels of our attendance in the iFX International Expo 2021, this year's event was held in-person during the period of 16-17 November 2021 at London, Old Billingsgate. Broctagon’s CEO Don Guo was present in London to speak directly with our clients and partners at the event. As a global provider of multi-asset trading news, research, and events, Finance Magnates' London Summit this year continues to be one of the largest events that is held in the financial industry. Crypto as the Latest Topic With its growing dominance within financial institutions, the discussion of crypto was embedded within the fabric of the event. In light of growing crypto adoption by institutions, we had many discussions with exchanges and even traditional brokers about NEXUS 2.0, our spot crypto liquidity hub. By aggregating liquidity representing 85% of the crypto market complete with best bid/ask price discovery that is executable via Smart Order Routing (SOR). NEXUS 2.0 allows corporations and institutions to purchase cryptocurrencies from the best sources. For exchanges, this translates to global liquidity beyond the confines of a local order book, resulting in enhanced market depth and instant access to more than 1000 crypto pairs, including the latest trending tokens. With the rising popularity of the metaverse and tokens poised to make an impact such as Decentraland (MANA), The Sandbox (SAND), Star Atlas (ATLAS), Axie Infinity (AXS), Enjin (ENJ), access to NEXUS 2.0 will allow exchanges to capitalize on the latest trading wave. Enhanced Crypto CFD Offerings Beyond spot crypto, the conversations surrounding brokers were on crypto derivatives, especially in the form of crypto CFDS. As one of the pioneers of Crypto CFD and together with NEXUS 2.0, Broctagon is able to price major crypto CFDs with ultra-competitive spreads: BTC/USD spreads starting from $30 USD ETH/USD spreads starting from $2.5 USD New Opportunities We would like to thank our clients, partners, and peers that have made the effort to schedule and meet with us during the event. We are happy to call it a great success and look forward to seeing you again at our next event!

- 24.11.2021

- All

- READ MORE

Naijacrypto is a premier cryptocurrency exchange platform that offers digital asset trading services such as trading tools and leverage trading.

- 19.10.2021

- Partnerships

- READ MORE

In our most recent update, we've focused on optimizing essential CRM modules. Key improvements include expedited onboarding with the ability to opt out of email OTP verification during account registration. Furthermore, trading reports are now automatically generated by default, and editing promotional link domains is now a seamless process without the need for recreation. Additionally, we have refined the user interface to enhance navigation and intuitiveness. Discover the details of these updates and enhancements below. Key Function Highlights Disable Email OTP Verification You can now opt for a faster account registration process by disabling email OTP verifications at the time of registration. This allows your clients to swiftly onboard initially and then choose to reinforce security by activating OTP verifications at a later stage. Send Trading Reports by Default Automated delivery of trading reports is now the default option upon trading account creation, eliminating the need for manual activation. Update Domain for Promotional Link You now have the ability to directly edit link domains, removing the hassle for deletion and recreation, thereby saving time and effort. UI Enhancements Client Portal Improvements: Your clients will now enjoy improved access to their User ID and Referral code, making it easier for them to navigate the platform. Client Group & Role Permissions UI Optimization: To streamline user experience, visible "Edit" icons have been implemented, simplifying the process of modifying group and role names and descriptions for improved usability. Sign Up Free Trial Request a Demo

- 27.03.2024

- All

- READ MORE

This new release spots a deposit interface overhaul, introducing intuitive icons on a streamlined single page for easy navigation. In addition, your clients can now directly purchase a package to participate in challenges, bypassing the need for an initial e-wallet deposit. These enhancements promise a smoother user experience. Additionally, we've optimized the MT4 comprehensive report extension and trading server display, further enhancing the overall functionality of our CRM. Key Function Highlights: 1. New Deposit Interface Enhanced VisualsNewly introduced visual elements enhances clarity and intuitiveness for users. Clients can now quickly identify their preferred deposit method at a glance. Single Page NavigationWith the deposit process optimized into a one-page format, clients can now navigate through each step seamlessly. This reduces complexity and ensures that all necessary details are presented cohesively, providing clients a clear overview of their entire deposit action. 2. Direct Purchase of Prop Packages Instant Prop Challenge Participation The introduction of a direct purchase function allows for faster and easier challenge access, greatly improving client conversion. Flexible Payment MethodsEnjoy full autonomy in configuring the permissible payment methods for each challenge package, meeting the diverse preferences of your target audience. 3. Additional Enhancements Improved MT4 Comprehensive Report Extension Building upon existing functionalities, the enhanced MT4 comprehensive report extension now includes referral data alongside downlines of specific clients, offering you deeper insights. Additionally, this update introduces further functions to enrich the user experience and analytical capabilities. Customizable Trading Server DisplayThe ability to customize trading server names provides you with greater flexibility and control over your platform's branding and presentation. Read here to find out more Sign Up Free Trial Request a Demo

- 26.02.2024

- All

- READ MORE

This major release brings a host of updates to our Prop Trading System, elevating experiences for both end users and administrators. Now, Prop Firms can effortlessly calculate and distribute profit sharing not only to challengers but IB/referrals as well, offering a powerful incentive to attract more participants. Furthermore, the challenge setup process has been refined for enhanced intuitiveness and flexibility, such as assigning challenges based on client groups, non-disruptive challenge terminations and more. Dive in to explore the full spectrum of improvements! 1. Revamped Challenge Setup Process Streamlined Step-by-Step Setup Experience a redesigned Challenge setup process, featuring a clear and intuitive progress bar providing real-time updates on remaining steps. Flexible Display Configuration Take control of your clients' experience by prioritizing which menu to show first: "My Challenge" or "Challenge Details." It's your call whether to have your clients jump right in to choosing packages or to first have an overview of the challenge. 2. Profit Sharing Distribution Profit Sharing Configuration Unlock unprecedented convenience by configuring profit sharing within the system, designed to distribute rewards seamlessly to both challengers and referrals, ensuring a hassle-fee process and timely payouts for all recipients. Flexible Distribution Methods Choose between automated distribution for administrative efficiency or manual distribution for greater control, incorporating a review step before profits are distributed. Adjustable Settlement Frequency Customize your profit-sharing distribution frequency to align with your business strategies and goals. 3. Dynamic Challenge Allocation Across Client Groups Tailored Challenges for Specific Client Groups Assign distinct challenges and packages to different client groups, ensuring a more targeted and customized approach to enhance your client conversion and retention. Non-Disruptive Experience on Live Clients The challenge assignment process emphasizes a seamless transition, guaranteeing that no challenge participant is impacted, thereby ensuring business continuity and and ongoing client engagement. 4. Smart-Switch Challenge Termination Process Seamless Challenge Termination Markets are dynamic and now, you can easily update your challenge configurations accordingly. The smart-switch feature will remove the older challenge preventing further signups while showcasing your new challenge with updated conditions. Non-Disruptive Experience for Live Clients Smart-switch intelligently handles the challenge termination process, ensuring that current participants of the older challenges are not affected, allowing them to proceed until completion. Participants in the older challenge will continue to track their progress, while new participants will enroll in the updated challenge seamlessly. 5. Advanced Notification Management Prop Trading Notification Tab Introducing a specialized Notifications Tab designed to filter all Prop-related requests and tasks, enhancing focus and efficiency. Personalized Congratulatory Email to Challengers Celebrate your challengers' successes with added flair. Now, when challengers successfully progress to the next level, they will automatically receive a congratulatory email from you, including a timestamp on the achieved milestone. You can further customize the email to embed a "Success" certificate as added recognition to your clients. Read here to find out more Sign Up Free Trial Request a Demo

- 21.02.2024

- All

- READ MORE

In this update, we’re thrilled to introduce an extension to our IB commission payout module. Now, alongside volume, spread, and profit-based payouts, you can reward your IBs based on commissions configured on your trading platform. Any commissions charged within your MT4, MT5, cTrader, Sirix and ZeroX are synchronized in real-time with the CRM, allowing you to distribute a percentage of these trading platform commissions directly to your IBs. This robust feature not only provides the flexibility to transform a direct platform commission into a multi-tiered reward system, but also ignites synergies for growth and collaboration within your IB network. Additionally, system popup notifications are now extended to your clients as well! Your clients no longer need to sift through emails for updates. The enhanced notification function sends automatic pop-up notifications within the CRM, promptly informing clients about request updates such as approvals or rejections. Stay connected and streamline client interactions effortlessly. Platform Trading Commission-Based IB Payout Model 1. Simple and Direct Configuration This innovative model allows you to extract the pre-set trading platform commissions and further customize it to be distributed by percentages across multiple levels, allowing brokers a straightforward approach to creating an effective IB reward structure. 2. Real-Time Synchronization of Trading Commissions The commissions configured on your trading platforms—MT4, MT5, cTrader, Sirix, and ZeroX—are now synchronized in real time with the CRM. This facilitates prompt payout distribution to your IBs based on the percentage of trading platform commissions you have set. 3. Enhanced Reporting Reports have been further refined with added commission details, providing a clear overview of charged commissions and the corresponding amounts paid to IBs. This optimization simplifies tracking and enhances transparency in your financial transactions. System Pop-Up Notifications to Clients 1. Enhanced Convenience Elevate the client experience with unparalleled convenience. Your clients no longer have to sift through emails; they can receive updates directly from the CRM, ensuring prompt and hassle-free communication. 2. Customizable Templates Tailor pop-up notifications to your preferences. Enjoy the flexibility of customizable pop-up templates, aligning notifications with your corporate branding for a cohesive client engagement. 3. Smart Language Preferences Experience intuitive and seamless communication as the CRM intelligently sends notifications in your client's preferred default language. Stay connected effortlessly with language preferences that prioritize your client's experience. Read here to find out more. Sign Up Free Trial Request a Demo

- 24.01.2024

- All

- READ MORE

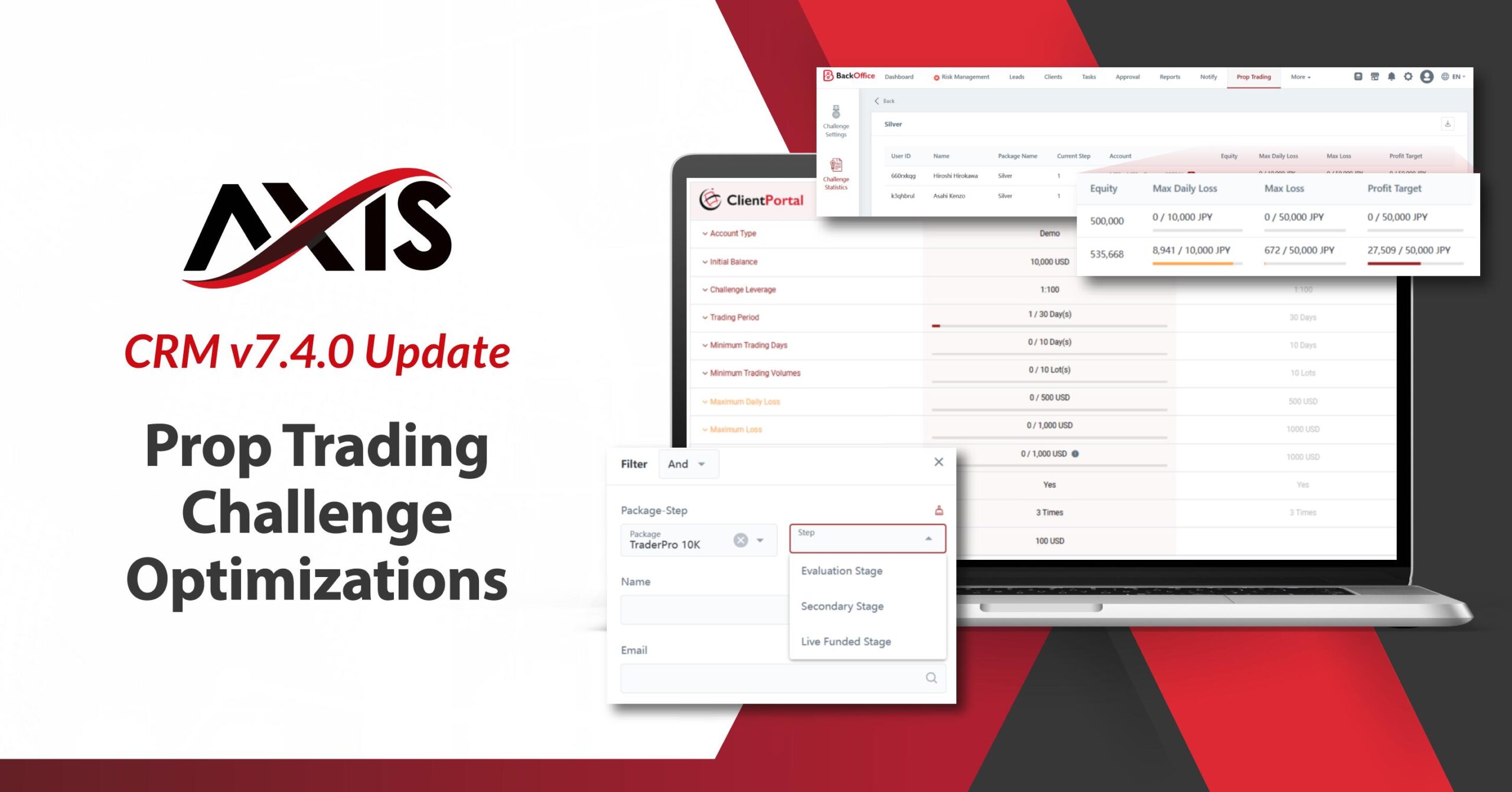

This release brings pivotal enhancements to the Proprietary Trading Challenge system. Notable improvements include more frequent equity monitoring, now calculated every 10 minutes and a more intuitive "participants" tab that now offers detailed snapshots of traders' status. Furthermore, we've streamlined the admin process with automated approval options, challenge duplication and more!

- 04.01.2024

- All

- READ MORE

In this new release, we're excited to present the all-new Calendar function—a powerful tool designed to help your team effortlessly manage tasks by providing a comprehensive overview of assignments and their corresponding deadlines. Stay organized and on top of your schedule with this intuitive feature. We've also fine-tuned our PSP deposit settings to offer you greater flexibility. Now, you have the ability to adjust the deposit amounts submitted by your clients, ensuring they align precisely with the funds received in your PSP. This optimization allows greater control in streamlining transactions and avoid administrative hassle. Furthermore, we understand the importance of efficiency in your IB commission processes. With the latest update, you can now choose to disable the display of zero commission data. This thoughtful enhancement not only helps declutter your CRM but also contributes to a more effective commission payout system for your IBs. Key Function Highlights: New Calendar Function Visualize Tasks with Calendar View: Immerse yourself in an intuitive experience as tasks come to life on the calendar, offering a vivid overview of upcoming deadlines. Enhance Collaboration: Empower each team member to seamlessly integrate tasks into the calendar, facilitating the coordination of goals and workloads with ease. Adjustable PSP Deposits Tailored Deposit Amount: Gain the flexibility to directly adjust deposit amounts based on actual funds received in your PSP, reducing post deposit reconciliation administrative work. Effortless Currency Conversion: Experience automatic currency conversion aligned with the updated deposit amount, ensuring effortless and accurate financial transactions. Conceal Zero IB Commission Data Enhance IB Commission Payout Efficiency: Elevate the speed and efficiency of IB commission payouts, fostering stronger relationships and greater trust with your IBs. Focus on Quality Payouts: Streamline analytics by concentrating on meaningful commission payouts by eliminating zero commission data. This contributes to the overall quality of your financial and business insights for informed decision-making. Read here to find out more. Sign Up Free Trial Request a Demo

- 13.12.2023

- All

- READ MORE

In this update, we're proud to present the seamless integration Twilio Verify into our CRM. This integration enhances your security measures by offering clients a diverse array of reliable verification methods. With Twilio Verify, clients now have the flexibility to opt for 2FA via various channels, such as voice, messaging, and WhatsApp during the onboarding process. Bid farewell to the constraints of email OTP verifications and empower your clients to select the verification method that best suits their preferences.

- 09.11.2023

- All

- READ MORE

Get ready to excite your traders with our latest feature: The Trading Competition module. Amp up the trading thrill by hosting trading competitions for your traders to battle it out for the top spot and win enticing prizes. Launch competitions with unprecedented ease complete with leadership boards and the flexibility to automatically distribute rewards. Install the module today and create an electrifying experience for your traders! Please note that Trading Competition is currently available for MT4 and MT5 only.

- 02.11.2023

- All

- READ MORE

Migrating its Forex CRM to MySQL HeatWave on Oracle Cloud Infrastructure, the Singapore-based ISV increases performance by 30% and reduces cost by 35%. Business Challenges & Goals Broctagon's AXIS Forex CRM equips retail brokerage firms with a solution that integrates multiple trading platforms, enhances trader's journey, optimizes admin operations, and facilitates rapid market expansion with advanced affiliate capabilities, redefining industry standards and expectations. Broctagon began hosting its Forex CRM product on AWS RDS Aurora, with the MySQL database as the foundation, serving each customer with its own cluster. Over time, with a rapid increase in client base and thus data size, the company found that the cost of scaling up for enhanced performance was becoming prohibitive. With the need to improve the performance versus cost ratio, the company decided to migrate the CRM solution to MySQL HeatWave running on Oracle Cloud Infrastructure (OCI). Business Results & Metrics Broctagon achieved better performance and availability with MySQL HeatWave, at a significantly lower cost. This allowed the company to enhance and develop a wider array of microservices for the AXIS FX Broker CRM. Furthermore, after conducting full load stress testing with identical specifications, Broctagon achieved a 30% performance improvement with MySQL HeatWave. When calculating the computing power required to deliver the solution to over 160 brokers and growing, the cost was 35% lower with MySQL HeatWave, allowing Broctagon to pass on these cost savings to brokers. Considering the significant performance increase, Broctagon made the decision to change its architecture to aggregate more transactional and operational data in MySQL HeatWave. MySQL HeatWave substantially enhanced query performance, achieving almost 14X better performance. By leveraging OCI's high availability, Forex Brokers can now start operations within a day. Technical infrastructure for new brokers can now be provisioned within 60 minutes. Leveraging the high performance of MySQL HeatWave, Broctagon provides its CRM users with real-time trading account information and trade history data—syncing data directly from different external sources such as the MetaTrader 4, MetaTrader 5, and cTrader platforms. By offering advanced filters on real-time trading reports, users can customize and rearrange multiple fields on single table reports. Powered by MySQL HeatWave on OCI, the AXIS FX Broker CRM is a fully branded solution for Forex Brokers that can be modified to individual requirements with more than 350 customizable parameters. MySQL HeatWave's analytical capabilities have led Broctagon to create a flexible and configurable risk management dashboard. This dashboard provides alerts, performance tracking analysis, insights into the most and least profitable traders, and many other data-driven features that enable Forex brokers to make more informed decisions to increase their profitability. Further value-added services delivered to its brokerage clients include instant calculation of multiple-tier commissions based on real-time trades, thanks to an in-house Extract-Transform-Load (ETL) program that pulls data from multiple trading platforms and synchronizes it with MySQL HeatWave. The company has found that moving the AXIS FX Broker CRM to MySQL HeatWave has freed developers from heavy administrative work by automating updates, backups, monitoring, and more, channeling focus to the development of new functions that are frequently rolled out. On the technical front, the company is embracing MySQL HeatWave's read/write workload isolation by splitting write operations from certain expensive read operations. This allows for better monitoring of different clients' performance usage and optimizes application design. Why MySQL HeatWave? In search of delivering better performance to clients while staying cost efficient, Broctagon chose MySQL HeatWave after successful load testing, which confirmed an optimal performance-to-cost ratio. Moreover, Broctagon's CRM developments require interaction with one of the most robust foreign exchange trading platforms in the world, which mostly utilizes MySQL as the backend database. Another key factor was Oracle's MySQL Support provided detailed guidance, comprehensive documentation, and assistance in load testing, as well as migrating to OCI, which only took two weeks. Next Steps With MySQL HeatWave offering increased performance and reduced costs for the CRM solution, Broctagon is considering migrating parts of its liquidity and cryptocurrency business to OCI. “If performance continues to be above expectations, we will be moving more workloads to OCI down the line,” said Michael Mai. Looking ahead, Broctagon's roadmap includes leveraging MySQL HeatWave's machine learning (ML) capabilities to help Forex brokers attract and retain traders. For example, HeatWave ML can be trained to provide brokers with useful recommendations based on their trading data. The ML capabilities will also generate ideas for features to increase customer satisfaction and bring in new business, thus enabling Forex Brokers to increase their profit with lower costs. *Credits to Oracle for the original article: https://www.mysql.com/why-mysql/case-studies/broctagon-fintech-migrates-flagship-forex-crm-mysql-heatwave.html

- 11.10.2023

- All

- READ MORE

We started with a dream to bridge the gap for highly tailored FX solutions that add tangible and impactful value to Forex Brokers. 14 years and hundreds of brokers later, we revisit the question – What is Broctagon? Our team at iFX Expo Asia 2023 shares their answers. Broctagon is about Business Integrity. With strict compliance and a perfect track record, our multi-asset liquidity and aggregator technology empowers some of the largest brokers in the world. Broctagon is Radical Innovation. We built the first FX CRM with multi-level IB rewards that is now fueling the expansion of many brokers globally, bringing in thousands of traders daily. Broctagon is about Freedom to clients. We understand that every client is unique and there is no cookie cutter solution that fits all. That is why our solutions are modular, bespoke and can be tailored to the specific needs of your Broker. Lastly, how do we motivate high performers and create synergy? Broctagon is all about Clan Culture. We are eager to collaborate both internally and with clients, and we stand firmly by our belief that our success only comes after yours. That is why the bulk of our clients have long-term partnerships with us. With a strong focus on these principal values and collaborative spirit, Broctagon has worked its way up to becoming the trusted partner for turnkey FX solutions, catering to the needs of brokers worldwide. If you ever need Forex solutions, remember - We’ve got your back, always.

- 19.07.2023

- All

- READ MORE

Broctagon’s Chief Technology Officer (CTO) and co-founder, Ted Quek, was recently invited to a sharing session at the National University of Singapore (NUS), where he detailed his experience of starting Broctagon Fintech Group with the students, and his journey of bringing it to the global presence it is today, with offices in 7 countries, and serving clients from over 50 countries. Big thanks to assistant dean, Associate Prof. Huang Ke-Wei, who organized this rare opportunity for the university’s new Masters’ Programme for Digital Financial Technology. Speaking to the young minds at the programme, Ted shared about how Broctagon started from its liquidity business more than ten years ago and how it expanded over the years to become the premier turnkey solutions provider. Today, Broctagon offers a full suite of forex brokerage solutions: industry-leading trading platforms, proprietary brokerage CRM, blockchain development and multi-asset FX and crypto liquidity. He shared that it is this expansion into a turnkey fintech hub that led Broctagon on its path to success today. As the CTO, Ted emphasized his focus on having a strong technological infrastructure, which he feels is the backbone of a successful FX brokerage business, and thus is what he has steered Broctagon’s solutions towards. Broctagon’s mission has always been to streamline and elevate brokerages by equipping brokers with the means necessary to attract clients, exceed performance expectations and redefine industry standards. With his experience in the financial markets and understanding of brokers’ needs, Ted led the technology and innovation teams to produce reliable trading systems, coupled with sophisticated risk management and security infrastructure – all crucial to build trust with clients and ensure long-term success. He discussed about the evolving needs of the forex market, from the importance of providing deep liquidity to diversify risk and reduce volatility, to having an FX CRM that can onboard traders efficiently and manage affiliate network expansions. Responding to some questions by students, Ted gave some insight on the operations of a forex brokerage, how it handles day-to-day operations, clients, risk management, trade executions and compliance. All of which Broctagon needs to understand and anticipate as a technological provider, in order to provide first-class service and solutions. The NUS Fintech students had a glimpse into valuable real-world experiences into possible careers in the dynamic and rapidly evolving fintech industry. Finally, Ted concluded by highlighting the importance of building a culture of innovation and continuous improvement within a company. He stressed the need for companies to constantly adapt and evolve in response to changing market conditions and technological advancements, a motto that has helped put Broctagon at the forefront of Fintech.

- 21.04.2023

- All

- READ MORE

You might be interested in starting a business in the world's biggest financial market - Forex. But where to start? There are mostly 2 options: Building a brokerage from scratch, and to start a forex brokerage with a white label.

- 22.03.2023

- All

- READ MORE

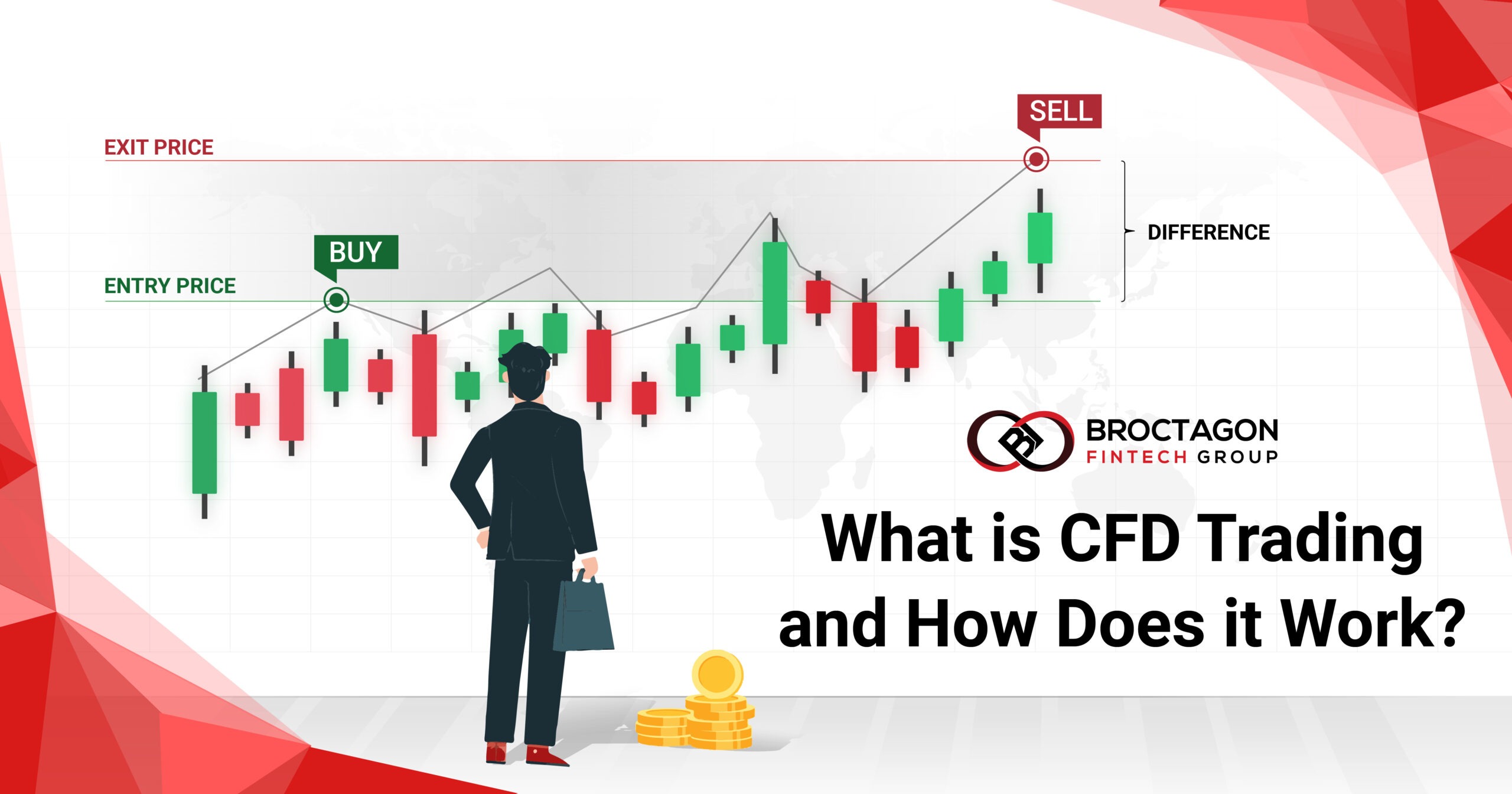

In the foreign exchange (FX) market, liquidity providers and brokers work together to facilitate trading. Liquidity providers supply the market with tradable currency pairs and provide pricing information. Brokers, on the other hand, connect traders with liquidity providers and execute trades into the market, on their behalf.

- 15.02.2023

- All

- READ MORE

Liquidity providers play a crucial role in financial markets and exchanges to ensure a seamless execution of trades, and to provide buyers and sellers with the ability to buy and sell at any time. By providing liquidity to the market, liquidity providers help reduce volatility, ensure that prices remain stable, and minimize the risk of slippage - the difference between the expected trade price and the actual price.

- 10.02.2023

- All

- READ MORE

Liquidity in cryptocurrencies is important, but unlike the Forex market, there is a notorious lack of liquidity in the crypto market. The need for liquidity aggregation is therefore really crucial to bring crypto to the level of trading and activity like in the forex market. In this article, we’ll understand why liquidity is important and […]

- 30.11.2022

- Liquidity

- READ MORE

It all started from tinkering with his uncle’s MS-DOS personal computer when Ted was just in primary school. Today, Ted Quek is Broctagon's CTO (Chief Technology Officer) and Co-founder, a company that is a licensed multi-asset liquidity and technology provider headquartered in Singapore with global presence serving clients across 50 countries.

- 24.11.2022

- All

- READ MORE

A good customer relationship management (CRM) system is an essential part of any successful brokerage. An ideal brokerage CRM will help businesses prepare for growth by organizing and managing all client-related information within one space. Choosing the right CRM will also help streamline business processes, increase efficiency, and improve business yield.

- 15.11.2022

- All

- READ MORE

Investing is about managing risks to reap rewards but everyone has different ideas about how to get there and just how much they are willing to gamble on reaching their wealth goals, says Broctagon Fintech Group's CEO Don Guo.

- 24.01.2022

- All

- READ MORE

Today, Ted Quek, the CTO and co-founder of Broctagon, had the honour of addressing students at Raffles Institution, one of Singapore's premier educational institutions known for nurturing some of the brightest minds and future leaders. Notably, Raffles Institution holds a special place in Singapore's history as the alma mater of the country's founding father, Mr. Lee Kwan Yew. Paying It Forward: Unleashing the Power of IKIGAI Ted's talk centred around the crucial concept of IKIGAI, emphasizing the importance of discovering that unique intersection where one's passion, mission, vocation, and profession converge — a philosophy that resonates deeply with aspiring entrepreneurs. During his session, Ted highlighted the significance of forming a dream team, stressing that success isn't a solitary pursuit but rather about building a tribe — a collective of individuals who share a common vision and unwavering commitment. Together, such teams create a solid foundation upon which businesses can thrive and innovate. Trials and Tribulations Navigating the entrepreneurial journey isn't without its challenges, Ted acknowledged. acknowledged a spectrum of obstacles that entrepreneurs often face, including rejection, loneliness, fear of failure, betrayal, burnout, and constant pressure. These challenges are part and parcel of the entrepreneurial journey, testing one's resilience and determination. However, he underscored that mindset matters, and with the right perspective and strategic approach, entrepreneurs can weather any storm that comes their way. Ted also painted a picture of the win-win magic that unfolds within passionate, aligned teams, where productivity is fuelled by shared enthusiasm and collaboration fosters groundbreaking innovation. A Heart of Gratitude Expressing gratitude and making a positive impact were recurring themes throughout Ted's talk. He urged aspiring entrepreneurs not only to appreciate their clients but also to pay it forward to society, thereby contributing to a collective tapestry of positive change. In contemplating the legacy we leave behind, Ted encouraged the audience to recognize that their actions ripple through time, inspiring others to follow in their footsteps and contribute to a brighter future for generations to come. Ultimately, Ted reminded the audience that as entrepreneurs, they are torchbearers tasked with igniting fires of possibility, sparking dreams, and creating a world brimming with opportunity and optimism. In Ted Quek's words, the journey of entrepreneurship isn't just about building successful businesses; it's about inspiring, igniting, and impacting lives, leaving behind a legacy of meaningful change and empowerment. The Broctagon Culture Ted Quek integrates the principles of resilience, collaboration, and purpose into both life and work. Broctagon's innovation is driven by embracing challenges as opportunities for growth, reflecting Ted's emphasis on maintaining a positive mindset and strategic approach. The company's client relationships are rooted in gratitude, impact, and legacy, exemplifying a commitment to exceptional service and a positive ripple effect in the industry. OrganizersThank you to Santusht Narula and the Raffles Entrepreneur's Network as well as Deon Senturk and the team at Slashie for making this session possible.

- 29.02.2024

- All

- READ MORE

We're back from the electrifying iFX Expo Dubai 2024, held in the heart of this dynamic city! The financial world converged on this dynamic event, and Broctagon was proud to be in the midst of it all. The expo, which took place from January 16-18, was a whirlwind of excitement and opportunity at the Dubai World Trade Centre. From reconnecting with familiar faces to forging new connections, the energy was infectious. The Welcome Party set the stage for an unforgettable experience and presented a fantastic opportunity to catch up over drinks with industry leaders, clients, and partners. Against the backdrop of the iconic Dubai skyline, we raised our glasses to the promising days ahead. For those who were there, you know what a fantastic night it was! And of course, we made sure to extend an invitation to everyone to visit Broctagon at Booth 130 during the expo. A Powerful Combination of Prop Solutions and World Class Liquidity Day 1 kicked off with a bang as the expo halls filled up rapidly with eager attendees. The Broctagon Team was ready to showcase our latest offerings and solutions tailored to meet the diverse needs of our clients. Whether it's crafting bespoke liquidity solutions spanning FX, shares, cryptocurrencies, and futures, or delving into the realm of fully managed Prop Trading, we left no stone unturned in demonstrating how we can help our partners stay ahead of the curve with our fully integrated solutions suite. The response from the crowd was overwhelming, and we couldn't be more thankful for the enthusiasm and support shown by both old friends and new acquaintances. Your satisfaction and trust in Broctagon fuel our drive for innovation, and we're committed to delivering nothing short of excellence in all that we do. Onward To the Next Adventure: Traders Fair Thailand 2024 As the curtains draw to a close on the iFX Expo Dubai 2024, we're already gearing up for the next adventure. Mark your calendars for the Traders Fair Thailand in Bangkok on 3rd Feb! We can’t wait to meet you in the bustling city of Bangkok to share our perfect blend of international expertise and localized Thai support. In closing, a heartfelt thank you to Dubai, the iFX Expo team, and everyone who made this event a resounding success. Until we meet again, let's keep pushing the boundaries and charting the course to success together. For now, its busy time again with the string of new prop firms and liquidity setups on the horizon. Missed Us at iFX? We are Online 24/7 Couldn't make it to iFX Expo Dubai 2024? No problem at all! You can easily schedule an online meeting with our specialists at your convenience. Fully ManagedProp Solutions Learn More Multi Asset Liquidity Learn More FX Broker CRM Learn More

- 19.01.2024

- All

- READ MORE

As the financial industry gears up for the prestigious iFX Expo in Dubai, Broctagon is poised to showcase its innovative suite of FX solutions that epitomize excellence and cutting-edge technology. Scheduled to take place at the Dubai World Trade Centre, this event holds special significance as the first of major finance expo of the year, setting the tone for industry trends and innovations. FIND US AT: Booth: 130 Date: 16 (Welcome Party), 17 – 18 (Expo) Jan 2024 Venue: Dubai World Trade Centre, Za’abeel Hall 6 With a rich history of bringing together global leaders, industry experts, and trailblazing technology providers, the iFX Expo has consistently served as a hub for networking, knowledge-sharing, and the unveiling of groundbreaking solutions. Broctagon's steadfast participation in iFX Expos for over a decade resonates with the expo's tradition of cultivating collaboration and presenting advancements that mold the future of the financial sector. Our enduring participation not only aligns with the expo's rich legacy but also provides Broctagon with a premier stage to spotlight our diverse array of products and services. Multi-Asset Liquidity At the heart of Broctagon’s exhibition is our Institutional grade liquidity spanning over 1,800 instruments. With spreads as low as zero and a 10-tier depth of market, our liquidity solutions are crafted with a commitment to delivering the best trading conditions your FX broker needs to stay ahead of competition. Whether your focus lies in forex, commodities, or cryptocurrencies, we are primed to propel your institutional trading endeavours. Fully Managed Prop Firm White Labels Designed to meet the evolving needs of the modern trader, Broctagon presents a seamless solution for aspiring Proprietary Firms. Our all-encompassing package includes the MT5 Trading platform, a branded CRM, risk management tools, and an end-to-end setup that gets your brand up and running in just one week. Additionally, you have the option to leverage our proprietary funding arrangements, effectively minimizing your capital risks. With Broctagon, embark on your proprietary trading journey with confidence and efficiency. Designing Your Tailored Solution With a believe that every broker’s needs are unique and a reputation for highly customizable solutions, Broctagon stands out as a trusted partner in the fintech space. Come by Booth 130 to have chat to let us propose a solution that best fits your needs. See you there! Schedule an appointment in advance to reserve a slot.

- 15.01.2024

- All

- READ MORE