Brokerage. Blockchain. Buzz.

Welcome, find all things buzzing on board at Broctagon’s blog! Here you’ll find the latest in blockchain news, exciting event highlights, insightful thought leadership in forex and crypto, and more. Be the first to know all about our events and most innovative tech updates – all in one space.

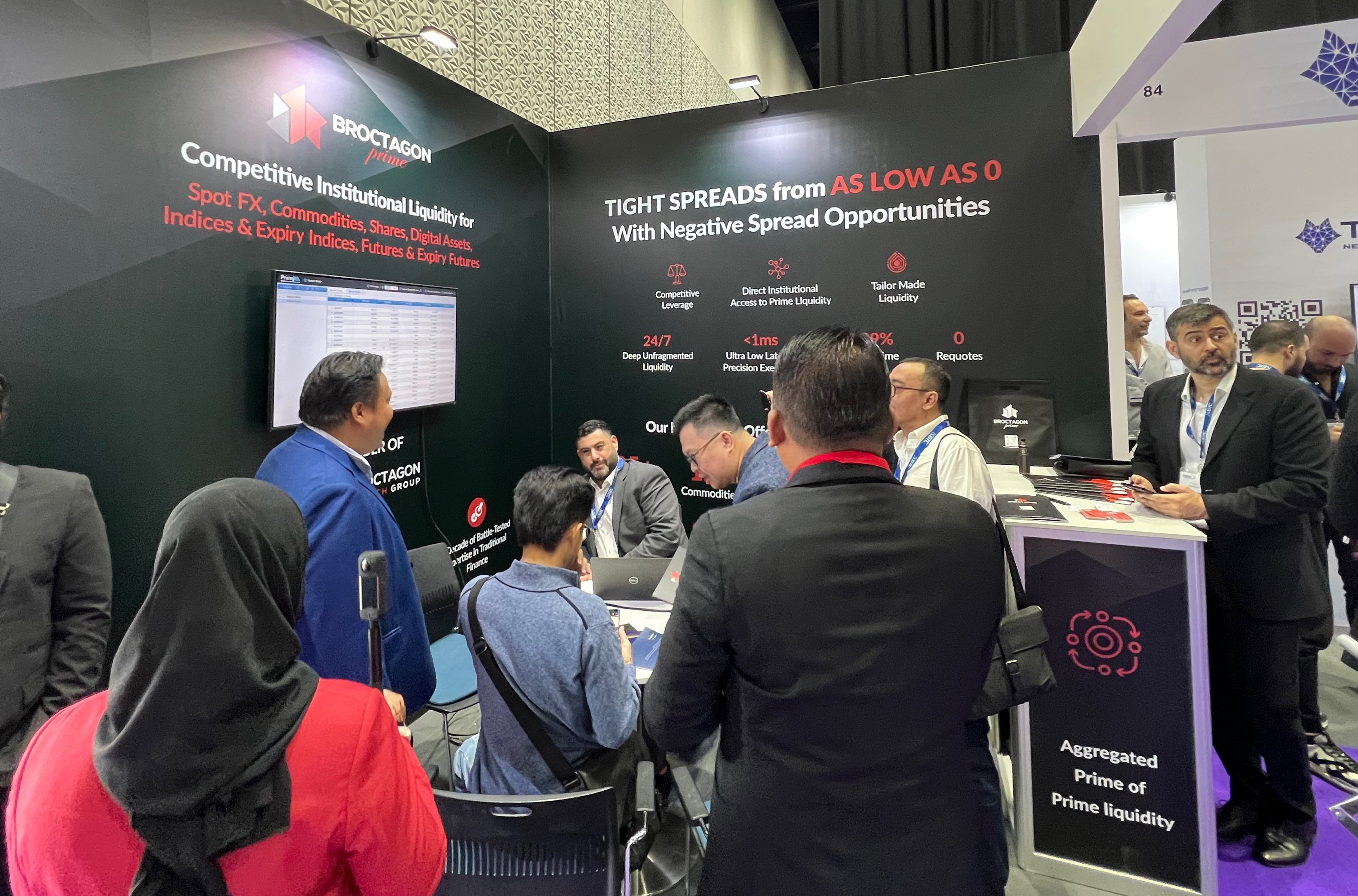

As the financial industry gears up for the prestigious iFX Expo in Dubai, Broctagon is poised to showcase its innovative suite of FX solutions that epitomize excellence and cutting-edge technology. Scheduled to take place at the Dubai World Trade Centre, this event holds special significance as the first of major finance expo of the year, setting the tone for industry trends and innovations. FIND US AT: Booth: 130 Date: 16 (Welcome Party), 17 – 18 (Expo) Jan 2024 Venue: Dubai World Trade Centre, Za’abeel Hall 6 With a rich history of bringing together global leaders, industry experts, and trailblazing technology providers, the iFX Expo has consistently served as a hub for networking, knowledge-sharing, and the unveiling of groundbreaking solutions. Broctagon's steadfast participation in iFX Expos for over a decade resonates with the expo's tradition of cultivating collaboration and presenting advancements that mold the future of the financial sector. Our enduring participation not only aligns with the expo's rich legacy but also provides Broctagon with a premier stage to spotlight our diverse array of products and services. Multi-Asset Liquidity At the heart of Broctagon’s exhibition is our Institutional grade liquidity spanning over 1,800 instruments. With spreads as low as zero and a 10-tier depth of market, our liquidity solutions are crafted with a commitment to delivering the best trading conditions your FX broker needs to stay ahead of competition. Whether your focus lies in forex, commodities, or cryptocurrencies, we are primed to propel your institutional trading endeavours. Fully Managed Prop Firm White Labels Designed to meet the evolving needs of the modern trader, Broctagon presents a seamless solution for aspiring Proprietary Firms. Our all-encompassing package includes the MT5 Trading platform, a branded CRM, risk management tools, and an end-to-end setup that gets your brand up and running in just one week. Additionally, you have the option to leverage our proprietary funding arrangements, effectively minimizing your capital risks. With Broctagon, embark on your proprietary trading journey with confidence and efficiency. Designing Your Tailored Solution With a believe that every broker’s needs are unique and a reputation for highly customizable solutions, Broctagon stands out as a trusted partner in the fintech space. Come by Booth 130 to have chat to let us propose a solution that best fits your needs. See you there! Schedule an appointment in advance to reserve a slot.

- 15.01.2024

- All

- READ MORE

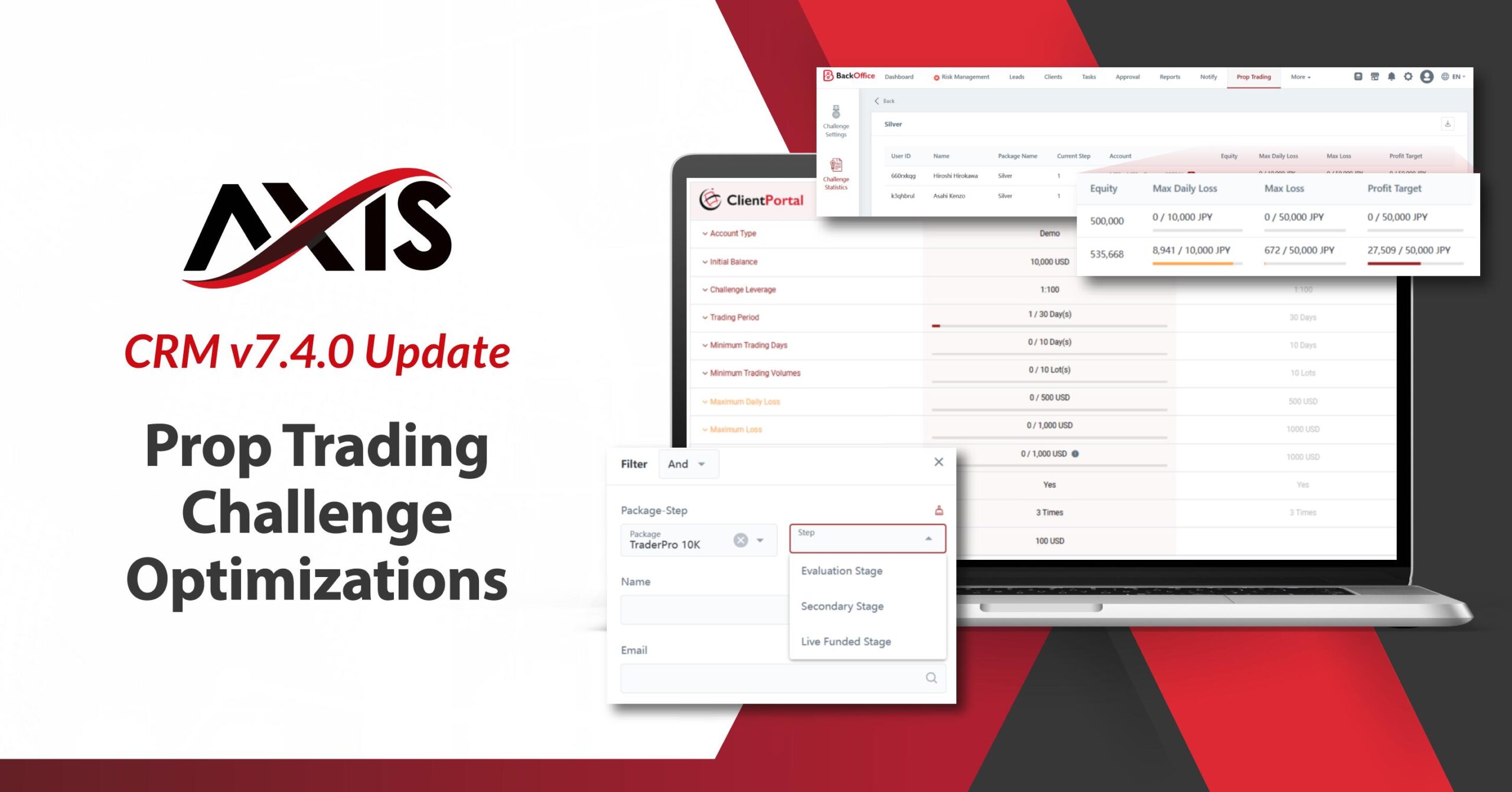

This release brings pivotal enhancements to the Proprietary Trading Challenge system. Notable improvements include more frequent equity monitoring, now calculated every 10 minutes and a more intuitive "participants" tab that now offers detailed snapshots of traders' status. Furthermore, we've streamlined the admin process with automated approval options, challenge duplication and more!

- 04.01.2024

- All

- READ MORE

In this new release, we're excited to present the all-new Calendar function—a powerful tool designed to help your team effortlessly manage tasks by providing a comprehensive overview of assignments and their corresponding deadlines. Stay organized and on top of your schedule with this intuitive feature. We've also fine-tuned our PSP deposit settings to offer you greater flexibility. Now, you have the ability to adjust the deposit amounts submitted by your clients, ensuring they align precisely with the funds received in your PSP. This optimization allows greater control in streamlining transactions and avoid administrative hassle. Furthermore, we understand the importance of efficiency in your IB commission processes. With the latest update, you can now choose to disable the display of zero commission data. This thoughtful enhancement not only helps declutter your CRM but also contributes to a more effective commission payout system for your IBs. Key Function Highlights: New Calendar Function Visualize Tasks with Calendar View: Immerse yourself in an intuitive experience as tasks come to life on the calendar, offering a vivid overview of upcoming deadlines. Enhance Collaboration: Empower each team member to seamlessly integrate tasks into the calendar, facilitating the coordination of goals and workloads with ease. Adjustable PSP Deposits Tailored Deposit Amount: Gain the flexibility to directly adjust deposit amounts based on actual funds received in your PSP, reducing post deposit reconciliation administrative work. Effortless Currency Conversion: Experience automatic currency conversion aligned with the updated deposit amount, ensuring effortless and accurate financial transactions. Conceal Zero IB Commission Data Enhance IB Commission Payout Efficiency: Elevate the speed and efficiency of IB commission payouts, fostering stronger relationships and greater trust with your IBs. Focus on Quality Payouts: Streamline analytics by concentrating on meaningful commission payouts by eliminating zero commission data. This contributes to the overall quality of your financial and business insights for informed decision-making. Read here to find out more. Sign Up Free Trial Request a Demo

- 13.12.2023

- All

- READ MORE

In this update, we're proud to present the seamless integration Twilio Verify into our CRM. This integration enhances your security measures by offering clients a diverse array of reliable verification methods. With Twilio Verify, clients now have the flexibility to opt for 2FA via various channels, such as voice, messaging, and WhatsApp during the onboarding process. Bid farewell to the constraints of email OTP verifications and empower your clients to select the verification method that best suits their preferences.

- 09.11.2023

- All

- READ MORE

Get ready to excite your traders with our latest feature: The Trading Competition module. Amp up the trading thrill by hosting trading competitions for your traders to battle it out for the top spot and win enticing prizes. Launch competitions with unprecedented ease complete with leadership boards and the flexibility to automatically distribute rewards. Install the module today and create an electrifying experience for your traders! Please note that Trading Competition is currently available for MT4 and MT5 only.

- 02.11.2023

- All

- READ MORE

Affiliate programs have become pivotal for modern brokerages, especially in today's interconnected digital marketplace. They have evolved from marketing strategies into integral growth drivers. These programs enable brokerages to expand their market reach, boost brand visibility, and generate substantial revenue through networking. In this article, we will provide a detailed explanation of how affiliate programs function, delve into the core concepts of affiliate business models, and explore every key component and functionality within the affiliate ecosystem. What Are Affiliate Programs? Forex affiliate programs are partnerships between Forex brokerages and individuals or entities who promote the broker's services in exchange for a commission or compensation. These programs play a crucial role in the marketing and customer acquisition strategies of Forex brokers. Who can become Affiliates? Individuals who can become Forex broker affiliates come from diverse backgrounds and may include: Bloggers: Owners of finance, trading, or Forex-related blogs can utilize their online presence to promote Forex brokerages. Social Media Influencers & Content Creators: Individuals with substantial followings on platforms like Instagram, Twitter, Facebook, or LinkedIn can create engaging content, offer trading tips, and endorse Forex brokers to their audience. Experienced Traders: Traders with in-depth FX knowledge can produce educational content, share trading strategies, and refer traders to their preferred brokerage. Email Marketers & SEO Specialist: Skilled email marketers can build lists of potential traders interested in Forex and use targeted email campaigns for brokerage promotion, while search engine optimization (SEO) experts can craft landing pages to attract and convert organic traffic. Educators: Forex educators who offer courses or training programs can promote brokerages to their students as a trusted platform for practicing what they learn. Key Opinion Leaders (KOLs): Administrators or prominent members of online forums, groups, or communities can endorse brokerages to their community members. How Do Affiliate Programs Work? Affiliate programs create a symbiotic relationship where affiliates help drive traffic and potential customers to the merchant's business, and in return, they earn a share of the revenue generated from these referrals. This model benefits both parties by expanding the FX Broker’s reach and boosting the affiliate's income potential. Affiliate programs come in different forms from simple embedded links to full-fledged multi-tier structures. Types Of Affiliate/Referral Programs Traders who are interested in becoming affiliates can join the partner's affiliate program. Upon enrolment, they receive exclusive tracking links or referral codes. These customized links play a crucial role in monitoring the traffic and actions resulting from the affiliate's referrals. Here are some of the commission types: Cost Per Acquisition (CPA): Affiliates earn a fixed one-time commission for each referred trader who meets specific criteria, such as opening an account, making a deposit, or completing a certain number of trades. CPA programs provide affiliates with immediate payouts for qualified referrals. Revenue Share (RevShare): Affiliates receive a percentage of the broker's revenue generated by the referred traders' trading activities. This commission structure allows affiliates to earn ongoing, recurring income as long as the referred traders continue to trade. Introducing Broker (IB) Programs: Strictly speaking, IB programs involve a deeper level of partnership than affiliates although it drives a similar objective. IBs earn commissions based on trading activity and often operate with a hierarchical commission structure with multiple levels of earnings. Why Do Brokers Need An Affiliate Program? Enhanced Exposure and Targeted Reach: An affiliate program empowers brokers to amplify their market presence by harnessing the promotional efforts of affiliates who cater to a relevant and interested audiences. This strategic approach broadens the broker's exposure, connecting them with potential clients they might not have otherwise reached. Cost-Effective Marketing Strategy: Due to its performance-based model, brokers compensate affiliates only when specific criteria are met, such as depositing funds or fulfilling a predefined trading volume. This outcome-driven approach makes it highly cost-effective as compared to traditional advertising campaigns that may incur upfront costs with uncertain lead quality. Brand Advocacy Affiliates advocating a broker's services have a vested interest in the broker's success. As active brand advocates, they can furnish positive reviews, testimonials, and recommendations rooted in their personal experiences. This organic promotion enhances the broker's reputation and credibility within the forex trading industry. Scalability and Flexibility Affiliate programs are extremely scalable tools that allow brokers to expand rapidly. With the right CRM and affiliate management technology, Brokers can easily monitor, optimize and refine their affiliate campaigns, leveraging on data-driven insights while working with many affiliates concurrently. Relationship Management Empowering the success of affiliates fosters brand loyalty, a synergy further heightened by integrating a CRM system equipped with affiliate marketing technology for efficient relationship management. This integrated platform streamlines communication, tracking, performance monitoring, and payouts transparently, bolstering operational efficiency and robust affiliate relationships. Competitive Advantage In a landscape where many forex brokers offer affiliate programs, possessing a technological edge becomes paramount. Advanced features like customizable commissions tailored to each affiliate group, real-time commission distribution, limitless referral hierarchy, and multi-tier commissions with customizable rank settings underscore a broker's unwavering commitment to expansion and fostering strategic partnerships. Broctagon AXIS’s IB & Affiliate Core Module Integrated as part of both the client and admin portal, AXIS CRM’s IB & Affiliate core module allows any trader to instantly promote your Brokerage. Deploy the industry’s most powerful multi-tier affiliate marketing tool and let your IBs, partners, and affiliates unlock their full potential. AXIS boasts exceptional affiliate capabilities, offering unlimited IB/Affiliate tiers within an expandable hierarchy. The IB Centre empowers partnering IBs and Affiliates to effortlessly track their daily progress, manage their operations, and gain insight into their referral network with dynamic data display for real-time performance and income breakdown. Additionally, each client account is equipped with a unique affiliate link for efficient online marketing and referral purposes. The admin portal features a host of customizable parameters, enabling brokers to launch tailored referral campaigns, customize IB Ranks, and configure commission tiers as well as deposit bonuses. Complete with an affiliate dashboard that gives insights to trading patterns, fund movements and client network activities for enhanced management. Want to launch a successful affiliate program or IB network and rapidly expand your brokerage business? Speak to us for a demo of all these functionalities.

- 12.10.2023

- All

- READ MORE

Migrating its Forex CRM to MySQL HeatWave on Oracle Cloud Infrastructure, the Singapore-based ISV increases performance by 30% and reduces cost by 35%. Business Challenges & Goals Broctagon's AXIS Forex CRM equips retail brokerage firms with a solution that integrates multiple trading platforms, enhances trader's journey, optimizes admin operations, and facilitates rapid market expansion with advanced affiliate capabilities, redefining industry standards and expectations. Broctagon began hosting its Forex CRM product on AWS RDS Aurora, with the MySQL database as the foundation, serving each customer with its own cluster. Over time, with a rapid increase in client base and thus data size, the company found that the cost of scaling up for enhanced performance was becoming prohibitive. With the need to improve the performance versus cost ratio, the company decided to migrate the CRM solution to MySQL HeatWave running on Oracle Cloud Infrastructure (OCI). Business Results & Metrics Broctagon achieved better performance and availability with MySQL HeatWave, at a significantly lower cost. This allowed the company to enhance and develop a wider array of microservices for the AXIS FX Broker CRM. Furthermore, after conducting full load stress testing with identical specifications, Broctagon achieved a 30% performance improvement with MySQL HeatWave. When calculating the computing power required to deliver the solution to over 160 brokers and growing, the cost was 35% lower with MySQL HeatWave, allowing Broctagon to pass on these cost savings to brokers. Considering the significant performance increase, Broctagon made the decision to change its architecture to aggregate more transactional and operational data in MySQL HeatWave. MySQL HeatWave substantially enhanced query performance, achieving almost 14X better performance. By leveraging OCI's high availability, Forex Brokers can now start operations within a day. Technical infrastructure for new brokers can now be provisioned within 60 minutes. Leveraging the high performance of MySQL HeatWave, Broctagon provides its CRM users with real-time trading account information and trade history data—syncing data directly from different external sources such as the MetaTrader 4, MetaTrader 5, and cTrader platforms. By offering advanced filters on real-time trading reports, users can customize and rearrange multiple fields on single table reports. Powered by MySQL HeatWave on OCI, the AXIS FX Broker CRM is a fully branded solution for Forex Brokers that can be modified to individual requirements with more than 350 customizable parameters. MySQL HeatWave's analytical capabilities have led Broctagon to create a flexible and configurable risk management dashboard. This dashboard provides alerts, performance tracking analysis, insights into the most and least profitable traders, and many other data-driven features that enable Forex brokers to make more informed decisions to increase their profitability. Further value-added services delivered to its brokerage clients include instant calculation of multiple-tier commissions based on real-time trades, thanks to an in-house Extract-Transform-Load (ETL) program that pulls data from multiple trading platforms and synchronizes it with MySQL HeatWave. The company has found that moving the AXIS FX Broker CRM to MySQL HeatWave has freed developers from heavy administrative work by automating updates, backups, monitoring, and more, channeling focus to the development of new functions that are frequently rolled out. On the technical front, the company is embracing MySQL HeatWave's read/write workload isolation by splitting write operations from certain expensive read operations. This allows for better monitoring of different clients' performance usage and optimizes application design. Why MySQL HeatWave? In search of delivering better performance to clients while staying cost efficient, Broctagon chose MySQL HeatWave after successful load testing, which confirmed an optimal performance-to-cost ratio. Moreover, Broctagon's CRM developments require interaction with one of the most robust foreign exchange trading platforms in the world, which mostly utilizes MySQL as the backend database. Another key factor was Oracle's MySQL Support provided detailed guidance, comprehensive documentation, and assistance in load testing, as well as migrating to OCI, which only took two weeks. Next Steps With MySQL HeatWave offering increased performance and reduced costs for the CRM solution, Broctagon is considering migrating parts of its liquidity and cryptocurrency business to OCI. “If performance continues to be above expectations, we will be moving more workloads to OCI down the line,” said Michael Mai. Looking ahead, Broctagon's roadmap includes leveraging MySQL HeatWave's machine learning (ML) capabilities to help Forex brokers attract and retain traders. For example, HeatWave ML can be trained to provide brokers with useful recommendations based on their trading data. The ML capabilities will also generate ideas for features to increase customer satisfaction and bring in new business, thus enabling Forex Brokers to increase their profit with lower costs. *Credits to Oracle for the original article: https://www.mysql.com/why-mysql/case-studies/broctagon-fintech-migrates-flagship-forex-crm-mysql-heatwave.html

- 11.10.2023

- All

- READ MORE

A proprietary trading challenge, often referred to as a prop trading challenge, is an assessment and evaluation process designed by proprietary trading firms (prop firms) to identify talented and skilled traders. The objective of such a challenge is to evaluate traders' trading strategies, risk management skills, and overall trading performance. Traders who successfully pass the challenge will then receive funding from the prop trading firm to trade with the firm's capital. Here's a step-by-step walkthrough of how a typical prop trading challenge works: Different Phases of a Prop Trading Challenge 1. Evaluation Phase:Traders participate in an initial evaluation phase where they trade on demo accounts. During this phase, they need to meet specific performance criteria, such as achieving a profit target, managing drawdown, and adhering to trading rules set by the prop trading firm. There may be multiple stages during the evaluation phase based on the discretion of the prop firm.Participating traders typically pay a registration fee to enter the challenge, and this fee may vary and are often proportional to the desired funded account size. Traders who successfully complete the challenge to the live stage are often eligible for a registration fee refund. 2. Verification Phase:This is the final step that traders must pass after successfully completing the initial challenge phase. The Verification Phase serves as a validation process to ensure that traders can consistently replicate their performance before they are funded by the proprietary trading firm. This phase may take place on either a demo or live account. 3. Account Review:When a trader successfully completes the verification phase by fulfilling all criteria, the prop trading firm typically reviews the trader's trading history, methodologies, and performance, including risk management and adherence to rules. This review process is an added layer of assurance that the prospective prop trader is aligned with the trading objectives of the firm. 4. Funding Phase:Upon successful completion of the review, the trader becomes eligible for a funded trading account offered by the prop trading firm. This trading account is typically funded with the firm's capital, enabling the trader to execute much larger positions compared to using their own money. The specific funded amount provided to the trader is dependent on the challenge they initially enrolled in. 5. Risk Management:Traders who receive funding are required to continue trading according to the prop firm's rules and risk management guidelines. This includes managing drawdown, adhering to position sizing rules, and following the firm's trading strategies. The trader may be funded for a certain period to be reviewed again for extending funding. Should the trader infringe any of the parameters set out by the prop firm, the funding will typically cease. It is important to note that the prop trader usually bears no financial risks except for the initial registration fee and/or the loss of potential profit share. 6. Profit Sharing: Profits generated from trading the funded account are shared between the trader and the prop trading firm based on a predetermined profit-sharing agreement, often at regular intervals decided by the Prop Firm. 7. Profit Withdrawals: Traders will then be allowed to withdraw their share of the profits, subject to the terms and conditions of the funding agreement. Proprietary trading challenges are a way for traders to prove their skills and gain access to institutional capital, which can amplify their trading opportunities. It's essential for traders to carefully read and understand the terms and conditions of the challenge and funding agreement before participating. Each prop trading firm may have its own specific rules and criteria for its challenges. Launch your very own Prop Trading Challenges Prop Trading Challenges are an innovative new offering that all FX Brokers should consider to not only expand their clientele but also retain the loyalty of existing traders by offering them an opportunity to trade on proprietary capital. This presents an alignment of interest and further reinforces the Broker’s commitment to the success of their traders. Launching fully customizable Prop Trading Challenges is simple with Broctagon’s plug-n-play Prop Challenge CRM module. Integrate now with zero setup or migration fees and start your own challenge in just 2 days. If you are an IB, Trader, Trainer, or a firm looking to begin your branded Prop Firm, our Fully Managed White Label solutions will get you started in a week. Learn more about our prop trading solutions here. Schedule a Free Demo

- 10.10.2023

- All

- READ MORE

Navigate the world of Proprietary Trading (Prop Trading) with our essential glossary of must-know terms! Whether you are a trader exploring this innovative new concept or Broker looking to expand your key offerings, this guide will help you chart a course to success by covering some of Prop Trading’s most important terms. 1. Prop Firm:A prop firm, also known as a proprietary trading firm, is a financial institution or company that uses its own capital for trading financial instruments. These firms often employ skilled traders with specific strategies and objectives, and profits generated from proprietary trading are typically shared between the firm and individual traders. 2. Proprietary Capital:This refers to the funds deployed for proprietary trading by a financial institution or company. It represents the firm's own capital utilized to trade various financial instruments with the primary objective of profit generation. 3. Proprietary Trading Challenge: A program offered by firms, brokers or institutions, where traders aim to meet specific trading objectives to qualify for a trading account funded by the company, otherwise termed as the prop firm. 4. Funded Trader:A trader who has met the criteria of a proprietary trading challenge and is provided with capital to trade. 5. Registration Fee:The fee traders must pay to participate in the challenge. This participation fee usually varies based on the desired funded account size, with larger funds incurring higher fees. These fees are typically reimbursed or offset by the profits earned during the final live trading stage. 6. Demo Account: A virtual environment allowing traders to practice without using real money. It provides access to live market data and tools for skill development and strategy testing. 7. Live Account: A trading account involving actual capital and real financial risk. It allows traders to participate actively in the live forex market. 8. Evaluation Phase: The first stage of a prop trading challenge where traders trade with virtual capital on demo accounts to meet set criteria. The evaluation phase may consist of multiple stages based on the discretion of the prop firm. 9. Verification Phase: The final stage of a prop trading challenge where traders demonstrate their ability to replicate their performance in a live or demo trading environment, based on the discretion of the prop firm. Traders who successfully pass the verification phase will move on to trading a live account funded by the prop firm. 10. Trading Rules: Guidelines and conditions established by the proprietary trading firm that traders must follow during the challenge. This is to ensure consistency in performance and allow for proper evaluation before gaining access to prop capital. 11. Trading Period: A specified timeframe within which traders must achieve the profit target and adhere to challenge rules. 12. Trading Days: The minimum number of days that traders are required to open new trades, within the trading period. This rule aims to promote a consistent trading strategy, discouraging attempts to achieve profit targets solely through a single, exceptionally profitable trade that may have a low likelihood of recurrence. 13. Profit Target: A predefined goal that traders must reach within the trading period. 14. Trading Rules: Guidelines and conditions established by the proprietary trading firm that traders must follow during the challenge. 15. Maximum Drawdown Limit: The maximum allowable account loss or equity decrease during the challenge. Exceeding this amount will result in challenge failure. 16. Maximum Daily Loss: The most significant allowable daily trading loss, as per challenge rules. This can be a fixed number or a percentage of the equity at the start of the day. Exceeding this amount will result in challenge failure. 17. Trade Size: The number of units or lots traded in a single position. 18. Risk-Free Period: A specific time frame during which losses do not affect the trader's account. 19. Free Repeat: An opportunity given to traders to retry a specific stage without extra fees. This usually occurs when all criteria are fulfilled at the end of the trading period except the profit target. 20. Scaling Plan: A strategy outlining how traders plan to achieve profit targets and manage risk. 21. Account Evaluation: The assessment of a trader's trading results and compliance with challenge rules before granting access to a funded account. This is typically a manual review process after the trader completes the verification phase. 22. Funded Account Size: The initial capital provided to traders upon successfully passing the challenge. 23. Profit Share: The division of trading profits between the trader and the proprietary trading firm, often following a pre-established split ratio. 24. Funding Agreement: The formal agreement outlining the terms and conditions of the funded trading account. 25. Funding Period: The duration for which traders have access to the funded account. 26. Forex Liquidity Provider: A Forex (FX) Liquidity Provider (LP) is a financial entity that provides bid and ask prices for diverse currency pairs. Typically in possession of a large pool of assets, the LP’s main role is fill client’s orders by both buying and selling assets. Prop firms typically trade with regulated LPs in reputable jurisdictions. 27. Scalping: Scalping is a trading strategy that entails rapid, frequent trades aiming to capitalize on minor price fluctuations within a short timeframe, often spanning seconds to minutes.These strategies are commonly categorized as higher-risk and may not align with prop trading guidelines, potentially leading to disqualification from trading challenges. 28. Anti-Expert Advisor (EA): An automated trading software that utilizes predetermined strategies and technical indicators to autonomously make trading decisions and execute trades on behalf of traders.EAs may not align with prop trading guidelines as they lack dynamic human assessment. 29. News Trading: Forex news trading is a strategy that seeks to profit from price fluctuations before or immediately after economic news and key data releases. It bears higher risk due to the volatile nature of market reactions to news events.As such, news trading permissibility is subject to the policies of prop trading firms. 30. Hedging: If hedging is allowed, traders are permitted to open and hold multiple positions in opposite directions (buy and sell) for the same currency pair simultaneously.Inadequate hedging may result in higher risks thus it is important to check if the prop firm allows this strategy or if there are additional associated conditions. Prop Firm Turnkey Setup Setting up a Prop Firm can be simple with Broctagon’s Fully Managed White Label solutions. Focus your efforts on marketing your brand while entrusting the technological backbone of your prop venture in expert hands. With our end-to-end solution suite, your Prop Firm can be up and running within a week. If you are a FX Broker looking to add Prop Trading Challenges to your offering, our CRM with integrated Prop Challenge Module will get you started in 2 days. Learn more about our prop trading solutions here. Schedule a Free Demo

- 04.10.2023

- All

- READ MORE

Fasset is a regulated, multi-country Digital Asset Gateway that aims to connect the next billion to buy, sell, send and store digital assets such as Bitcoin and Real World Asset Tokens.

- 15.10.2021

- Partnerships

- READ MORE

BITLEVEX revolutionizes investment platforms by offering leveraged options priced according to traditional Black & Scholes mathematical models.

- 13.10.2021

- Partnerships

- READ MORE

“While a huge driver of its growth, shib's status as a memecoin may very well also be its bane," said Don Guo, the chief executive of trading technology company Broctagon, said in emailed comments, adding he believes it's "impossible" that shiba inu could ever reach $1.

- 10.10.2021

- All

- READ MORE

“Named the Boba Network, the project is a layer-2 solution that allows crypto to have payment processing speeds that rival payment heavyweights like Visa and Mastercard,” Don Guo, CEO of Broctagon, said. “Game-changers like these, much like the NEXUS WorldBook movement, which is an inter-exchange liquidity network for digital assets, can create greater visibility and trust for crypto as a whole.”

- 06.10.2021

- All

- READ MORE

AscendEX is a global cryptocurrency financial platform with a comprehensive product suite including spot, margin, and futures trading, wallet services, and staking support for over 150 blockchain projects such as bitcoin, ether, and ripple.

- 28.09.2021

- Partnerships

- READ MORE

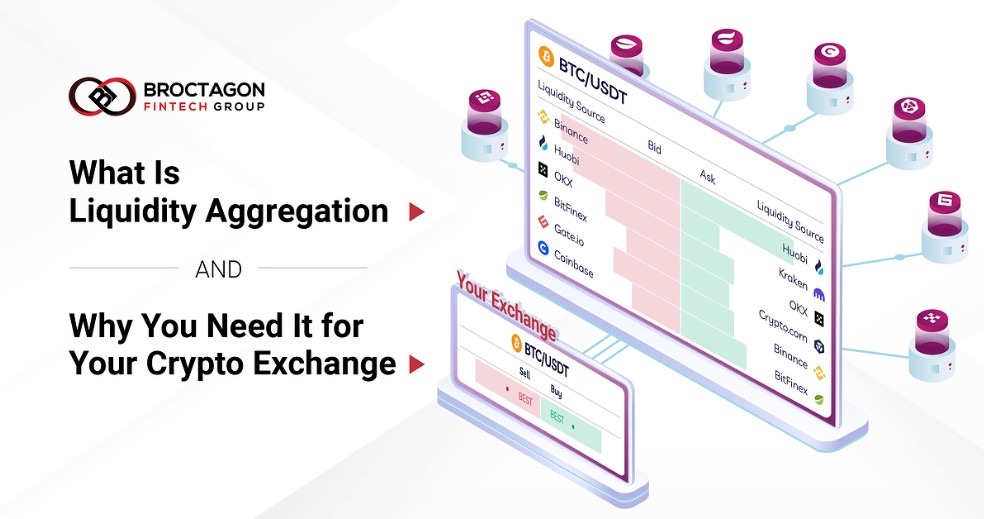

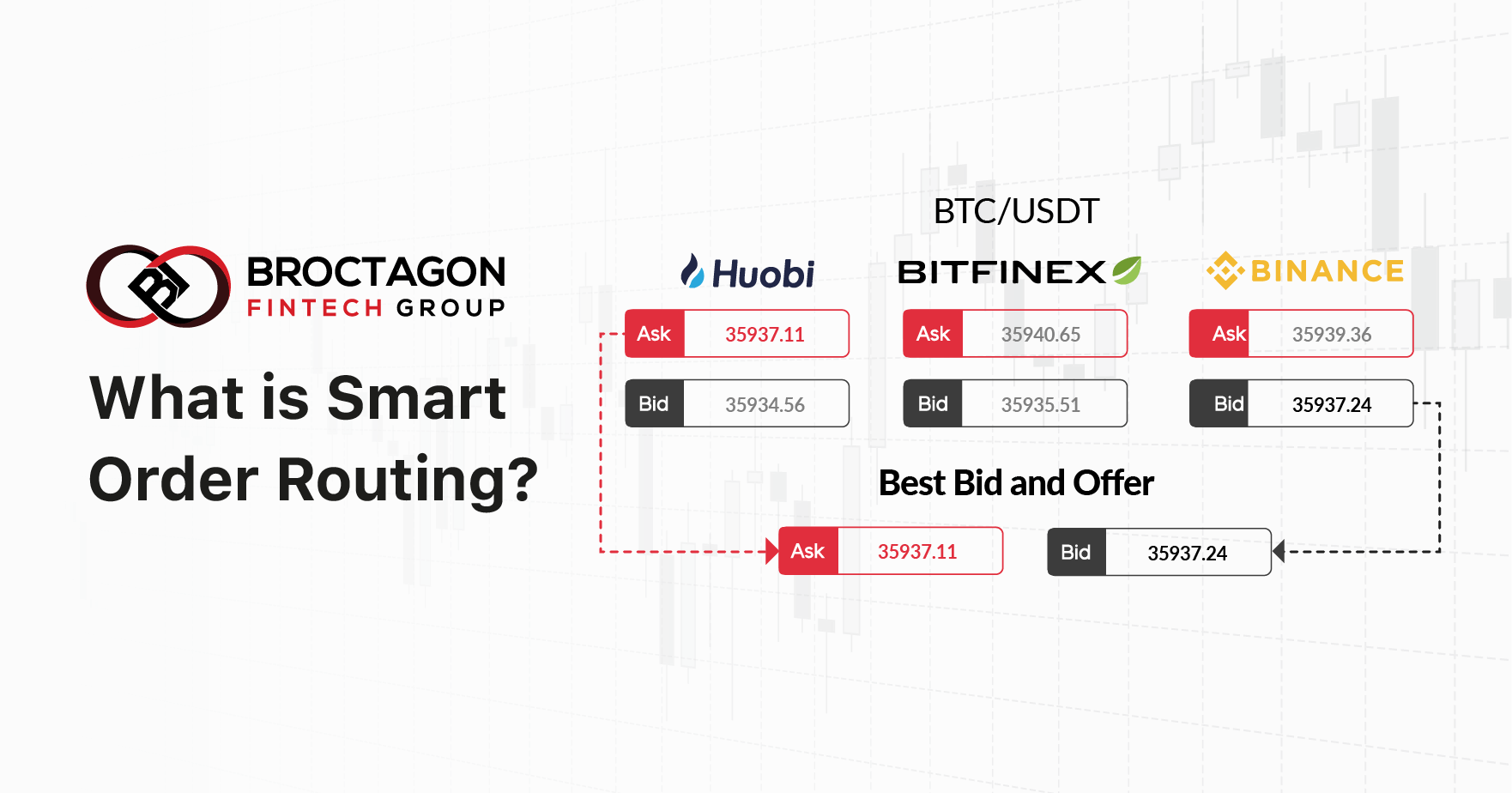

Singapore, September 14, 2021: Fintech solutions provider, Broctagon Fintech Group, today launched WorldBook, a global crypto movement focused on solving key liquidity issues plaguing the industry. WorldBook is the world’s first crypto STP (Straight-Through Processing) network with the largest aggregated liquidity pool. The initiative aims to introduce a universal standard of liquidity for digital assets, uniting both processes and technology within the crypto industry under a single framework. Unlike the highly streamlined Forex or Securities financial markets, crypto trading is highly fragmented with significant price disparity across exchanges. This is largely because of existing market norms where exchanges operate in a silo within their orderbook, limiting their offerings and therefore prices to the participants within. The eponymous WorldBook combines the orderbooks of all connected exchanges to create a unified orderbook that enables multilateral liquidity flow. Instead of being confined to local orderbooks which may represent less than 1% of the total industry, exchanges now gain access to 85% of the market. This is made possible by the NEXUS 2.0 aggregator, the driving engine that powers the WorldBook with SOR (Smart Order Routing), which allows for global price discovery and best bid and offer. Don Guo, CEO of Broctagon Fintech Group “Despite the gaining acceptance of crypto, it remains a “wild west” with no dominant technology or standard in which it operates. With the WorldBook’s price aggregation, we found that bitcoin had an average negative spread of USD$10, even amongst the major exchanges. This means that with over USD$15.5 trillion in trading volume over the past year, traders could have saved USD$5.7 billion in spreads and this is for bitcoin alone, which is already the most efficient and liquid digital asset. The price disparity could only be worse for the thousands of altcoins across many smaller exchanges.” said Don Guo, Co-Founder and CEO, Broctagon Fintech Group highlighting the issues. “We engineered the WorldBook infrastructure taking a page from the fundamentals of FX interbank liquidity. With our experience as a regulated FX liquidity provider, we believe the Prime of Prime (PoP) model has the potential to disrupt the industry and increase crypto trading volumes by more than 400% in the near future.” The WorldBook is part of Broctagon’s commitment to propel the crypto industry towards regulatory compliance, adoption, and maturity. As Singapore looks to be a poster child for the crypto industry with its welcoming policies, the homegrown fintech company seeks to support this national agenda. Exchanges are welcome to connect to the WorldBook for free. The advantages for exchanges include an evident increase in volumes and a decrease in bid-ask spread amongst others. For example, the BTSE exchange experienced an eight-fold increase in trading volume, surpassing 10,000 trades across six crypto pairs within the first month. “Liquidity challenges exist for newer and established exchanges alike. The former requires extensive capital for marketing to capture enough users for a liquid orderbook while the latter often pay hefty fees for external market maker services to drive profitability. The WorldBook is a solution for both. With universal prices and unprecedented depth, exchanges can focus on other aspects of the business to bring further value to their clients.” said Don. Shadab Taiyabi, President of Singapore FinTech Association “We congratulate Broctagon, which is one of our active members, on their launch of the WorldBook. The growth of our FinTech ecosystem is a collective effort of all members of the community, fintech and financial institutions alike,” said Shadab Taiyabi, President of Singapore FinTech Association, a cross-industry non-profit initiative recognised by the Monetary Authority of Singapore. Globally, crypto exchanges that are not within the top 3 percentile account for only less than 10% of total trading volume, according to data derived from CoinGecko. With its symmetrical flow of liquidity, the WorldBook levels the playing field for newer exchanges to contend and explore new frontiers, driving growth for the entire industry at large. “We recognize how a standardized framework for liquidity can ensure steady supply and demand for our clients. It is a pleasure to work with the WorldBook, and we shall support them as they look to introduce cohesive standards for the entire industry and elicit greater public adoption of cryptocurrency,” said Weber Woo, CEO, XT Exchange, the first digital asset social trading platform with close to half a million active monthly traders. Beyond a liquidity network, the Worldbook is also an open initiative to forge greater collaboration amongst industry peers old and new, to create a digital asset landscape primed for multifaceted participation. Amongst its pioneering members are Huobi Group, FCA-regulated Archax, BitKub, as well as RegTech companies such as Horangi and Cypnopsis as well as Defi and blockchain firms like Hodlnaut and Bholdus amongst many others. Those who want to be members may visit nexusworldbook.com to indicate interest. Alternatively, they can reach out to the WorldBook through its Telegram (https://t.me/nexusworldbook) or drop the WorldBook an email at [email protected].

- 14.09.2021

- All

- READ MORE

ParallelChain, an award-winning blockchain wallet solution provider, is the latest participant to join the inter-exchange liquidity network known as the WorldBook™. The NEXUS WorldBook is an initiative by Broctagon Fintech Group, under the licensed entity Broctagon Prime Markets Limited to create a universal liquidity standard for digital assets. Ian Huang, Founder and CEO of ParallelChain, said: “The DeFi and crypto space is reshaping the financial system. Due to these distinctive characteristics, DeFi community and traditional enterprises are facing big challenges as they become more intertwined. We need to create an environment that enables seamless access between the two, one that understands their respective needs and values — this is at the heart of what we do at ParallelChain. In support of the WorldBook initiative, ParallelChain will bring the much-needed stability, accountability and privacy protection for the institutional adoption of crypto.” Cecilia Chan, Head of Liquidity (Asia) and Executive Director of Broctagon Fintech Group, commented on ParallelChain’s participation on the WorldBook network, saying: “More than just a wallet solution, ParallelChain’s cross-functional utility can even cover KYC, data security, and supply chain solutions. Through their understanding of scalability, latency and security — all important issues surrounding blockchain technology, the WorldBook will gain a greater perspective of how blockchain can be employed in various use cases.” About ParallelChainParallelChain is a layer-1 project that brings accountability to the public blockchain and crypto sector. Comprised of public and private networks, ParallelChain creates an ecosystem where enterprises and the crypto community can enjoy seamless access to each other’s markets and value-adding interaction. It provides the necessary backbone infrastructure as this new fusion economy takes shape. About NEXUS WorldBookThe NEXUS WorldBook™ is the world’s first crypto liquidity ecosystem, committed to building a cohesive network for both makers and takers. The WorldBook leverages on the NEXUS 2.0 aggregator technology to offer its members global price discovery and direct STP capabilities on a universal liquidity standard. To find out more about ParallelChain, visit: Website: https://www.parallelchain.io/Telegram: https://t.me/parallelchainofficialTwitter: https://twitter.com/DTL_blockchainLinkedIn: https://linkedin.com/company/digital-transaction-limitedMedium: https://medium.com/digital-transaction-limitedYouTube: https://www.youtube.com/c/DigitalTransaction To find out more about or to join the NEXUS WorldBook, visit: Website: https://nexusworldbook.comFacebook: https://www.facebook.com/NEXUSWorldBookLinkedIn: https://www.linkedin.com/showcase/74741847/Twitter: https://twitter.com/NEXUSWorldBookInstagram: https://www.instagram.com/nexusworldbook/YouTube: https://www.youtube.com/channel/UCT5_f3W2SEBDsWrJc8YGAEw

- 13.09.2021

- Partnerships

- READ MORE

AlphaPoint, a global provider of white-label software for launching and operating crypto and digital asset marketplaces, is the latest participant to join the inter-exchange liquidity network known as the WorldBook™. The NEXUS WorldBook is an initiative by Broctagon Fintech Group, under the licensed entity Broctagon Prime Markets Limited to create a universal liquidity standard for digital assets. Igor Telyatnikov, Co-founder and CEO of AlphaPoint, said: “AlphaPoint and its award winning blockchain technology have helped startups and institutions discover and execute their blockchain strategies since 2013. We are committed to furthering development and implementation of new technologies and standards to promote adoption worldwide and increase the net-benefit impact of crypto. Our membership in the WorldBook movement is an expression of this commitment, and we expect exciting opportunities to follow from this partnership.” Ted Quek, CTO of Broctagon Fintech Group, commented on AlphaPoint’s participation on the WorldBook network, saying: “AlphaPoint is uniquely positioned as the only technology provider in the crypto-exchange platform space that offers software solutions for both primary issuance and secondary trading. Given their experience in launching exchanges from the ground up, we are excited to welcome AlphaPoint to the WorldBook. As a solutions provider, their adoption of universal crypto-standards will undoubtedly set the pace for their takers.” About AlphaPointAlphaPoint is a white-label software company powering crypto exchanges worldwide. Through its secure, scalable, and customizable digital asset trading platform, AlphaPoint has enabled over 150 customers in 35 countries to launch and operate crypto markets, as well as digitize assets. About NEXUS WorldBookThe NEXUS WorldBook™ is the world’s first crypto liquidity ecosystem, committed to building a cohesive network for both makers and takers. The WorldBook leverages on the NEXUS 2.0 aggregator technology to offer its members global price discovery and direct STP capabilities on a universal liquidity standard. To find out more about AlphaPoint, visit: Website: https://alphapoint.com/Facebook: https://www.facebook.com/AlphaPointLive/Twitter: https://twitter.com/AlphaPointLiveLinkedIn: https://linkedin.com/company/alpha-pointYouTube: https://www.youtube.com/channel/UClPeLvua-m00J_I5ah8ZdpQ To find out more about or to join the NEXUS WorldBook, visit: Website: https://nexusworldbook.comFacebook: https://www.facebook.com/NEXUSWorldBookLinkedIn: https://www.linkedin.com/showcase/74741847/Twitter: https://twitter.com/NEXUSWorldBookInstagram: https://www.instagram.com/nexusworldbook/YouTube: https://www.youtube.com/channel/UCT5_f3W2SEBDsWrJc8YGAEw

- 08.09.2021

- Partnerships

- READ MORE

Archax, the first FCA-regulated exchange, is the latest participant to join the inter-exchange liquidity network known as the WorldBook™. The NEXUS WorldBook is an initiative by Broctagon Fintech Group, under the licensed entity Broctagon Prime Markets Limited to create a universal liquidity standard for digital assets. Simon Barnby, CMO of Archax, said: “Archax has built its niche working in highly regulated markets. This has enabled us to acquire a deep understanding of the blockchain and DLT landscape as well as a vision of how to evolve and transparently open up digital assets to institutions. As the only FCA-regulated digital securities exchange, we are excited to be working with WorldBook to continue our journey to enable the onset of mass digital asset acceptance.” Ted Quek, CTO of Broctagon Fintech Group, commented on Archax’s participation on the WorldBook network, saying: “Archax’s extensive portfolio encompasses investment, trading, listing and digital asset custody. Their work and experience with both institutional investors and regulatory bodies will help paint a clearer picture of the latter’s expectations, and we are thrilled to have them onboard the movement.” About ArchaxArchax is a global, FCA-regulated, digital asset exchange, brokerage and custodian based in London. Founded by experts from the financial markets world and backed by an accomplished advisory board, Archax offers a credible bridge between the blockchain-centric crypto community and the traditional investment space. About NEXUS WorldBookThe NEXUS WorldBook™ is the world’s first crypto liquidity ecosystem, committed to building a cohesive network for both makers and takers. The WorldBook leverages on the NEXUS 2.0 aggregator technology to offer its members global price discovery and direct STP capabilities on a universal liquidity standard. To find out more about Archax, visit: Website: https://www.archax.com/Twitter: https://twitter.com/archaxexMedium: https://medium.com/archaxexLinkedIn: https://www.linkedin.com/company/archaxex/ To find out more about or to join the NEXUS WorldBook, visit: Website: https://nexusworldbook.comFacebook: https://www.facebook.com/NEXUSWorldBookLinkedIn: https://www.linkedin.com/showcase/74741847/Twitter: https://twitter.com/NEXUSWorldBookInstagram: https://www.instagram.com/nexusworldbook/YouTube: https://www.youtube.com/channel/UCT5_f3W2SEBDsWrJc8YGAEw

- 02.09.2021

- Partnerships

- READ MORE

In this latest version update AXIS CRM V6.5, we are pleased to announce the latest platform updates that feature new integrations that bring exciting enhancements. With this update, the new features offer increased personalization and enhanced data management. These integrations empower brokerages to tailor their CRM experience to a broader range of specific needs and requirements, enabling more efficient communication and collaboration.

- 21.08.2023

- All

- READ MORE

We started with a dream to bridge the gap for highly tailored FX solutions that add tangible and impactful value to Forex Brokers. 14 years and hundreds of brokers later, we revisit the question – What is Broctagon? Our team at iFX Expo Asia 2023 shares their answers. Broctagon is about Business Integrity. With strict compliance and a perfect track record, our multi-asset liquidity and aggregator technology empowers some of the largest brokers in the world. Broctagon is Radical Innovation. We built the first FX CRM with multi-level IB rewards that is now fueling the expansion of many brokers globally, bringing in thousands of traders daily. Broctagon is about Freedom to clients. We understand that every client is unique and there is no cookie cutter solution that fits all. That is why our solutions are modular, bespoke and can be tailored to the specific needs of your Broker. Lastly, how do we motivate high performers and create synergy? Broctagon is all about Clan Culture. We are eager to collaborate both internally and with clients, and we stand firmly by our belief that our success only comes after yours. That is why the bulk of our clients have long-term partnerships with us. With a strong focus on these principal values and collaborative spirit, Broctagon has worked its way up to becoming the trusted partner for turnkey FX solutions, catering to the needs of brokers worldwide. If you ever need Forex solutions, remember - We’ve got your back, always.

- 19.07.2023

- All

- READ MORE

The current era of rapid digital transformation has revolutionized financial transactions and investment models. Cryptocurrencies and blockchain technology have ushered in a new age of Decentralized Finance (DeFi) and tokenization strategies. Amidst these significant shifts, one strategy has emerged as a vital component in this evolving landscape: Token Vesting. This strategy, which involves a structured and systematic approach to releasing tokens to investors, employees, and other project participants, has proven instrumental in ensuring fairness, transparency, and security in the token economy. But how can one effectively harness this game-changing strategy? Enter Broctagon's bespoke Token Vesting Platform Development services. Broctagon's Token Vesting Platform: A Beacon of Trust and Security At the heart of our offering is the ready-made, white-label Token Vesting Platform. Designed as a secure and trustworthy solution, this platform fundamentally aims to safeguard the long-term value of your digital assets. While doing so, it does not compromise on user experience, instead providing an unparalleled, user-centric interface for your token stakeholders. Our platform addresses multiple areas of concern in the digital asset management landscape. Its robust security and customization features set it apart from the crowd. Whether it's the flexibility in vesting schedules, the assurance of pre-audited smart contracts, or its compatibility with any token, our platform demonstrates our unyielding commitment to safety and customization. Why Choose Broctagon? At Broctagon, we believe that your brand's identity is integral to your success. This conviction is reflected in our token vesting platform, which offers a ready-made User Interface (UI) with fully customizable branding options. Our platform is a perfect blend of technology and aesthetics, delivering a seamless and user-friendly experience that seamlessly mirrors your brand's identity and vision. One of the fundamental pillars of the digital token world is safety and security. To safeguard your digital assets, our platform is built upon the robust framework of self-executing smart contracts. These contracts function with precision and impartiality, ensuring the secure distribution of tokens. Furthermore, our smart contracts have undergone rigorous pre-audit procedures, ensuring they are free from vulnerabilities and risks. This added layer of security serves to fortify the trust of your token holders in your brand and its digital assets. Embracing Flexibility and Transparency Project timelines and requirements can vary greatly, necessitating a flexible approach to token distribution. Keeping this in mind, our platform provides flexibility in vesting schedules and distribution plans. Be it linear, monthly, or quarterly token distributions with cliffs, our platform caters to a wide range of distribution strategies, enabling you to adapt to your project's unique requirements. Transparency is the cornerstone of any successful token distribution strategy. We emphasize this principle by integrating a visual tracking interface into our platform. This intuitive tool provides user-friendly visuals that allow token holders to track allocated and claimable tokens effortlessly. This transparent tracking mechanism not only fosters trust but also promotes active participation from token holders, contributing to the overall success of your project. The Broctagon Advantage: Harnessing Expertise and Delivering Dedicated Support At Broctagon, we bring to the table industry-leading expertise and experience in fintech and blockchain. Our in-depth knowledge and skills enable us to develop and deliver cutting-edge solutions that align perfectly with your business needs. Our commitment to your success extends beyond the delivery of our platform. We offer dedicated support throughout your journey, from the initial setup to the launch and even beyond. Our team is committed to ensuring a seamless and rewarding experience, enabling you to concentrate on what truly matters - driving the growth and success of your business. Unleashing the Potential of Token Vesting The volatile nature of digital assets underscores the importance of a strategic, measured approach to token distribution. Token vesting is a strategy that has proven its mettle in maintaining the value of digital assets over the long term. By ensuring a gradual, scheduled release of tokens, it effectively mitigates the risks associated with abrupt sell-offs and market fluctuations. Broctagon's Token Vesting Platform Development services masterfully leverage this strategy, bringing its full potential to bear on your project. Our platform's flexible and customizable vesting schedules allow you to fine-tune your token distribution to perfectly align with your project's objectives and the expectations of your stakeholders. This adaptability sets us apart from our competitors, equipping us to cater to different participant categories and unique project requirements. Powering Ahead with Broctagon: Ensuring a Seamless Token Distribution Experience At Broctagon, we harness the power of blockchain technology to design our token vesting platform. The foundation of this platform is self-executing smart contracts, which facilitate a seamless and secure token distribution process. Moreover, these smart contracts have been pre-audited to eliminate vulnerabilities and ensure the safe handling of your digital assets. Our platform is designed to accommodate any token, marking it as a truly universal solution. So, whether you're dealing with established cryptocurrencies or launching a brand-new digital asset, our platform is ready to cater to your needs. Embark on Your Journey Towards a Prosperous Token Economy with Broctagon The future of tokenization is here, and it is secure, transparent, and customizable. Optimize your token distribution, instill confidence in your stakeholders, and empower your token economy with Broctagon's superior token vesting platform. Experience the transformative power of an efficient and equitable token distribution system by scheduling a free demo with us. Together, let's redefine the landscape of token distribution and shape a fair, fruitful token economy. Don't just take our word for it - reach out to us today and start your journey towards a thriving token economy. With Broctagon's comprehensive Token Vesting Platform Development services at your side, the future of your project looks bright indeed.

- 15.07.2023

- All

- READ MORE

Broctagon has introduced a brokerage CRM for cTrader with its integration into the proprietary FX brokerage customer management system– AXIS.

- 16.05.2023

- All

- READ MORE

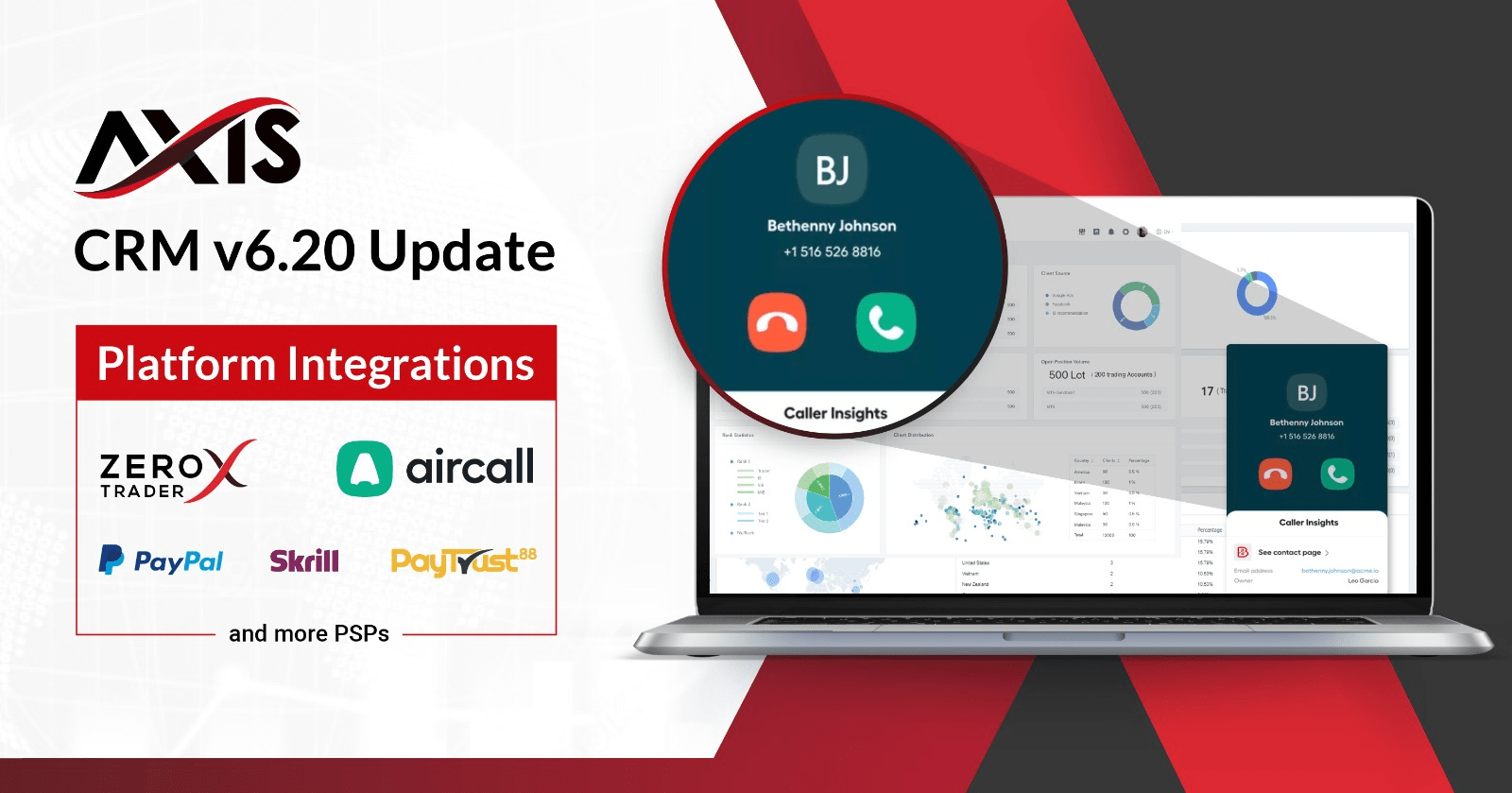

In this latest version update AXIS CRM V6.2, we are pleased to announce the latest platform integrations that will allow more customization, flexibility and streamlining of processes in trader management. We also introduced other new functionalities that would improve networking capabilities and optimization for brokerages.

- 03.04.2023

- All

- READ MORE

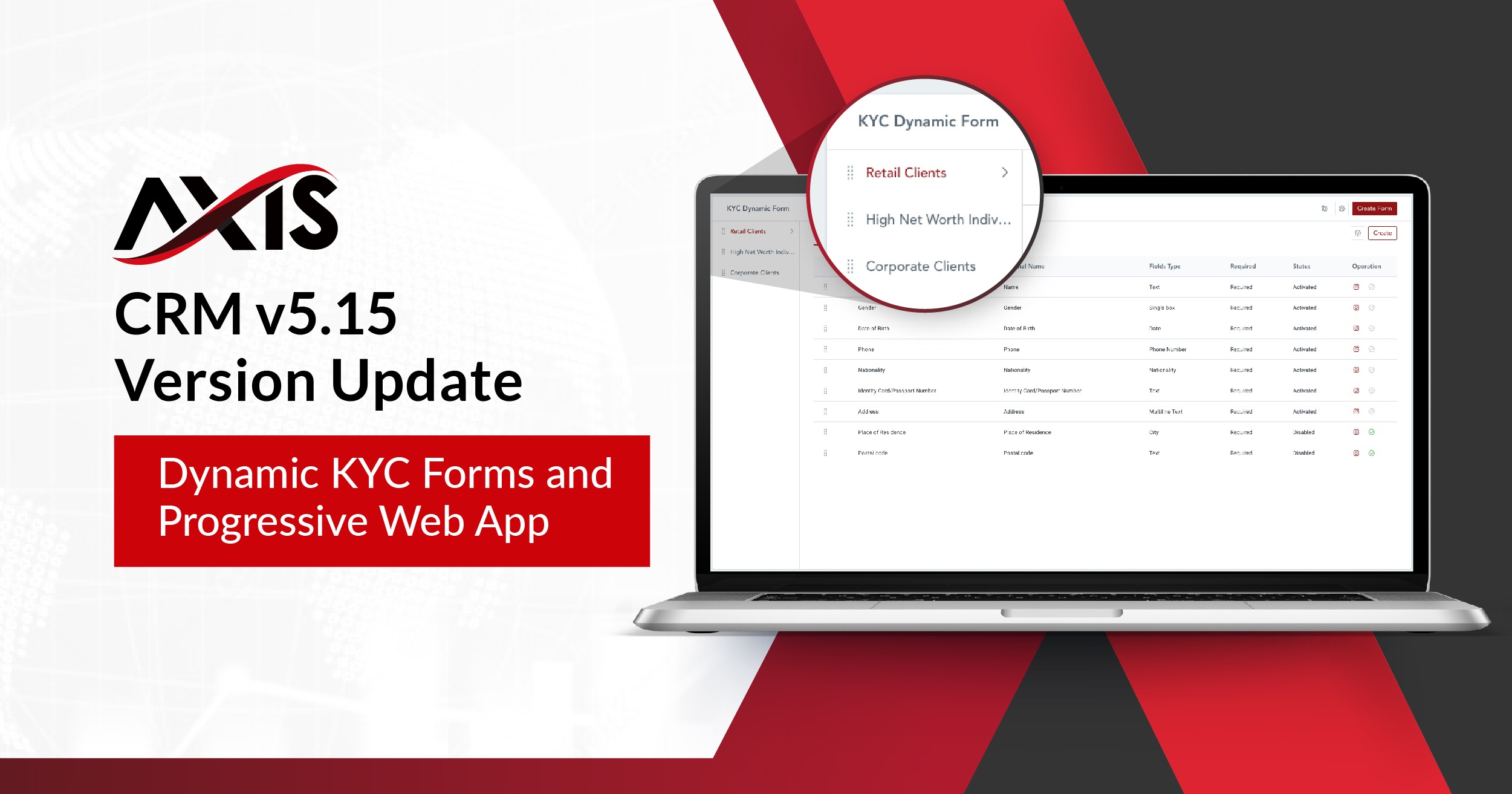

In this latest version update AXIS CRM V5.15, we are pleased to announce the launch of a game-changer for FX brokerages using AXIS – the Progressive Web App (PWA) client portal. We also introduced other updates that would improve dynamic customization and control for brokers to onboard new users. Progressive Web App (PWA) We have launched the progressive web app (PWA) for brokers, introducing a stunning combination of rich functionality and the smooth user experience associated with native apps, while also offering seamless compatibility. The PWA will mimic navigation and interactions of a native app, allowing brokers to implement dynamic functionalities without requiring any complication installation process. The PWA will bring a host of advantages to brokerages and their clients: Full Responsiveness and Browser Compatibility: PWAs work with all browsers and are compatible with any device, delivering the same experience to tablet and mobile users as well. The PWA is built according to progressive enhancement, a web design strategy that provides functionality and content regardless of types of browsers while delivering more sophisticated page versions to users whose newer browsers can support them. Connectivity Independence: Progressive web applications can work both offline and on low-quality networks and delivers basic functionality regardless of connectivity. Easy Updates and Installation: Apps can be shared through a URL instead of having to download it only from the app store. The installation is simple, traders can now install the client portal desktop app from their browsers. Here’s how you share the PWA for different operating systems and devices: For Apple iOS Devices Safari browser: The installation window cannot be set to automatically pop up. Users can click the "Share" button and select "Add to Home Screen" from settings Chrome and Edge browsers: Similarly, the installation window cannot be set to automatically pop up. The PWA cannot be added to the desktop through these browsers, as iOS system does not allow this permission to third-party applications. For Android Devices For Chrome and Edge browsers: Different mobile phone brands may behave differently. The following brands have been tested: OPPO, Xiaomi: The installation window pops up, and PWA can be installed on the desktop. HUAWEI HarmonyOS: The installation window pops up, users can manually add it to their desktop. Dynamic KYC Forms We have also introduced dynamic KYC form settings to introduce a more seamless and efficient onboarding process for different categories of clients that may require different sets of KYC information. Admins can now add multiple KYC forms under the ‘KYC Settings’ in the ‘KYC Dynamic Form’ tab. Field descriptions can now be added on the ‘Form Type Settings’ page to provide clarity for forms and their functions for internal teams. Admins can edit, disable, or delete the forms from the same page. We have added a preview function in the ‘Display Mode’ for documents uploaded to ‘KYC Dynamic Form’. The only formats not supported are .txt, .xlsx and .docx. On the client portal, users will get the option to select the relevant KYC form before submitting it. The trader registration process is optimized to 4 steps to greatly reduce sign-up friction. Client Management A new ‘tasks’ function has been added to allow brokers to better manage clients and structure their internal processes by creating tasks and to-do lists. Here is the new ‘Tasks Settings’ page, which shows an overview of all pending tasks assigned, follow-up needed for clients and their priority status. Tasks will also show up on a specific client’s page, and admins can add new tasks where needed. Tasks can also be set to follow up on a ‘Leads’ page, so that no potential leads are lost.Permissions can be configured for different admin levels such as ‘Read Tasks’ and ‘Add Tasks’. Types of admin-data permissions include: Company Wide: View all tasks assigned to company-wide on the list, and client and lead details pages. All Referred Clients: View tasks assigned to all subordinate users on the list, including client and lead details pages. Directly Referred Clients: View tasks assigned to direct subordinate users on the list, including client and lead details pages. Time stamps have been added to ‘Follow-up Record’ to allow client follow-ups to be better managed. Automated System Tags For certain event-trigged actions, the CRM system can now tag these actions automatically, allowing admins to sort and view account actions clearly. These events are: ‘Deposited’: The trading account or wallet has made its first deposit ‘Account Opened’: The trading account has been opened or bound to a client ‘Traded’: The bound trading account has a opened a position or created a trade history These system tags are also added as a new field in the filters for the ‘Client’ list, where admins can check and filter accounts that have performed specific actions, in order to follow up with them. The filtering system has also been enhanced to filter by ‘Trading Account’ and ‘Lead Source’. Deposit Settings We have added an automatic retry function in the event of a deposit auto-approval failure. Admins can trigger this function by checking “Automatic retry on audit failure” to allow the system to automatically retry failed approval requests. This function allows the system to automatically attempt re-approval in the event that the MT connection is unstable and causes deposit auto-approval to fail initially. Caution: When the system automatically retries deposit approval, it checks the trading platform’s database for the corresponding deposit records. However, in abnormal situations, if the database fails to sync the correct result, this will result in duplicate deposits. Brokers will then have to manually withdraw the incorrect funds or consider disabling this function. It is highly recommended that brokers using this function continuously perform account reconciliation to detect duplicate deposits. Retry settings: If the option ‘Automatic’ or ‘Partial Approval’ has been selected, and the ‘Automatic retry” box is checked, the system will perform a deposit retry on the failed records every 30 minutes for records within the hour. Notification settings: Admins can configure settings to send notifications to selected parties in the event of an automatic verification failure. A description field has been added to online deposit method in ‘Deposit Settings’. Users can now configure a time range according to time zones for their ‘Daily Deposit Settings’. Automated Affiliate Tier Upgrade As the core of the AXIS CRM, the multi-tier affiliate system has received another major upgrade. With the new automated tier upgrade function, affiliate promotions can now be self-triggered upon criteria fulfilment, allow brokers and IBs to manage their affiliate networks much more efficiently. Tier Upgrade Settings: Affiliate network tiers can now be upgraded automatically via a sophisticated rule-setting algorithm. Simply create a new rule and set the relevant parameters in which a client’s tier should be upgraded. When these criteria are met, the upgrade happens automatically with no manual administrative process required. Tier Upgrade Reports: Reports can be generated for an in-depth overview of clients and their current tiers, network hierarchy, their new upgraded tiers and more. A time range function has been added for which client reports can be viewed. Limits can be set for a number of weeks or months, and further segregated by levels of referred clients. Client Portal Client Dashboard(i) For quicker navigation, shortcuts to frequently-used functions have been added to the dashboard, so that clients can click on the icons to access them. (ii) An overview chart of the user’s ‘Total Balance’ in the last month can also be viewed from the dashboard. My ClientsClient data has been streamlined with a detailed ‘Client Distribution’ table, sorting number and percentage of clients by country. CommissionAn overview chart of the user’s ‘Commission’ in the last month can be viewed from the Referral tab. Exchange RateIf the exchange rate has been changed, a prompt will now appear when clients attempt to make a deposit, transfer, or withdrawal, to keep them informed and updated. Sign Up Free Trial Book a Demo

- 22.02.2023

- All

- READ MORE

In this latest version update AXIS CRM V5.6, we enhanced control for brokers by introducing more UI customization options and data filtering to fully utilize the AXIS’ core IB/affiliate network capabilities. UI Customization We have enabled more customization for the user interfaces of both the Admin Portal and Client Portal, allowing brokers to take control of business processes to better suit their needs. The portal landing page and navigation settings now have more customization options. Create your unique CRM that exudes in-house vibes. Client Portal The default style of the landing page is now set to 'center'. Users can also choose to set it to 'left', 'right'. Light and dark themes are also available. The theme color is also customizable with specific HTML color codes. The default style of the navigation bar is now set to 'left'. Users can also set the navigation bar to appear at the top. Admin Portal The default style of the landing page is now set to 'center'. Users can also choose to set it to 'left', 'right'. Light and dark themes are also available. The theme color is also customizable with specific HTML color codes. The default style of the navigation bar is now set to 'top'. Users can also set the navigation bar to appear on the left. 9 different variations and colors of email templates have been added for admins to customize emails for specific branding or occasions. To trigger this, admins will have to install the application in the marketplace. To use templates when sending emails, go to 'Notify' > 'Email'. Payment and Funding We have added functionalities for payment and banking to streamline processes for brokers. Deposits through ChillPay are now supported. Deposits through Paypal are now supported. A minimum and maximum amount can now be set in transfer settings to minimize transfer errors. The process of adding bank cards and KYC verification has been streamlined. The 'Bank Card' module in 'Clients Details' has been moved till after the 'KYC' module. This is to prevent adding of bank cards before the KYC process. Admins can add now and update clients' bank cards on the 'Clients Details' page. Notifications Admins now have the ability to revoke pop-up notifications within two hours of publishing. Permissions for viewing emails and pop-up notifications can now be customized depending on network roles. Company Wide: Permission to view all emails and pop-up notifications sent to clients. Directly Referred Clients: Permission to view emails and pop-up notifications sent to clients by direct team members. Same Role: Permission to view emails and pop-up notifications sent to clients by admins of the same role. All Referred Clients: Permission to view emails and pop-up notifications sent to clients by team members. Admin Portal Promotion Links In 'Promotion Link' settings, 'Downlines' has been added as a group option. This is to allow IBs to create promotional links that specifically target their referred clients. Bonus Campaigns Admins can now amp up marketing and referrals via distribution of bonuses. Bonuses can be rewarded via Bonus Campaigns, which can be created under 'Bonus' > ‘Bonus Settings' > 'New Campaign'. Trading Platform Under 'Trading Platform' settings, the information that is automatically synced to the MT platform can now be customized. Here are the additional optional fields: Phone Number Email Agent Account KYC (including Place of Residence, Postal code and Address KYC During the trader registration and KYC approval process, a notification has been set to trigger when a KYC Identity Card/Passport Number already exists in the system. This is to ensure that each entry is unique and reduce accidental duplication. Filtering The client list can now be filtered by those who have a referrer and those who do not. The client list can now also be filtered by those who do not possess a trading account. The lead source for clients can now be displayed. It is hidden by default. Admins can now do a quick search of reports by keying in the order ID. Supported reports: Back Office → Reports → CRM Reports→Transactions Back Office → Reports → MT Reports → Trade History Back Office → Reports → MT Reports → Open Positions Back Office → Reports → MT Reports → Pending Orders Client Portal → Referral → Clients' Reports → Transactions Client Portal → Referral → Clients' Reports → Trade History Client Portal → Referral → Clients' Reports → Open Positions Client Portal → Referral → Clients' Reports → Pending Orders Reports Report functions have been improved to introduce more sophistication for bonus tracking. Trigger Order Reports: 'Trigger Order' reports can be generated to track bonuses that are rewarded when clients deposit funds. This allows admins to track the source of bonuses and events in which they are triggered. Bonus Reports: The system can auto-generate regular bonus reports, which allows admins to view all the calculated bonus records. Bonus Payout Reports: 24 hours after a bonus calculation is completed, the bonuses for each client will be calculated and a one-time deposit will be made to the client's account. Admin can view all statuses of rewarded bonuses. General To improve user experience, the following formatting has been done: All figures showing monetary currency is now formatted to be clearly separated by commas. For example, 10000 USD will show as 10,000 USD. A space is now added after a colon in fields. This takes effect in 'Client' > 'KYC' page and all approval request detail pages. Learn More Schedule a Demo

- 31.10.2022

- All

- READ MORE

Broctagon has expanded liquidity offerings list to 1,800+ instruments! With our proprietary aggregator technology, we are ever-increasing our assets offered, providing enhanced market depth and razor thin spreads in a frictionless marketplace.

- 24.10.2022

- All

- READ MORE

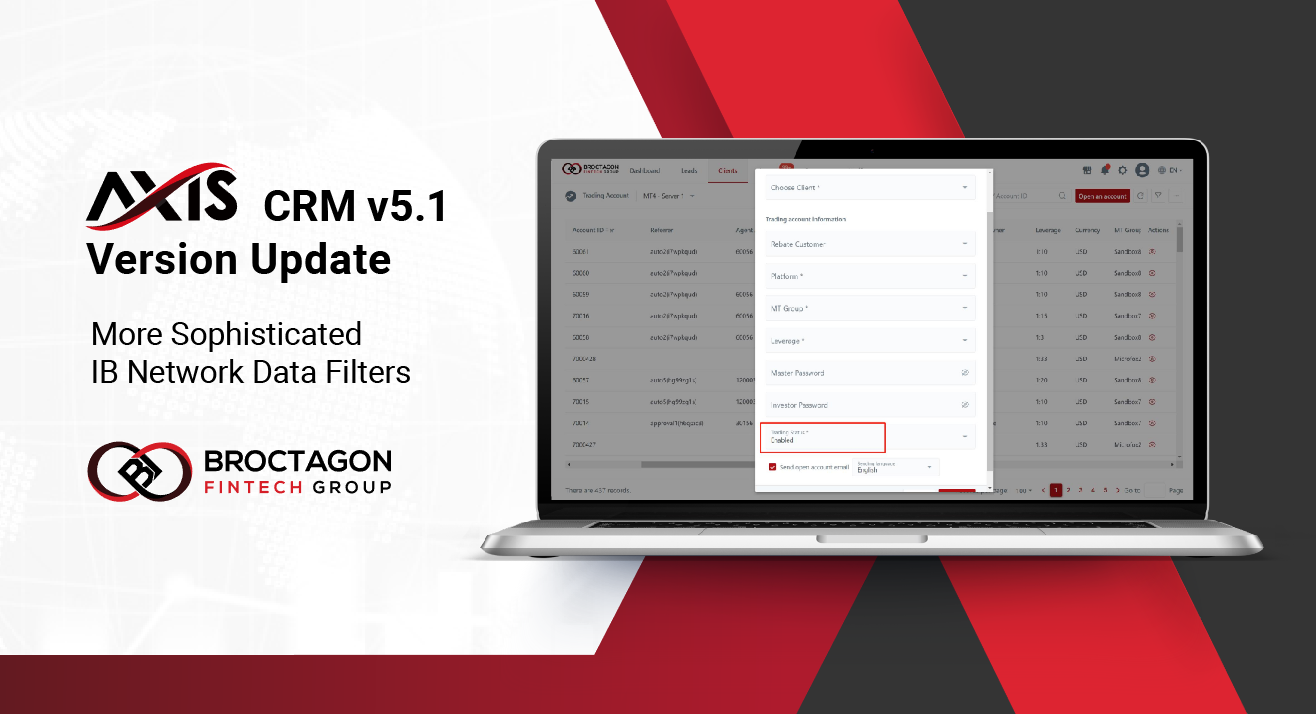

In this latest version upgrade for AXIS 3.0, we have made updates and adjustments to Broctagon's fully customisable SaaS solution and CRM for brokerages engineered for client expansion. We have worked to make account and trader management more efficient and customizable for brokers and IBs.

- 31.08.2022

- All

- READ MORE

The main thing that puzzles most non-crypto fanatics is, why would anyone pay for high value NFTs when in this digital age, anything can be watched, copied or downloaded for free?

- 07.12.2021

- Blockchain

- READ MORE

Owing to the country’s friendly regulatory environment with respect to financial markets, and fintech and blockchain within it, various other global cryptocurrency groups are expanding their presence in Singapore.

- 25.10.2021

- All

- READ MORE

Non-Fungible Tokens (NFT) can help artists in a way by driving a change in how art is bought, sold, supported, enjoyed and created.

- 26.08.2021

- Blockchain

- READ MORE