Brokerage. Blockchain. Buzz.

Welcome, find all things buzzing on board at Broctagon’s blog! Here you’ll find the latest in blockchain news, exciting event highlights, insightful thought leadership in forex and crypto, and more. Be the first to know all about our events and most innovative tech updates – all in one space.

Dubai, UAE – We are pleased to announce that Broctagon Fintech Group has been honored with the prestigious title of “Best Prop Trading Technology Provider” at the recently concluded Dubai Forex Expo 2023. With the industry’s top innovators and game-changers gathered under one roof, this recognition further solidifies our position as a leading force and serves as a testament to our relentless commitment to reinvent ourselves and constantly provide value to our clients in the dynamic forex arena. With our suite of Prop Trading solutions, FX Brokers and prop firms can easily launch their own prop trading challenges to capitalize on this rising trend to generate new streams of revenue. Official Launch of Prop Trading System A highlight of the Forex Expo Dubai 2023 was Broctagon's official unveiling of our prop trading solutions, including a “Fully managed Prop Firm White Label” and a “Plug-and-play Prop System” designed for seamless integration into existing FX brokerages. The surge in popularity of proprietary trading challenges reflects the vibrancy and innovation in the trading landscape, with many keen to establish prop firms to uncover trading talents while traders benefit from these challenges by gaining access to institutional capital, a truly win-win situation. This trajectory is set to gain further momentum with the aid of cutting-edge technological solutions, exemplified by Broctagon's turnkey systems, which empower FX Brokers to instantly deploy highly customizable prop challenges or enable aspiring Prop Firms to go-to-market within a week. A Resounding Response on The Expo Floor The response from the expo participants was nothing short of remarkable. At our booth, Broctagon representatives were inundated with inquiries, with several clients even signing up on the spot. Broctagon’s technological advantage coupled with a compelling proposition that is success-focused with no upfront setup or migration fees, makes it an easy decision for clients. Ted Quek, CTO of Broctagon, shared his thoughts on the accolade, stating, "Winning the title of 'Best Prop Trading Technology Provider' at the Forex Expo Dubai 2023 is a strong affirmation of our team's unwavering dedication and expertise. It is truly gratifying to witness several clients signing up on the spot, which accentuates the tangible value and impact of our technology." Here is an overview of our Prop Trading Solutions: Anticipating A Rising Demand Broctagon's success in Dubai underscores the growing demand for competitive Prop Trading solutions in the financial industry. The Prop Trading business model has created unique opportunities in the Forex sphere due to its accessibility and lower barriers of entry as compared to starting a full-fledged FX Brokerage. Now, IBs, Forex Trainers and Educators, Fund Managers, and practically any firm or individual can establish a Prop Firm and launch challenges easily, without huge upfront expenses. Broctagon’s focus on adaptability and scalability ensures all FX Brokers and prospective Prop Firms have access to the tools, support, and knowledge to operate Prop Challenges efficiently and profitably. Modern trading is undergoing a refreshing new shift once again, let us help position you in the forefront of this new landscape. Speak to us for a free Prop Trading System demo today. We will be happy to answer any inquiries you may have with regards to the Prop Trading Business Model.

- 28.09.2023

- All

- READ MORE

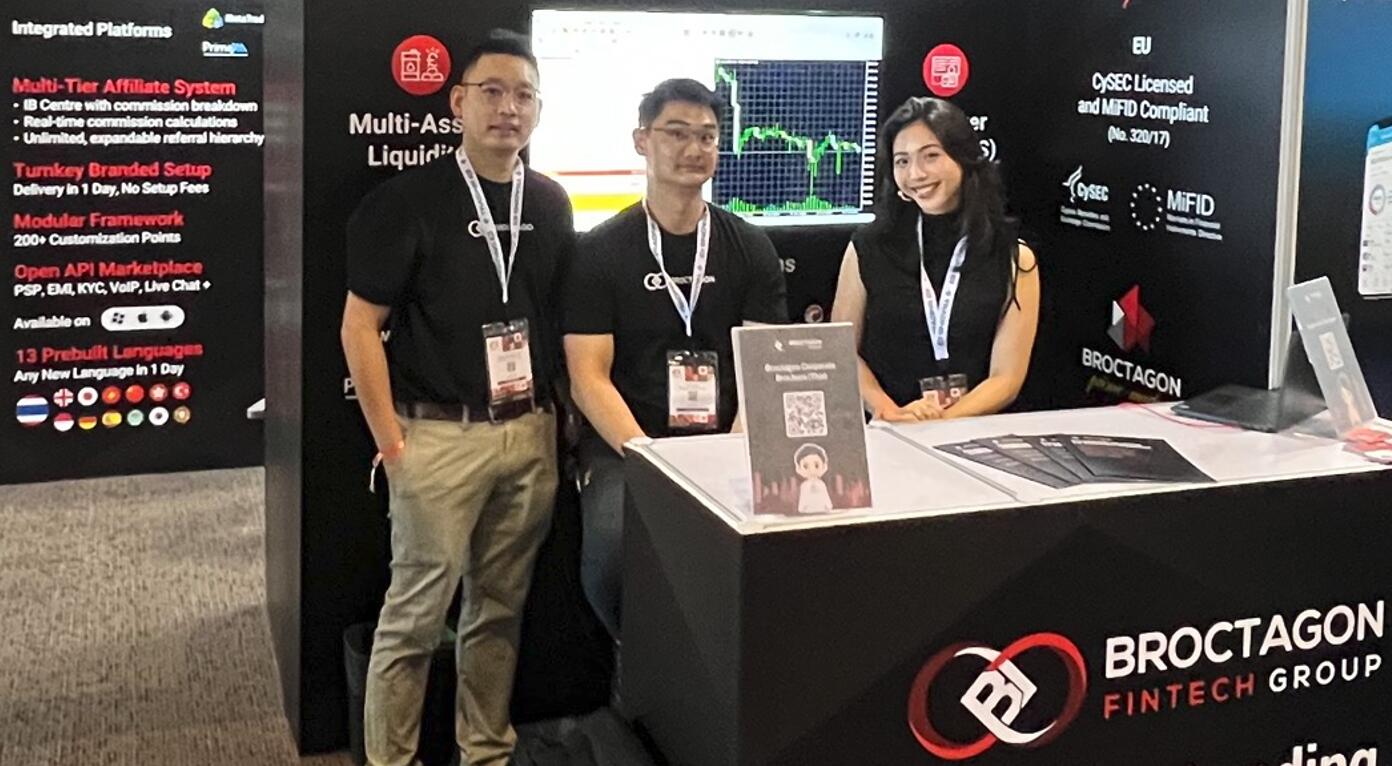

Day 1 is abuzz at iFX International 2023! The day is lively as attendees from around the globe gathered at the impressive City of Dreams Integrated Resort, with its vibrant landscape of Liquidity Solutions, Forex Brokers and Technology Providers showcasing their cutting-edge products and services. FIND US AT Date:19-21 September 2023 Venue:City of Dreams Mediterranean Integrated Resort in Limassol, Cyprus The Demand For Bespoke Liquidity This year, we witnessed a notable surge in demand for tailored liquidity solutions, as FX Brokers look to enhance their trading conditions to distinguish themselves in the increasingly competitive FX arena. Beyond our already extensive portfolio of over 1,800 assets featuring ultra-tight spreads as low as zero, we're excited to introduce new innovations this year that have garnered an overwhelming response. Be sure to check us out! Looking To Supercharge Your FX Brokerage? Beyond liquidity, we are a full suite FX Solutions Provider with a proven track record serving over 350 clients worldwide. For all your FX needs, partner with the best, at Broctagon. Meet Our Experts We're here at iFX International Expo until September 21st, so don't miss the opportunity to have a chat with us in person! If you can't make it to the expo, no worries—our specialists are also available online at any time to discuss your business needs. We're committed to providing you with top-notch support, whether you're here with us in person or connecting virtually. Your success is our priority, and we're ready to assist you every step of the way. Schedule a Consultation Meet Us At Our Next Event Broctagon will be at the upcoming Forex Expo Dubai 2023, the 6th grand edition of the premier trade and investment ecosystem event which brings together Forex traders, IBs, Investors, Financial Institutions, and Brokers from all over the world. Join us at the World Trade Centre in Dubai, Hall 6, Booth 178 from 26-27 September 2023!

- 20.09.2023

- All

- READ MORE

In this latest version update AXIS CRM V6.5, we are pleased to announce the latest platform updates that feature new integrations that bring exciting enhancements. With this update, the new features offer increased personalization and enhanced data management. These integrations empower brokerages to tailor their CRM experience to a broader range of specific needs and requirements, enabling more efficient communication and collaboration.

- 21.08.2023

- All

- READ MORE

Starting a Forex Brokerage can be a thrilling business venture. However, just like any other business, it is crucial to take into account vital aspects such as developing a sound business plan, registering the business, obtaining the necessary technology, partnering with liquidity providers, and selecting the types of trading assets to offer. You might be wondering, how do I start, and how much is the cost to start a forex brokerage? Cashflow plays a significant role in most start-ups and businesses and an FX Brokerage is no exception. One of the main challenges is the failure to recognize and prepare for the running expenses. This article will explore the factors to consider when calculating the cost of setting up a new brokerage. With this knowledge, you can proceed with clarity. How much does it cost to start a Forex Brokerage? If you want to start a Forex Broker but are concerned about the capital required, then this article is for you. We will explain and breakdown the potential cost to start a forex brokerage, and the potential things will have to bear for every aspect. While launching your Forex Brokerage, you have the choice of: Building an FX Brokerage from scratchCost Estimate – upwards of $60,000 to $100,000 per month (excluding operational manpower costs). Cost is dependent on the size of your IT team and the complexity of the product you are developing. Selecting a White Label SolutionCost Estimate – between $4,000 to $8,000 a month (excluding operational manpower costs). Cost is dependent on your number of users and whether you require additional customizations and plugins. Both options have their pros and cons. While developing from scratch provides you full control and technology ownership, it demands a monumental amount of time, resources and money. To do so successfully, you must possess a significant technological expertise and a thorough understanding of the Forex business modus operandi. The capital outlay is also highly intensive to maintain a team of engineers, DevOps, solution architects and more. The basic salary of such a team to develop all the technological aspects will be minimally tens of thousands of dollars. This intricate and time-consuming process coupled with high entry barriers is the reason why many entrants opt to use existing white label solutions to enter the lucrative Forex market. Turnkey solution providers offer a fuss-free approach that saves both time and money, leveraging ready-technology and that can be deployed for your immediate usage. Although there are more limitations as compared to developing your own software, modern White Label solutions are extremely modular and are highly customizable and more often than not, able to satisfy the unique requirements of each Forex Broker. In the following sections, we will explore the various White Label Solutions available to complete a full brokerage setup. What type of fees to expect for starting a Forex business? The charging model for providers varies with many accompanying factors for consideration. However, aspiring brokers can expect the following categories of fees. Setup fee These are usually one-off fees associated with the first configuration and branding to suit your brokerage’s specific requirements. This could be setting up a trading platform, a Client Office (CRM), or liquidity. Monthly fee These are recurring licence fees to Technology Providers for utilizing their software. These fees are commonly based on user count and inclusive of hosting fees. Volume-based fee These type of fees are usually paid to Liquidity Providers for the total volume of transactions executed. Such fees also apply to Payment Solution Providers and charged based on the volume of funds processed. Now, let’s dive deeper into each component to understand the accompanying cost to start a forex brokerage. Incorporation and Licensing For a Forex Broker to be considered trustworthy and legitimate, it is crucial to register as a financial body with a reputable regulator. This process involves incorporating a company and obtaining a license from the regulatory body, which comes with varying fees and requirements depending on the jurisdiction and type of license. Some licenses may require a regulatory capital that ranges from 100,000 USD to upwards of £750,000, especially for principal licences. Besides costs, time is also an important factor to consider before deciding your regulatory body of choice. Established regulators such as Cyprus Securities and Exchange Commission (CySEC), UK’s Financial Conduct Authority (FCA), or Labuan Financial Services Authority (LFSA) may take more than 12 months and cost upwards of 80,000 USD for the application. Forex licences in jurisdictions such as Vanuatu, Comoros, Mauritius, and Seychelles may take anywhere from 2 to 6 months and cost upwards of 20,000 USD. It is important to note that some software solution providers require certain licenses in order to onboard. Less-reputed licences may not be accepted. Therefore, it is essential to evaluate the licensing fees and requirements of various regulatory bodies to determine the most suitable option for your brokerage. The process can also be significantly hastened by working with a FX full-suite provider that offers incorporation and licensing consultancy and services. Disclaimer: Fees are accurate at the time of publish and are offered as an estimate. Fees may vary based on the complexity of the application. Banking and Payments Channels In order to collect deposits for your Forex Brokerage, you will need to consider banking options and payment systems. Under certain offshore jurisdictions, you may require an agent to help with the opening of bank accounts and service fees can range in a couple of thousand dollars. To facilitate easy deposits and withdrawals for your traders, integrating with reputed payment service providers (PSPs) are also important. Fees generally range between 1.5% to 5% of volume, depending on the size of your monthly transactions and currency type, in addition to a fixed fee per transaction. To easily access a wider range of PSPs, it is advisable to choose a software solutions provider that has pre-integrated with these channels, so everything is readily available and there is no further technical hassle on your end. Technology Trading Platform The core element of any Forex Broker is none other than the trading platform. It needs to be robust, secure, intuitive and packed with trading tools for your clients. Recognized as the industry standard by the global trading community, the MetaTrader 4 and MetaTrader 5 stands out as the preferred choice of trading platform. In order to apply for the MT4 or MT5 Main Label licence, you will be required to pass a stringent KYC process and a major Forex License is a prerequisite that will set you back tens of thousands. At the time of publishing, White Labels are no longer being offered and Main Labels will cost upwards of 7,500 USD per month and increase based on the number of users. Other prominent platforms include the cTrader and ZeroX Trader amongst others. These platforms also offer multi-platform trading terminals on desk, web, and mobile and are great alternatives to the MetaTrader 4 and 5. There are usually no major license requirements, and the monthly fees start from 3,000 USD, at a more affordable range. Do note that different platform providers’ charging model varies, while some are also based on user count, others could be volume based with a monthly minimum fee. CRM (Client Portal + Admin Backoffice) A great CRM is indispensable for Forex Brokers, given how such software can streamline client management and enhance end-user experiences. A CRM usually consists of 2 main components: Client Portal – The frontend login for traders to manage all their accounts at a glance, change preferences, deposit and withdrawal funds and interact with support etc. Admin Backoffice – A backend login for your Broker’s operational team to handle all clients’ requests, access reports, manage user roles and leads etc. These functionalities of a CRM become increasingly important as you expand, granting the automation necessary for scalability. Selecting the right CRM for your brokerage is crucial for driving business success. The ideal Forex Brokerage CRM should be modular, highly customizable, and dynamic with automated marketing and Introducing Broker (IB) management tools, enabling brokerages to build networks and increase visibility for their brand. The best brokerage CRM will prepare your brokerage for rapid expansion by offering a range of tools, from affiliate marketing to ticketing support, to ensure smooth onboarding and retention of clients. Learn about some key features a good brokerage CRM should have here. Broctagon is home to one of the industry’s most powerful Forex Broker CRM. With more than 350 customizable parameters and a multi-tiered IB/affiliate system, Broctagon’s AXIS CRM can be branded and deployed in just 24 hours. Fully integrated with MT4, MT5, cTrader, and ZeroX with an open API Marketplace that is preconnected to VoIP, KYC, and Payment service providers, your Brokerage can begin operations instantly. Depending on the user count, and choice of SaaS or dedicated, a CRM setup and licensing fee from Broctagon begins at 500 USD with no compromise on functions across all packages. Liquidity The choice of Liquidity Provider affects the product offerings and trading environment that a brokerage can provide its clients. It is essential to choose a liquidity provider that offers tight spreads and a wide range of instruments so that your brokerage is competitively priced with sufficient market exposure. Even more importantly, it is crucial to work with a licensed and regulated liquidity provider in reputable jurisdictions, to reduce your counterparty risk. Established providers typically offer Prime of Prime (PoP) liquidity, which acts as an intermediary between retail Forex Brokerages and Banks (Prime Brokers). This enables the retail Forex Brokerage to gain access to institutional interbank liquidity, providing the necessary liquidity for seamless trade execution. Broctagon is a leading Prime of Prime, dual-licensed (CySEC, Labuan FSA) Liquidity Provider with more than 1800+ assets across FX, Metals, Oil, Commodities, Indices, Shares (US/HK/EU/JP/UK) ETFs, Futures and Crypto CFDs. Via proprietary price aggregation technology, we stream liquidity up to 10-tier Depth of Market (DOM) with a straightforward “plug and play” integration even for clients with no existing liquidity bridge. The charging model for most liquidity providers is a monthly minimum fee and volume fee, whichever is higher. The Monthly minimum fee for Broctagon liquidity starts from 2,500 USD per month with a flat volume fee across all instrument types. Conclusion The cost to start a Forex Brokerage business can be complex with many movable parts and factors. It requires a thorough analysis of various elements such as the type of business structure, location, licensing, technology, liquidity providers, payment systems, and customer relationship management. Moreover, different jurisdictions have different regulatory requirements and compliance costs, which can affect the overall expenses. Therefore, it is important for aspiring brokers to approach this process with careful consideration and planning. It is also advisable to seek professional advice from experienced full-suite solution providers who have both the width and depth of experience to help ensure you make informed decisions to minimize any unnecessary risks and detours. By taking these steps, new brokers can determine the most effective and efficient way to start their business and build a strong foundation for long-term success in the highly competitive forex market. If you wish to speak with our specialist for a free consultation, we are always happy to chat.

- 21.07.2023

- All

- READ MORE

We started with a dream to bridge the gap for highly tailored FX solutions that add tangible and impactful value to Forex Brokers. 14 years and hundreds of brokers later, we revisit the question – What is Broctagon? Our team at iFX Expo Asia 2023 shares their answers. Broctagon is about Business Integrity. With strict compliance and a perfect track record, our multi-asset liquidity and aggregator technology empowers some of the largest brokers in the world. Broctagon is Radical Innovation. We built the first FX CRM with multi-level IB rewards that is now fueling the expansion of many brokers globally, bringing in thousands of traders daily. Broctagon is about Freedom to clients. We understand that every client is unique and there is no cookie cutter solution that fits all. That is why our solutions are modular, bespoke and can be tailored to the specific needs of your Broker. Lastly, how do we motivate high performers and create synergy? Broctagon is all about Clan Culture. We are eager to collaborate both internally and with clients, and we stand firmly by our belief that our success only comes after yours. That is why the bulk of our clients have long-term partnerships with us. With a strong focus on these principal values and collaborative spirit, Broctagon has worked its way up to becoming the trusted partner for turnkey FX solutions, catering to the needs of brokers worldwide. If you ever need Forex solutions, remember - We’ve got your back, always.

- 19.07.2023

- All

- READ MORE

The current era of rapid digital transformation has revolutionized financial transactions and investment models. Cryptocurrencies and blockchain technology have ushered in a new age of Decentralized Finance (DeFi) and tokenization strategies. Amidst these significant shifts, one strategy has emerged as a vital component in this evolving landscape: Token Vesting. This strategy, which involves a structured and systematic approach to releasing tokens to investors, employees, and other project participants, has proven instrumental in ensuring fairness, transparency, and security in the token economy. But how can one effectively harness this game-changing strategy? Enter Broctagon's bespoke Token Vesting Platform Development services. Broctagon's Token Vesting Platform: A Beacon of Trust and Security At the heart of our offering is the ready-made, white-label Token Vesting Platform. Designed as a secure and trustworthy solution, this platform fundamentally aims to safeguard the long-term value of your digital assets. While doing so, it does not compromise on user experience, instead providing an unparalleled, user-centric interface for your token stakeholders. Our platform addresses multiple areas of concern in the digital asset management landscape. Its robust security and customization features set it apart from the crowd. Whether it's the flexibility in vesting schedules, the assurance of pre-audited smart contracts, or its compatibility with any token, our platform demonstrates our unyielding commitment to safety and customization. Why Choose Broctagon? At Broctagon, we believe that your brand's identity is integral to your success. This conviction is reflected in our token vesting platform, which offers a ready-made User Interface (UI) with fully customizable branding options. Our platform is a perfect blend of technology and aesthetics, delivering a seamless and user-friendly experience that seamlessly mirrors your brand's identity and vision. One of the fundamental pillars of the digital token world is safety and security. To safeguard your digital assets, our platform is built upon the robust framework of self-executing smart contracts. These contracts function with precision and impartiality, ensuring the secure distribution of tokens. Furthermore, our smart contracts have undergone rigorous pre-audit procedures, ensuring they are free from vulnerabilities and risks. This added layer of security serves to fortify the trust of your token holders in your brand and its digital assets. Embracing Flexibility and Transparency Project timelines and requirements can vary greatly, necessitating a flexible approach to token distribution. Keeping this in mind, our platform provides flexibility in vesting schedules and distribution plans. Be it linear, monthly, or quarterly token distributions with cliffs, our platform caters to a wide range of distribution strategies, enabling you to adapt to your project's unique requirements. Transparency is the cornerstone of any successful token distribution strategy. We emphasize this principle by integrating a visual tracking interface into our platform. This intuitive tool provides user-friendly visuals that allow token holders to track allocated and claimable tokens effortlessly. This transparent tracking mechanism not only fosters trust but also promotes active participation from token holders, contributing to the overall success of your project. The Broctagon Advantage: Harnessing Expertise and Delivering Dedicated Support At Broctagon, we bring to the table industry-leading expertise and experience in fintech and blockchain. Our in-depth knowledge and skills enable us to develop and deliver cutting-edge solutions that align perfectly with your business needs. Our commitment to your success extends beyond the delivery of our platform. We offer dedicated support throughout your journey, from the initial setup to the launch and even beyond. Our team is committed to ensuring a seamless and rewarding experience, enabling you to concentrate on what truly matters - driving the growth and success of your business. Unleashing the Potential of Token Vesting The volatile nature of digital assets underscores the importance of a strategic, measured approach to token distribution. Token vesting is a strategy that has proven its mettle in maintaining the value of digital assets over the long term. By ensuring a gradual, scheduled release of tokens, it effectively mitigates the risks associated with abrupt sell-offs and market fluctuations. Broctagon's Token Vesting Platform Development services masterfully leverage this strategy, bringing its full potential to bear on your project. Our platform's flexible and customizable vesting schedules allow you to fine-tune your token distribution to perfectly align with your project's objectives and the expectations of your stakeholders. This adaptability sets us apart from our competitors, equipping us to cater to different participant categories and unique project requirements. Powering Ahead with Broctagon: Ensuring a Seamless Token Distribution Experience At Broctagon, we harness the power of blockchain technology to design our token vesting platform. The foundation of this platform is self-executing smart contracts, which facilitate a seamless and secure token distribution process. Moreover, these smart contracts have been pre-audited to eliminate vulnerabilities and ensure the safe handling of your digital assets. Our platform is designed to accommodate any token, marking it as a truly universal solution. So, whether you're dealing with established cryptocurrencies or launching a brand-new digital asset, our platform is ready to cater to your needs. Embark on Your Journey Towards a Prosperous Token Economy with Broctagon The future of tokenization is here, and it is secure, transparent, and customizable. Optimize your token distribution, instill confidence in your stakeholders, and empower your token economy with Broctagon's superior token vesting platform. Experience the transformative power of an efficient and equitable token distribution system by scheduling a free demo with us. Together, let's redefine the landscape of token distribution and shape a fair, fruitful token economy. Don't just take our word for it - reach out to us today and start your journey towards a thriving token economy. With Broctagon's comprehensive Token Vesting Platform Development services at your side, the future of your project looks bright indeed.

- 15.07.2023

- All

- READ MORE

Broctagon was invited to the Oracle’s Executive Connect Session held at the Sheraton Tower Hotel, Singapore, on 12 July 2023.

- 13.07.2023

- All

- READ MORE

In the ever-evolving world of the Forex markets, Broctagon has consistently emerged as a leading provider of comprehensive turnkey solutions for brokerages worldwide. Recently, at the internationally acclaimed Bangkok iFX Expo Asia 2023, the team at Broctagon had the opportunity to sit down with renowned financial news media outlet FX168 for an exclusive interview on how we stay competitive, relevant and innovative. The Industry’s Trusted Name For 14 Years The focus of the interview with FX168 was Broctagon's cutting-edge FX Broker technology solutions as well as our wealth of experience as the industry’s trusted multi-asset liquidity provider. During the interview, Broctagon's Sales Director Sy Jinn shared our journey to becoming a recognized name and premier solutions provider, being one of the few providers in the forex industry to have a long-established history of 14 years. Broctagon's success is rooted in our ability to constantly innovate, delivering highly customizable end-to-end solutions that cater to the diverse needs of both forex brokers and their traders, through a deep understanding accumulated from years of battle-tested experience. From our institutional liquidity of more than 1,800 instruments, to the industry’s most powerful unlimited-tier IB system and now with the latest launch of our ZeroX trading platform, Brokers get a leg up on the competition with Broctagon’s turnkey and tailored technology. Broctagon sets itself apart with its dedication in challenging the status quo and delivering beyond expectations. Harnessing the power of emerging technologies allows us to stay at the forefront of Brokerage technological advancements, but it is being fiercely client-centric that drives continuous improvement. The Future of Fintech Jinn shared the vision for the future of Broctagon within the forex industry, fueled by the company's commitment to ongoing expansion of products and service offerings. Owing to this, Broctagon has been unparalleled by other providers, propelling us far ahead, particularly in the last two years. He commented on the growing global interest and shifts in trends for trading due to stricter regulations, stating that these are exciting times for investors and thus a great opportunity for full-suite solution providers like Broctagon, to anticipate their needs. Interested in starting an FX Broker or a demo of any of our products? Schedule a free consultation with us to discuss tailoring our solutions to your needs.

- 11.07.2023

- Forex

- READ MORE

Read more about what is CFD (Contracts for Difference) Trading and the benefits for FX Brokers to provide CFD trading.

- 05.07.2023

- All

- READ MORE

BTSE, a multi-currency digital assets exchange, is the latest participant to join the inter-exchange liquidity network known as the WorldBook™. The NEXUS WorldBook is an initiative by Broctagon Fintech Group, under the licensed entity Broctagon Prime Markets Limited to create a universal liquidity standard for digital assets. Jonathan Leong, Founder of BTSE Jonathan Leong, Founder of BTSE, said: “Through technology, BTSE aims to bridge the convenience of digital assets solutions with the conventions of traditional finance. As such, we are delighted to be part of the NEXUS WorldBook through our strong partnership with Broctagon Fintech Group. Together we strengthen crypto’s market network to bring digital assets to the forefront of the institutional financial landscape.” Cecilia Chan, Head of Liquidity (Asia) and ED of Broctagon Cecilia Chan, Head of Liquidity (Asia) and Executive Director of Broctagon Fintech Group, commented on BTSE’s participation on the WorldBook network, saying: “BTSE’s suite of turnkey exchange solutions include spot trading, white-labels, OTC, asset management, and payment gateways. Now with access to the WorldBook’s unified liquidity standard, BTSE’s liquidity pool will be positioned to offer better prices and tighter spreads for the many arms of its business.” About BTSEBTSE is a leading digital assets exchange and fintech company that empowers users by offering a simple and secure way to trade. Its growing suite of financial services is designed to bridge digital assets solutions with traditional finance. About NEXUS WorldBookThe NEXUS WorldBook™ is the world’s first crypto liquidity ecosystem, committed to building a cohesive network for both makers and takers. The WorldBook leverages on the NEXUS 2.0 aggregator technology to offer its members global price discovery and direct STP capabilities on a universal liquidity standard. To find out more about BTSE, visit: Website: https://www.btse.com/Facebook: https://www.facebook.com/btsecomTwitter: https://twitter.com/BTSEcomMedium: https://btse-official.medium.com/Telegram: https://t.me/btsecomYouTube: https://www.youtube.com/channel/UCnCG4T18V6MfNxCnTTCWV0g/featured To find out more about or to join the Nexus WorldBook, visit:Website: https://nexusworldbook.comFacebook: https://www.facebook.com/NEXUSWorldBookLinkedIn: https://www.linkedin.com/showcase/74741847/Twitter: https://twitter.com/NEXUSWorldBookInstagram: https://www.instagram.com/nexusworldbook/YouTube: https://www.youtube.com/channel/UCT5_f3W2SEBDsWrJc8YGAEw

- 27.08.2021

- Partnerships

- READ MORE

Hodlnaut, a crypto interest-earning platform based out of Singapore, is the latest participant to join the inter-exchange liquidity network known as the WorldBook™. The NEXUS WorldBook is an initiative by Broctagon Fintech Group, under the licensed entity Broctagon Prime Markets Limited to create a universal liquidity standard for digital assets. Juntao Zhu, Co-founder and CEO of Hodlnaut, said: “Traditionally, Bitcoin holders will only be able to profit off-price increments from the asset. At the same time, they’re also looking for ways to improve the return on their assets while waiting for the value to appreciate. That’s why we came up with Hodlnaut. We want to help Bitcoin holders earn interest on their Bitcoin and unlock its full value and the opportunity costs of holding it. This method is called “yield farming.” What makes us different from, let say, depositing your assets into decentralized finance is that we focus on the customer experience. As a centralized finance platform, we take care of everything and ensure users get the best return on their investment without any hassle. The WorldBook initiative is a wonderful avenue where we can work together towards a more standardized and healthy crypto ecosystem.” Desmond Ang, Managing Director of Broctagon Fintech Group, commented on Hodlnaut’s participation on the WorldBook network, saying: “We are pleased to welcome Hodlnaut to the WorldBook initiative. With up to 12.73% APY, Hodlnaut’s crypto-interest account allows for its clients to deposit crypto and earn immediately with no lock ups or withdrawal limits. As crypto becomes a bigger part of mainstream investment, crypto-finance companies like Hodlnaut will play an integral role in financing the crypto-economy.” About HodlnautHodlnaut is the leading Crypto Borrowing and Lending Platform based in Singapore whose mission is to provide financial services to cryptocurrency users. The platform currently has over $500 Million USD of Digital Assets under Management and is growing at an average of 20% month on month. About NEXUS WorldBookThe NEXUS WorldBook™ is the world’s first crypto liquidity ecosystem, committed to building a cohesive network for both makers and takers. The WorldBook leverages on the NEXUS 2.0 aggregator technology to offer its members global price discovery and direct STP capabilities on a universal liquidity standard. To find out more about Hodlnaut, visit: Website: https://www.hodlnaut.com/Facebook: https://www.facebook.com/hodlnautdotcomInstagram: https://www.instagram.com/hodlnautdotcom/Twitter: https://twitter.com/hodlnautdotcomTelegram: https://twitter.com/hodlnautdotcom To find out more about or to join the NEXUS WorldBook, visit: Website: https://nexusworldbook.comFacebook: https://www.facebook.com/NEXUSWorldBookLinkedIn: https://www.linkedin.com/showcase/74741847/Twitter: https://twitter.com/NEXUSWorldBookInstagram: https://www.instagram.com/nexusworldbook/YouTube: https://www.youtube.com/channel/UCT5_f3W2SEBDsWrJc8YGAEw

- 24.08.2021

- Partnerships

- READ MORE

XT Exchange, the world’s first social infused exchange, is the latest participant to join the inter-exchange liquidity network known as the WorldBook™. The NEXUS WorldBook is an initiative by Broctagon Fintech Group, under the licensed entity Broctagon Prime Markets Limited to create a universal liquidity standard for digital assets. Weber Woo, CEO of XT, said: “XT is a comprehensive transaction platform with more than 100 high-quality currencies and 300 trading pairs. As the world’s first socialized digital asset trading platform with close to half a million active monthly traders, we recognize how a standardized framework for liquidity can ensure steady supply and demand for our clients. It is a pleasure to work with the WorldBook, and we both have great ideas and exciting events in store that will introduce cohesive standards for the entire industry and elicit greater adoption of crypto from the public.” Cecilia Chan, Head of Liquidity (Asia) and Executive Director of Broctagon Fintech Group, commented on XT’s participation on the WorldBook network, saying: “With more than 7 million members registered globally across all its owned platforms, XT connects and creates unified communities through its extensive network. Their emphasis on the social element of trading depends heavily on the availability of information, including price information. This requirement can be complemented with the WorldBook’s universal standard of liquidity, which provides the crypto industry with price information symmetry. We welcome XT to our network of partners.” About XT ExchangeFounded in 2018, XT Exchange is the world’s first socialized digital asset trading platform. The platform has more than 3 million registered users, over 400,000 active users monthly, and 13 million users in its ecosystem. With full trading options available for its traders, XT.com provides more than 100 currencies and 300 trading pairs. About NEXUS WorldBookThe NEXUS WorldBook™ is the world’s first crypto liquidity ecosystem, committed to building a cohesive network for both makers and takers. The WorldBook leverages on the NEXUS 2.0 aggregator technology to offer its members global price discovery and direct STP capabilities on a universal liquidity standard. To find out more about XT Exchange, visit: Website: https://www.xt.com/Instagram: https://www.instagram.com/xt.com_exchange/Twitter: https://twitter.com/XTexchangeMedium: https://medium.com/@XT_comReddit: https://www.reddit.com/user/okoAldermanLinkedIn: https://www.linkedin.com/company/xt-com-exchange/YouTube: https://www.youtube.com/channel/UCeiEo_mY82qbg5v0C22TyZA To find out more about or to join the NEXUS WorldBook, visit: Website: https://nexusworldbook.comFacebook: https://www.facebook.com/NEXUSWorldBookLinkedIn: https://www.linkedin.com/showcase/74741847/Twitter: https://twitter.com/NEXUSWorldBookInstagram: https://www.instagram.com/nexusworldbook/YouTube: https://www.youtube.com/channel/UCT5_f3W2SEBDsWrJc8YGAEw

- 20.08.2021

- Partnerships

- READ MORE

Horangi Cyber Security, a cyber security company specializing in detecting and preventing attacks from hackers, is the newest participant to join the inter-exchange liquidity network known as the WorldBook™. The NEXUS WorldBook is an initiative by Broctagon Fintech Group, under the licensed entity Broctagon Prime Markets Limited to create a universal liquidity standard for digital assets. Paul Hadjy, CEO and co-founder of Horangi, said: “The WorldBook initiative to enable liquidity for crypto exchanges is key in driving the mainstream adoption of blockchain technologies and unlocking the unique benefits that they bring. Horangi’s emphasis on developing Warden as an easy-to-use Cloud Security and RegTech solution for the payments, Crypto, and financial services industries demonstrates our shared commitment to enabling and securing the cyberspace. Horangi already accepts crypto payments and have numerous crypto exchanges and blockchain companies as partners. We look forward to growing with the WorldBook ecosystem to help the industry take the next step.” Ted Quek, CTO of Broctagon Fintech Group, commented on Horangi’s participation on the WorldBook network, saying: “Horangi’s cloud security solutions allow for its takers to detect and fix security threats in real time. As a centralised security management platform, it allows for a detailed level of monitoring that runs the gamut of cyber security, covering compliance, digital asset management, and even ICOs. Their experience has the potential to shape the landscape of crypto-security, and we are pleased to welcome them to our network of partners.” About HorangiHorangi is a leading cybersecurity company founded by ex Palantir Technologies engineers and is headquartered in Singapore. Horangi’s best-in-class Warden cloud security platform protects organizations in the public cloud, complemented by an elite team of cybersecurity experts providing CREST-accredited offensive and strategic cybersecurity services to customers across the world. About NEXUS WorldBook™The NEXUS WorldBook™ is the world’s first crypto liquidity ecosystem, committed to building a cohesive network for both makers and takers. The WorldBook leverages on the NEXUS 2.0 aggregator technology to offer its members global price discovery and direct STP capabilities on a universal liquidity standard. To find out more about Horangi, visit:Website: https://www.horangi.com/Facebook: https://www.facebook.com/horangicorporationYouTube: https://www.youtube.com/channel/UCSdmG-UitqoP_6Xim6OSLoQLinkedIn: https://www.linkedin.com/company/horangi To find out more about or to join the NEXUS WorldBook, visit:Website: https://nexusworldbook.comFacebook: https://www.facebook.com/NEXUSWorldBookLinkedIn: https://www.linkedin.com/showcase/74741847/Twitter: https://twitter.com/NEXUSWorldBookInstagram: https://www.instagram.com/nexusworldbook/YouTube: https://www.youtube.com/channel/UCT5_f3W2SEBDsWrJc8YGAEw

- 16.08.2021

- Partnerships

- READ MORE

Cynopsis Solutions, a RegTech solutions provider specialising in the digitisation and automation of Compliance and regulatory processes, is the latest participant to join the inter-exchange liquidity network known as the WorldBook™. The NEXUS WorldBook is an initiative by Broctagon Fintech Group, under the licensed entity Broctagon Prime Markets Limited. Chionh Chye Kit, CEO and Founder of Cynopsis Solutions Chionh Chye Kit, CEO and Founder of Cynopsis Solutions, said: “Having worked with Broctagon previously gave us the confidence that WorldBook will institutionalise cryptocurrency order book amalgamation globally for the benefit of end investors, be it retail or professionals. A sustainable ecosystem necessitates proper compliance with prevailing rules and regulations in particular KYC and AML. We are honoured to be the first KYC/AML RegTech partner for this exciting initiative and looking forward to serve the ecosystem better going forward.” Mr Chionh Chye Kit is also the Founding Member, Regulatory and Compliance Sub-Committee of Blockchain Association of Singapore (BAS). Don Guo, CEO of Broctagon Fintech Group Don Guo, CEO of Broctagon Fintech Group, commented on Cynopsis’ participation on the WorldBook network, saying: “Cynopsis’ identification technology allows for automated client onboarding and screening in the KYC/AML process. This expertise in the finer aspects of KYC/AML will enable the WorldBook to form a more comprehensive picture of what regulators worldwide expect from crypto. We are glad to have them onboard to share their knowledge with the rest of the WorldBook’s participants.” About Cynopsis SolutionsCynopsis Solutions offers RegTech solutions designed to digitise and automate Compliance and regulatory processes, in particular KYC, AML, and CTF. Our end-to-end KYC/AML solutions are designed according to the global FATF recommendations, applicable to more than 180 jurisdictions. About Nexus WorldBookThe NEXUS WorldBook™ is the world’s first crypto liquidity ecosystem, committed to building a cohesive network for both makers and takers. The WorldBook leverages on the NEXUS 2.0 aggregator technology to offer its members global price discovery and direct STP capabilities on a universal liquidity standard. To find out more about Cynopsis Solutions, visit: Website: https://www.cynopsis-solutions.com/Facebook: https://www.facebook.com/cynopsis.co/LinkedIn: https://www.linkedin.com/company/cynopsis-solutions/Instagram: https://www.instagram.com/cynopsis.co/ To find out more about or to join the Nexus WorldBook, visit:Website: https://nexusworldbook.comFacebook: https://www.facebook.com/NEXUSWorldBookLinkedIn: https://www.linkedin.com/showcase/nexus-worldbookTwitter: https://twitter.com/NEXUSWorldBookInstagram: https://www.instagram.com/nexusworldbook/YouTube: https://www.youtube.com/channel/UCT5_f3W2SEBDsWrJc8YGAEw

- 11.08.2021

- Partnerships

- READ MORE

Bholdus, a blockchain network dedicated to DeFi apps, is the newest participant to join the inter-exchange liquidity network known as the WorldBook™. The NEXUS WorldBook is an initiative by Broctagon Fintech Group, under the licensed entity Broctagon Prime Markets Limited. Ronald Le, CEO of Bholdus Ronald Le, CEO of Bholdus, said: “Through our partnership with the WorldBook, we hope to use our expertise in DeFi and token issuance to help build a platform that can enable stronger outreach to existing communities within South East Asia. These include crypto-traders, businesses, institutions, and governments within South East Emerging Economies. We foresee that this will allow for greater opportunities in standardization, NFTs issuance, market expansion, and even fundraising.” Don Guo, CEO of Broctagon Fintech Group Don Guo, CEO of Broctagon Fintech Group, commented on Bholdus’ participation on the WorldBook network, saying: “Bholdus’ comprehensive understanding of DeFi will allow us to glean greater understanding of the standards required in all facets of crypto. We are pleased to welcome Bholdus to our network of partners, and look forward to greater collaboration in time to come.” About BholdusBholdus is an inter-operable & cross-chain blockchain network dedicated to DeFi apps and NFTs with unprecedented transaction throughput and security. About NEXUS WorldBook™The NEXUS WorldBook™ is the world’s first crypto liquidity ecosystem, committed to building a cohesive network for both makers and takers. The WorldBook leverages on the NEXUS 2.0 aggregator technology to offer its members global price discovery and direct STP capabilities on a universal liquidity standard. To find out more about Bholdus, visit:Website: https://bholdus.com/Facebook: https://www.facebook.com/bholdus/LinkedIn: https://www.linkedin.com/company/bholdus/Instagram: https://www.instagram.com/bholdus/Twitter: https://twitter.com/bholdusMedium: https://bholdus.medium.com/Github: https://github.com/Bholdus To find out more about or to join the Nexus WorldBook, visit:Website: https://nexusworldbook.comFacebook: https://www.facebook.com/NEXUSWorldBookLinkedIn: https://www.linkedin.com/showcase/nexus-worldbookTwitter: https://twitter.com/NEXUSWorldBookInstagram: https://www.instagram.com/nexusworldbook/YouTube: https://www.youtube.com/channel/UCT5_f3W2SEBDsWrJc8YGAEw

- 05.08.2021

- Partnerships

- READ MORE

Broctagon Fintech Group today announces the appointment of Michael Lee as Head of FX Sales to support its move towards establishing a greater presence in the APAC region.

- 10.06.2021

- All

- READ MORE

Multi-asset liquidity provider Broctagon today announces the deployment of its NEXUS 2.0 aggregation engine in the multi-currency digital assets exchange BTSE. The collaboration will enhance crypto liquidity for the exchange through NEXUS 2.0, proprietary crypto liquidity aggregation and Straight-Through Processing (STP) engine.

- 01.06.2021

- Partnerships

- READ MORE

Broctagon is proud to announce that Cecilia Chan, a sell-side veteran with two decades of experience, has joined us as Executive Director. This appointment comes shortly after Broctagon officially obtained its new Money Broking Licence from the Labuan IBFC.

- 24.03.2021

- Broprime Markets

- READ MORE

With Broctagon's professional whitepaper writing services, our team of business consultants, blockchain advisors, marketers, and industry experts will come together to help you conceptualize and create a whitepaper that makes your project shine.

- 17.08.2022

- All

- READ MORE

Broctagon has just announced the launch of its customized DeFi Decentralized Exchanges (DEX) Platform and Automated Market Maker (AMM) Protocol integration.

- 29.07.2022

- All

- READ MORE

In this brand-new upgrade, we tapped on the experience having served hundreds of brokers, to rollout a multitude of optimizations and customizations that address the common pain points of brokerages, allowing them to have enhanced control over client data with increased customizability, flexibility, and efficiency.

- 30.06.2022

- All

- READ MORE

In this new version update of the AXIS CRM, we have focused on a few new functionalities and fixes to make the process of client management and acquisition smoother.

- 25.05.2022

- All

- READ MORE

In this latest AXIS CRM V4 update, we continue to implement updates to improve the user experience of administrators and IBs, to enable them to handle customer data more efficiently.

- 29.04.2022

- All

- READ MORE

Broctagon Fintech Group has launched a unique social media-based NFT marketplace white label solution for businesses, communities and individuals looking to launch their own NFT marketplace.

- 11.03.2022

- Blockchain

- READ MORE

Broctagon has developed Cryptography as a Service, with a suite of solutions specifically designed to give clients the best of both worlds – the efficiencies of blockchain technology with the assurance of data privacy.

- 25.02.2021

- All

- READ MORE

NEXUS 2.0's latest update covers upgraded features including an all-new monitoring system, LMS enhancements and randomized volume scaling.

- 27.11.2020

- Products

- READ MORE

Brokerages in Asia will now have a wider variety of trading platforms made available with Broctagon's Spotware partnership to offer the cTrader Platform.

- 13.10.2020

- Partnerships

- READ MORE

In early January, Bitcoin's value rose to an all-time high of about $42,000 before tumbling down to about $30,000. This might seem like a repeat of 2017's bubble, but will it burst this time?

- 15.02.2021

- All

- READ MORE

Public, private, permissioned, Bitcoin, Ethereum protocols, and more – it might seem really daunting on how to choose the right blockchain for your business.

- 09.02.2021

- All

- READ MORE

Many investors and traders are familiar with the idea of trading cryptocurrencies. While crypto spot trading has been more prevalent, crypto CFDs have also emerged with growing popularity.

- 01.02.2021

- All

- READ MORE

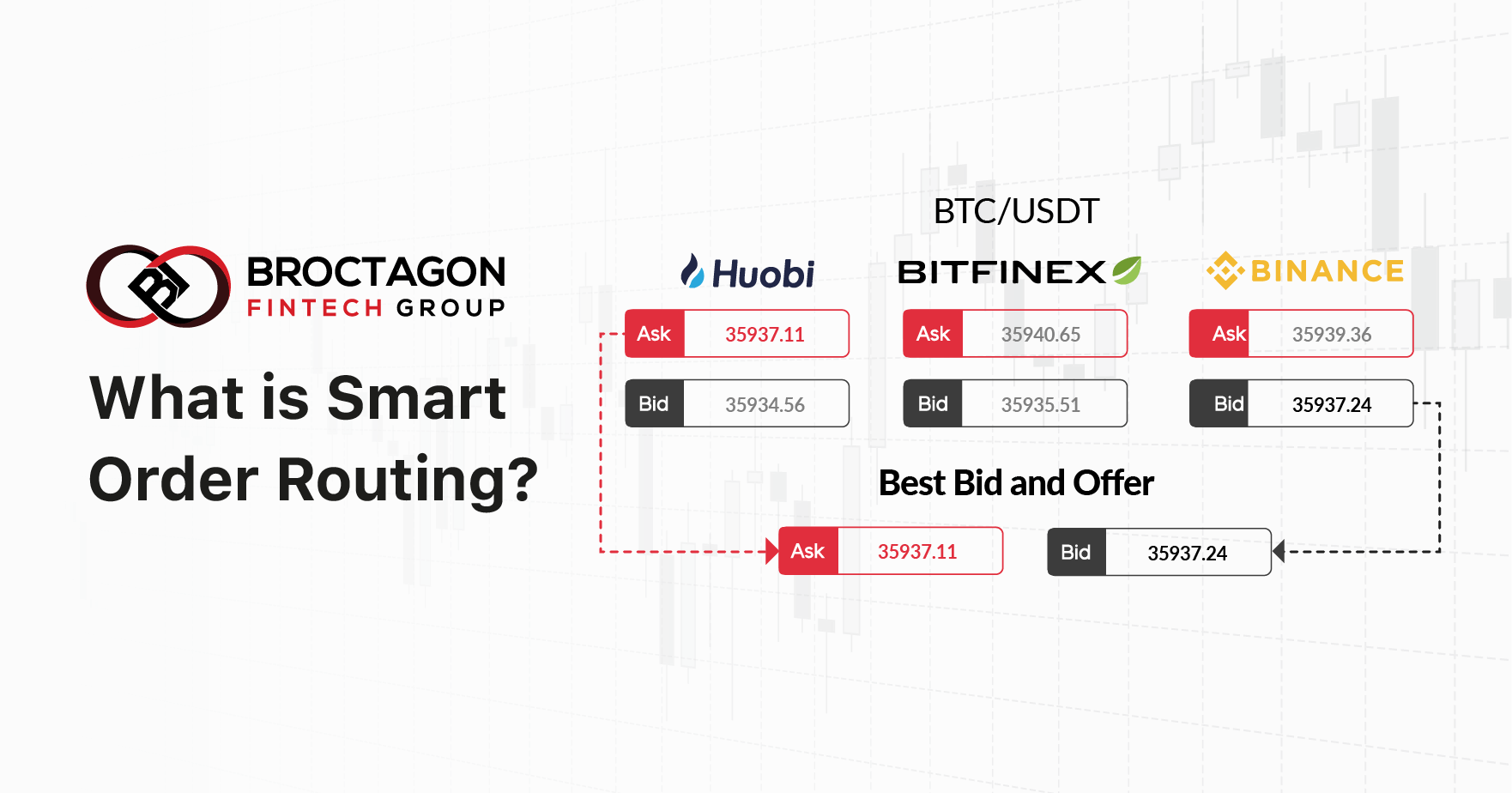

Smart Order Routing (SOR) is an automated order processing mechanism, designed to take the best available opportunity across a variety of different trading platforms.

- 21.01.2021

- Knowledge

- READ MORE

As a brokerage, offering multi-asset classes to your clients can bring you competitve advantage over other brokerages. Here are 5 key reasons.

- 08.01.2021

- Knowledge

- READ MORE

Kick-starting your very own crypto exchange made simple with Broctagon's comprehensive guide, with just 3 main steps you need to keep in mind.

- 24.11.2020

- Knowledge

- READ MORE

The decision to regulate all entities operating within the cryptocurrency industry in Hong Kong has been dubbed as a "positive move" by Broctagon CEO.

- 04.11.2020

- In The Press

- READ MORE

We take a look at what greater adoption of crypto payments mean for liquidity in the market, and what needs to be done to address illiquidity.

- 29.10.2020

- Thought Leadership

- READ MORE

CEO of Broctagon, Don Guo, feels that there are better ways to regulate rather than an outright ban of crypto derivatives in the UK.

- 16.10.2020

- Thought Leadership

- READ MORE

Broctagon Fintech Group was recently awarded 'Best Crypto Liquidity Solutions' at the Crypto Expo Dubai 2022, as a recognition for our newly-upgraded product, the NEXUS 2.0 Crypto Liquidity Hub. Held at Dubai Festival City from 16 -17 March, more than 100+ crypto companies gathered at the premier cryptocurrency event.

- 18.03.2022

- Awards

- READ MORE

Broctagon Fintech Group is proud to be the Gold Sponsor for the upcoming Crypto Expo Dubai 2022! Join us at Booth 84 in the expo held from 16 -17 March, where more than 3000+ investors will congregate for this annual event.

- 02.03.2022

- All

- READ MORE

Broctagon Prime participated at the iFX EXPO Dubai, one of our first events in 2022. Held at Dubai’s World Trade Centre from 22nd – 24th February 2022, the 3-day event presented over 60+ speakers on its agenda, with its title as the largest global fintech B2B exhibition.

- 28.02.2022

- All

- READ MORE

Broctagon Prime will be at the iFX Expo hosted in the Dubai World Trade Center, 22-24 February. Meet us at Booth 106 to find out about the most competitive liquidity products for your brokerage.

- 21.02.2022

- All

- READ MORE

Since our last attendance at their virtual summit last year where we were awarded “Best Tailored Blockchain Solutions Provider”, we are excited to meet again in person our clients and future partners.

- 10.11.2021

- All

- READ MORE

Broctagon participated in Labuan IBFC's CoDE Asia 2021 on Thursday, 21 October 2021. Growing into its third edition, CoDE Asia 2021 is themed "Future Forward: Next Gen Digital Ecosystems”. Representing Broctagon was Cecilia Chan, our Head of Liquidity (Asia) and Executive Director. With 22 years in the financial industry, Cecilia was the former Vice President at Singapore Exchange and a Senior Manager in Exchange & Regulatory relations at Hang Seng Indexes. On Recent Trends Cecilia pointed out that within the digitalisation space, the most interesting aspect of digitalisation in recent times would be digital currencies issued by the central bank. As Decentralised Finance (DeFi) continues to grow, central banks want to be more involved in the process. Cecilia explained that we are more familiar with central bank money because it’s safe, liquid, and has integrity - given that context, central banks have to evolve to suit the digitalisation aspect of the economy. The Advantages of Digital Currencies Cecilia shared that digital currency allows for better cross-border payments at a lower cost. This improves efficiency across borders, leading to faster settlements, making payment less of a hassle for retail and consumers. The Future and the Now Cecelia expresses that here at Broctagon, we stay ahead of the game by trying to foresee what the market needs before the problem arises. As a tech solutions provider the specialises in Fintech, we are actuely aware of the issues that plague it, such as the problem of fragmented liquidity that the crypto market faces as a whole. Liquidity in crypto, for example, is concentrated in the top 3% of crypto exchanges, accounting for less than 25% of trading volume - not including the OTC desk and P2P aspects In light of this, we want to create awareness and inclusion of digital assets for mainstream adoption. AUM growth in crypto has tripled from 2020 to 2021, so we want to create solutions to cater to the institutional crowd and address liquidity as it continues to be a big problem in the institutional space. Staying Relevant Cecilia explained that the beauty of DeFi is its ability to skip through all the intermediaries, allowing their users to go straight to the source without any intervention. Regulators know that DeFi will continue to evolve given this, and they are now starting to establish regulations in the DeFi space. As regulators, they are bound to keep in check investor and consumer interests and are unable to sit out this process as the welfare of their citizens are at stake. While they explore this space, they are trying to navigate and create guidelines. Yet because the industry is so borderless, it is very difficult for them to work with one another. The lack of a single framework makes it more difficult for regulators to transverse the crypto landscape.

- 22.10.2021

- All

- READ MORE

With a long history of uniting businesses in Europe, Asia and the Middle East, iFX EXPO International is the flagship show trusted by thousands of retail & institutional brokers, technology & liquidity providers, payment service providers, banks, affiliates & IBs, regulators & compliance as well as crypto and blockchain brands. Broctagon has been a veteran participant in this leading conference, which connects top-level executives in online trading, financial services and fintech from around the world. As the world gradually opens up after the covid disruptions, we are excited to meet our clients and future partners once again in Cyprus! Schedule a meetup with us at iFX Expo Cyprus to find out more about our CySEC-regulated liquidity offerings and how it can help you stay ahead of competition. As one of the first in the industry to offer Digital Asset CFDs alongside over 1,000 instruments including FX, Shares, Indices and Commodities with spreads from zero, we are confident to bring value to your brokerage. Our Liquidity Expert Andreas Charalambous, Director of Operations, Broctagon Prime SCHEDULE A MEETUP WITH US Margin and CFD Liquidity - For Brokers Our CySEC-regulated liquidity offerings encompasses over 1,000 instruments with spreads starting from zero. Forex Shares Indices Metals Commodities Digital Assets VIEW LIVE QUOTES Spot Crypto Liquidity - For Exchanges Stream the aggregated orderbooks of top exchanges direct into your exchange with the NEXUS WorldBook™. Improve your liquidity instantly for over 350 crypto pairs. VIEW LIVE QUOTES As Featured On Our Liquidity Partners and more...! Experience for yourself how a partnership with Broctagon can bring value to your brokerage. Schedule a meetup with us at iFX Expo Cyprus now to find out more! SCHEDULE A MEETUP WITH US *Limited slots available

- 01.10.2021

- All

- READ MORE

Teams from Singapore, China, Hong Kong, India and Thailand, gathered in the land of smiles as ‘One Company, One Family’ for the annual Broctagon retreat.

- 07.01.2020

- Events

- READ MORE

Broctagon Fintech Group had a strong entrance into the Middle Eastern market at The Forex Expo Dubai 2019, held recently from 2nd to 3rd Oct 2019 at Dubai, United Arab Emirates.

- 08.10.2019

- Events

- READ MORE

Being a key essential to any Crypto Exchange, it is important to know what exactly Crypto Exchange Liquidity is and its importance, as well as the factors affecting it and how it can be measured.

- 16.12.2020

- Knowledge

- READ MORE

Kick-starting your very own crypto exchange made simple with Broctagon's comprehensive guide, with just 3 main steps you need to keep in mind.

- 24.11.2020

- Knowledge

- READ MORE

Broctagon Fintech Group and Takeprofit Technology has collaborated to present dynamic leverage scheduling for brokers. | Finance Magnates

- 14.01.2021

- In The Press

- READ MORE

The decision to regulate all entities operating within the cryptocurrency industry in Hong Kong has been dubbed as a "positive move" by Broctagon CEO.

- 04.11.2020

- In The Press

- READ MORE

We take a look at what greater adoption of crypto payments mean for liquidity in the market, and what needs to be done to address illiquidity.

- 29.10.2020

- Thought Leadership

- READ MORE

Broctagon Fintech Group, a liquidity and technology provider to the brokerage industry, has partnered with Spotware, thus becoming a specialist provider of cTrader White Labels.

- 12.10.2020

- In The Press

- READ MORE

Singapore-based Broctagon Fintech Group has upgraded its NEXUS 2.0 liquidity aggregator technology, with the launch of Native Altcoin Liquidity Management.

- 02.09.2020

- In The Press

- READ MORE

As the coronavirus lockdown begins to lift across the world, investment opportunities in traditional stock markets and cryptocurrencies couldn't be greater.

- 17.06.2020

- Thought Leadership

- READ MORE

What was once regarded by many as ‘internet money’ is slowly stumbling its way into mainstream acceptance, Broctagon's CTO Ted Quek tells Yahoo! Finance.

- 02.06.2020

- Thought Leadership

- READ MORE

Broctagon's CEO Don Guo states that governments across the world need to begin taking action on the regulation of crypto and digital assets. | Yahoo Finance

- 12.05.2020

- Thought Leadership

- READ MORE

Halving might boost Bitcoin price due to its added scarcity, giving it a positive trend, says Broctagon CEO Don Guo in his analysis to CoinDesk.

- 04.05.2020

- In The Press

- READ MORE