Brokerage. Blockchain. Buzz.

Welcome, find all things buzzing on board at Broctagon’s blog! Here you’ll find the latest in blockchain news, exciting event highlights, insightful thought leadership in forex and crypto, and more. Be the first to know all about our events and most innovative tech updates – all in one space.

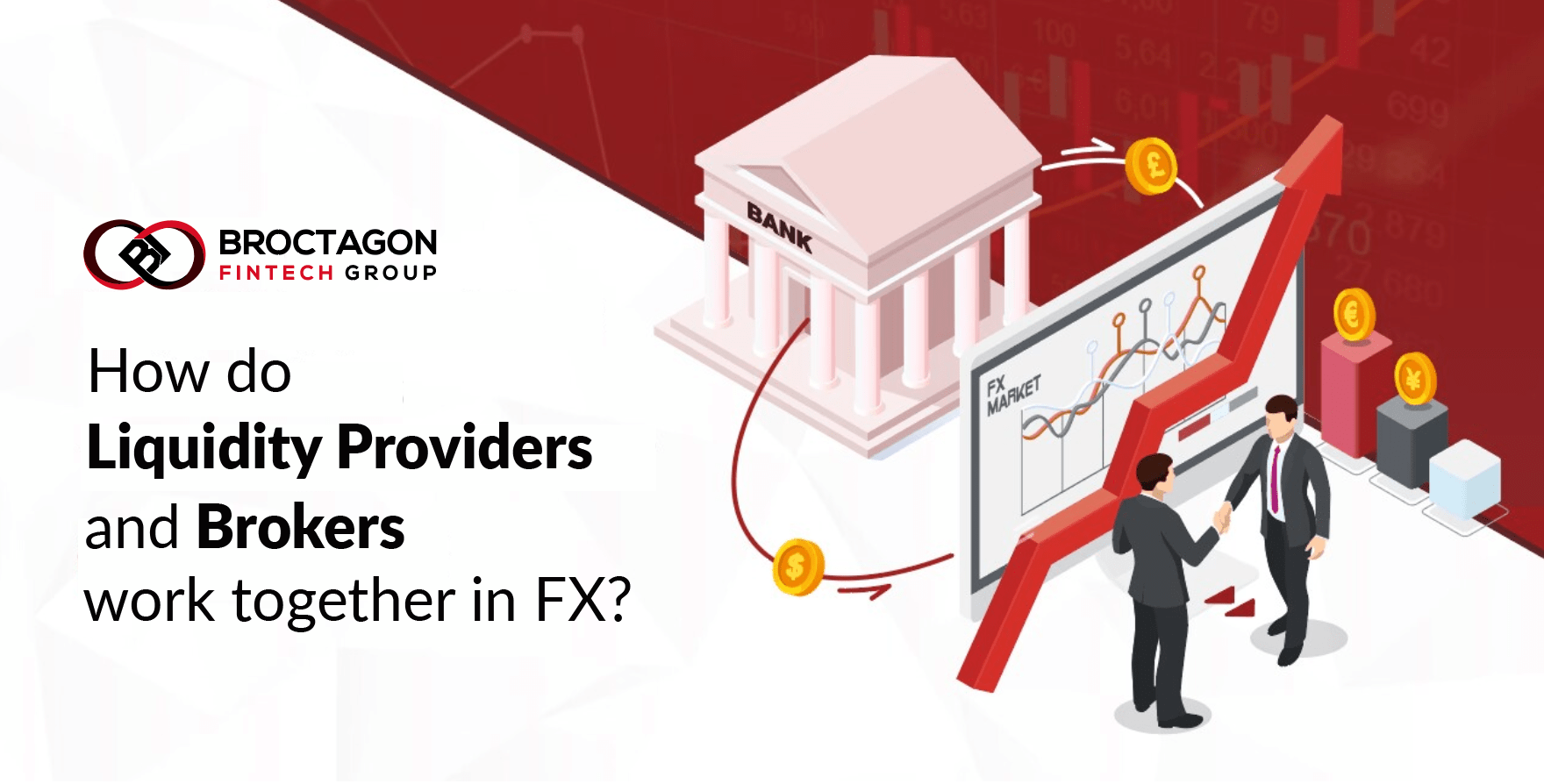

The foreign exchange (Forex) market is the world's largest and most liquid financial market, and in recent years, the rise of online trading platforms and mobile proliferation have made it easier than ever for individuals to participate, driving increased retail trading activity. Trading technology has also advanced significantly with many Software-as-a-service (SaaS) platforms providing White Label services, making it simpler and less capital intensive for new Forex Brokers to emerge. If you're interested in setting up a Forex Brokerage, it's essential to understand the processes involved in starting and running such a business. Establishing a forex brokerage can be a lucrative venture, but it requires careful planning, preparation, and execution. The ability to differentiate yourself in an increasingly crowded marketplace is also pivotal to success. In this guide, we will outline the key steps involved in setting up a Forex Brokerage, from researching regulatory requirements to acquiring the necessary technology and talent to run the business. Whether you’re an IB looking to launch your own brokerage, an aspiring entrepreneur, or an experienced trader looking to set up your own trading firm, this guide will provide you with a comprehensive overview of the critical steps involved in launching a successful forex brokerage. 1. Define Your Target Market To enhance your likelihood of success, it is essential to have a clear understanding of the crucial demographics and psychographics of your target audience, ideal customers, and competitors. This knowledge will enable you to tailor your offering and make your marketing approach more targeted, as well as help decide on the jurisdiction in which you would like to incorporate your company. It is also highly advantageous to have an existing Introducing Broker (IB) network when you kick-start your FX Brokerage. IBs are crucial when it comes to market expansion as they are essentially referrals who market your platform and are paid commissions when their referred clients trade. Establishing such networks will set the foundation for a healthy launch. 2. Determine the Capital Needed One of the main reasons for the failure of Forex Brokerages is a lack of understanding of the true cost of running an FX business. Whether you're considering white labelling or building a brokerage from scratch, the capital required for starting up can vary significantly. It's important to consider the various expenses involved, such as registration fees, setup fees, technology costs, licensing fees, and monthly service fees. To gain a better understanding of the costs involved in setting up a forex brokerage, you may refer to our article "How Much Does It Cost to Set Up a Forex Brokerage?" This article provides a detailed breakdown of the expenses associated with starting and running a forex brokerage, enabling you to better plan and budget for your new business venture. 3. Decide Which Jurisdiction to Incorporate and License to Obtain When deciding on the country of incorporation and jurisdiction for your forex brokerage, it's important to consider several factors beyond just your target audience. These factors may include: Which licence are you intending to apply for? How crucial is the jurisdiction in attracting and retaining clients? Some jurisdictions are deemed more reputable. How quickly do you want to launch your forex brokerage? What are your preferred methods for processing client transactions? Which bank would you choose to open your corporate bank account with? What is your available budget? The timeline and costs associated with incorporating in a particular jurisdiction or obtaining certain licenses can be vastly different. While some jurisdictions may allow for a relatively quick incorporation process of one to two months, others may take 12 months or more. In terms of licensing, the capital requirements and application fees can also add up to a hefty sum, especially with more reputed licenses such as Financial Conduct Authority (FCA UK) or Cyprus Securities and Exchange Commission (CySEC). By carefully evaluating your needs and resources, you can make an informed decision on which jurisdiction is best suited for your Forex Brokerage. To save both time and money, it is highly recommended to seek advisory from seasoned FX solutions providers or licensing agents to help increase the chances of successful license applications. 4. Choose the Right Business Model In addition to the choice of jurisdiction, the decision on which brokerage model to adopt is equally important. There are four models available, namely the market maker model, the agency or STP model, the ECN model, and the hybrid model. Each of these models has its own unique characteristics, advantages, and disadvantages. The brokerage model you choose will have a significant impact on how transactions are executed and how fees are determined, whether in the form of commissions or spreads. It's important to carefully consider the various factors and trade-offs associated with each model before making a final decision. Ultimately, choosing the right brokerage model is critical to the success of your forex brokerage and its ability to meet the needs of your clients. Read: STP vs MM Brokerage Model 5. Set Up Brokerage Infrastructure – Trading Platform & Technology There are typically 2 options to set up an FX Brokerage, each with its pros and cons: Building a brokerage from scratch or setting up via a White Label solution. The former will allow you complete control and full autonomy of all nitty-gritty elements, but it will require immense time, manpower and resources. You will not only require a deep understanding of Forex, but also the technological aspects as well, to form the right team for product development. For the majority of brokers, the ideal choice would be to work with an established solutions provider. A reputable full suite FX provider will be able to supply all technological components that a FX Broker requires, from trading platform and managed server hosting to Customer Relationship Management Systems (CRMs) and trading plugins. As a White Label, your broker will get a quick start while still enjoying the benefits of being customizable and operating under your own brand. Brokers usually pay a monthly license fee for usage of these White Label software and in some cases a setup fee. However, these fees are a mere fraction of the cost required to develop your own. Choosing the right technology partners will set you on the right path to success in providing a great trading experience to your clients. In fact, it is never too late to start developing your proprietary technology after gaining experience from running a successful and profitable brokerage, when tailored needs, security or privacy becomes ascendingly important. At that stage, your business insights, knowledge of the markets and budget available may be more apt in embarkation of such a mammoth technological undertaking. 6. Connect With a Liquidity Provider (LP) Having a wide variety of trading instruments with tight spreads is crucial to providing a competitive trading environment for your traders. To achieve this, liquidity is a vital factor in ensuring smooth execution at the best prices. With many options in the market, selecting the right Liquidity Provider (LP) can be narrowed down to these few factors. Regulatory – funds security is of utmost importance, and you will want to deal with a regulated entity in reputable jurisdictions. Some examples are UK Financial Regulatory Authority and the Australian Securities and Investments Commission, Cyprus Securities and Exchange Commission and the Malta Financial Services Department. These licences require the LP’s client’s funds, in other words your funds, to be in a segregated bank account so that it does not co-mingle with the LP’s operational funds. This provides an additional layer of security. Aggregated liquidity – you will want to pick an LP with liquidity that is aggregated from multiple sources so that you consistently have access to the best prices. Such LPs also have a wider range of asset classes as well as greater market depth should you require to send large orders. 24/7 Support – trading occurs round the clock and with the advent of digital assets, weekends are now open for trading as well. The LP you choose must offer timely support to solve issues fast as the Forex markets are rapid and unforgiving. Every erroneous second can be extremely costly. 7. Connect With a Payment Processor In order to accept deposits from clients as efficiently and effortlessly as possible, you need to work with one or more Payment Service Providers (PSPs). A PSP is a third-party service provider that creates a single gateway for a Forex Broker to accept a broad range of payments via credit cards, debit cards, digital wallets (e.g. Paypal, Skrill, etc.), and crypto wallets. There are a variety of factors to consider when choosing a PSP. Starting from the provider’s risk profile to countries of operation, technical aptitude, number of available currencies, amount of payment channels, transaction costs, holding time, stability and reputation. A reliable PSP can also get you better conversion rates, which are savings you can pass on to your clients. PSPs usually charge a flat transaction fee per transaction as well as a fee a percentage volume fee. The lower these fees are, the better rates you’ll be able to offer your clients. Because PSPs have access to your funds, you want to choose one that is well-established with a good reputation. The easiest way to go about this is to work with a long-standing FX solutions provider once again. Experienced providers usually have an existing network of PSPs already integrated into their systems so there is no need for additional onboarding costs or lead time. 8. Hiring A Team Running a Forex Brokerage requires a dedicated team of professionals, including sales personnel, client support representatives, core IT team, affiliate managers, accounting staff, risk management team and more. The number and roles of the team members needed depend on the size of your brokerage operations. When building your team, it's important to consider the costs of employment, such as salaries, benefits, and training expenses. Recruiting the right team is a critical aspect of building a successful forex brokerage. Each team member plays a vital role in the overall success of your brokerage, and it's essential to ensure that they have the necessary skills and expertise to perform their duties effectively. By carefully considering the number and roles of staff needed, as well as the associated costs, you can plan and build a strong team that will help your brokerage thrive in a highly competitive market. Turnkey Brokerage Setup For a fuss-free brokerage setup, many choose to launch their brokerages with a turnkey solutions provider like Broctagon. By seeking an experienced provider, not only will you benefit from time and cost savings, but you will also be able to navigate the perils of wrong decisions and unnecessary mistakes. You can also have confidence of service quality and consistency, as well as the assurance that all technological components will work seamlessly together, creating a cohesive and unified system that optimizes performance and enhances the overall user experience for your team and your clients. With more than a decade of experience in the fintech industry, Broctagon has established itself as a leading provider of cutting-edge brokerage solutions. We take pride in our unwavering commitment to delivering top-notch trading technology and multi-asset liquidity to brokerages globally. We are dedicated to elevating brokerages by equipping them with the necessary technology to attract clients and manage their business operations efficiently. Set up a meeting with us for a free advisory call, platform demo, and tailor your winning combination of brokerage solutions!

- 30.06.2023

- All

- READ MORE

Broctagon returned to Thailand once again for the internationally acclaimed iFX Expo Asia 2023 from 20-22 June 2023 at Centara Grand & Bangkok Convention Centre at CentralWorld. After a successful launch for the first time in Bangkok in 2022, this year’s immersive event set a new benchmark, bringing together over 100 speakers and 3,000 attendees for 2+ days of networking and knowledge sharing. The iFX Expo proved to be a dynamic platform for engaging in vibrant and innovative discussions, where industry leaders and influencers came together to shape the future of the FX market. Broctagon: More than just a Full Suite FX Solutions Provider We started with a dream to bridge the gap for highly tailored FX solutions that add tangible value to Forex Brokers. 14 years and hundreds of brokers later, we revisit the question – What is Broctagon? Our team at iFX Expo Asia shares their answers. With a strong focus on business integrity, radical innovation, freedom to customize and a collaborative clan culture, Broctagon is the trusted partner for turnkey FX solutions, catering to the needs of brokers worldwide. We’ve got your back, always. The Complete FX Broker Turnkey Solution - Trading Platform, CRM & Liquidity fully integrated As the leading full-suite FX solutions provider in Asia and a longstanding partner of iFX Expo for over 8 years, we were greeted with many familiar faces and grateful for the overwhelming response and significant interest in our products and offerings – especially with the launch of the ZeroX Trader. Fully integrated and optimized with our proprietary CRM and Multi-Asset Liquidity, Brokers with the ZeroX will instantly be able to offer more than 1800 financial instruments such as Forex, Commodities, Shares, Indices, Futures and Crypto CFDs in a safe and secure environment. Coupled with the industry’s most powerful AXIS FX CRM, Brokers can leverage sophisticated data tools and multi-tiered IB and affiliate system to expand their business rapidly. The ZeroX trading platform answers the industry’s need for an alternative trading platform that is simple yet powerful. ZeroX easily supports the seamless migration of all trading activity including open positions and history from any other trading platforms. Thank you for visiting our booth. We treasure every conservation as inspiration that drives our innovation and improvement. If you wish to explore any of our solutions, our team of specialists is always at your service and ever willing to share our extensive knowledge, resource, and network. Your success is our motivation, let’s talk! An Exclusive Interview with FX168 At the expo, we had the opportunity to sit down with renowned financial news media outlet FX168 for an exclusive interview on how we stay competitive, relevant, and innovative. Our Sales Director, Sy Jinn gave insights into our journey to becoming a recognized name and premier solutions provider, being one of the few providers in the forex industry to have a long-established history of more than a decade. Watch the full interview here Read More: Interview with FX168 Missed Us at iFX? We are Online 24/7. Didn’t manage to attend iFX Expo Asia 2023? No worries. Schedule an online meeting with our specialists anytime to chat with us about your FX Broker needs. Our team of experts is fully prepared to offer personalized guidance and address any inquiries you may have. Whether you intend to customize our solutions specific to your business needs or explore potential avenues for expansion, we are excited and always ready to tailor effective solutions just for you!

- 23.06.2023

- All

- READ MORE

Understanding the differences between a Straight-through-processing (STP) and Market Maker (MM) broker.

- 23.06.2023

- All

- READ MORE

We are excited to be returning to Thailand once again for the internationally acclaimed iFX Expo Asia 2023! This premier event brings together over 100 speakers and 3000 attendees for 2+ days of networking and knowledge sharing.

- 16.06.2023

- All

- READ MORE

Broctagon Fintech Group, an award-winning multi-asset liquidity and technology provider, has partnered with Convrs, a leading provider of omnichannel messaging solutions for FX and CFD brokers. The collaboration will enable FX brokers to seamlessly integrate with the Convrs omnichannel messaging platform through Broctagon’s AXIS FX CRM marketplace. With its IB-centric module at the core, the AXIS FX CRM offers a range of advanced affiliate tools, and the addition of Convrs' messaging solution is expected to enhance lead generation and client conversion performance. Convrs' technology integrates messaging apps like WhatsApp, Telegram, Messenger, LINE, SMS, and Web Chat into the customer journey of companies, allowing them to meet their customers where they already are. "With the proliferation of smart devices, traders are becoming increasingly mobile. That is why Broctagon’s AXIS FX CRM was designed to allow traders seamless management of all their trading accounts and affiliate campaigns in one powerful App, anytime, anywhere,” said Ted Quek, CTO & Co-Founder of Broctagon Fintech Group. "Now, coupled with the convenience that Convrs brings with an array of social messaging channels directly integrated within AXIS, FX brokers will find it even easier to engage traders, expand outreach, hasten sales conversion and reduce support turnaround time." "Complementing the strong boost in customer management efficiency that Broctagon’s AXIS FX CRM enables for brokers, Convrs enables effective customer engagement by building a direct link between brokers and traders through popular messaging apps. This powerful fusion of technology allows brokers to achieve a whole new level of engagement, derived from innovation and responsive adaptation to customer preferences in the digital era," added Enis Mehmet, Co-Founder of Convrs. Combining their expertise, Broctagon and Convrs enable brokers to engage with their clients using the channels they live by, providing a personalized customer engagement platform that will be an asset in today's fast-paced and competitive Forex/CFD industry. This partnership will undoubtedly transform the way FX brokers conduct their business, providing them with a competitive edge in an industry where customer engagement is paramount.

- 06.06.2023

- All

- READ MORE

Broctagon has introduced a brokerage CRM for cTrader with its integration into the proprietary FX brokerage customer management system– AXIS.

- 16.05.2023

- All

- READ MORE

Broctagon’s Chief Technology Officer (CTO) and co-founder, Ted Quek, was recently invited to a sharing session at the National University of Singapore (NUS), where he detailed his experience of starting Broctagon Fintech Group with the students, and his journey of bringing it to the global presence it is today, with offices in 7 countries, and serving clients from over 50 countries. Big thanks to assistant dean, Associate Prof. Huang Ke-Wei, who organized this rare opportunity for the university’s new Masters’ Programme for Digital Financial Technology. Speaking to the young minds at the programme, Ted shared about how Broctagon started from its liquidity business more than ten years ago and how it expanded over the years to become the premier turnkey solutions provider. Today, Broctagon offers a full suite of forex brokerage solutions: industry-leading trading platforms, proprietary brokerage CRM, blockchain development and multi-asset FX and crypto liquidity. He shared that it is this expansion into a turnkey fintech hub that led Broctagon on its path to success today. As the CTO, Ted emphasized his focus on having a strong technological infrastructure, which he feels is the backbone of a successful FX brokerage business, and thus is what he has steered Broctagon’s solutions towards. Broctagon’s mission has always been to streamline and elevate brokerages by equipping brokers with the means necessary to attract clients, exceed performance expectations and redefine industry standards. With his experience in the financial markets and understanding of brokers’ needs, Ted led the technology and innovation teams to produce reliable trading systems, coupled with sophisticated risk management and security infrastructure – all crucial to build trust with clients and ensure long-term success. He discussed about the evolving needs of the forex market, from the importance of providing deep liquidity to diversify risk and reduce volatility, to having an FX CRM that can onboard traders efficiently and manage affiliate network expansions. Responding to some questions by students, Ted gave some insight on the operations of a forex brokerage, how it handles day-to-day operations, clients, risk management, trade executions and compliance. All of which Broctagon needs to understand and anticipate as a technological provider, in order to provide first-class service and solutions. The NUS Fintech students had a glimpse into valuable real-world experiences into possible careers in the dynamic and rapidly evolving fintech industry. Finally, Ted concluded by highlighting the importance of building a culture of innovation and continuous improvement within a company. He stressed the need for companies to constantly adapt and evolve in response to changing market conditions and technological advancements, a motto that has helped put Broctagon at the forefront of Fintech.

- 21.04.2023

- All

- READ MORE

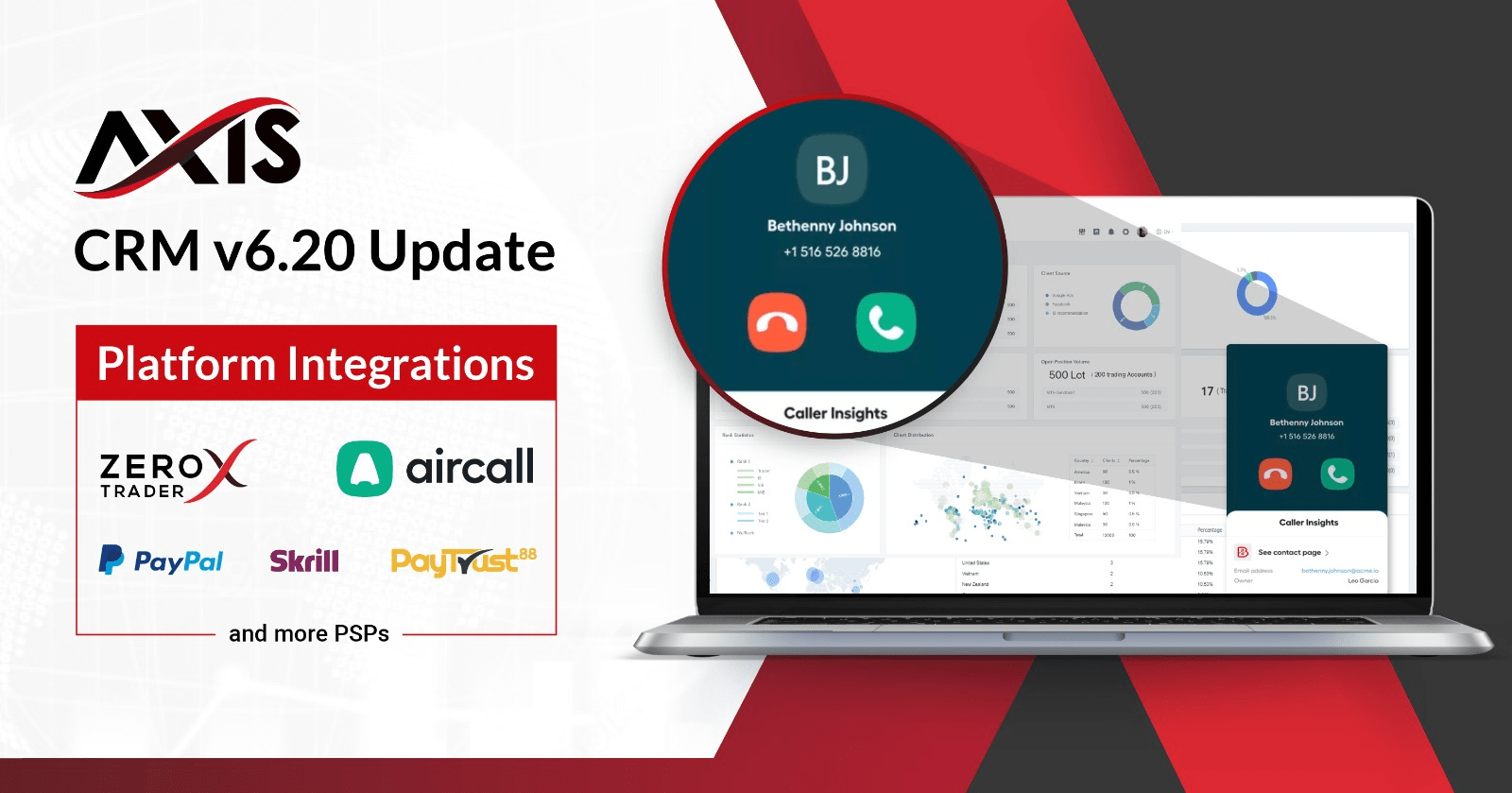

In this latest version update AXIS CRM V6.2, we are pleased to announce the latest platform integrations that will allow more customization, flexibility and streamlining of processes in trader management. We also introduced other new functionalities that would improve networking capabilities and optimization for brokerages.

- 03.04.2023

- All

- READ MORE

You might be interested in starting a business in the world's biggest financial market - Forex. But where to start? There are mostly 2 options: Building a brokerage from scratch, and to start a forex brokerage with a white label.

- 22.03.2023

- All

- READ MORE

Multi-asset liquidity provider Broctagon is proud to announce a partnership with FXCubic, London-based fintech firm.

- 07.01.2021

- Partnerships

- READ MORE

Broctagon Fintech Group is proud to announce a partnership with Takeprofit Tech to increase risk-management choices for global forex brokers.

- 05.01.2021

- Partnerships

- READ MORE

We review how the COVID-19 pandemic has transformed businesses in 2020. At Broctagon, we are fortunate that operations have remained largely unaffected.

- 01.01.2021

- News

- READ MORE

GoldGo is a government-recognised utility token directly backed by a physical gold supply and secured by blockchain technology.

- 22.12.2020

- News

- READ MORE

Broctagon is pleased to announce that we have received the 'Best Tailored Blockchain Solutions Provider’ award at the Finance Magnates Awards 2020!

- 25.11.2020

- News

- READ MORE

The decision to regulate all entities operating within the cryptocurrency industry in Hong Kong has been dubbed as a "positive move" by Broctagon CEO.

- 04.11.2020

- In The Press

- READ MORE

Broctagon Fintech Group is proud to announce that we have obtained a Money Broking Licence from the Labuan International Business and Financial Centre (Labuan IBFC).

- 28.10.2020

- Partnerships

- READ MORE

Brokerages in Asia will now have a wider variety of trading platforms made available with Broctagon's Spotware partnership to offer the cTrader Platform.

- 13.10.2020

- Partnerships

- READ MORE

Broctagon Fintech Group, a liquidity and technology provider to the brokerage industry, has partnered with Spotware, thus becoming a specialist provider of cTrader White Labels.

- 12.10.2020

- In The Press

- READ MORE

Broctagon Fintech Group, a liquidity and technology provider to the brokerage industry, has partnered with Spotware, thus becoming a specialist provider of cTrader White Labels.

- 12.10.2020

- In The Press

- READ MORE

Brokerages with Broctagon's AXIS CRM can now reward their traders better with an improved, highly-configurable system for new client acquisition.

- 10.09.2020

- Products

- READ MORE

Broctagon has launched NEXUS' Native Altcoin Liquidity Management, allowing exchanges to regulate the demand and supply of their native altcoins.

- 02.09.2020

- Products

- READ MORE

Singapore-based Broctagon Fintech Group has upgraded its NEXUS 2.0 liquidity aggregator technology, with the launch of Native Altcoin Liquidity Management.

- 02.09.2020

- In The Press

- READ MORE

Brokerages with AXIS can now bring greater convenience and flexibility to their traders experience on the platform, now with the added capability to accept over 40+ cryptocurrency deposit types.

- 02.06.2020

- Products

- READ MORE

Covid 19 has heavily impacted the the crypto markets within the past few months. Learn how to hypercharge your exchange liquidity during the bearish run.

- 14.05.2020

- Products

- READ MORE

Multi-asset liquidity provider Broctagon has launched NEXUS 2.0, a new service designed to tackle the issue of crypto exchange price disparity. | Coin Rivet

- 11.12.2019

- In The Press

- READ MORE

Broctagon Fintech Group has launched Blockchain-in-a-Box (BIB), a blockchain solutions kit starter kit designed to provide a tangible proof-of-concept for modern companies looking to integrate blockchain into their businesses.

- 20.08.2019

- News

- READ MORE

Ted Quek, CTO of Broctagon, explains how the crypto space must adopt liquidity standards similar to those of FX markets, in order to scale new peaks.

- 10.08.2020

- Thought Leadership

- READ MORE

The decline in trading volumes rekindle questions over how many cryptocurrency exchanges are really needed to serve the nascent but fast-growing market.

- 08.07.2020

- Thought Leadership

- READ MORE

As the coronavirus lockdown begins to lift across the world, investment opportunities in traditional stock markets and cryptocurrencies couldn't be greater.

- 17.06.2020

- Thought Leadership

- READ MORE

What was once regarded by many as ‘internet money’ is slowly stumbling its way into mainstream acceptance, Broctagon's CTO Ted Quek tells Yahoo! Finance.

- 02.06.2020

- Thought Leadership

- READ MORE

Covid 19 has heavily impacted the the crypto markets within the past few months. Learn how to hypercharge your exchange liquidity during the bearish run.

- 14.05.2020

- Products

- READ MORE

Broctagon's CEO Don Guo states that governments across the world need to begin taking action on the regulation of crypto and digital assets. | Yahoo Finance

- 12.05.2020

- Thought Leadership

- READ MORE

Cryptocurrency was thrust into the spotlight by Bitcoin, but it is blockchain, the technology behind it that we should pay attention to.

- 11.05.2020

- Blockchain

- READ MORE

Should a regulatory precedent not be set and the space continue to be a “Wild West”, we could see a stall in institutional involvement. | Don Guo Opinion Piece

- 24.04.2020

- Thought Leadership

- READ MORE

Price swings are a distraction from what we should really be looking at – and that’s how blockchain can curb a pandemic like COVID-19.

- 23.03.2020

- Thought Leadership

- READ MORE

Broctagon was present at the recently-concluded Saigon Financial Education Summit (SFES), held at Ho Ch Minh City, Vietnam, on September 21st 2019.

- 24.09.2019

- Awards

- READ MORE

Broctagon Fintech Group officially opened the doors to our new Singapore headquarters with much fanfare at our opening party on 24th July 2019, right in the heart of Asia’s financial hub.

- 30.07.2019

- Events

- READ MORE

Broctagon Fintech Group was awarded the title of "Best Cryptocurrency Liquidity Provider" at the WikiFX Kuala Lumpur Financial Summit 2019.

- 09.07.2019

- Awards

- READ MORE

Broctagon Fintech Group was recently at the NEXTBLOCK Asia Conference held by Krypton Events in Bangkok, Thailand from 25th to 26 June.

- 27.06.2019

- Events

- READ MORE

Over the past week, Broctagon attended 2 key industry events — iFX EXPOand Malta AI and Blockchain Summit.

- 28.05.2019

- Events

- READ MORE

The newly introduced offering entails a number of solutions aimed at addressing issues of liquidity typically associated with digital currency trading. | Finance Magnates

- 11.11.2017

- In The Press

- READ MORE

- 05.07.2023

- All

- READ MORE

- 23.06.2023

- All

- READ MORE

- 15.02.2023

- All

- READ MORE

Should a regulatory precedent not be set and the space continue to be a “Wild West”, we could see a stall in institutional involvement. | Don Guo Opinion Piece

- 24.04.2020

- Thought Leadership

- READ MORE

As the coronavirus starts to impact global growth prospects, how will cryptocurrencies hold up? Bitcoin could be perceived as a safe haven asset. | Business Times

- 03.03.2020

- In The Press

- READ MORE

As the coronavirus starts to impact global growth prospects, how will cryptocurrencies hold up? Bitcoin could be perceived as a safe haven asset. | Bloomberg

- 02.03.2020

- In The Press

- READ MORE

Countries who can correctly implement a CBDC will stand to benefit as they will have a currency which is totally borderless, efficient, and immutable. | Coin Rivet

- 22.01.2020

- In The Press

- READ MORE

Broctagon CEO Don Guo has described the Bank of England’s decision to assess the potential benefits of a central bank digital currency (CBDC) as “ironic”. | Yahoo! Finance

- 22.01.2020

- In The Press

- READ MORE

If the equities markets currently look calm, they don't hold a candle to the foreign exchange markets, where volatility is at its lowest points in years. | Finance Derivative

- 15.01.2020

- In The Press

- READ MORE

With growing global fears around climate change, how we manage our cities is becoming ever more important. Technology can facilitate better urban planning and solve pertinent problems with more data. | Connected Technology Solutions

- 04.01.2020

- In The Press

- READ MORE

Experts across the blockchain and cryptocurrency space shared about their predictions for 2020, from cybersecurity concerns to greater mainstream adoption. | Verdict

- 17.12.2019

- In The Press

- READ MORE

Multi-asset liquidity provider Broctagon has launched NEXUS 2.0, a new service designed to tackle the issue of crypto exchange price disparity. | Coin Rivet

- 11.12.2019

- In The Press

- READ MORE