Brokerage. Blockchain. Buzz.

Welcome, find all things buzzing on board at Broctagon’s blog! Here you’ll find the latest in blockchain news, exciting event highlights, insightful thought leadership in forex and crypto, and more. Be the first to know all about our events and most innovative tech updates – all in one space.

A good customer relationship management (CRM) system is an essential part of any successful brokerage. An ideal brokerage CRM will help businesses prepare for growth by organizing and managing all client-related information within one space. Choosing the right CRM will also help streamline business processes, increase efficiency, and improve business yield.

- 15.11.2022

- All

- READ MORE

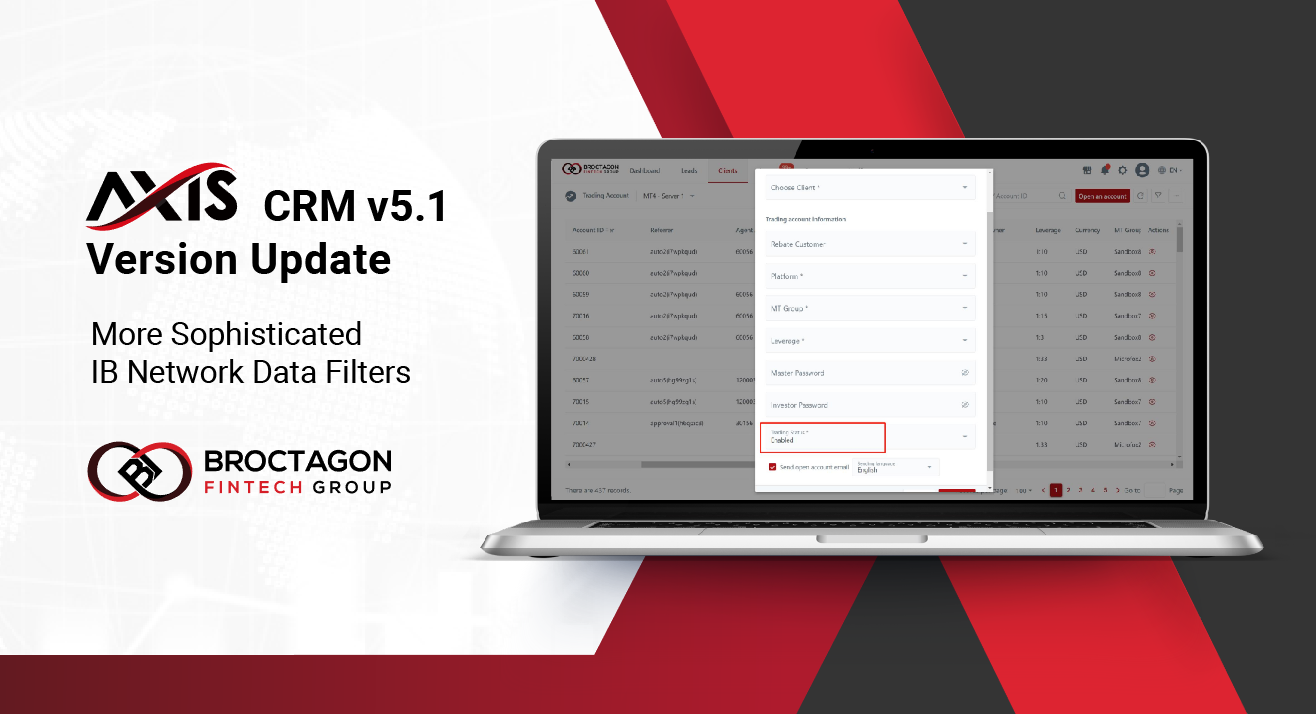

In this latest version update AXIS CRM V5.6, we enhanced control for brokers by introducing more UI customization options and data filtering to fully utilize the AXIS’ core IB/affiliate network capabilities. UI Customization We have enabled more customization for the user interfaces of both the Admin Portal and Client Portal, allowing brokers to take control of business processes to better suit their needs. The portal landing page and navigation settings now have more customization options. Create your unique CRM that exudes in-house vibes. Client Portal The default style of the landing page is now set to 'center'. Users can also choose to set it to 'left', 'right'. Light and dark themes are also available. The theme color is also customizable with specific HTML color codes. The default style of the navigation bar is now set to 'left'. Users can also set the navigation bar to appear at the top. Admin Portal The default style of the landing page is now set to 'center'. Users can also choose to set it to 'left', 'right'. Light and dark themes are also available. The theme color is also customizable with specific HTML color codes. The default style of the navigation bar is now set to 'top'. Users can also set the navigation bar to appear on the left. 9 different variations and colors of email templates have been added for admins to customize emails for specific branding or occasions. To trigger this, admins will have to install the application in the marketplace. To use templates when sending emails, go to 'Notify' > 'Email'. Payment and Funding We have added functionalities for payment and banking to streamline processes for brokers. Deposits through ChillPay are now supported. Deposits through Paypal are now supported. A minimum and maximum amount can now be set in transfer settings to minimize transfer errors. The process of adding bank cards and KYC verification has been streamlined. The 'Bank Card' module in 'Clients Details' has been moved till after the 'KYC' module. This is to prevent adding of bank cards before the KYC process. Admins can add now and update clients' bank cards on the 'Clients Details' page. Notifications Admins now have the ability to revoke pop-up notifications within two hours of publishing. Permissions for viewing emails and pop-up notifications can now be customized depending on network roles. Company Wide: Permission to view all emails and pop-up notifications sent to clients. Directly Referred Clients: Permission to view emails and pop-up notifications sent to clients by direct team members. Same Role: Permission to view emails and pop-up notifications sent to clients by admins of the same role. All Referred Clients: Permission to view emails and pop-up notifications sent to clients by team members. Admin Portal Promotion Links In 'Promotion Link' settings, 'Downlines' has been added as a group option. This is to allow IBs to create promotional links that specifically target their referred clients. Bonus Campaigns Admins can now amp up marketing and referrals via distribution of bonuses. Bonuses can be rewarded via Bonus Campaigns, which can be created under 'Bonus' > ‘Bonus Settings' > 'New Campaign'. Trading Platform Under 'Trading Platform' settings, the information that is automatically synced to the MT platform can now be customized. Here are the additional optional fields: Phone Number Email Agent Account KYC (including Place of Residence, Postal code and Address KYC During the trader registration and KYC approval process, a notification has been set to trigger when a KYC Identity Card/Passport Number already exists in the system. This is to ensure that each entry is unique and reduce accidental duplication. Filtering The client list can now be filtered by those who have a referrer and those who do not. The client list can now also be filtered by those who do not possess a trading account. The lead source for clients can now be displayed. It is hidden by default. Admins can now do a quick search of reports by keying in the order ID. Supported reports: Back Office → Reports → CRM Reports→Transactions Back Office → Reports → MT Reports → Trade History Back Office → Reports → MT Reports → Open Positions Back Office → Reports → MT Reports → Pending Orders Client Portal → Referral → Clients' Reports → Transactions Client Portal → Referral → Clients' Reports → Trade History Client Portal → Referral → Clients' Reports → Open Positions Client Portal → Referral → Clients' Reports → Pending Orders Reports Report functions have been improved to introduce more sophistication for bonus tracking. Trigger Order Reports: 'Trigger Order' reports can be generated to track bonuses that are rewarded when clients deposit funds. This allows admins to track the source of bonuses and events in which they are triggered. Bonus Reports: The system can auto-generate regular bonus reports, which allows admins to view all the calculated bonus records. Bonus Payout Reports: 24 hours after a bonus calculation is completed, the bonuses for each client will be calculated and a one-time deposit will be made to the client's account. Admin can view all statuses of rewarded bonuses. General To improve user experience, the following formatting has been done: All figures showing monetary currency is now formatted to be clearly separated by commas. For example, 10000 USD will show as 10,000 USD. A space is now added after a colon in fields. This takes effect in 'Client' > 'KYC' page and all approval request detail pages. Learn More Schedule a Demo

- 31.10.2022

- All

- READ MORE

Broctagon has expanded liquidity offerings list to 1,800+ instruments! With our proprietary aggregator technology, we are ever-increasing our assets offered, providing enhanced market depth and razor thin spreads in a frictionless marketplace.

- 24.10.2022

- All

- READ MORE

Broctagon was at Forex Expo Dubai 2022, the largest trading event of the year in the Middle East! More than 8,000+ Investors and Forex industry leaders came together to network and explore new business opportunities in the forex space. Find out from our industry experts about the current investment trends and regulations in the forex markets. […]

- 17.10.2022

- All

- READ MORE

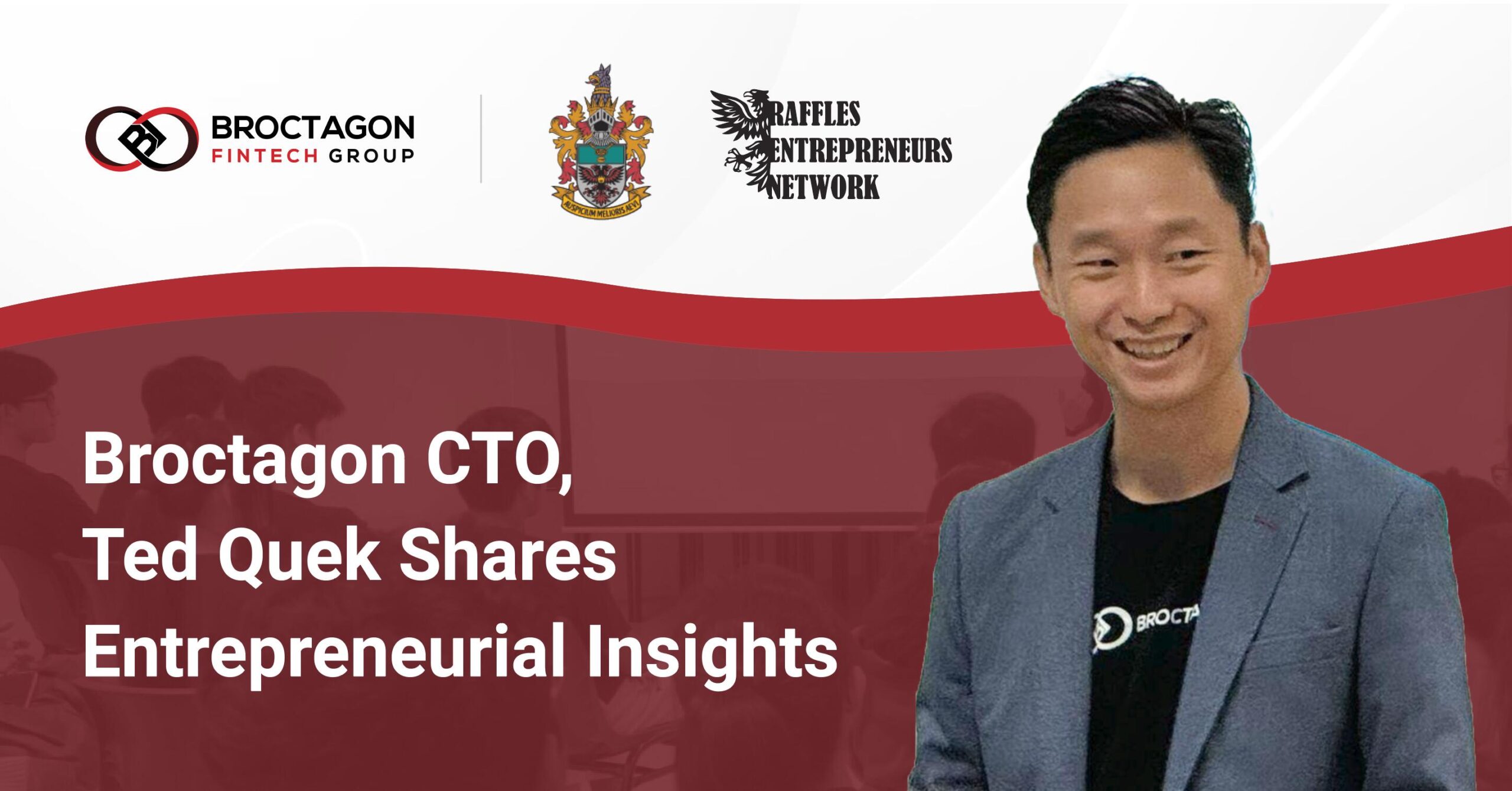

Broctagon Fintech Group was at iFX Expo Asia 2022, held for the very first time in Bangkok featuring some of the most prominent companies within the FX industry and engaging content from inspiring industry leaders. Our SaaS CRM and multi-asset liquidity met with an influx of interest, and this was nothing short of a spectacular event. Meet team Broctagon. Event Highlights Panel Session at iFX Expo Asia 2022 We were incredibly honored to have been invited as a panelist on the topic of “East vs West Liquidity in APAC and Beyond”, where our Chief Technology Officer & Co-Founder Ted Quek shared insights into the trends and opportunities within the Asian market, drawing from his deep-rooted experience driving innovation at the helm of the group. Impeccably apt for this panel, we have our European-licensed liquidity arm Broctagon Prime, regulated by CySEC, and Asian-licensed liquidity arm Broctagon Prime Markets regulated by Labuan FSA. Our dual-licensed liquidity solution puts us in a position with in-depth understanding of both East and West. The Only East, Amongst the West As the only panelist with the unique insight into Asia's financial landscape, Ted provided valuable analysis on Asia's market trends, sharing that cryptocurrency CFDs have been in high demand in Asia in the recent years, with a bubbling shift in the West as well. Brokerages are urged to keep up by seeking liquidity providers with the capabilities and infrastructure to meet that demand. As one of the major liquidity providers of crypto CFDs, we can attest first hand to that growing necessity, and we see brokerages and LPs need to cater to that demand to remain competitive and not fall behind. Strong Interest in our Full Suite of FX Solutions Broctagon garnered lots of interest at the expo, particularly for our AXIS FX CRM as its sophisticated multi-tiered IB module fits the aggressive affiliate marketing landscape of Asia to a tee. The SaaS model was also highly welcomed due to the absence of a setup fee with an almost immediate turnaround time allowing brokers to go-to-market fast. Also, being an end-to-end solutions provider from setup and licensing to technology and institutional prime liquidity under dual jurisdictions, we are happy to be of service to many potential clients. It was an amazing chance at the expo, in a historic moment that it was held in Bangkok, to forge new connections with fintech industry professionals and strengthen bonds with our existing Thai clients and partners. Missed us at the expo? Find out more about how we can tailor solutions for your brokerage by scheduling a consultation. Schedule a Meeting

- 30.09.2022

- All

- READ MORE

Broctagon is proud to be one of the partners at Vancouver International Financial Summit (VIFS) 2022. From September 2 to 3, 2022, VIFS hosted top financial companies from Canada and globally, focusing on the cutting-edge transaction, technology and financial services.

- 15.09.2022

- All

- READ MORE

In this latest version upgrade for AXIS 3.0, we have made updates and adjustments to Broctagon's fully customisable SaaS solution and CRM for brokerages engineered for client expansion. We have worked to make account and trader management more efficient and customizable for brokers and IBs.

- 31.08.2022

- All

- READ MORE

With Broctagon's professional whitepaper writing services, our team of business consultants, blockchain advisors, marketers, and industry experts will come together to help you conceptualize and create a whitepaper that makes your project shine.

- 17.08.2022

- All

- READ MORE

Broctagon has just announced the launch of its customized DeFi Decentralized Exchanges (DEX) Platform and Automated Market Maker (AMM) Protocol integration.

- 29.07.2022

- All

- READ MORE

Increasing market demand for more sophisticated crypto trading methods drives Broctagon Fintech Group to new heights, pushing it past $5million in turnover.

- 11.09.2019

- News

- READ MORE

Broctagon Fintech Group has launched Blockchain-in-a-Box (BIB), a blockchain solutions kit starter kit designed to provide a tangible proof-of-concept for modern companies looking to integrate blockchain into their businesses.

- 20.08.2019

- News

- READ MORE

Broctagon Fintech Group officially opened the doors to our new Singapore headquarters with much fanfare at our opening party on 24th July 2019, right in the heart of Asia’s financial hub.

- 30.07.2019

- Events

- READ MORE

Fintech solutions provider Broctagon Fintech Group announced that it will be opening its new headquarters in the heart of Asia, metropolitan city-state Singapore.

- 14.07.2019

- News

- READ MORE

Broctagon Fintech Group was awarded the title of "Best Cryptocurrency Liquidity Provider" at the WikiFX Kuala Lumpur Financial Summit 2019.

- 09.07.2019

- Awards

- READ MORE

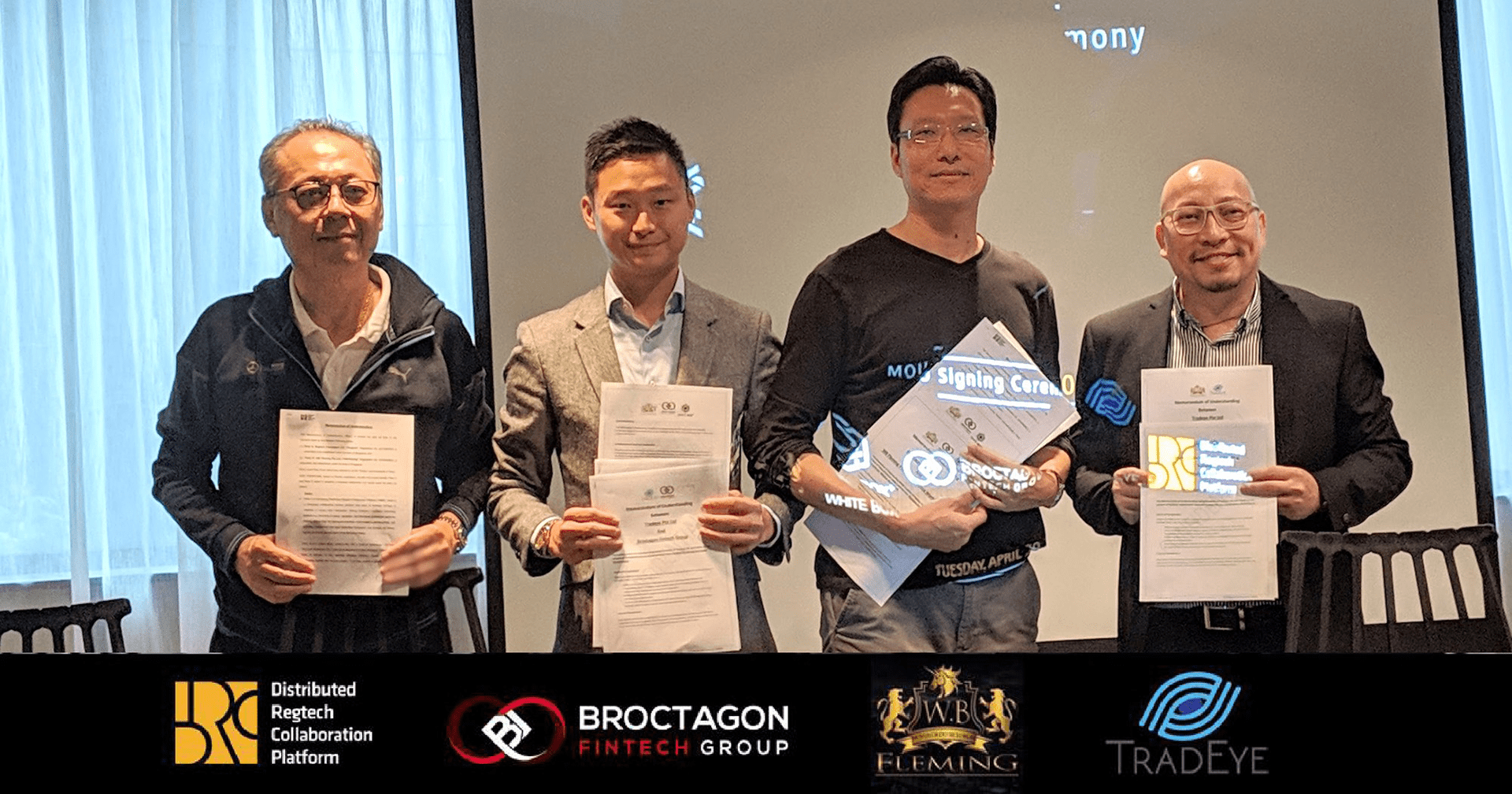

In a momentous occasion for the fintech community, Broctagon Fintech Group signed memorandum of understanding (MoU) on Tuesday, 30th April.

- 05.05.2019

- News

- READ MORE

Broctagon Fintech Group, the leading provider in forex and crypto solutions, is pleased to announce that it has attained technology partner status in the Amazon Web Services (AWS) Partner Network.

- 25.02.2019

- Partnerships

- READ MORE

Broctagon would be working alongside trading technology firm TradAir to provide cryptocurrency liquidity akin to the foreign exchange (FX) market. | Finance Magnates

- 14.01.2019

- In The Press

- READ MORE

Broctagon Fintech Group, an all-in-one provider for forex and blockchain solutions, is proud to be a new member of the Singapore FinTech Association (SFA).

- 05.09.2018

- News

- READ MORE

- 04.01.2024

- All

- READ MORE

- 09.11.2023

- All

- READ MORE

- 02.11.2023

- All

- READ MORE

Despite a heightened flurry of discussion about institutional investors entering the crypto space, crypto adoption has been slow to take root.

- 04.12.2018

- Thought Leadership

- READ MORE

- 13.07.2023

- All

- READ MORE

- 05.07.2023

- All

- READ MORE

- 23.06.2023

- All

- READ MORE

- 15.02.2023

- All

- READ MORE

NEXUS is developed with Broctagon's vision of elevating the disruptive boom of crypto trading to the sheer scale and efficiency of the forex market. | Yahoo! Finance

- 26.11.2018

- In The Press

- READ MORE

The newly introduced offering entails a number of solutions aimed at addressing issues of liquidity typically associated with digital currency trading. | Finance Magnates

- 11.11.2017

- In The Press

- READ MORE