Brokerage. Blockchain. Buzz.

Welcome, find all things buzzing on board at Broctagon’s blog! Here you’ll find the latest in blockchain news, exciting event highlights, insightful thought leadership in forex and crypto, and more. Be the first to know all about our events and most innovative tech updates – all in one space.

Broctagon Fintech Group was recently awarded 'Best Crypto Liquidity Solutions' at the Crypto Expo Dubai 2022, as a recognition for our newly-upgraded product, the NEXUS 2.0 Crypto Liquidity Hub. Held at Dubai Festival City from 16 -17 March, more than 100+ crypto companies gathered at the premier cryptocurrency event.

- 18.03.2022

- Awards

- READ MORE

Broctagon Fintech Group has launched a unique social media-based NFT marketplace white label solution for businesses, communities and individuals looking to launch their own NFT marketplace.

- 11.03.2022

- Blockchain

- READ MORE

Jumio Corporation, a leading provider of AI-powered end-to-end identity orchestration, eKYC and AML solutions, is the latest participant to join the inter-exchange liquidity network known as the WorldBook™.

- 04.03.2022

- All

- READ MORE

Broctagon Fintech Group is proud to be the Gold Sponsor for the upcoming Crypto Expo Dubai 2022! Join us at Booth 84 in the expo held from 16 -17 March, where more than 3000+ investors will congregate for this annual event.

- 02.03.2022

- All

- READ MORE

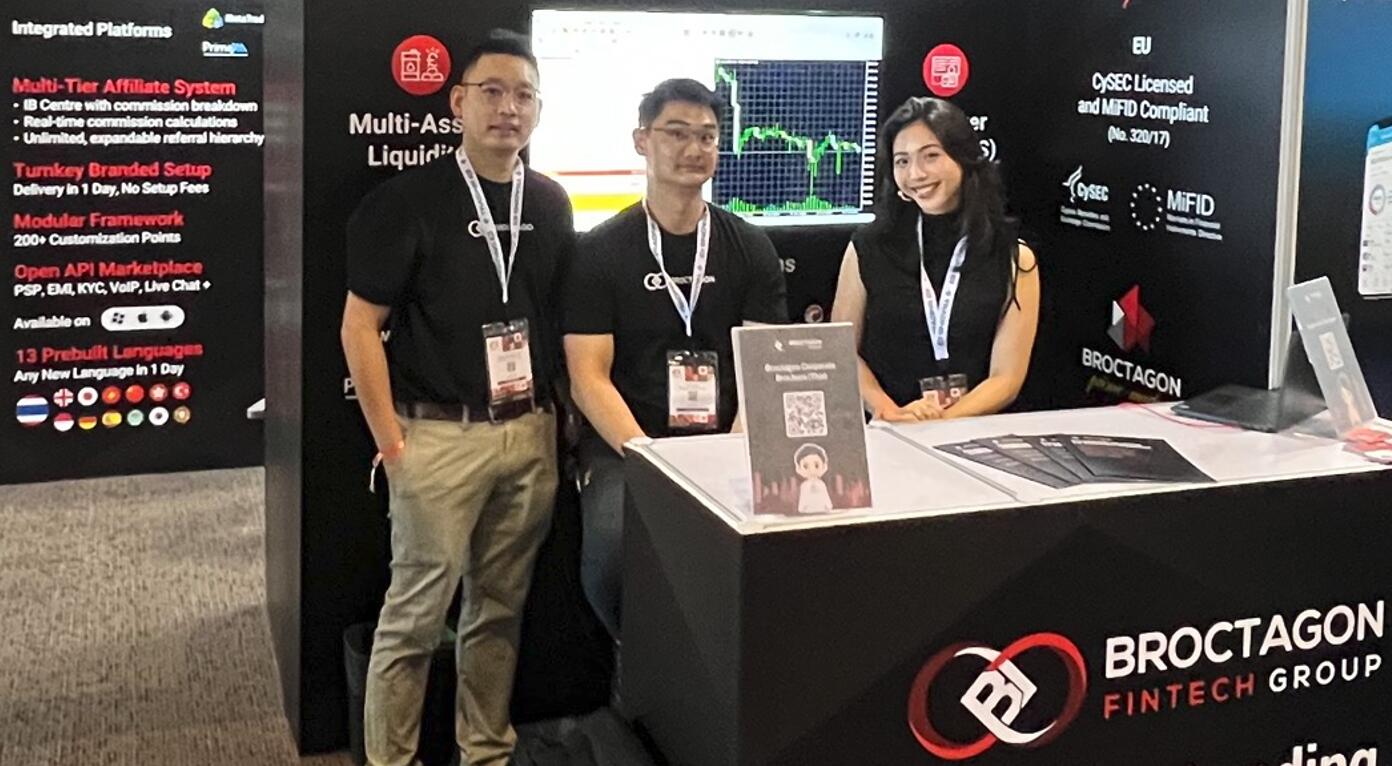

Broctagon Prime participated at the iFX EXPO Dubai, one of our first events in 2022. Held at Dubai’s World Trade Centre from 22nd – 24th February 2022, the 3-day event presented over 60+ speakers on its agenda, with its title as the largest global fintech B2B exhibition.

- 28.02.2022

- All

- READ MORE

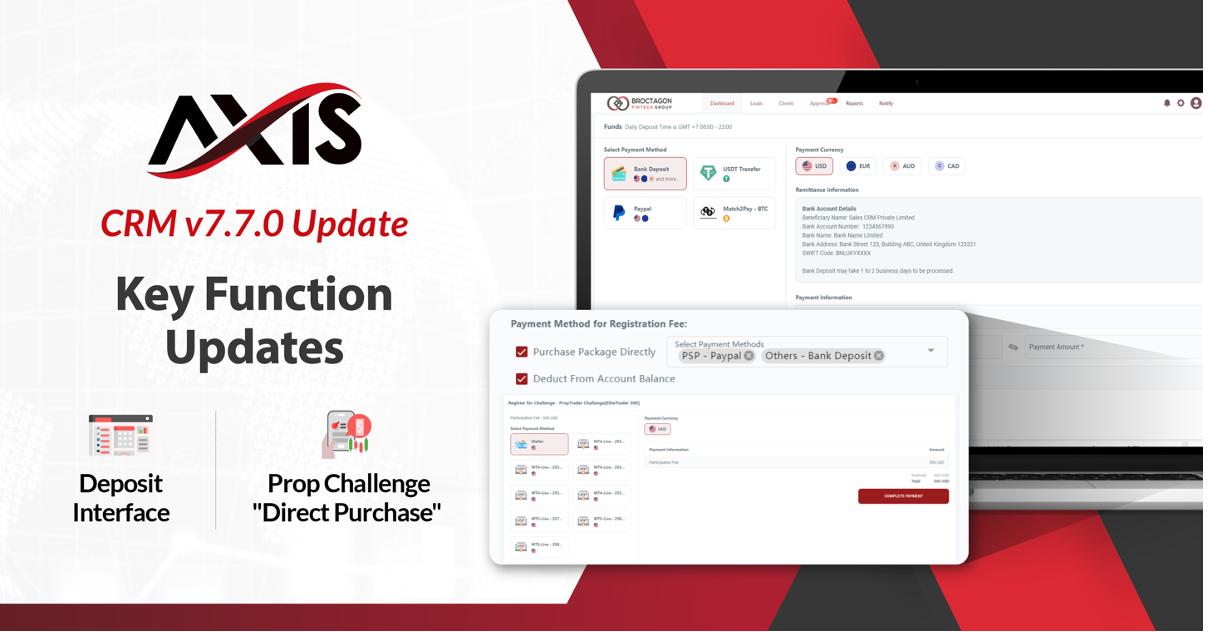

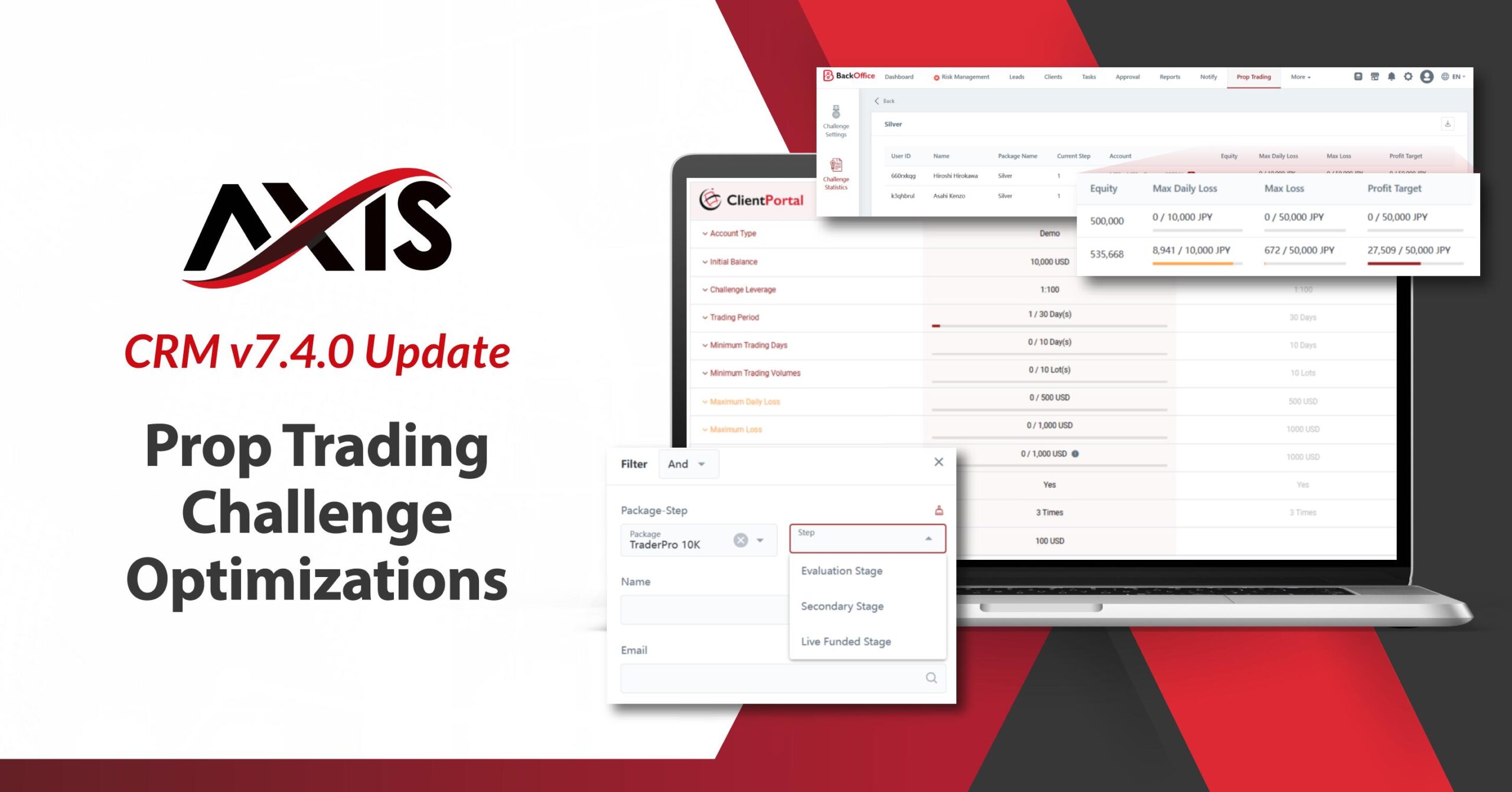

In this latest update log, we pay special attention to the experience of administrators, finding ways to improve both efficiency and data access so that they will be able to handle client data more effectively.

- 25.02.2022

- All

- READ MORE

Broctagon Prime will be at the iFX Expo hosted in the Dubai World Trade Center, 22-24 February. Meet us at Booth 106 to find out about the most competitive liquidity products for your brokerage.

- 21.02.2022

- All

- READ MORE

In this first episode of the CryptoNow podcast, we link up with Hodlnaut to discuss the current state of the cryptocurrency markets, including its security, perspectives, and regulatory expectations.

- 27.01.2022

- All

- READ MORE

Tokenize Xchange, a Singapore-based digital exchange platform , is the latest participant to join the inter-exchange liquidity network known as the WorldBook™. The NEXUS WorldBook is an initiative by Broctagon Fintech Group, under the licensed entity Broctagon Prime Markets Limited to create a universal liquidity standard for digital assets. Hong Qi Yu, Founder and CEO of Tokenize Xchange, said: “As a digital asset fiat-on/off ramp, Tokenize aims to provide frictionless access to digital assets through the best user experience and a wide range of product offerings. We enable users to trade on an orderbook in their countries’ respective currencies while providing them competitive fees and spreads, low slippage and seamless settlements. We are excited to be part of the WorldBook initiative to contribute to greater standardisation within the crypto ecosystem." Desmond Ang, Managing Director of Broctagon Fintech Group, commented on Tokenize Xchange’s participation on the WorldBook network, saying: “Tokenize’s experience in digital assets goes beyond its functionalities as a digital assets platform. With yield models of up to 8.3% APY on Bitcoin & Ethereum, they have grown beyond the traditional exchange model and are now branching into the field of custody. We are honoured by their participation in our movement, and anticipate further collaborations to come.” About Tokenize XchangeTokenize Xchange is a Singapore-headquartered digital exchange platform that allows the trading of digital assets in a safe and secure environment with competitive fees. The platform currently allows the trading of over 60 cryptocurrencies and is one of the few platforms that is available in Singapore that allows users to buy cryptocurrencies via an orderbook exchange in Singapore dollars. About NEXUS WorldBookThe NEXUS WorldBook™ is the world’s first crypto liquidity ecosystem, committed to building a cohesive network for both makers and takers. The WorldBook leverages on the NEXUS 2.0 aggregator technology to offer its members global price discovery and direct STP capabilities on a universal liquidity standard. To find out more about Tokenize Xchange, visit:Website: https://tokenize.exchange/Medium: https://medium.com/tokenize-xchangeFacebook: https://www.facebook.com/tokenize.exchange/ Instagram: https://www.instagram.com/tokenize.exchange/ Twitter: https://twitter.com/TokenizeXchange Linkedin: https://www.linkedin.com/company/tokenize-exchange YouTube: https://www.youtube.com/channel/UCy6ckPyiMAOla7euez-W1FA To find out more about or to join the NEXUS WorldBook, visit:Website: https://nexusworldbook.com Facebook: https://www.facebook.com/NEXUSWorldBook LinkedIn: https://www.linkedin.com/showcase/74741847/ Twitter: https://twitter.com/NEXUSWorldBook Instagram: https://www.instagram.com/nexusworldbook/ YouTube: https://www.youtube.com/channel/UCT5_f3W2SEBDsWrJc8YGAE

- 26.01.2022

- All

- READ MORE

- 07.03.2024

- Partnerships

- READ MORE

- 05.03.2024

- Partnerships

- READ MORE

- 30.12.2022

- All

- READ MORE

- 29.12.2022

- Broprime Markets

- READ MORE

- 23.03.2022

- Partnerships

- READ MORE

- 18.03.2022

- Awards

- READ MORE

- 19.10.2021

- Partnerships

- READ MORE

- 04.01.2024

- All

- READ MORE

- 09.11.2023

- All

- READ MORE

- 02.11.2023

- All

- READ MORE

- 22.03.2023

- All

- READ MORE

- 15.02.2023

- All

- READ MORE

- 10.02.2023

- All

- READ MORE

- 30.11.2022

- Liquidity

- READ MORE

- 24.11.2022

- All

- READ MORE

- 15.11.2022

- All

- READ MORE

- 24.01.2022

- All

- READ MORE

- 13.07.2023

- All

- READ MORE

- 05.07.2023

- All

- READ MORE

- 23.06.2023

- All

- READ MORE

- 15.02.2023

- All

- READ MORE

- 24.11.2022

- All

- READ MORE

- 29.03.2022

- All

- READ MORE

- 25.10.2021

- All

- READ MORE

Why ‘Dogecoin Killers’ Are Making Huge Price Gains, Leaving Bitcoin, Ethereum, BNB, XRP And Cardano In The Dust

- 10.10.2021

- All

- READ MORE

- 06.10.2021

- All

- READ MORE