About the App

Introduction

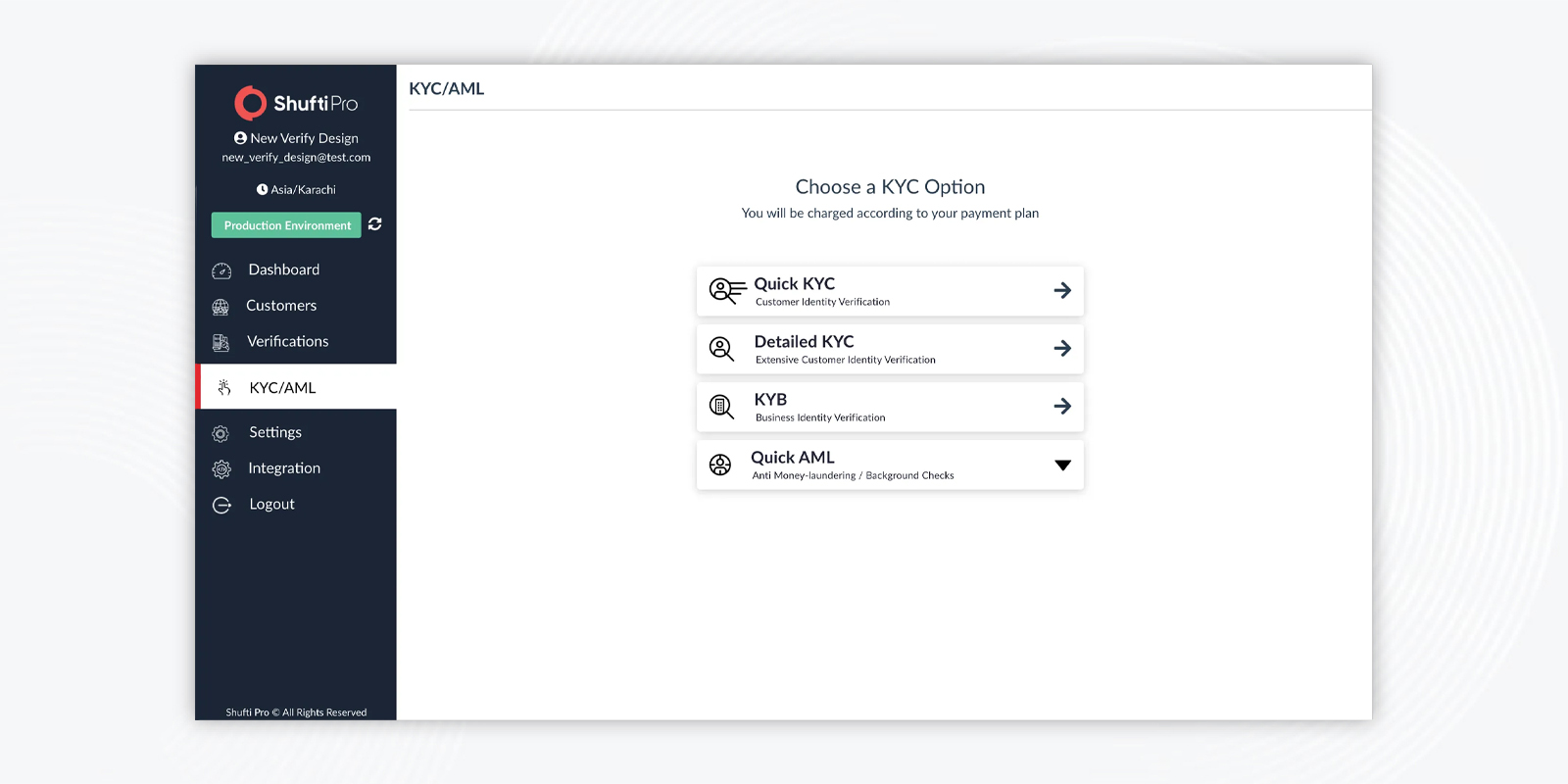

ShuftiPro offers a comprehensive identity verification solution that covers Know Your Customer (KYC), Know Your Business (KYB), and Anti-Money Laundering (AML) screening. With advanced AI-driven verification, real-time document authentication, and global coverage, ShuftiPro helps businesses enhance security, reduce fraud, and comply with regulatory requirements.Integration

Broctagon x ShuftiPro

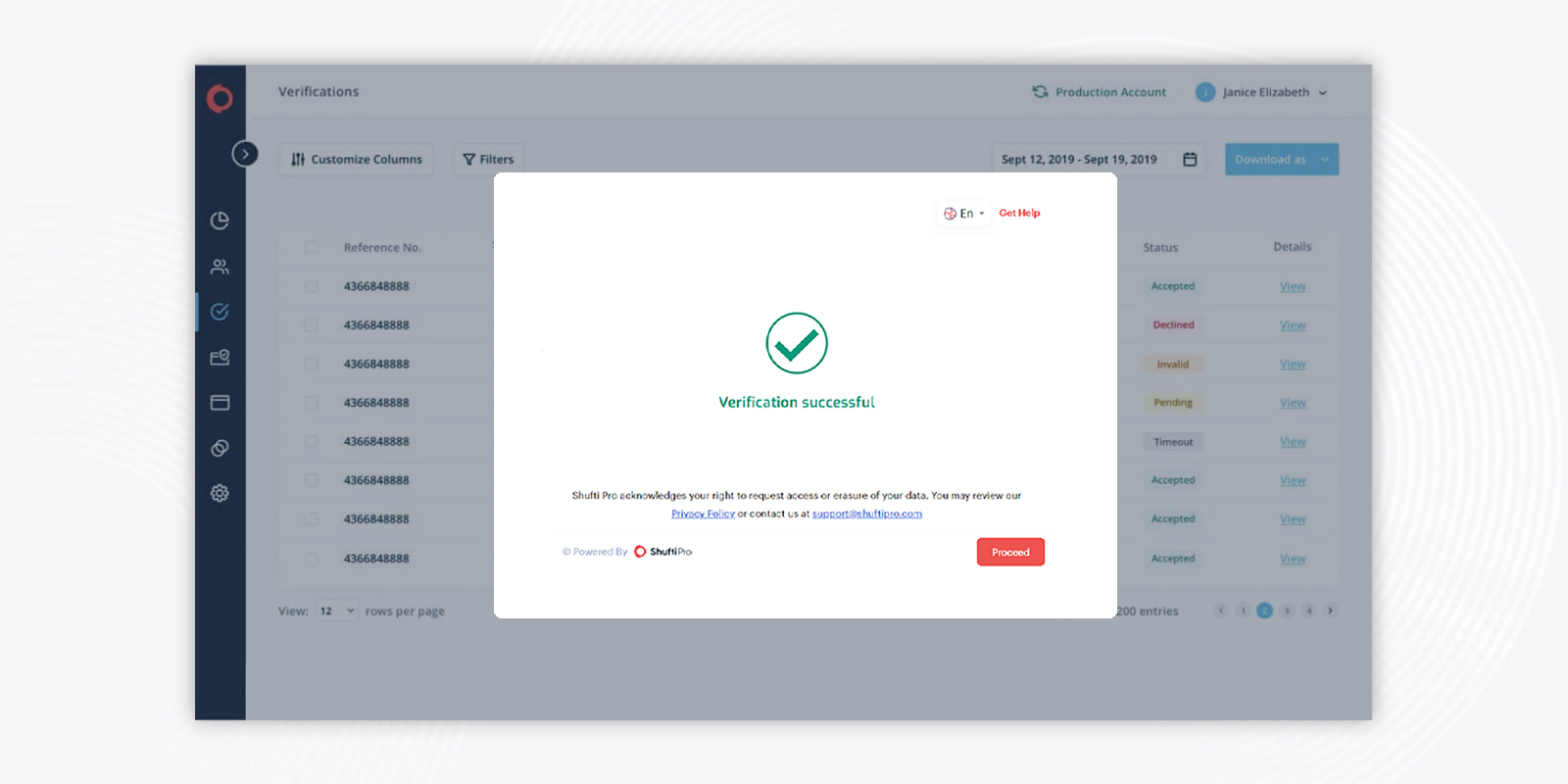

The integration of ShuftiPro with the AXIS Forex CRM enhances KYC verification and AML screening with automated workflows, real-time risk detection, and global compliance coverage. Instantly verify clients against sanctions lists, PEP databases, and adverse media sources while streamlining onboarding with configurable verification rules and automated approvals. The seamless onboarding process accelerates account activation, allowing traders to start trading sooner.

App Details

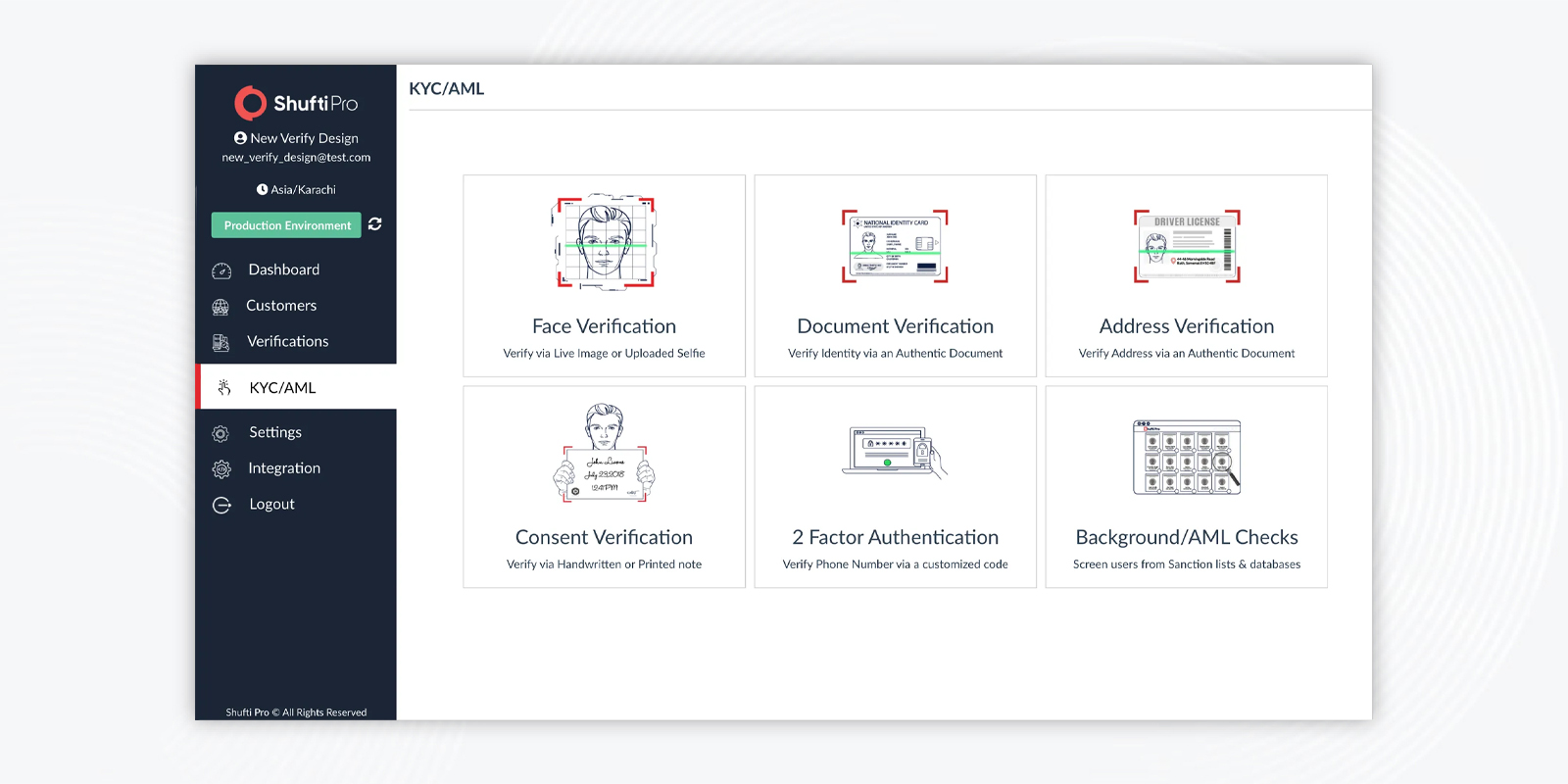

Key Features

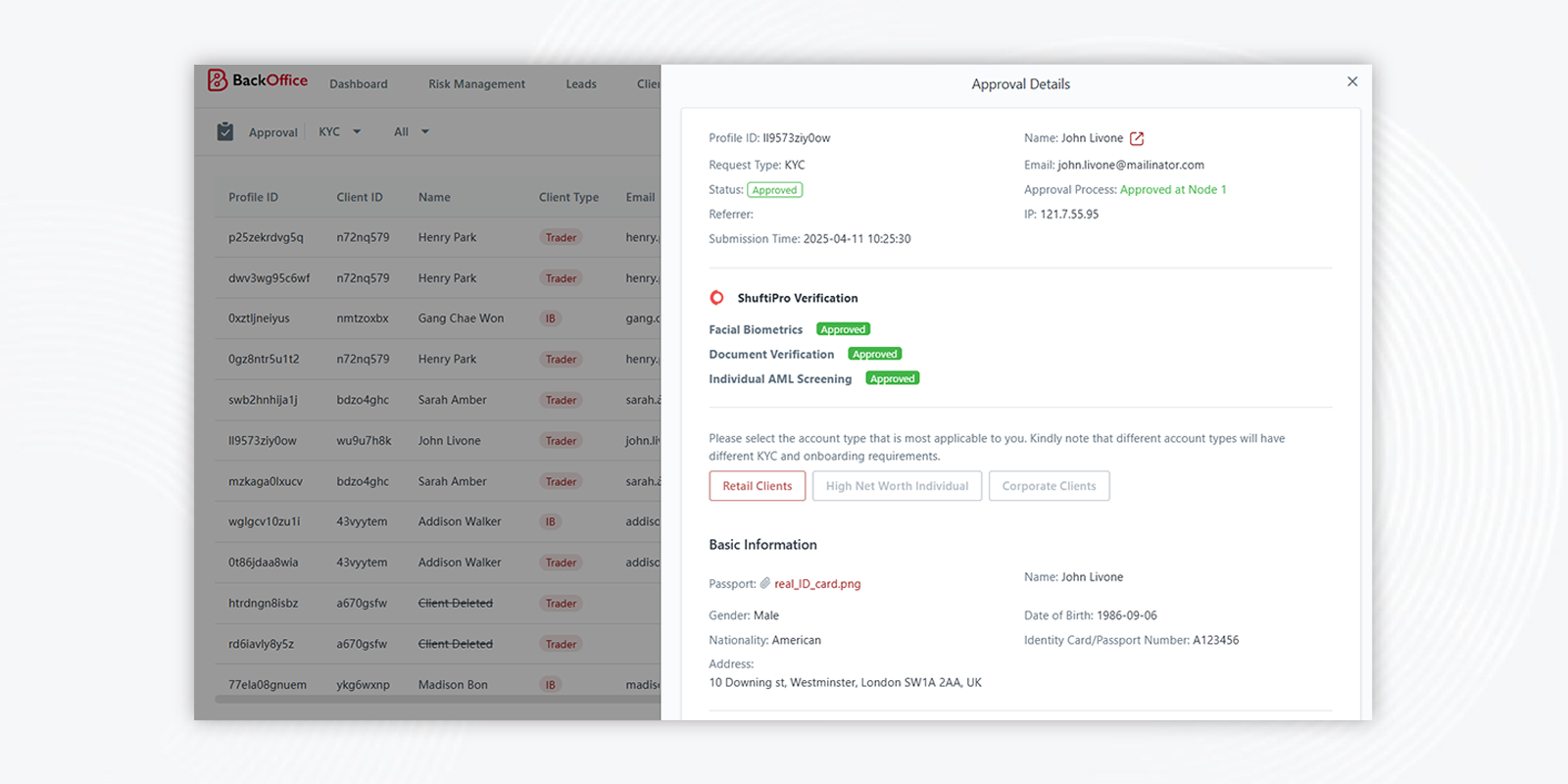

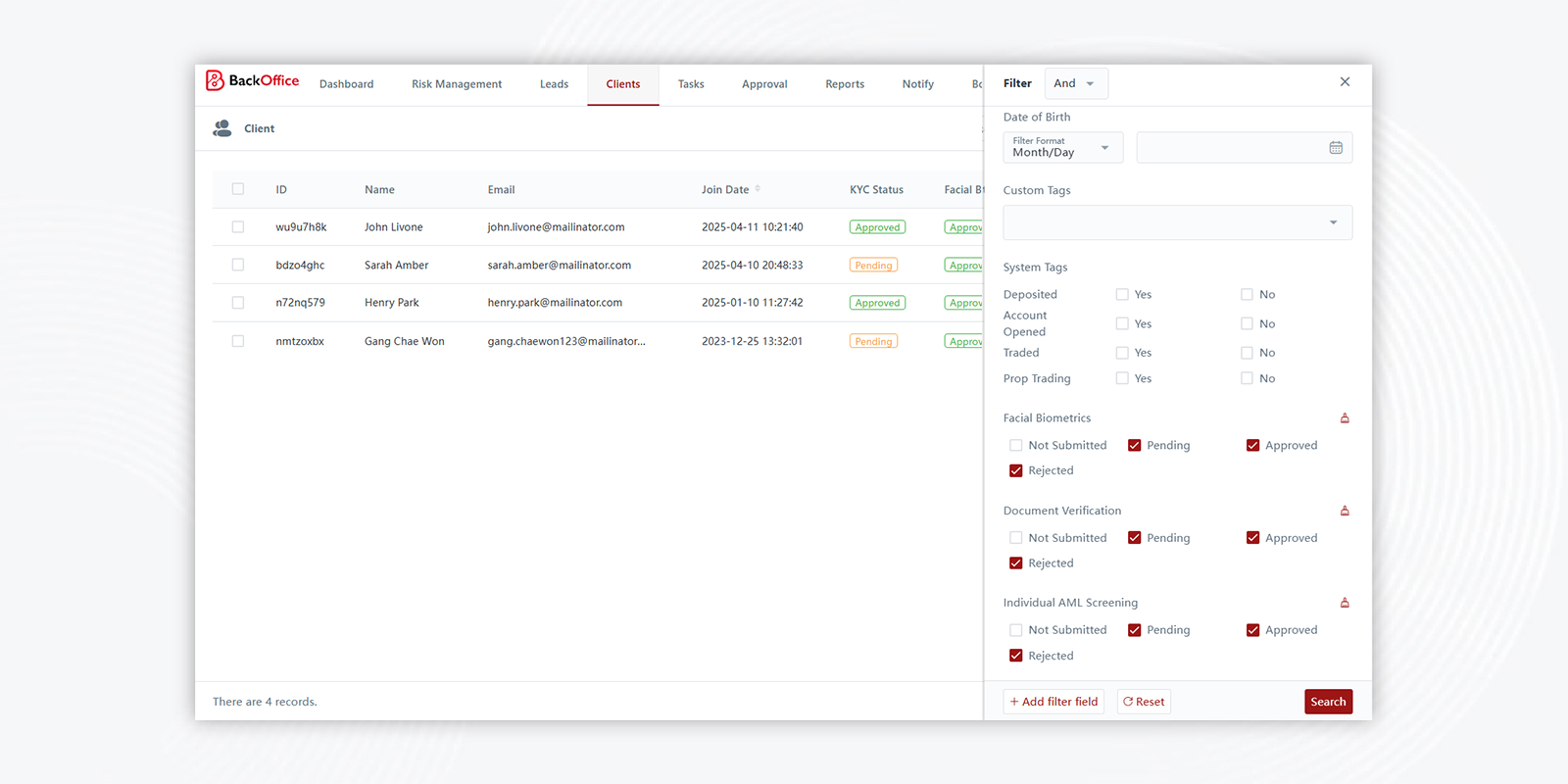

- Facial Biometrics

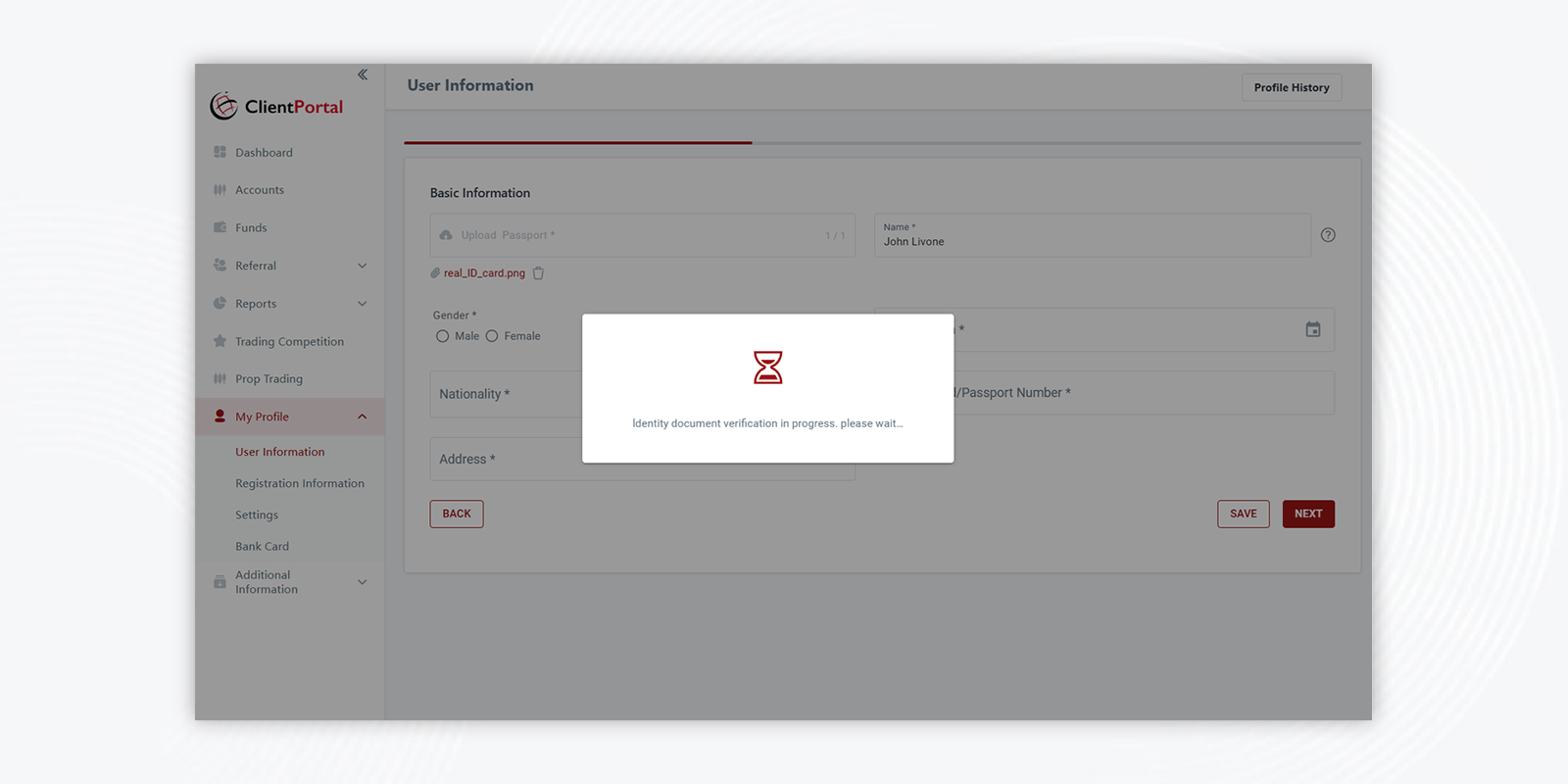

Automatically verifies identities in real-time using ShuftiPro’s advanced facial recognition technology, ensuring authenticity and preventing fraud. - Document Verification

ShuftiPro’s AI-powered identity document verification technology checks the format and information on uploaded documents, including IDs, passports, and other official documents, ensuring validity and compliance. - OCR Technology

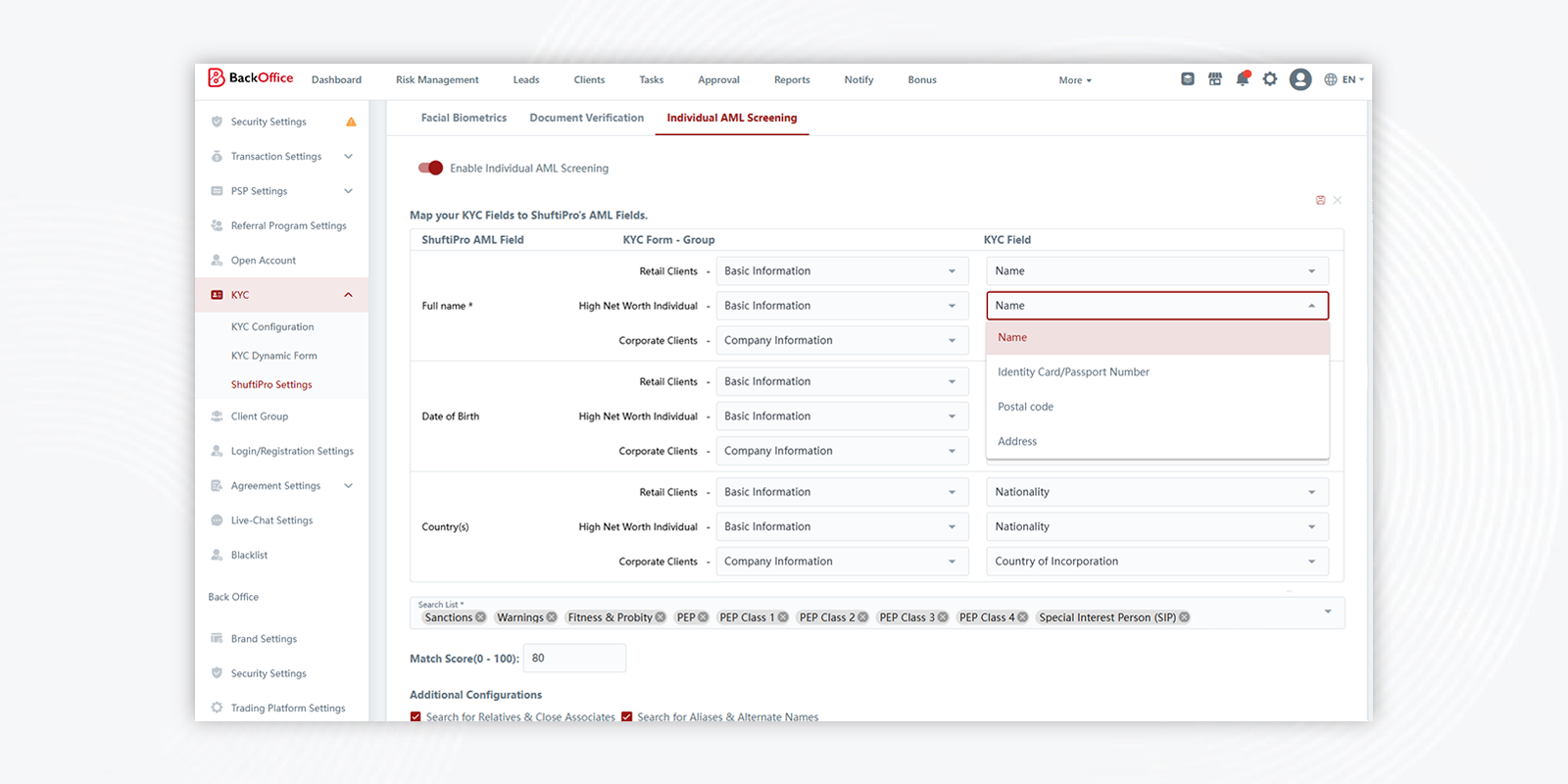

Leverages Optical Character Recognition (OCR) to automatically extract key information from identity documents and populate the KYC form, reducing manual input and improving efficiency. - AML Screening

Automatically screens clients against ShuftiPro’s comprehensive global database to identify potential risks, including Politically Exposed Persons (PEPs), adverse media, and other compliance concerns. - Real-Time Verification Results

Provides instant access to verification results, including facial biometrics, document validation, and AML screening, enabling informed decision-making with real-time insights.