AXIS Forex CRM v7.21.0 Update – Multi-Module Enhancements

We’re excited to introduce several key enhancements in V7.21.0, designed to improve the user experience for both brokers and traders. Customizable two-factor authentication now allows clients to choose between email or authenticator app OTP based on their preferences. The updated dashboard offers deeper insights into deposit and withdrawal activities, providing a clearer overview of financial inflows and outflows. These updates, along with many other improvements, are focused on boosting efficiency and ease of use. Read on for a detailed look at these upgrades.

Key Highlights

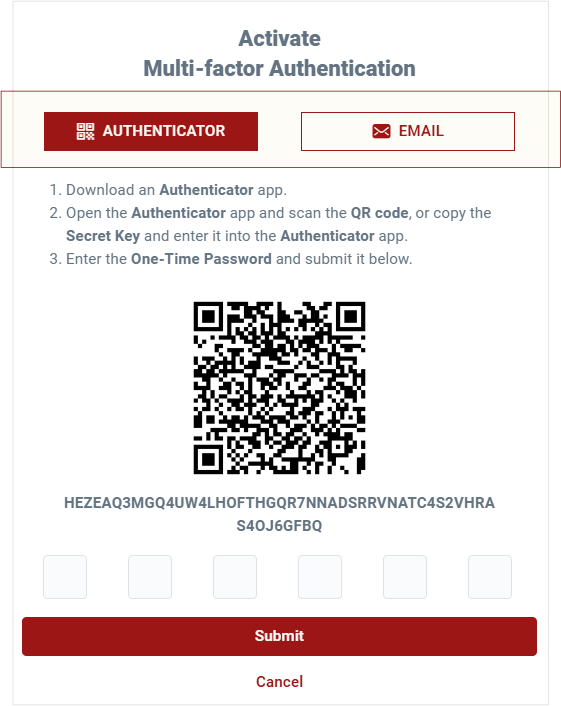

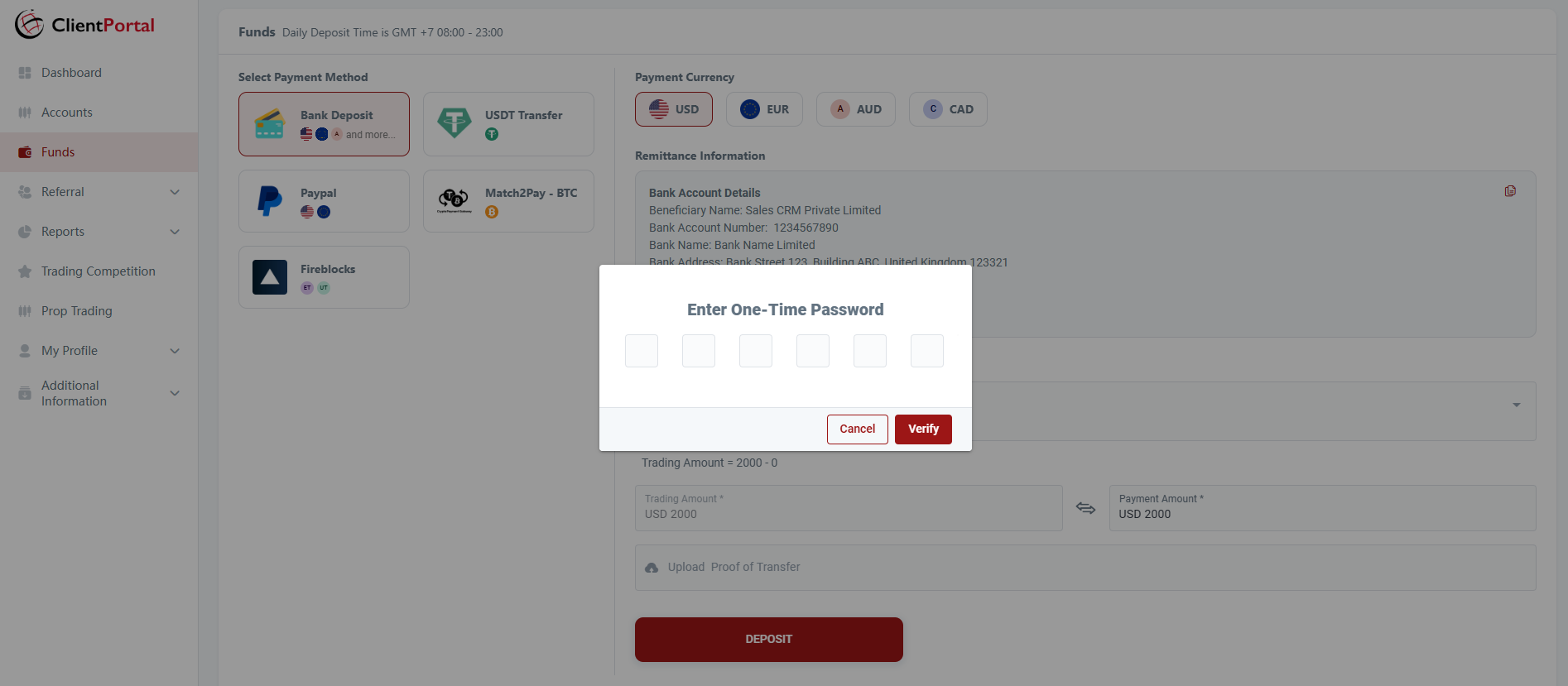

1. Flexible Two-Factor Authentication

-

Authentication Options

Let clients choose between email or app-based OTP for added convenience and flexibility.

-

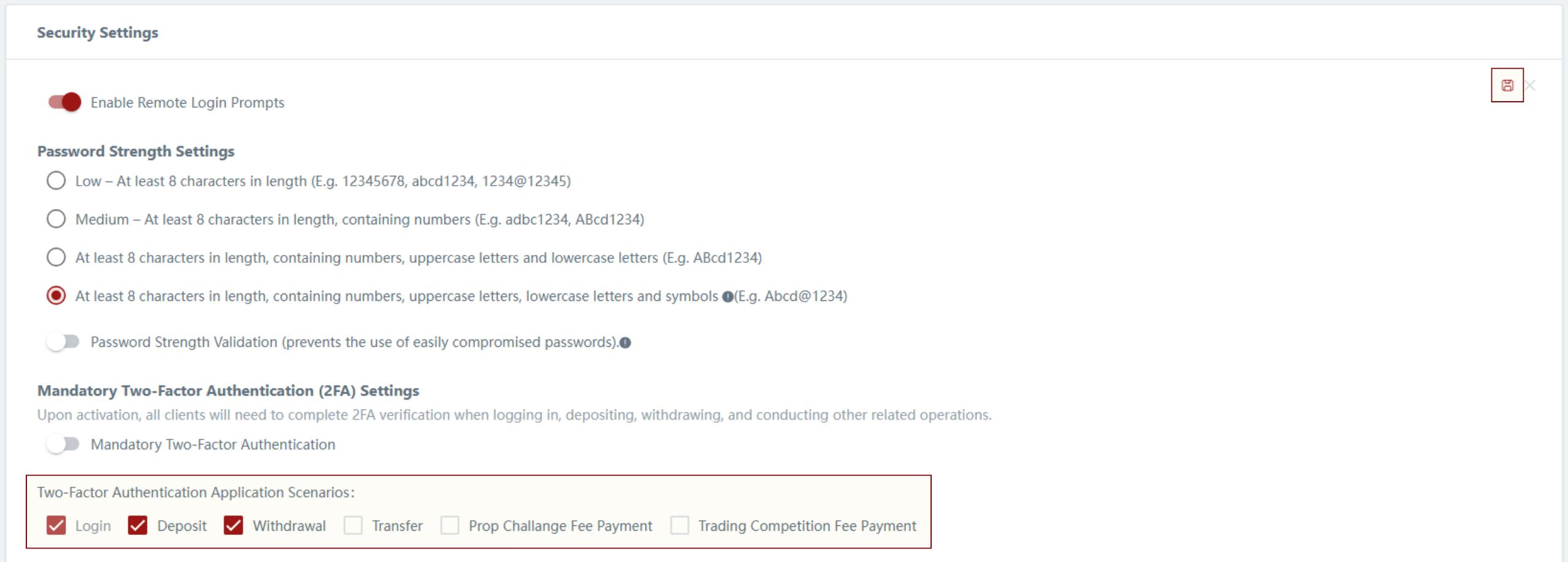

Customizable 2FA Settings

Customizable 2FA Settings: Set mandatory 2FA for specific operations to align with your security needs.

2. Flexible Two-Factor Authentication

Gain a comprehensive view of your fund inflows, outflows, and overall financial standing with insights into the top 10 accounts by deposit and withdrawal volume, excluding internal transfers and system-generated transactions like commissions or bonuses.

3. Streamlined Deposit & Withdrawal Management

-

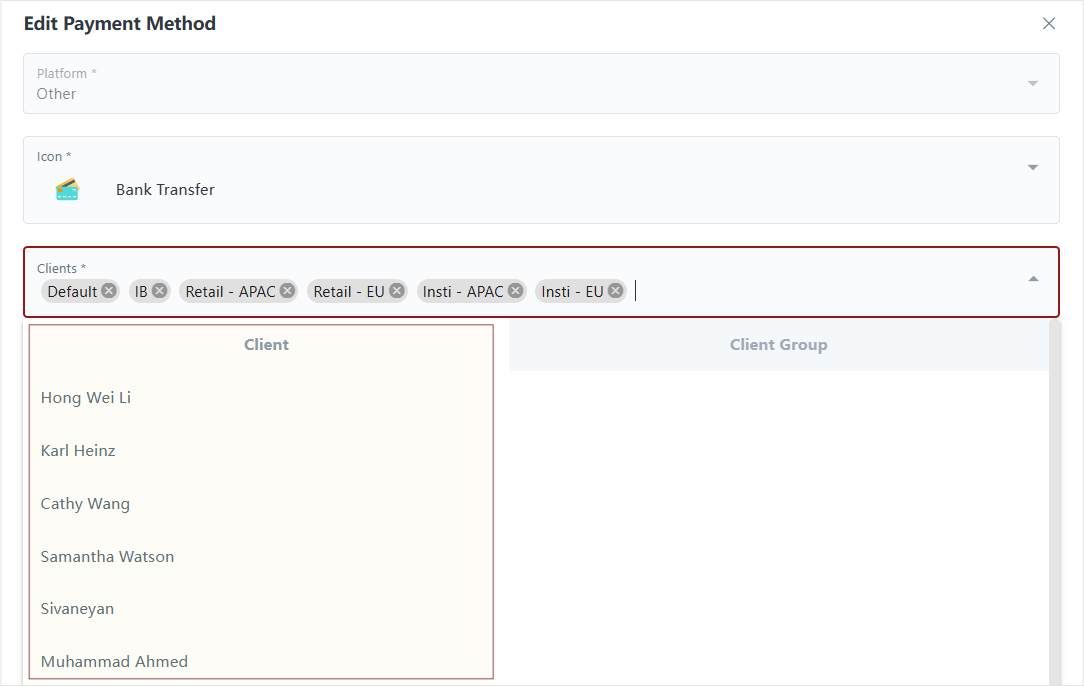

Individualized Control

Assign specific deposit and withdrawal methods to individual clients, for greater control beyond client groups.

-

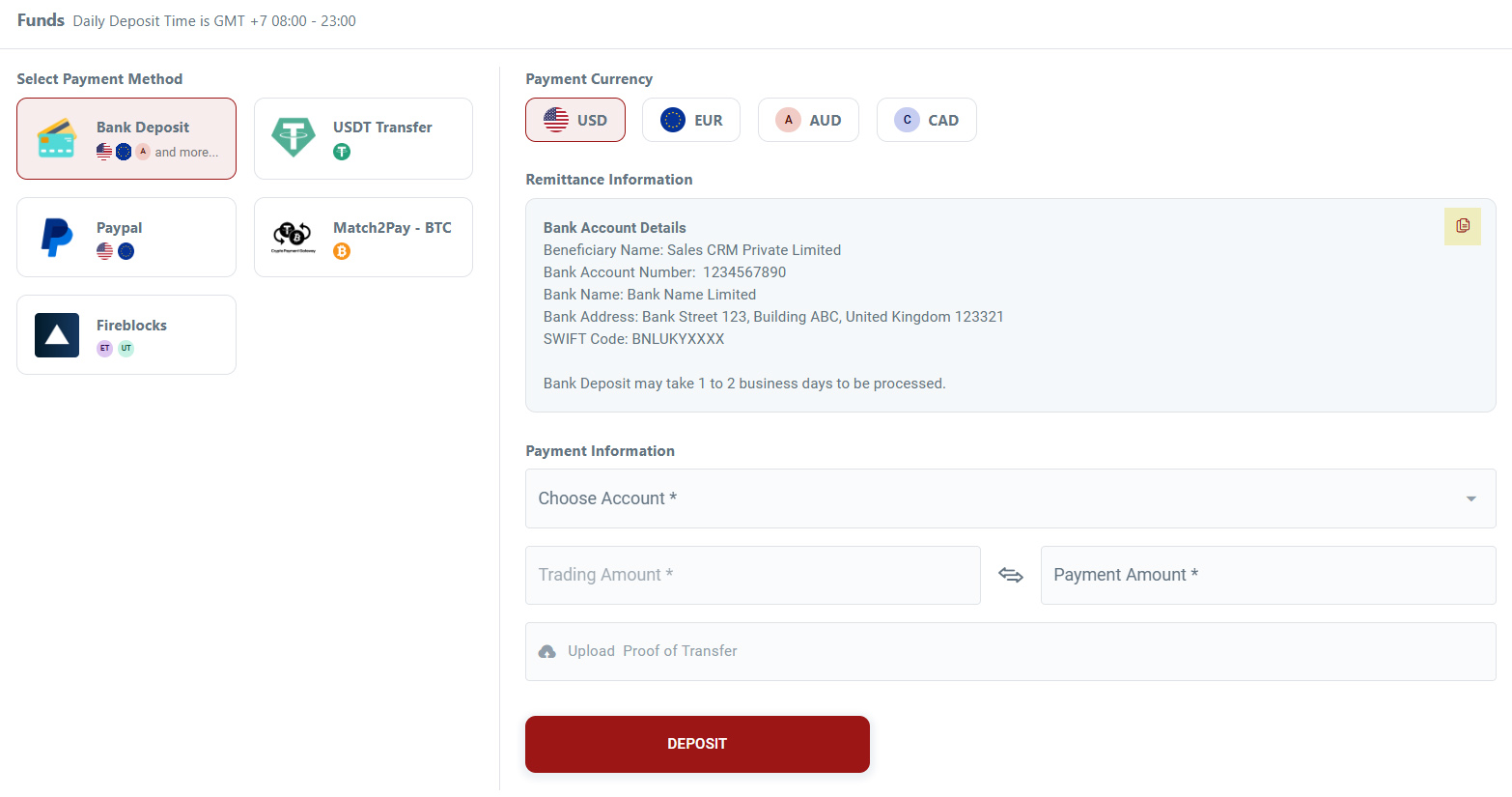

Simplified Transfers

Clients can easily copy deposit details using the “Quick Copy” button, reducing manual entry and minimizing errors.

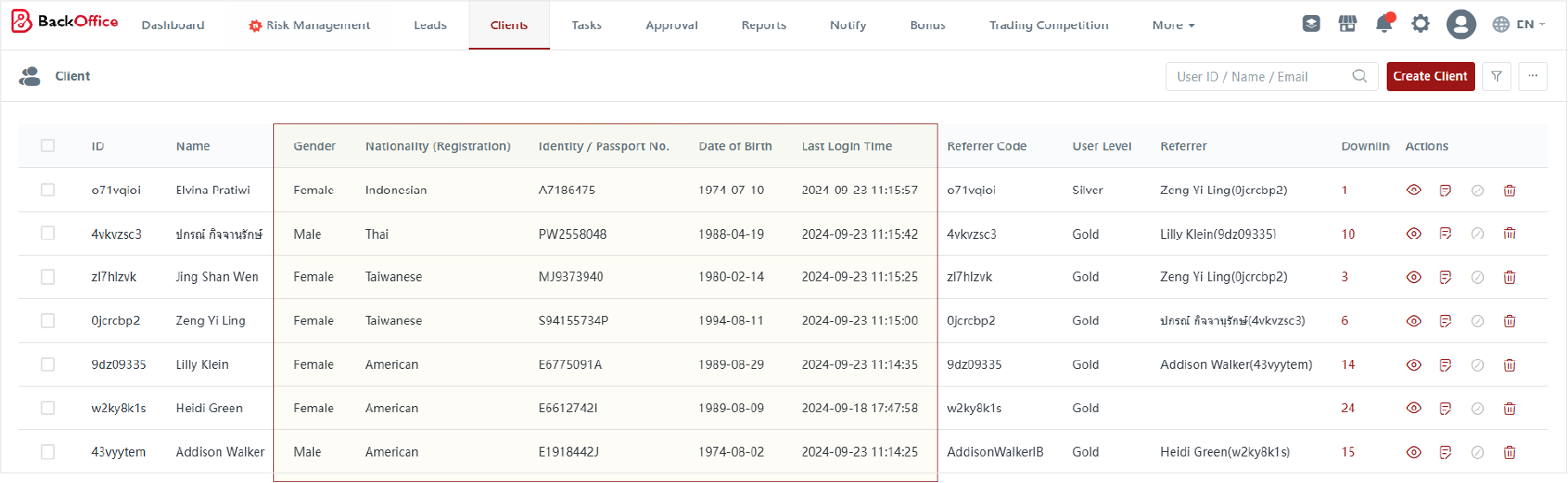

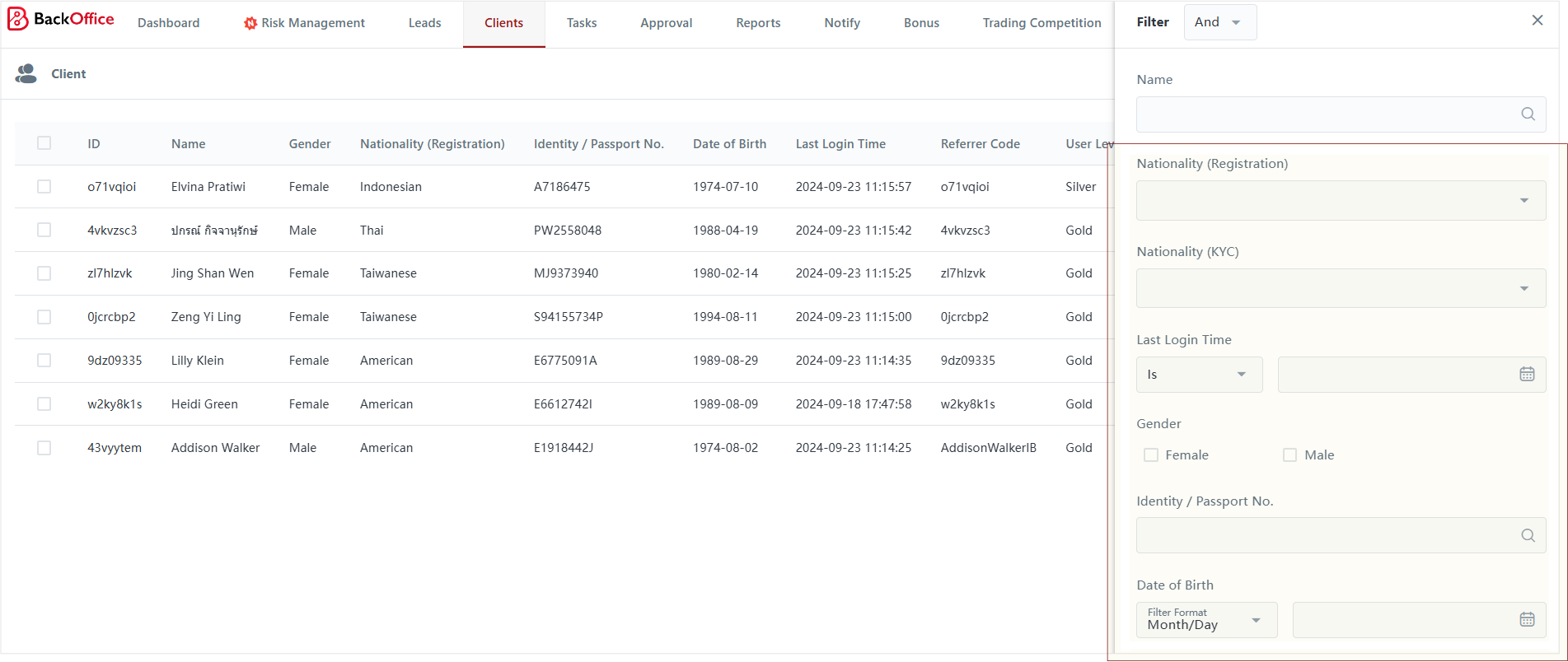

4. Expanded Client Data and Filtering Options

Access more granular client information with new filters, including nationality, KYC fields (Passport No, DOB, Gender), and last login time, for improved client segmentation and management.

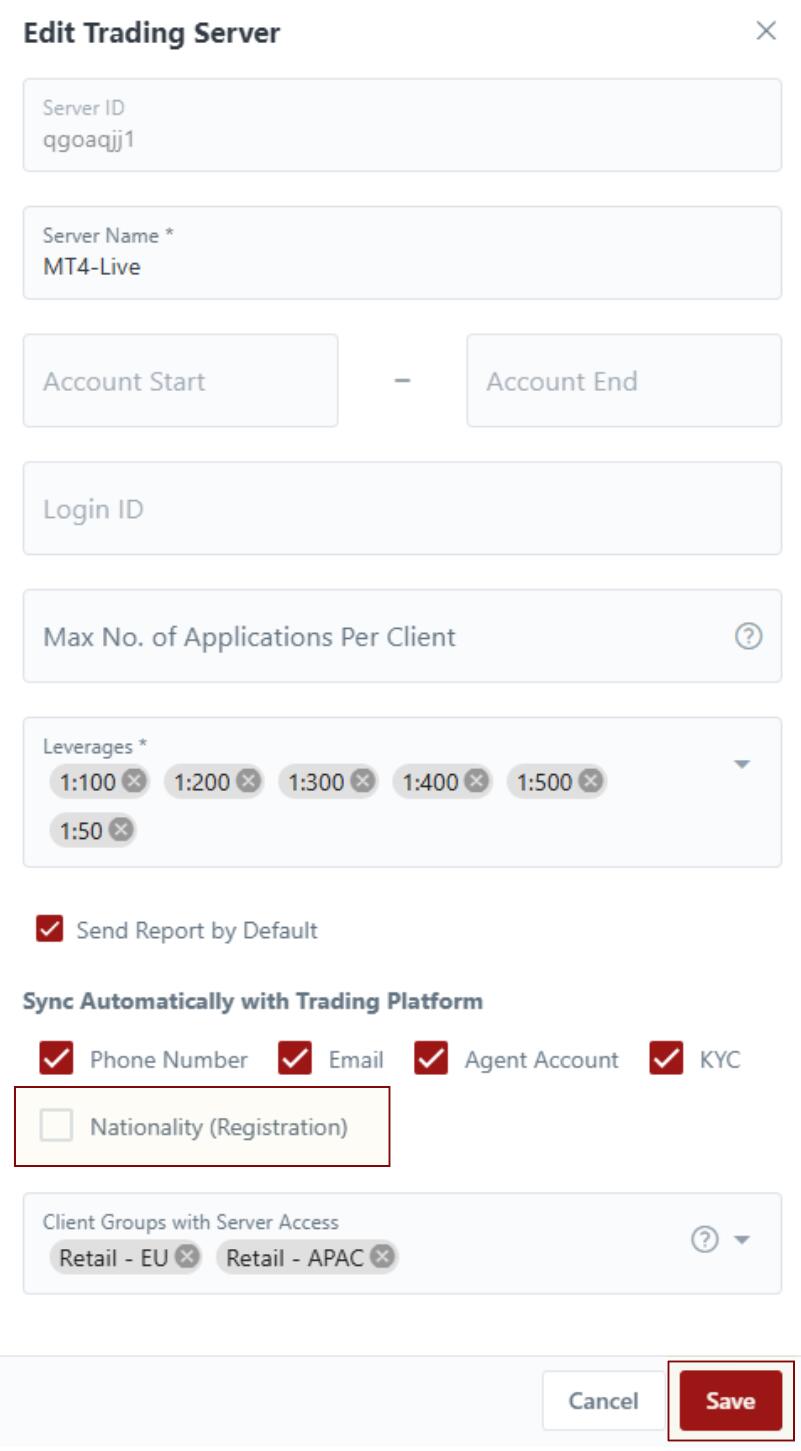

5. Auto-Sync Nationality to MT Accounts

Client nationality is now synced from the CRM to MT trading accounts, ensuring accurate and up-to-date information. This automated process removes the need for manual updates, maintaining consistency across systems.

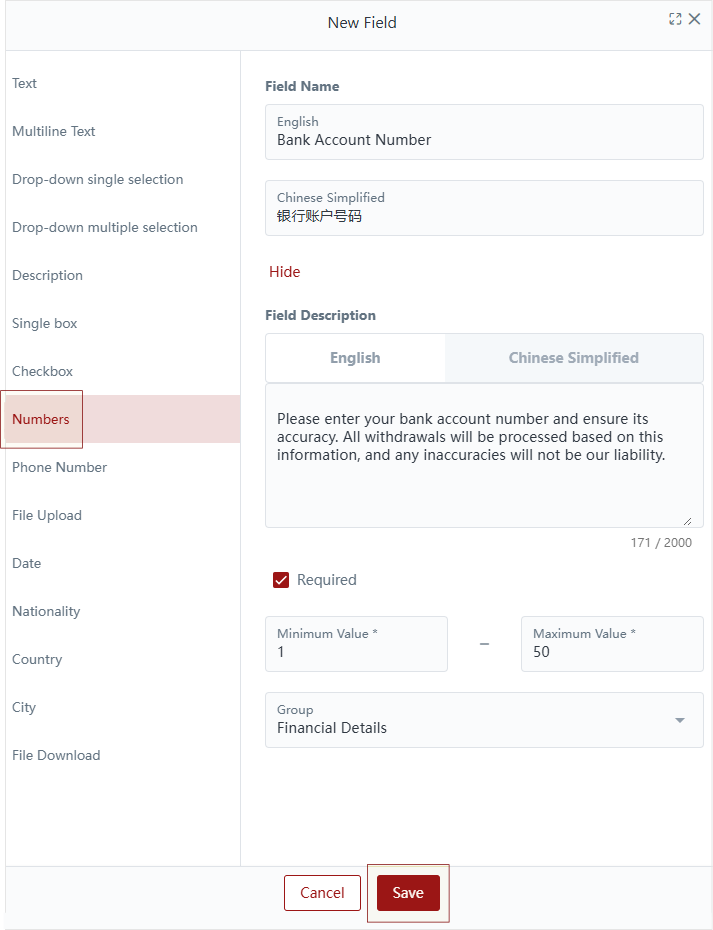

6. New KYC Numeric Field

Introducing a ‘Numbers’ field type in your KYC form, which restricts inputs to numeric values only—perfect for fields such as bank account numbers and card details.

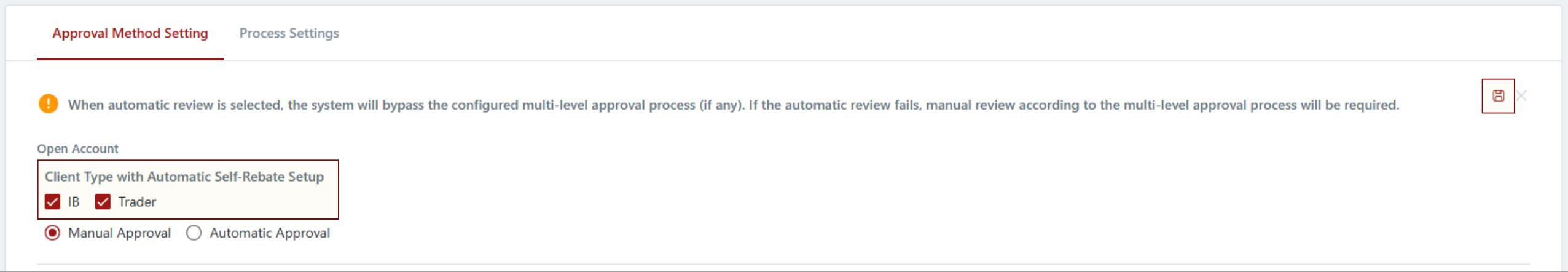

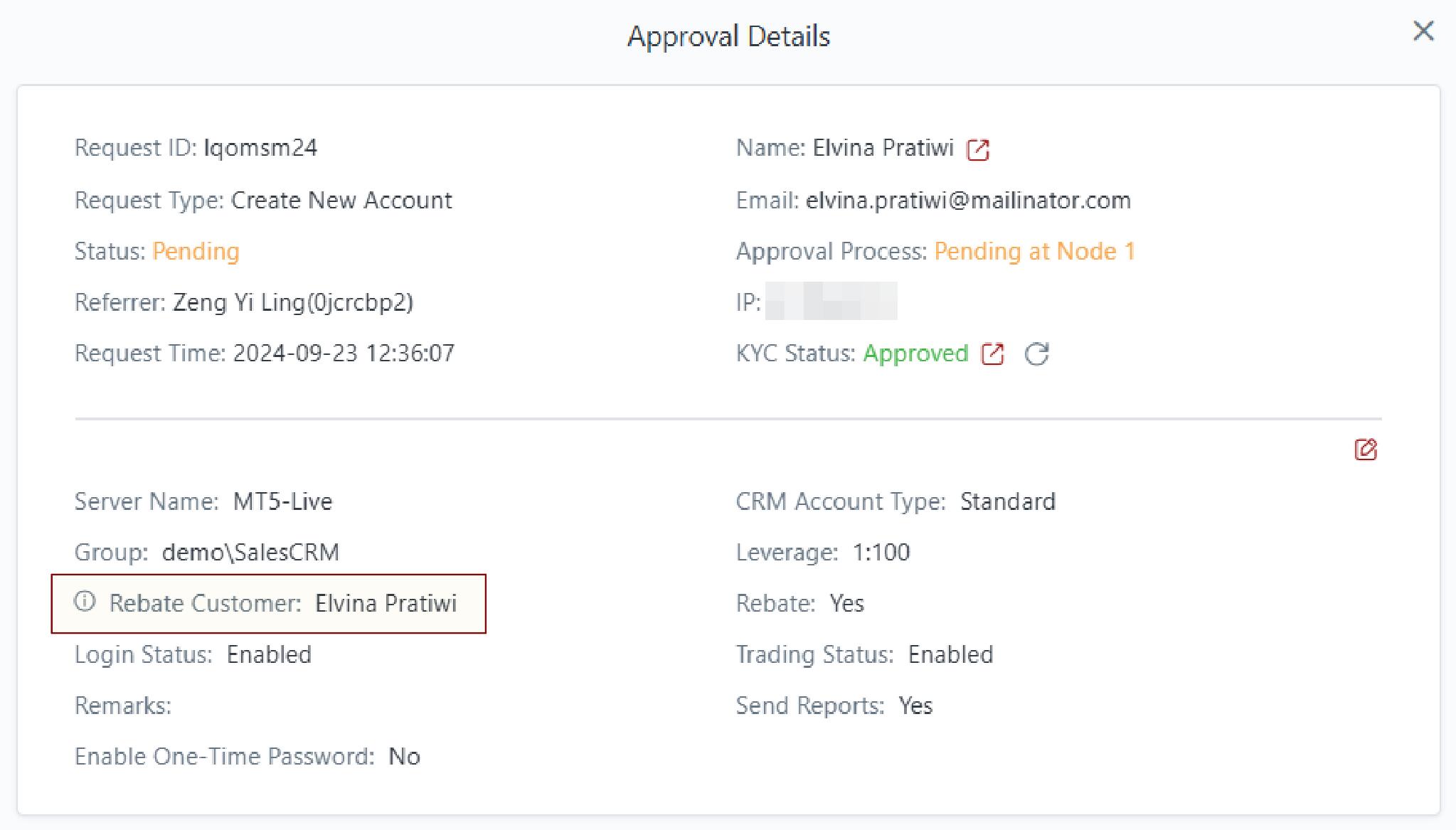

7. Automated Self-Rebate for Specific Client Types

Automatically assign self-rebate to specific client types upon account creation, eliminating manual adjustments and saving time.

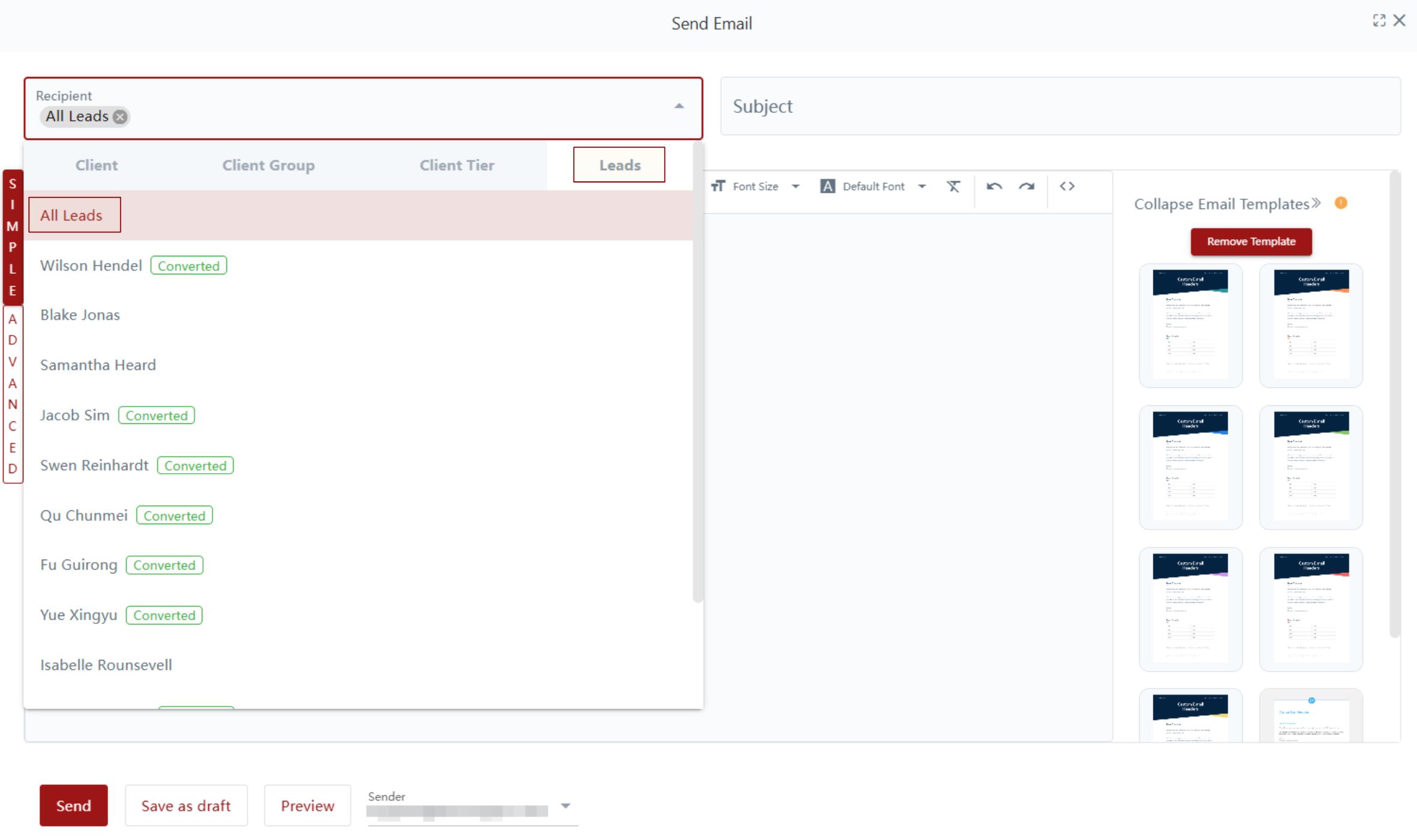

8. Bulk Email Notifications to All Leads

Improve communications with the ability to send email notifications to all leads in one step, simplifying your outreach.

9. Automated Client Name Formatting

The CRM now automatically removes extra spaces in client names, ensuring accurate data integration and preventing errors with payment service providers and third-party platforms.About Broctagon Fintech Group

Broctagon Fintech Group is a leading multi-asset liquidity and FX technology provider with over 15 years of global expertise. We empower forex brokers with performance-driven, bespoke solutions — anchored by our flagship AXIS FX CRM, institutional-grade liquidity, and prop-trading solutions. Trusted by 350+ clients in 50+ countries, we deliver the technology that keeps brokerages ahead of the curve.