Brokerage. Breakthroughs. Buzz.

Welcome aboard the Broctagon Blog — where innovation meets insight. Explore the latest breakthroughs in fintech, get a front-row seat to industry events, and dive into fresh perspectives on forex and brokerage trends. Stay in the loop with product launches, expert takes, and everything buzzing behind the scenes — all in one place.

All

News

Products

Thought Leadership

Events

Knowledge

In The Press

Prop

8 Nov 2024 |

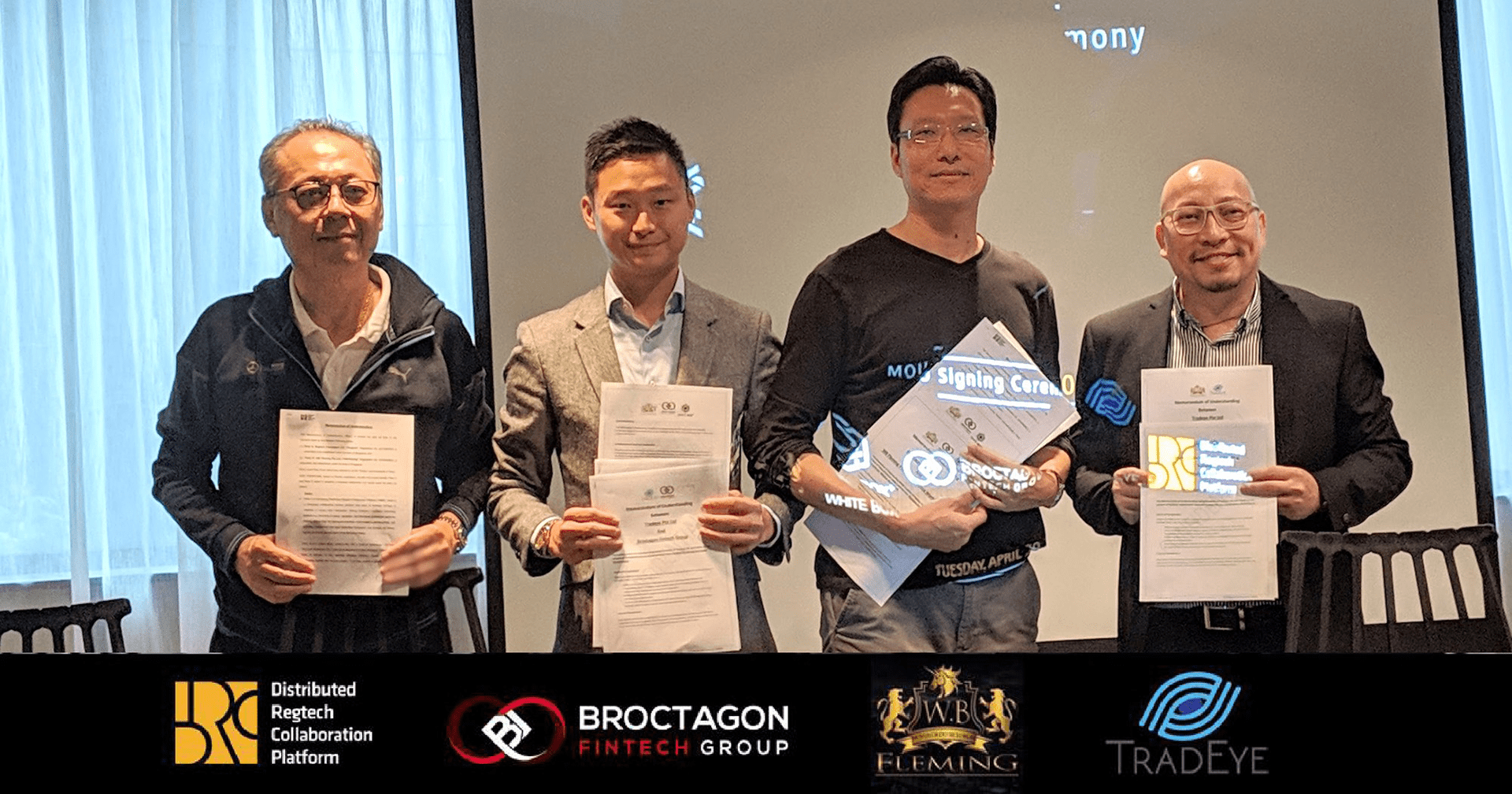

Partnerships, All, News, Products, In The Press

Exclusive Partnership: Free Autochartist Trading Resources for AXIS CRM Brokers

Broctagon and Autochartist team up to boost Broker success with free educational and signal resources.

23 Sep 2024 |

Partnerships, All, News, Products

Broctagon’s 300% user growth powered by MongoDB Atlas

We are proud to announce that Broctagon has been featured as a successful case study by MongoDB, a leading developer...

19 Jul 2023 |

All, Products, Thought Leadership, Events

Broctagon – More than just a Full Suite FX Solutions Provider

We started with a dream to bridge the gap for highly tailored FX solutions that add tangible and impactful value to Fore...

15 Feb 2023 |

All, Forex, Thought Leadership, Knowledge

How do Liquidity Providers and Brokers work together in FX?

In the foreign exchange (FX) market, liquidity providers and brokers work together to facilitate trading. Liquidity prov...

10 Feb 2023 |

All, Thought Leadership, Knowledge

Liquidity Providers and the Role They Play in Forex

Liquidity providers play a crucial role in financial markets and exchanges to ensure a seamless execution of trades, and...

30 Nov 2022 |

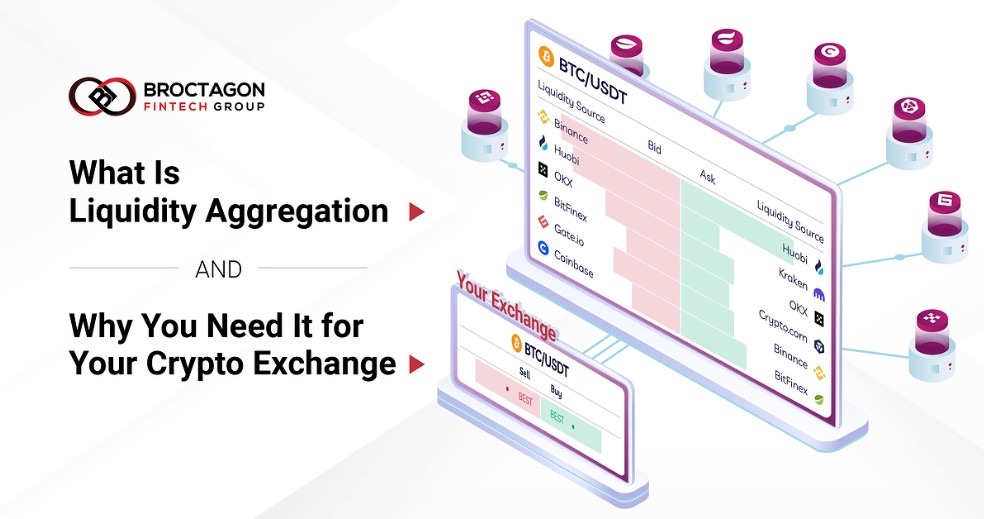

Liquidity, All, Crypto, Thought Leadership, Knowledge

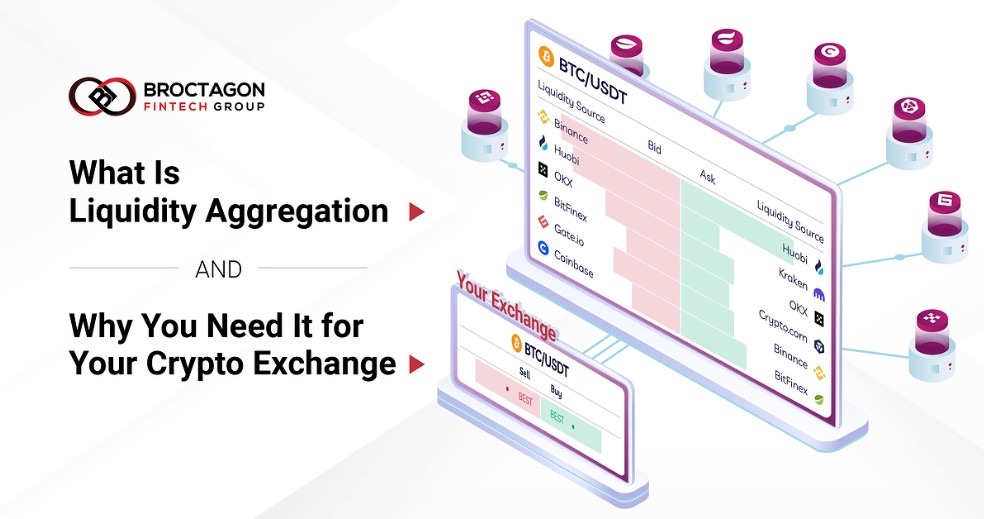

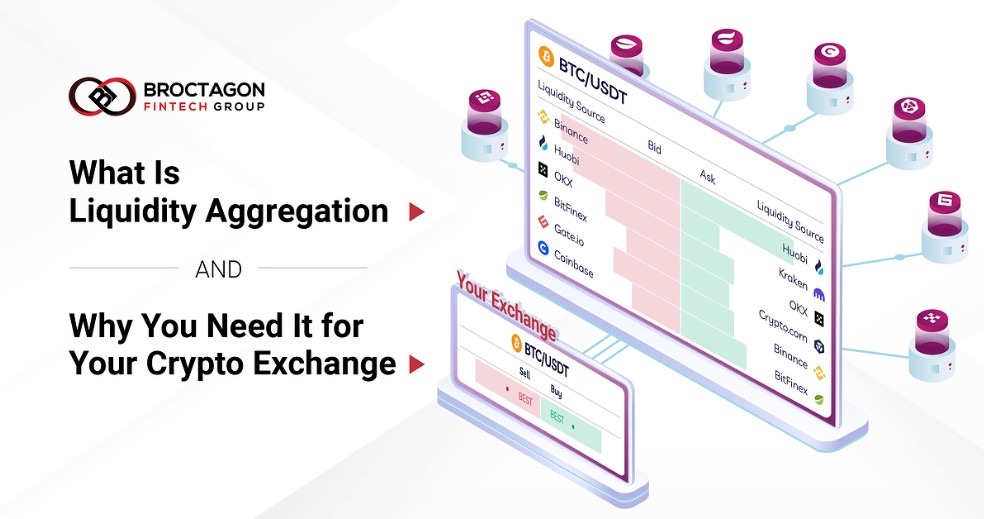

What Is Liquidity Aggregation and It’s Important for Your Crypto Exchange

Liquidity in cryptocurrencies is important, but unlike the Forex market, there is a notorious lack of liquidity in the c...

15 Nov 2022 |

All, Thought Leadership, Knowledge

7 Key Features of the Best Brokerage CRM

A good customer relationship management (CRM) system is an essential part of any successful brokerage. An ideal brokerag...

24 Jan 2022 |

All, Thought Leadership, In The Press

FEATURE: Money can empower us to be better selves, says fintech exec

Investing is about managing risks to reap rewards but everyone has different ideas about how to get there and just how m...

7 Dec 2021 |

All, Blockchain, Thought Leadership

How to Create High Value NFTs?

The main thing that puzzles most non-crypto fanatics is, why would anyone pay for high value NFTs when in this digital a...

25 Oct 2021 |

All, Thought Leadership, In The Press

OP-ED: Singapore can be a progressive haven for global crypto businesses

Owing to the country’s friendly regulatory environment with respect to financial markets, and fintech and blockchain wit...

26 Aug 2021 |

All, Blockchain, Thought Leadership

How NFTs Can Help Artists

Non-Fungible Tokens (NFT) can help artists in a way by driving a change in how art is bought, sold, supported, enjoyed a...

30 Jul 2021 |

All, Crypto, Thought Leadership

The Future of Social Media with NFTs

Today, social media platforms are a part of our everyday lives. We barely notice it, but millions of people around the w...

14 Jul 2021 |

Liquidity, All, Crypto, Thought Leadership

The Cryptocurrency Whale Phenomenon: How Do Investors Thread Volatility Splashes?

One contributing factor to volatility is that the crypto markets have an abundance of whales – a term given to someone w...

21 May 2021 |

All, Blockchain, Crypto, Thought Leadership

Creating Permanent Memories with NFTs – Non Fungible Tokens

Capturing memory has always been on a constant evolution, with people finding ways to make it more instant, accurate, an...

5 May 2021 |

Broprime Markets, All, Forex, In The Press

Labuan Set To Only Grow Stronger And Further In The Digital Finance Space

“Labuan has adopted a very positive and welcoming attitude to new entities in the region. We can see the positive outloo...

9 Apr 2021 |

All, Blockchain, Crypto, Thought Leadership, Knowledge

What is an NFT? Non-Fungible Tokens Explained

What exactly is an NFT and why did one just sell for US $69 million dollars? What are NFTs and how they work explained.

25 Mar 2021 |

All, Crypto, Thought Leadership

How Can Trading Technology Propel Altcoins to New Heights?

The success of Bitcoin and Ethereum alone is not enough to make crypto mainstream. Exchanges must evolve to the next pha...

15 Feb 2021 |

All, Crypto, Thought Leadership

2017’s Bitcoin Bubble Unlikely to Return as Bitcoin Matures

In early January, Bitcoin's value rose to an all-time high of about $42,000 before tumbling down to about $30,000. This ...

9 Feb 2021 |

All, Blockchain, Thought Leadership, Knowledge

How to Choose the Right Blockchain Protocol for Your Business

Public, private, permissioned, Bitcoin, Ethereum protocols, and more – it might seem really daunting on how to choose th...

1 Feb 2021 |

All, Crypto, Thought Leadership, Knowledge

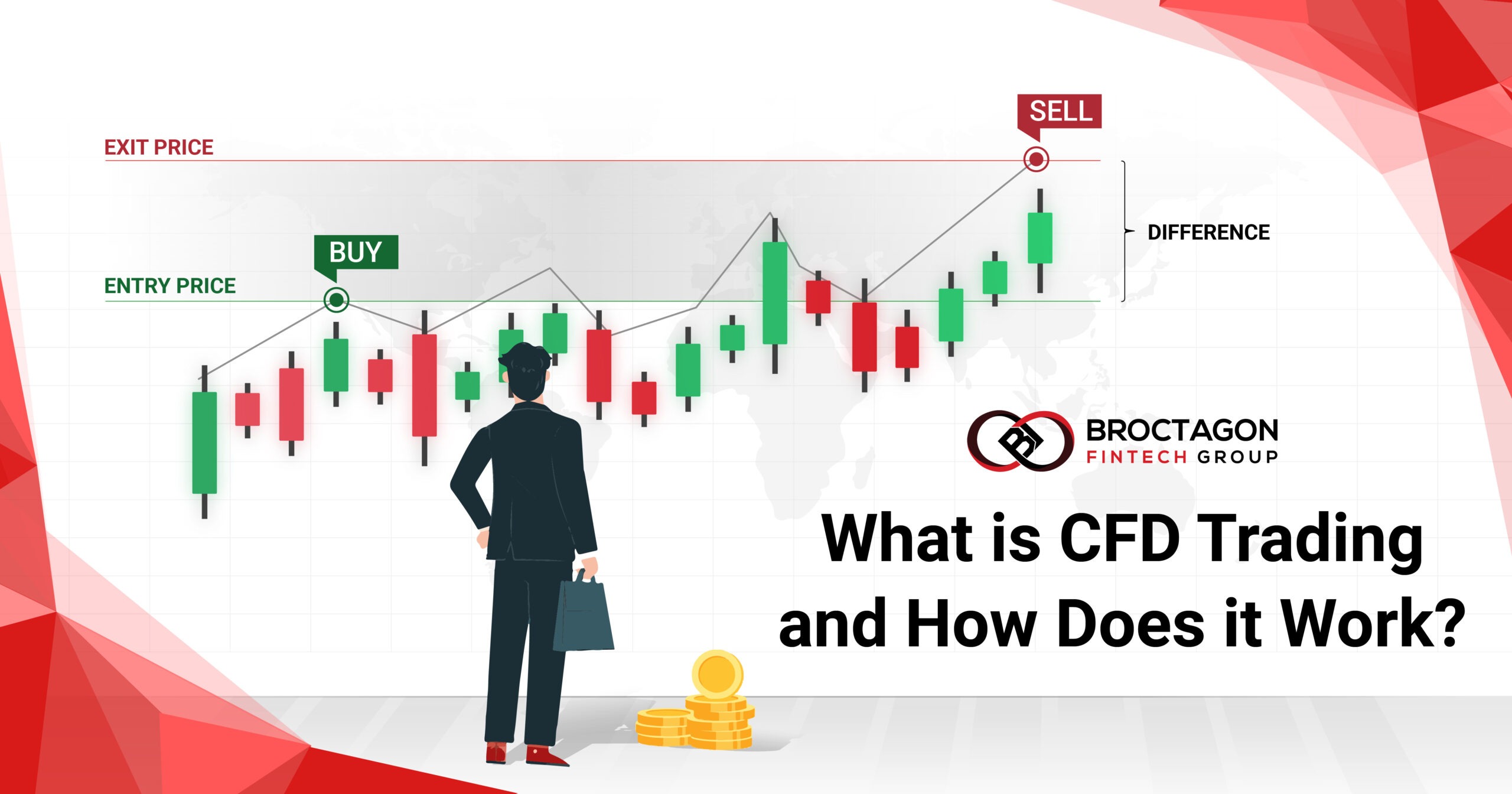

Crypto CFD vs Crypto Spot

Many investors and traders are familiar with the idea of trading cryptocurrencies. While crypto spot trading has been mo...

21 Jan 2021 |

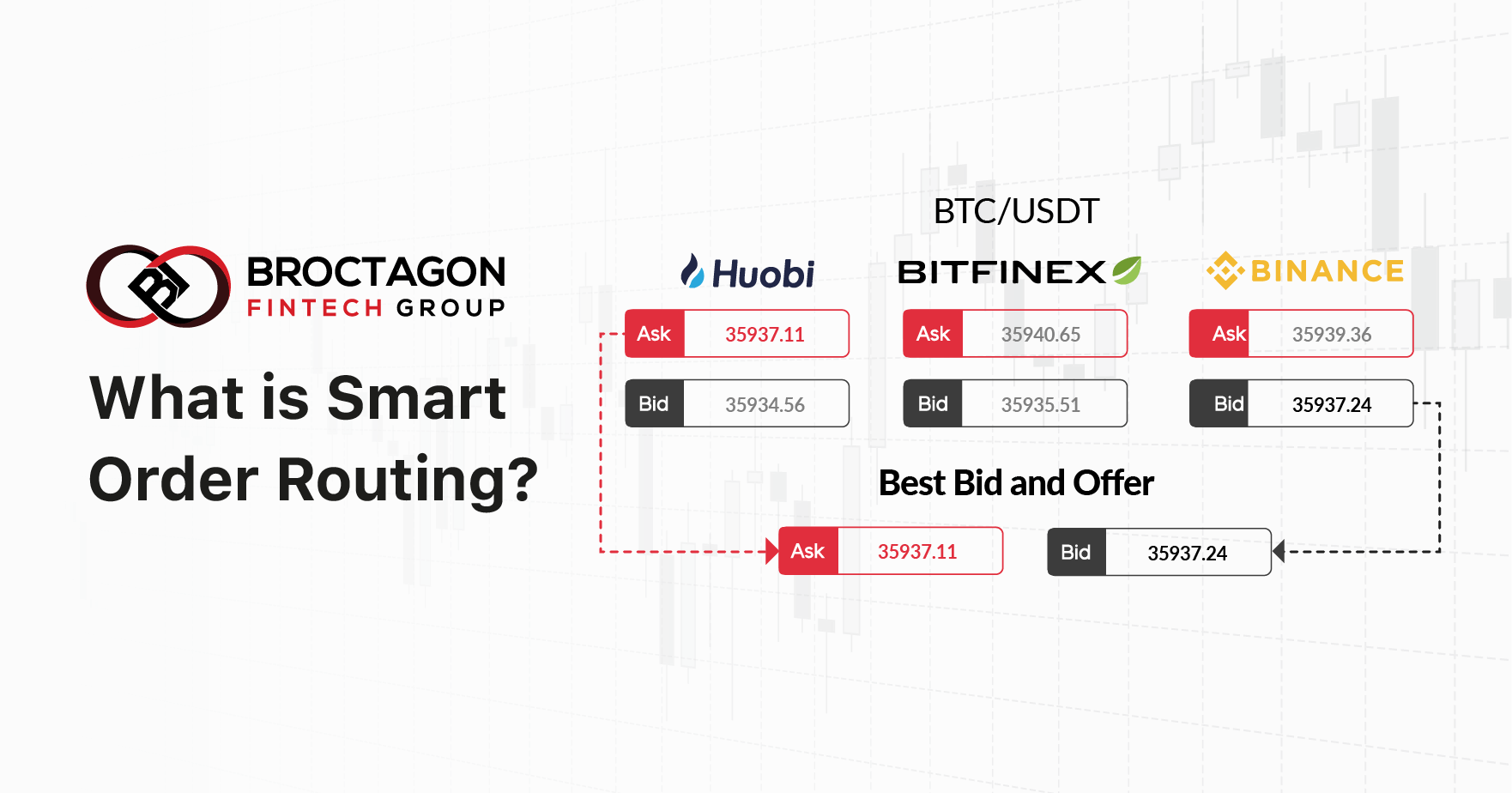

Knowledge, Liquidity, All, Crypto, Thought Leadership

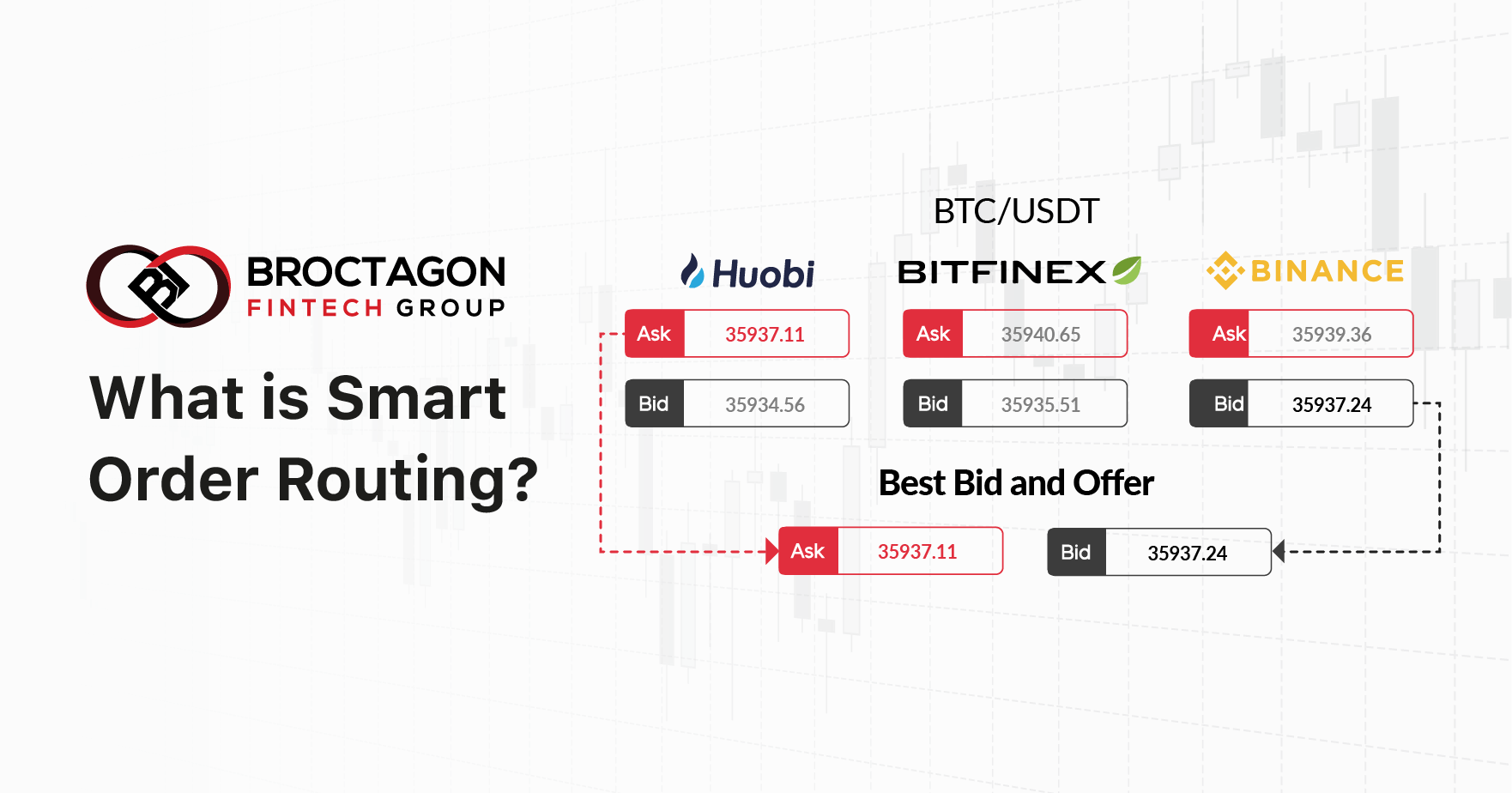

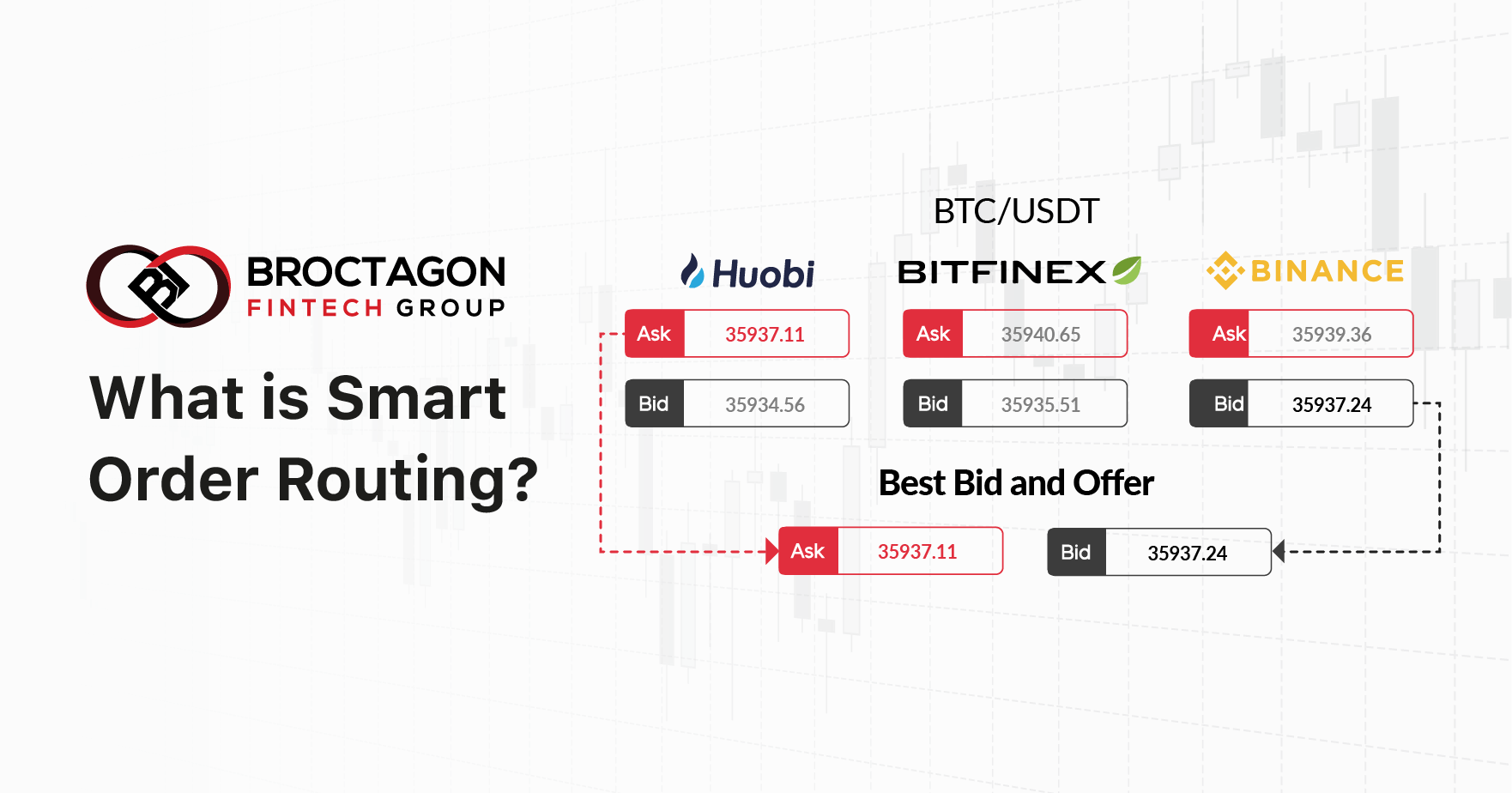

What is Smart Order Routing?

Smart Order Routing (SOR) is an automated order processing mechanism, designed to take the best available opportunity ac...

8 Jan 2021 |

Knowledge, All, Thought Leadership

Why Offer Multi-Asset Classes?

As a brokerage, offering multi-asset classes to your clients can bring you competitve advantage over other brokerages. H...

7 Jan 2021 |

Partnerships, Liquidity, All, News

Broctagon and FXCubic Announce New Multi-Level Partnership

Multi-asset liquidity provider Broctagon is proud to announce a partnership with FXCubic, London-based fintech firm.

16 Dec 2020 |

Knowledge, Liquidity, All

What is Crypto Exchange Liquidity?

Being a key essential to any Crypto Exchange, it is important to know what exactly Crypto Exchange Liquidity is and...

24 Nov 2020 |

Knowledge, All, Crypto, Crypto, Thought Leadership

Starting a Crypto Exchange

Kick-starting your very own crypto exchange made simple with Broctagon's comprehensive guide, with just 3 main step...

4 Nov 2020 |

In The Press, All, News, Crypto, Crypto, Thought Leadership

Hong Kong’s Crypto Regulation Hailed a “Positive Move”

The decision to regulate all entities operating within the cryptocurrency industry in Hong Kong has been dubbed as a "po...

29 Oct 2020 |

Thought Leadership, Liquidity, All, Crypto, Crypto, In The Press

What Grassroots Use of Bitcoin Could Mean for Liquidity

We take a look at what greater adoption of crypto payments mean for liquidity in the market, and what needs to be done t...

28 Oct 2020 |

Partnerships, Broprime Markets, All, News

Broctagon Solidifies Stronghold in Asia Markets with New Labuan Money Broking Licence

Broctagon Fintech Group is proud to announce that we have obtained a Money Broking Licence from the Labuan...

13 Oct 2020 |

Partnerships, Liquidity, All, News, Forex, Products

Broctagon Partners Spotware to Offer cTrader Platform

Brokerages in Asia will now have a wider variety of trading platforms made available with Broctagon's Spotware partnersh...

12 Oct 2020 |

In The Press, Partnerships, Liquidity, All, News, Products

Broctagon to Offer cTrader White Labels with Spotware Partnership

Broctagon Fintech Group, a liquidity and technology provider to the brokerage industry, has partnered with Spotware, thu...

2 Sep 2020 |

In The Press, Liquidity, All, News, Crypto, Products

Broctagon to Boost Exchange Native Altcoin Liquidity Through NEXUS Upgrade

Singapore-based Broctagon Fintech Group has upgraded its NEXUS 2.0 liquidity aggregator technology, with the launch...

10 Aug 2020 |

Thought Leadership, Liquidity, All, Forex, Crypto

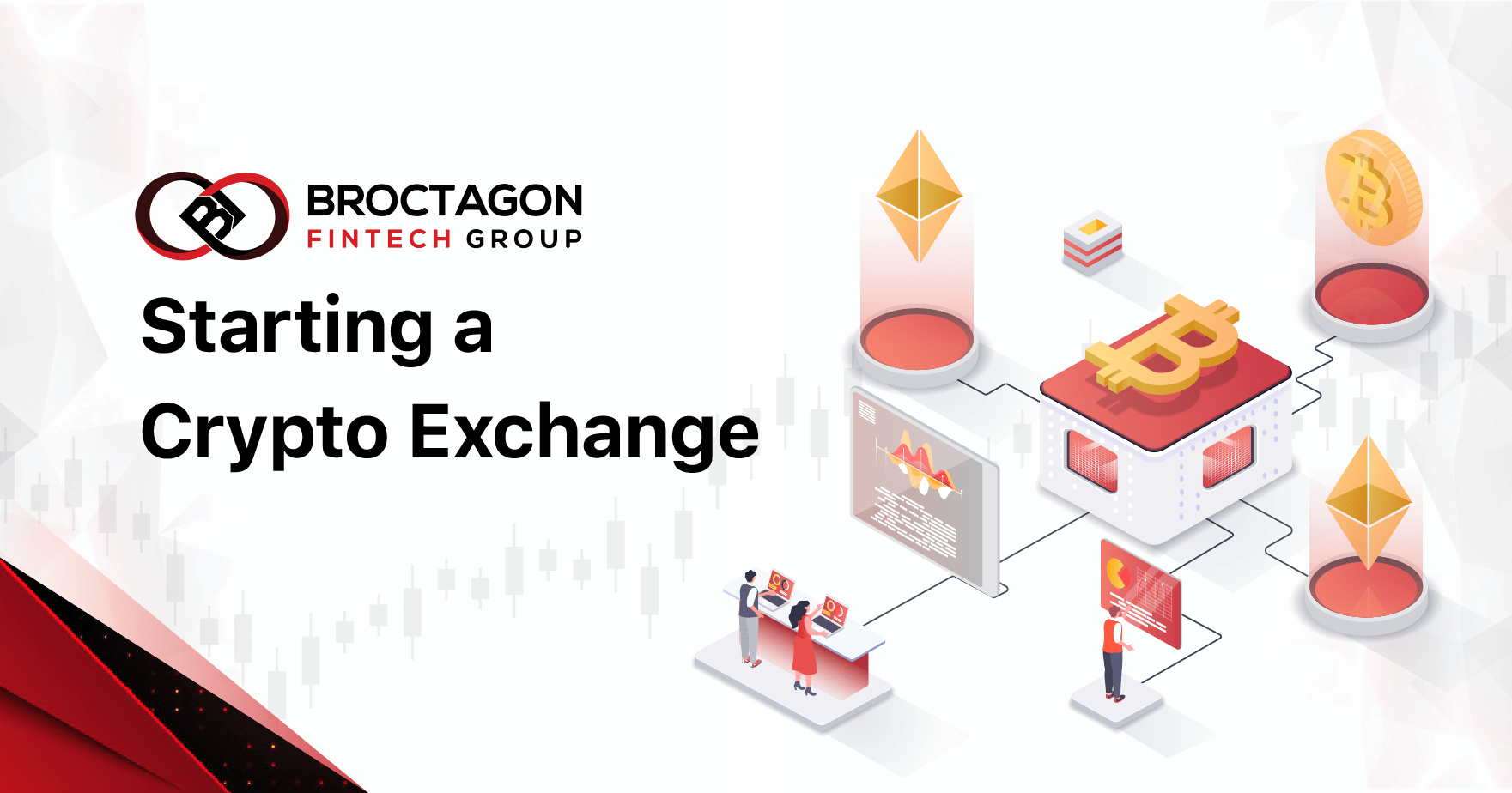

Preparing Crypto Liquidity For Economic Recovery And Rising Demand

Ted Quek, CTO of Broctagon, explains how the crypto space must adopt liquidity standards similar to those of FX markets,...

8 Jul 2020 |

Thought Leadership, Liquidity, All, Crypto

With Trading Volumes Slumping, Are There Too Many Crypto Exchanges?

The decline in trading volumes rekindle questions over how many cryptocurrency exchanges are really needed to serve the ...

17 Jun 2020 |

Thought Leadership, All, Crypto, Crypto, In The Press

Cryptocurrency Expert Sees Opportunities Amidst Global Crisis

As the coronavirus lockdown begins to lift across the world, investment opportunities in traditional stock markets and c...

2 Jun 2020 |

Thought Leadership, All, Crypto, Crypto, In The Press

Expert Examines JP Morgan’s Spectacular U-turn on Bitcoin

What was once regarded by many as ‘internet money’ is slowly stumbling its way into mainstream acceptance, Broctagon's C...

14 May 2020 |

Products, All, News, Crypto, Thought Leadership

Get Ready to Hypercharge Your Exchange Liquidity

Covid 19 has heavily impacted the the crypto markets within the past few months. Learn how to hypercharge your exchange ...

12 May 2020 |

Thought Leadership, All, Crypto, Crypto, In The Press

Broctagon CEO urges governments to “take action” on crypto regulation

Broctagon's CEO Don Guo states that governments across the world need to begin taking action on the regulation of crypto...

11 May 2020 |

Blockchain, All, Thought Leadership

Can Blockchain Application for Businesses Become More Than Just an Ideal?

Cryptocurrency was thrust into the spotlight by Bitcoin, but it is blockchain, the technology behind it that we should p...

4 May 2020 |

In The Press, All, News, Crypto, Crypto

Bitcoin Price May Drop After Halving, Historical Data Shows

Halving might boost Bitcoin price due to its added scarcity, giving it a positive trend, says Broctagon CEO Don Guo in h...

24 Apr 2020 |

Thought Leadership, All, Crypto, Crypto, In The Press

Governments Must Take Action On Crypto Regulation Now, Or Risk The Wild West Getting Off Scot Free

Should a regulatory precedent not be set and the space continue to be a “Wild West”, we could see a stall in institution...

23 Mar 2020 |

Thought Leadership, All, Blockchain, Crypto

Can Blockchain Curb the Spread of a Pandemic like COVID-19?

Price swings are a distraction from what we should really be looking at – and that’s how blockchain can curb a pandemic ...

2 Mar 2020 |

In The Press, All, Crypto, Crypto, Thought Leadership

Bitcoin’s Rally May Have More Room to Run, Technicals Suggest

As the coronavirus starts to impact global growth prospects, how will cryptocurrencies hold up? Bitcoin could be perceiv...

4 Jan 2020 |

In The Press, Blockchain, All

A Data Driven Future for Cities

With growing global fears around climate change, how we manage our cities is becoming ever more important...

17 Dec 2019 |

In The Press, Blockchain, All, Crypto

Blockchain and cryptocurrency predictions for 2020: 22 industry experts have their say

Experts across the blockchain and cryptocurrency space shared about their predictions for 2020, from cybersecurity...

11 Dec 2019 |

In The Press, All, News, Crypto, Products

Broctagon launches NEXUS 2.0 to tackle crypto exchange price disparity

Multi-asset liquidity provider Broctagon has launched NEXUS 2.0, a new service designed to tackle the issue of crypto ex...

19 Jun 2019 |

Thought Leadership, All, Crypto

Five Reasons Why We Are Excited About Facebook Libra

The cryptocurrency will be released in the first half of 2020, with great excitement from the community as many see it a...

7 Jun 2019 |

Thought Leadership, All, Forex, Crypto

Responsible Leverage: CFD Trading and the Current State of Regulations

Historically, professional traders are subject to ever-shifting regulatory climates, especially traders with a preferenc...

17 May 2019 |

In The Press, Blockchain, All, Forex, Crypto

One of the World’s Fastest-Growing FX and Crypto Brokerage Solution Providers

Singapore-based Broctagon is a fast-growing technology provider that merges traditional finance with the innovations of ...

22 Apr 2019 |

Thought Leadership, All, Blockchain

Proof of Work or Proof of Waste?

As we discuss its position as a frontier in technology, blockchain — with all its applications and hype as the ‘future o...

18 Mar 2019 |

Thought Leadership, All, Blockchain

Going Green: Can Blockchain Save the Planet?

It's ironic that blockchain can save the planet due to it's energy-intensive nature, but with the right adoption, it jus...

14 Jan 2019 |

In The Press, Partnerships, All, Forex, News, Crypto

TradAir Partners With NEXUS for Cryptocurrency Liquidity

Broctagon would be working alongside trading technology firm TradAir to provide cryptocurrency liquidity akin to the for...

26 Nov 2018 |

In The Press, All, Forex, Crypto

Broctagon Unveils NEXUS Aggregator for Unified Crypto Liquidity

NEXUS is developed with Broctagon's vision of elevating the disruptive boom of crypto trading to the sheer scale and eff...

11 Nov 2017 |

In The Press, All, Crypto, Events

Broctagon Rolls Out Newly Diversified Cryptocurrency Solutions Suite

The newly introduced offering entails a number of solutions aimed at addressing issues of liquidity typically associated...

Load More Articles

8 Nov 2024 |

Partnerships, All, News, Products, In The Press

Exclusive Partnership: Free Autochartist Trading Resources for AXIS CRM Brokers

Broctagon and Autochartist team up to boost Broker success with free educational and signal resources.

23 Sep 2024 |

Partnerships, All, News, Products

Broctagon’s 300% user growth powered by MongoDB Atlas

We are proud to announce that Broctagon has been featured as a successful case study by MongoDB, a leading developer...

7 Jan 2021 |

Partnerships, Liquidity, All, News

Broctagon and FXCubic Announce New Multi-Level Partnership

Multi-asset liquidity provider Broctagon is proud to announce a partnership with FXCubic, London-based fintech firm.

4 Nov 2020 |

In The Press, All, News, Crypto, Crypto, Thought Leadership

Hong Kong’s Crypto Regulation Hailed a “Positive Move”

The decision to regulate all entities operating within the cryptocurrency industry in Hong Kong has been dubbed as a "po...

28 Oct 2020 |

Partnerships, Broprime Markets, All, News

Broctagon Solidifies Stronghold in Asia Markets with New Labuan Money Broking Licence

Broctagon Fintech Group is proud to announce that we have obtained a Money Broking Licence from the Labuan...

13 Oct 2020 |

Partnerships, Liquidity, All, News, Forex, Products

Broctagon Partners Spotware to Offer cTrader Platform

Brokerages in Asia will now have a wider variety of trading platforms made available with Broctagon's Spotware partnersh...

12 Oct 2020 |

In The Press, Partnerships, Liquidity, All, News, Products

Broctagon to Offer cTrader White Labels with Spotware Partnership

Broctagon Fintech Group, a liquidity and technology provider to the brokerage industry, has partnered with Spotware, thu...

2 Sep 2020 |

In The Press, Liquidity, All, News, Crypto, Products

Broctagon to Boost Exchange Native Altcoin Liquidity Through NEXUS Upgrade

Singapore-based Broctagon Fintech Group has upgraded its NEXUS 2.0 liquidity aggregator technology, with the launch...

14 May 2020 |

Products, All, News, Crypto, Thought Leadership

Get Ready to Hypercharge Your Exchange Liquidity

Covid 19 has heavily impacted the the crypto markets within the past few months. Learn how to hypercharge your exchange ...

4 May 2020 |

In The Press, All, News, Crypto, Crypto

Bitcoin Price May Drop After Halving, Historical Data Shows

Halving might boost Bitcoin price due to its added scarcity, giving it a positive trend, says Broctagon CEO Don Guo in h...

11 Dec 2019 |

In The Press, All, News, Crypto, Products

Broctagon launches NEXUS 2.0 to tackle crypto exchange price disparity

Multi-asset liquidity provider Broctagon has launched NEXUS 2.0, a new service designed to tackle the issue of crypto ex...

14 Jan 2019 |

In The Press, Partnerships, All, Forex, News, Crypto

TradAir Partners With NEXUS for Cryptocurrency Liquidity

Broctagon would be working alongside trading technology firm TradAir to provide cryptocurrency liquidity akin to the for...

Load More Articles

8 Nov 2024 |

Partnerships, All, News, Products, In The Press

Exclusive Partnership: Free Autochartist Trading Resources for AXIS CRM Brokers

Broctagon and Autochartist team up to boost Broker success with free educational and signal resources.

23 Sep 2024 |

Partnerships, All, News, Products

Broctagon’s 300% user growth powered by MongoDB Atlas

We are proud to announce that Broctagon has been featured as a successful case study by MongoDB, a leading developer...

19 Jul 2023 |

All, Products, Thought Leadership, Events

Broctagon – More than just a Full Suite FX Solutions Provider

We started with a dream to bridge the gap for highly tailored FX solutions that add tangible and impactful value to Fore...

13 Oct 2020 |

Partnerships, Liquidity, All, News, Forex, Products

Broctagon Partners Spotware to Offer cTrader Platform

Brokerages in Asia will now have a wider variety of trading platforms made available with Broctagon's Spotware partnersh...

12 Oct 2020 |

In The Press, Partnerships, Liquidity, All, News, Products

Broctagon to Offer cTrader White Labels with Spotware Partnership

Broctagon Fintech Group, a liquidity and technology provider to the brokerage industry, has partnered with Spotware, thu...

2 Sep 2020 |

In The Press, Liquidity, All, News, Crypto, Products

Broctagon to Boost Exchange Native Altcoin Liquidity Through NEXUS Upgrade

Singapore-based Broctagon Fintech Group has upgraded its NEXUS 2.0 liquidity aggregator technology, with the launch...

14 May 2020 |

Products, All, News, Crypto, Thought Leadership

Get Ready to Hypercharge Your Exchange Liquidity

Covid 19 has heavily impacted the the crypto markets within the past few months. Learn how to hypercharge your exchange ...

11 Dec 2019 |

In The Press, All, News, Crypto, Products

Broctagon launches NEXUS 2.0 to tackle crypto exchange price disparity

Multi-asset liquidity provider Broctagon has launched NEXUS 2.0, a new service designed to tackle the issue of crypto ex...

Load More Articles

19 Jul 2023 |

All, Products, Thought Leadership, Events

Broctagon – More than just a Full Suite FX Solutions Provider

We started with a dream to bridge the gap for highly tailored FX solutions that add tangible and impactful value to Fore...

15 Feb 2023 |

All, Forex, Thought Leadership, Knowledge

How do Liquidity Providers and Brokers work together in FX?

In the foreign exchange (FX) market, liquidity providers and brokers work together to facilitate trading. Liquidity prov...

10 Feb 2023 |

All, Thought Leadership, Knowledge

Liquidity Providers and the Role They Play in Forex

Liquidity providers play a crucial role in financial markets and exchanges to ensure a seamless execution of trades, and...

30 Nov 2022 |

Liquidity, All, Crypto, Thought Leadership, Knowledge

What Is Liquidity Aggregation and It’s Important for Your Crypto Exchange

Liquidity in cryptocurrencies is important, but unlike the Forex market, there is a notorious lack of liquidity in the c...

15 Nov 2022 |

All, Thought Leadership, Knowledge

7 Key Features of the Best Brokerage CRM

A good customer relationship management (CRM) system is an essential part of any successful brokerage. An ideal brokerag...

24 Jan 2022 |

All, Thought Leadership, In The Press

FEATURE: Money can empower us to be better selves, says fintech exec

Investing is about managing risks to reap rewards but everyone has different ideas about how to get there and just how m...

7 Dec 2021 |

All, Blockchain, Thought Leadership

How to Create High Value NFTs?

The main thing that puzzles most non-crypto fanatics is, why would anyone pay for high value NFTs when in this digital a...

25 Oct 2021 |

All, Thought Leadership, In The Press

OP-ED: Singapore can be a progressive haven for global crypto businesses

Owing to the country’s friendly regulatory environment with respect to financial markets, and fintech and blockchain wit...

26 Aug 2021 |

All, Blockchain, Thought Leadership

How NFTs Can Help Artists

Non-Fungible Tokens (NFT) can help artists in a way by driving a change in how art is bought, sold, supported, enjoyed a...

30 Jul 2021 |

All, Crypto, Thought Leadership

The Future of Social Media with NFTs

Today, social media platforms are a part of our everyday lives. We barely notice it, but millions of people around the w...

14 Jul 2021 |

Liquidity, All, Crypto, Thought Leadership

The Cryptocurrency Whale Phenomenon: How Do Investors Thread Volatility Splashes?

One contributing factor to volatility is that the crypto markets have an abundance of whales – a term given to someone w...

21 May 2021 |

All, Blockchain, Crypto, Thought Leadership

Creating Permanent Memories with NFTs – Non Fungible Tokens

Capturing memory has always been on a constant evolution, with people finding ways to make it more instant, accurate, an...

9 Apr 2021 |

All, Blockchain, Crypto, Thought Leadership, Knowledge

What is an NFT? Non-Fungible Tokens Explained

What exactly is an NFT and why did one just sell for US $69 million dollars? What are NFTs and how they work explained.

25 Mar 2021 |

All, Crypto, Thought Leadership

How Can Trading Technology Propel Altcoins to New Heights?

The success of Bitcoin and Ethereum alone is not enough to make crypto mainstream. Exchanges must evolve to the next pha...

15 Feb 2021 |

All, Crypto, Thought Leadership

2017’s Bitcoin Bubble Unlikely to Return as Bitcoin Matures

In early January, Bitcoin's value rose to an all-time high of about $42,000 before tumbling down to about $30,000. This ...

9 Feb 2021 |

All, Blockchain, Thought Leadership, Knowledge

How to Choose the Right Blockchain Protocol for Your Business

Public, private, permissioned, Bitcoin, Ethereum protocols, and more – it might seem really daunting on how to choose th...

1 Feb 2021 |

All, Crypto, Thought Leadership, Knowledge

Crypto CFD vs Crypto Spot

Many investors and traders are familiar with the idea of trading cryptocurrencies. While crypto spot trading has been mo...

21 Jan 2021 |

Knowledge, Liquidity, All, Crypto, Thought Leadership

What is Smart Order Routing?

Smart Order Routing (SOR) is an automated order processing mechanism, designed to take the best available opportunity ac...

8 Jan 2021 |

Knowledge, All, Thought Leadership

Why Offer Multi-Asset Classes?

As a brokerage, offering multi-asset classes to your clients can bring you competitve advantage over other brokerages. H...

7 Jan 2021 |

Partnerships, Liquidity, All, News

Broctagon and FXCubic Announce New Multi-Level Partnership

Multi-asset liquidity provider Broctagon is proud to announce a partnership with FXCubic, London-based fintech firm.

16 Dec 2020 |

Knowledge, Liquidity, All

What is Crypto Exchange Liquidity?

Being a key essential to any Crypto Exchange, it is important to know what exactly Crypto Exchange Liquidity is and...

24 Nov 2020 |

Knowledge, All, Crypto, Crypto, Thought Leadership

Starting a Crypto Exchange

Kick-starting your very own crypto exchange made simple with Broctagon's comprehensive guide, with just 3 main step...

4 Nov 2020 |

In The Press, All, News, Crypto, Crypto, Thought Leadership

Hong Kong’s Crypto Regulation Hailed a “Positive Move”

The decision to regulate all entities operating within the cryptocurrency industry in Hong Kong has been dubbed as a "po...

29 Oct 2020 |

Thought Leadership, Liquidity, All, Crypto, Crypto, In The Press

What Grassroots Use of Bitcoin Could Mean for Liquidity

We take a look at what greater adoption of crypto payments mean for liquidity in the market, and what needs to be done t...

13 Oct 2020 |

Partnerships, Liquidity, All, News, Forex, Products

Broctagon Partners Spotware to Offer cTrader Platform

Brokerages in Asia will now have a wider variety of trading platforms made available with Broctagon's Spotware partnersh...

12 Oct 2020 |

In The Press, Partnerships, Liquidity, All, News, Products

Broctagon to Offer cTrader White Labels with Spotware Partnership

Broctagon Fintech Group, a liquidity and technology provider to the brokerage industry, has partnered with Spotware, thu...

2 Sep 2020 |

In The Press, Liquidity, All, News, Crypto, Products

Broctagon to Boost Exchange Native Altcoin Liquidity Through NEXUS Upgrade

Singapore-based Broctagon Fintech Group has upgraded its NEXUS 2.0 liquidity aggregator technology, with the launch...

10 Aug 2020 |

Thought Leadership, Liquidity, All, Forex, Crypto

Preparing Crypto Liquidity For Economic Recovery And Rising Demand

Ted Quek, CTO of Broctagon, explains how the crypto space must adopt liquidity standards similar to those of FX markets,...

8 Jul 2020 |

Thought Leadership, Liquidity, All, Crypto

With Trading Volumes Slumping, Are There Too Many Crypto Exchanges?

The decline in trading volumes rekindle questions over how many cryptocurrency exchanges are really needed to serve the ...

17 Jun 2020 |

Thought Leadership, All, Crypto, Crypto, In The Press

Cryptocurrency Expert Sees Opportunities Amidst Global Crisis

As the coronavirus lockdown begins to lift across the world, investment opportunities in traditional stock markets and c...

2 Jun 2020 |

Thought Leadership, All, Crypto, Crypto, In The Press

Expert Examines JP Morgan’s Spectacular U-turn on Bitcoin

What was once regarded by many as ‘internet money’ is slowly stumbling its way into mainstream acceptance, Broctagon's C...

14 May 2020 |

Products, All, News, Crypto, Thought Leadership

Get Ready to Hypercharge Your Exchange Liquidity

Covid 19 has heavily impacted the the crypto markets within the past few months. Learn how to hypercharge your exchange ...

12 May 2020 |

Thought Leadership, All, Crypto, Crypto, In The Press

Broctagon CEO urges governments to “take action” on crypto regulation

Broctagon's CEO Don Guo states that governments across the world need to begin taking action on the regulation of crypto...

11 May 2020 |

Blockchain, All, Thought Leadership

Can Blockchain Application for Businesses Become More Than Just an Ideal?

Cryptocurrency was thrust into the spotlight by Bitcoin, but it is blockchain, the technology behind it that we should p...

4 May 2020 |

In The Press, All, News, Crypto, Crypto

Bitcoin Price May Drop After Halving, Historical Data Shows

Halving might boost Bitcoin price due to its added scarcity, giving it a positive trend, says Broctagon CEO Don Guo in h...

24 Apr 2020 |

Thought Leadership, All, Crypto, Crypto, In The Press

Governments Must Take Action On Crypto Regulation Now, Or Risk The Wild West Getting Off Scot Free

Should a regulatory precedent not be set and the space continue to be a “Wild West”, we could see a stall in institution...

23 Mar 2020 |

Thought Leadership, All, Blockchain, Crypto

Can Blockchain Curb the Spread of a Pandemic like COVID-19?

Price swings are a distraction from what we should really be looking at – and that’s how blockchain can curb a pandemic ...

2 Mar 2020 |

In The Press, All, Crypto, Crypto, Thought Leadership

Bitcoin’s Rally May Have More Room to Run, Technicals Suggest

As the coronavirus starts to impact global growth prospects, how will cryptocurrencies hold up? Bitcoin could be perceiv...

19 Jun 2019 |

Thought Leadership, All, Crypto

Five Reasons Why We Are Excited About Facebook Libra

The cryptocurrency will be released in the first half of 2020, with great excitement from the community as many see it a...

7 Jun 2019 |

Thought Leadership, All, Forex, Crypto

Responsible Leverage: CFD Trading and the Current State of Regulations

Historically, professional traders are subject to ever-shifting regulatory climates, especially traders with a preferenc...

10 May 2019 |

Thought Leadership, Blockchain, Crypto

Initial Exchange Offerings: The Next Era of Token Sales

Initial Exchange Offerings are addressing the market need by overcoming some of the limitations associated with first-ge...

22 Apr 2019 |

Thought Leadership, All, Blockchain

Proof of Work or Proof of Waste?

As we discuss its position as a frontier in technology, blockchain — with all its applications and hype as the ‘future o...

18 Mar 2019 |

Thought Leadership, All, Blockchain

Going Green: Can Blockchain Save the Planet?

It's ironic that blockchain can save the planet due to it's energy-intensive nature, but with the right adoption, it jus...

Load More Articles

19 Jul 2023 |

All, Products, Thought Leadership, Events

Broctagon – More than just a Full Suite FX Solutions Provider

We started with a dream to bridge the gap for highly tailored FX solutions that add tangible and impactful value to Fore...

11 Nov 2017 |

In The Press, All, Crypto, Events

Broctagon Rolls Out Newly Diversified Cryptocurrency Solutions Suite

The newly introduced offering entails a number of solutions aimed at addressing issues of liquidity typically associated...

Load More Articles

15 Feb 2023 |

All, Forex, Thought Leadership, Knowledge

How do Liquidity Providers and Brokers work together in FX?

In the foreign exchange (FX) market, liquidity providers and brokers work together to facilitate trading. Liquidity prov...

10 Feb 2023 |

All, Thought Leadership, Knowledge

Liquidity Providers and the Role They Play in Forex

Liquidity providers play a crucial role in financial markets and exchanges to ensure a seamless execution of trades, and...

30 Nov 2022 |

Liquidity, All, Crypto, Thought Leadership, Knowledge

What Is Liquidity Aggregation and It’s Important for Your Crypto Exchange

Liquidity in cryptocurrencies is important, but unlike the Forex market, there is a notorious lack of liquidity in the c...

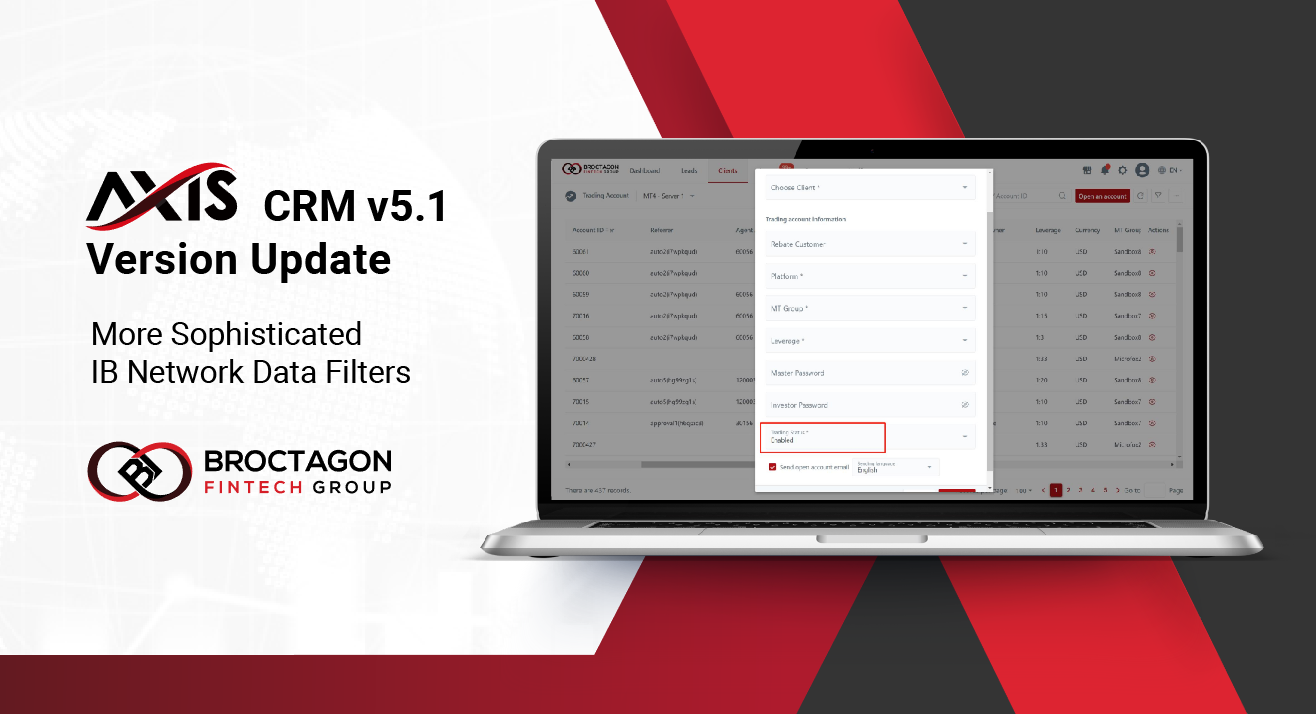

15 Nov 2022 |

All, Thought Leadership, Knowledge

7 Key Features of the Best Brokerage CRM

A good customer relationship management (CRM) system is an essential part of any successful brokerage. An ideal brokerag...

9 Apr 2021 |

All, Blockchain, Crypto, Thought Leadership, Knowledge

What is an NFT? Non-Fungible Tokens Explained

What exactly is an NFT and why did one just sell for US $69 million dollars? What are NFTs and how they work explained.

9 Feb 2021 |

All, Blockchain, Thought Leadership, Knowledge

How to Choose the Right Blockchain Protocol for Your Business

Public, private, permissioned, Bitcoin, Ethereum protocols, and more – it might seem really daunting on how to choose th...

1 Feb 2021 |

All, Crypto, Thought Leadership, Knowledge

Crypto CFD vs Crypto Spot

Many investors and traders are familiar with the idea of trading cryptocurrencies. While crypto spot trading has been mo...

21 Jan 2021 |

Knowledge, Liquidity, All, Crypto, Thought Leadership

What is Smart Order Routing?

Smart Order Routing (SOR) is an automated order processing mechanism, designed to take the best available opportunity ac...

8 Jan 2021 |

Knowledge, All, Thought Leadership

Why Offer Multi-Asset Classes?

As a brokerage, offering multi-asset classes to your clients can bring you competitve advantage over other brokerages. H...

16 Dec 2020 |

Knowledge, Liquidity, All

What is Crypto Exchange Liquidity?

Being a key essential to any Crypto Exchange, it is important to know what exactly Crypto Exchange Liquidity is and...

24 Nov 2020 |

Knowledge, All, Crypto, Crypto, Thought Leadership

Starting a Crypto Exchange

Kick-starting your very own crypto exchange made simple with Broctagon's comprehensive guide, with just 3 main step...

Load More Articles

8 Nov 2024 |

Partnerships, All, News, Products, In The Press

Exclusive Partnership: Free Autochartist Trading Resources for AXIS CRM Brokers

Broctagon and Autochartist team up to boost Broker success with free educational and signal resources.

24 Jan 2022 |

All, Thought Leadership, In The Press

FEATURE: Money can empower us to be better selves, says fintech exec

Investing is about managing risks to reap rewards but everyone has different ideas about how to get there and just how m...

25 Oct 2021 |

All, Thought Leadership, In The Press

OP-ED: Singapore can be a progressive haven for global crypto businesses

Owing to the country’s friendly regulatory environment with respect to financial markets, and fintech and blockchain wit...

5 May 2021 |

Broprime Markets, All, Forex, In The Press

Labuan Set To Only Grow Stronger And Further In The Digital Finance Space

“Labuan has adopted a very positive and welcoming attitude to new entities in the region. We can see the positive outloo...

24 Nov 2020 |

Knowledge, All, Crypto, Crypto, Thought Leadership

Starting a Crypto Exchange

Kick-starting your very own crypto exchange made simple with Broctagon's comprehensive guide, with just 3 main step...

4 Nov 2020 |

In The Press, All, News, Crypto, Crypto, Thought Leadership

Hong Kong’s Crypto Regulation Hailed a “Positive Move”

The decision to regulate all entities operating within the cryptocurrency industry in Hong Kong has been dubbed as a "po...

29 Oct 2020 |

Thought Leadership, Liquidity, All, Crypto, Crypto, In The Press

What Grassroots Use of Bitcoin Could Mean for Liquidity

We take a look at what greater adoption of crypto payments mean for liquidity in the market, and what needs to be done t...

12 Oct 2020 |

In The Press, Partnerships, Liquidity, All, News, Products

Broctagon to Offer cTrader White Labels with Spotware Partnership

Broctagon Fintech Group, a liquidity and technology provider to the brokerage industry, has partnered with Spotware, thu...

2 Sep 2020 |

In The Press, Liquidity, All, News, Crypto, Products

Broctagon to Boost Exchange Native Altcoin Liquidity Through NEXUS Upgrade

Singapore-based Broctagon Fintech Group has upgraded its NEXUS 2.0 liquidity aggregator technology, with the launch...

17 Jun 2020 |

Thought Leadership, All, Crypto, Crypto, In The Press

Cryptocurrency Expert Sees Opportunities Amidst Global Crisis

As the coronavirus lockdown begins to lift across the world, investment opportunities in traditional stock markets and c...

2 Jun 2020 |

Thought Leadership, All, Crypto, Crypto, In The Press

Expert Examines JP Morgan’s Spectacular U-turn on Bitcoin

What was once regarded by many as ‘internet money’ is slowly stumbling its way into mainstream acceptance, Broctagon's C...

12 May 2020 |

Thought Leadership, All, Crypto, Crypto, In The Press

Broctagon CEO urges governments to “take action” on crypto regulation

Broctagon's CEO Don Guo states that governments across the world need to begin taking action on the regulation of crypto...

4 May 2020 |

In The Press, All, News, Crypto, Crypto

Bitcoin Price May Drop After Halving, Historical Data Shows

Halving might boost Bitcoin price due to its added scarcity, giving it a positive trend, says Broctagon CEO Don Guo in h...

24 Apr 2020 |

Thought Leadership, All, Crypto, Crypto, In The Press

Governments Must Take Action On Crypto Regulation Now, Or Risk The Wild West Getting Off Scot Free

Should a regulatory precedent not be set and the space continue to be a “Wild West”, we could see a stall in institution...

2 Mar 2020 |

In The Press, All, Crypto, Crypto, Thought Leadership

Bitcoin’s Rally May Have More Room to Run, Technicals Suggest

As the coronavirus starts to impact global growth prospects, how will cryptocurrencies hold up? Bitcoin could be perceiv...

4 Jan 2020 |

In The Press, Blockchain, All

A Data Driven Future for Cities

With growing global fears around climate change, how we manage our cities is becoming ever more important...

17 Dec 2019 |

In The Press, Blockchain, All, Crypto

Blockchain and cryptocurrency predictions for 2020: 22 industry experts have their say

Experts across the blockchain and cryptocurrency space shared about their predictions for 2020, from cybersecurity...

11 Dec 2019 |

In The Press, All, News, Crypto, Products

Broctagon launches NEXUS 2.0 to tackle crypto exchange price disparity

Multi-asset liquidity provider Broctagon has launched NEXUS 2.0, a new service designed to tackle the issue of crypto ex...

17 May 2019 |

In The Press, Blockchain, All, Forex, Crypto

One of the World’s Fastest-Growing FX and Crypto Brokerage Solution Providers

Singapore-based Broctagon is a fast-growing technology provider that merges traditional finance with the innovations of ...

14 Jan 2019 |

In The Press, Partnerships, All, Forex, News, Crypto

TradAir Partners With NEXUS for Cryptocurrency Liquidity

Broctagon would be working alongside trading technology firm TradAir to provide cryptocurrency liquidity akin to the for...

26 Nov 2018 |

In The Press, All, Forex, Crypto

Broctagon Unveils NEXUS Aggregator for Unified Crypto Liquidity

NEXUS is developed with Broctagon's vision of elevating the disruptive boom of crypto trading to the sheer scale and eff...

11 Nov 2017 |

In The Press, All, Crypto, Events

Broctagon Rolls Out Newly Diversified Cryptocurrency Solutions Suite

The newly introduced offering entails a number of solutions aimed at addressing issues of liquidity typically associated...

Load More Articles