What is Crypto Exchange Liquidity?

Liquidity is a key essential to any Crypto Exchange. It is important to know what exactly Crypto Exchange Liquidity is and its importance, as well as the factors that affect it and how it can be measured.

What is Exchange Liquidity?

Liquidity is the degree of ease in which an asset can be readily converted into another asset, without affecting its price.

In terms of cryptocurrency exchanges, both the “degree of ease” and the “price” are crucial. In ideal situations, traders would want their asset to be traded over as fast and as easy as possible, without the bid price being too far off from the ask price.

Importance of Exchange Liquidity

- Fair Prices

In a liquid exchange, prices are bound to be fair for everyone due to the large number of traders in the market. The high trading activity forces sellers to sell their assets at competitive prices while buyers would in turn bid at higher prices as well. An equilibrium market price that is fair for both sellers and buyers is thus formed.

- Market Stability

A market with high liquidity will ensure market stability. This means that the market will not be affected by large swings due to large trades. In an illiquid market with little activity, big players can severely influence the prices of assets. However, the large number of traders present in a liquid market helps the prices remain stable and be invulnerable to large swings.

- Quicker Transaction Time

In high liquidity markets, transactions are completed much faster as compared to markets with low liquidity because of the large number of market participants. Trading in liquid markets is also beneficial for short-term traders as they are able to enter and exit a trade quickly.

- Technical Analysis

A quick explanation of Technical Analysis would be that it is the study of past statistical trends from trading activities and using the information to forecast future price movements. In a liquid market, technical analysis will prove to be more accurate than analysing trends in illiquid markets. Since there is a big pool of information to gather from in a liquid market, the prediction of future price movements will inevitably be more accurate than forecasting in an illiquid market.

What Affects Exchange Liquidity?

- Acceptance of Cryptocurrency

The greater the acceptance of cryptocurrency, the higher its liquidity. Cryptocurrency has become a mode of payment that is accepted by businesses (eg. PayPal, Amazon, etc) to stretch the utility of cryptocurrencies. As of now, there are more than 250 businesses that accept crypto payment.

- Laws and Regulations

Laws and regulations of different countries can impact liquidity. There are countries with government regulations that affect cryptocurrencies such as the prohibition of cryptocurrency trading. Liquidity in those specific countries would be damaged since the prohibition of cryptocurrencies would be the same as a ban on crypto exchanges. Traders would have to privately source for a seller or use peer-to-peer platforms. Those countries would then suffer from poor liquidity which ultimately leads to higher prices as the demand for crypto would be much more than supply as there are only a few sellers.

How is Liquidity Determined?

Liquidity in an exchange can be determined in many ways. Here are 3 ways you can do so, by evaluating the:

- Overall Trade Volume

The higher the volume of trade occurring daily, the more liquid the exchange is. For example, industry giants such as Binance and Huobi records trade volume in the billions daily and the figures can be found at the exchange’s respective websites. Also, CoinMarketCap has a helpful metric called “Avg. Liquidity” where you can rank exchanges based on their liquidity score in ascending or descending order.

You might wonder how to determine the liquidity of a specific asset as well. A quick and simple way would be to refer to the 24hour trade volume at CoinMarketCap. At the site, you can compare the trading volume of different assets.

- Long and Short Positions

Looking at the total number of open long and short (buying and selling) positions, analysts can see which assets are being traded the most, as well as how fast the trade is being fulfilled. A higher trading volume and a greater number of open positions lead to a more liquid market.

The number of outstanding purchases or the sale of any asset, which also consists of stop-limit orders and iceberg orders, should be included in the total as well.

- Bid/Ask Spread

Bid/ask spread refers to the difference between the expected sell price of an asset and the price at which the asset was bought. A small bid/ask spread means that the market is liquid because both sellers and buyers are trading at a price they deem fair.

Enhancing Liquidity: NEXUS 2.0

Liquidity ensures everything is smooth and efficient and keeps the traders coming to your crypto exchange. So, if you have an exchange with insufficient liquidity, how do you improve that?

Developed by Broctagon, NEXUS 2.0 is our proprietary liquidity aggregator and STP (Straight-Through Processing) engine, designed to combine the orderbook of top exchanges direct in your Crypto Exchange with real-time upstream execution. We will connect your Crypto Exchange to the liquidity pool of the industry’s largest exchanges such as Binance, Huobi, Bitfinex and more.

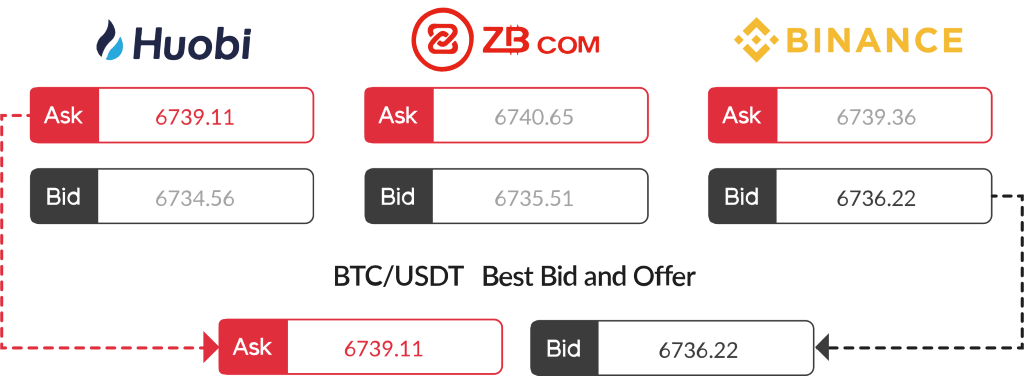

Using SOR, NEXUS 2.0 selects the best bid and ask prices across all connected exchanges to be displayed in your order book:

Enjoy enhanced charts featuring higher tick frequency, improved market depths of an aggregated order book, consistent best bid/ask pricing quotes and the ability to execute STP orders.

In essence, your Crypto Exchange will have equal or better offerings than any single top tier exchange and connecting to us is just a simple API away.

Getting Started

If you would like to elevate your exchange, Broctagon is here to kick-start your journey with unparalleled liquidity centred within a complete ecosystem to rival industry giants right from Day 1.

Schedule a demo with us today: https://broctagon.com/contact.

About Broctagon Fintech Group

Broctagon Fintech Group is a leading multi-asset liquidity and FX technology provider headquartered in Singapore, with over 15 years of global presence across China, Hong Kong, Malaysia, India, Thailand, and Armenia. We deliver performance-driven, bespoke solutions to more than 350 clients in over 50 countries, offering institutional-grade liquidity, brokerage and prop trading solutions, as well as enterprise blockchain development.