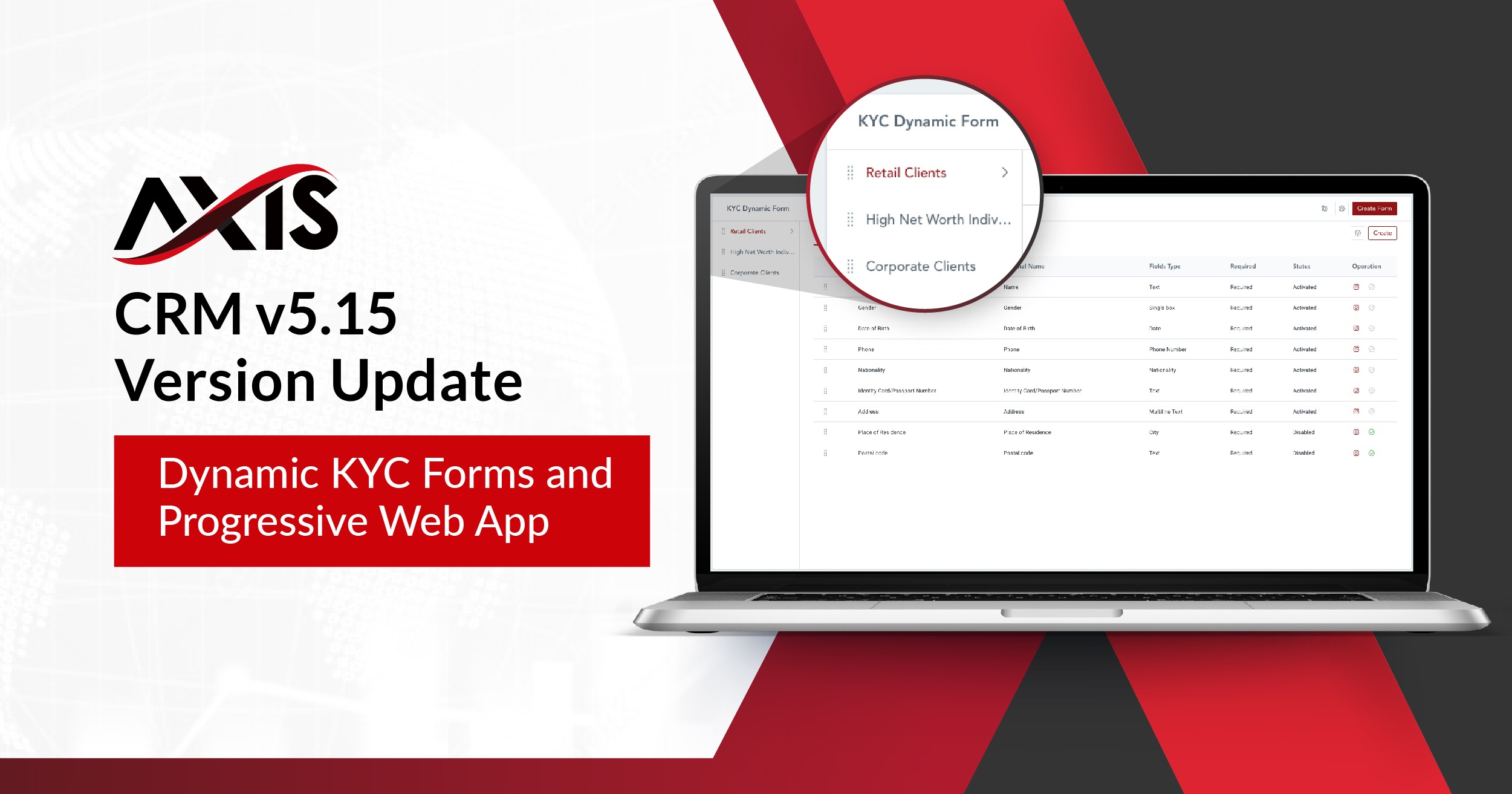

AXIS CRM V5.15 – Version Update

In this latest version update AXIS CRM V5.15, we are pleased to announce the launch of a game-changer for FX brokerages using AXIS – the Progressive Web App (PWA) client portal. We also introduced other updates that would improve dynamic customization and control for brokers to onboard new users.

Progressive Web App (PWA)

We have launched the progressive web app (PWA) for brokers, introducing a stunning combination of rich functionality and the smooth user experience associated with native apps, while also offering seamless compatibility. The PWA will mimic navigation and interactions of a native app, allowing brokers to implement dynamic functionalities without requiring any complication installation process.

The PWA will bring a host of advantages to brokerages and their clients:

- Full Responsiveness and Browser Compatibility: PWAs work with all browsers and are compatible with any device, delivering the same experience to tablet and mobile users as well. The PWA is built according to progressive enhancement, a web design strategy that provides functionality and content regardless of types of browsers while delivering more sophisticated page versions to users whose newer browsers can support them.

- Connectivity Independence: Progressive web applications can work both offline and on low-quality networks and delivers basic functionality regardless of connectivity.

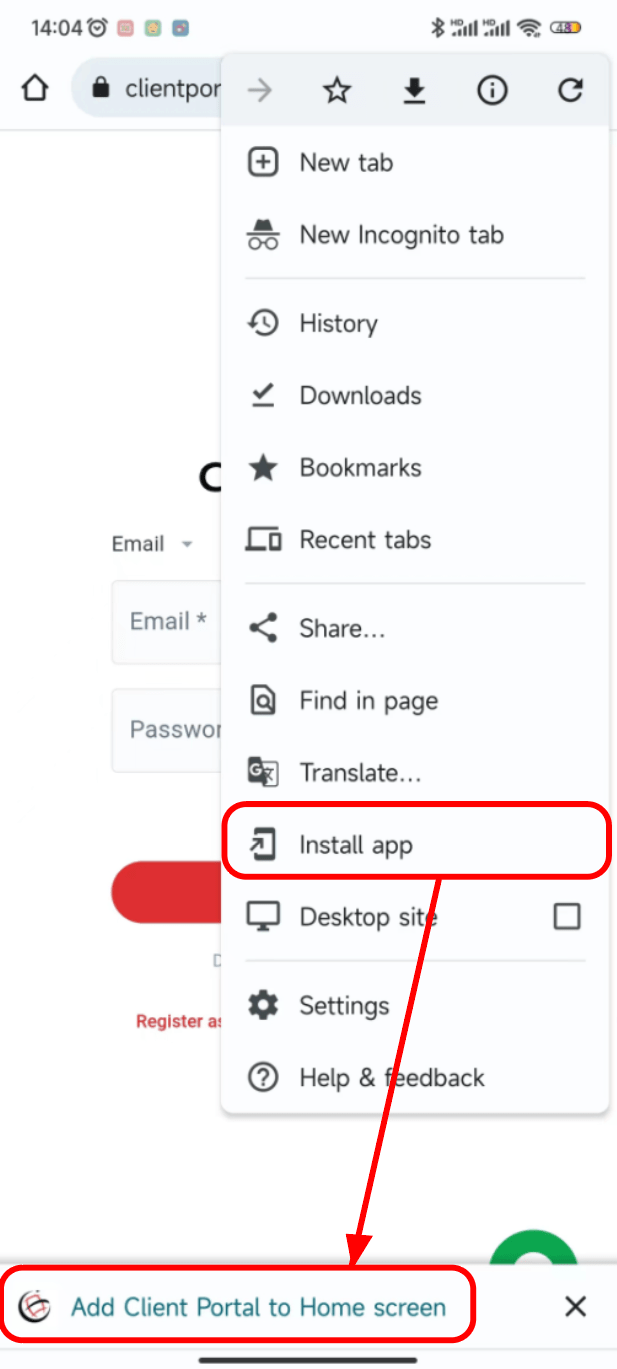

- Easy Updates and Installation: Apps can be shared through a URL instead of having to download it only from the app store. The installation is simple, traders can now install the client portal desktop app from their browsers.

Here’s how you share the PWA for different operating systems and devices:

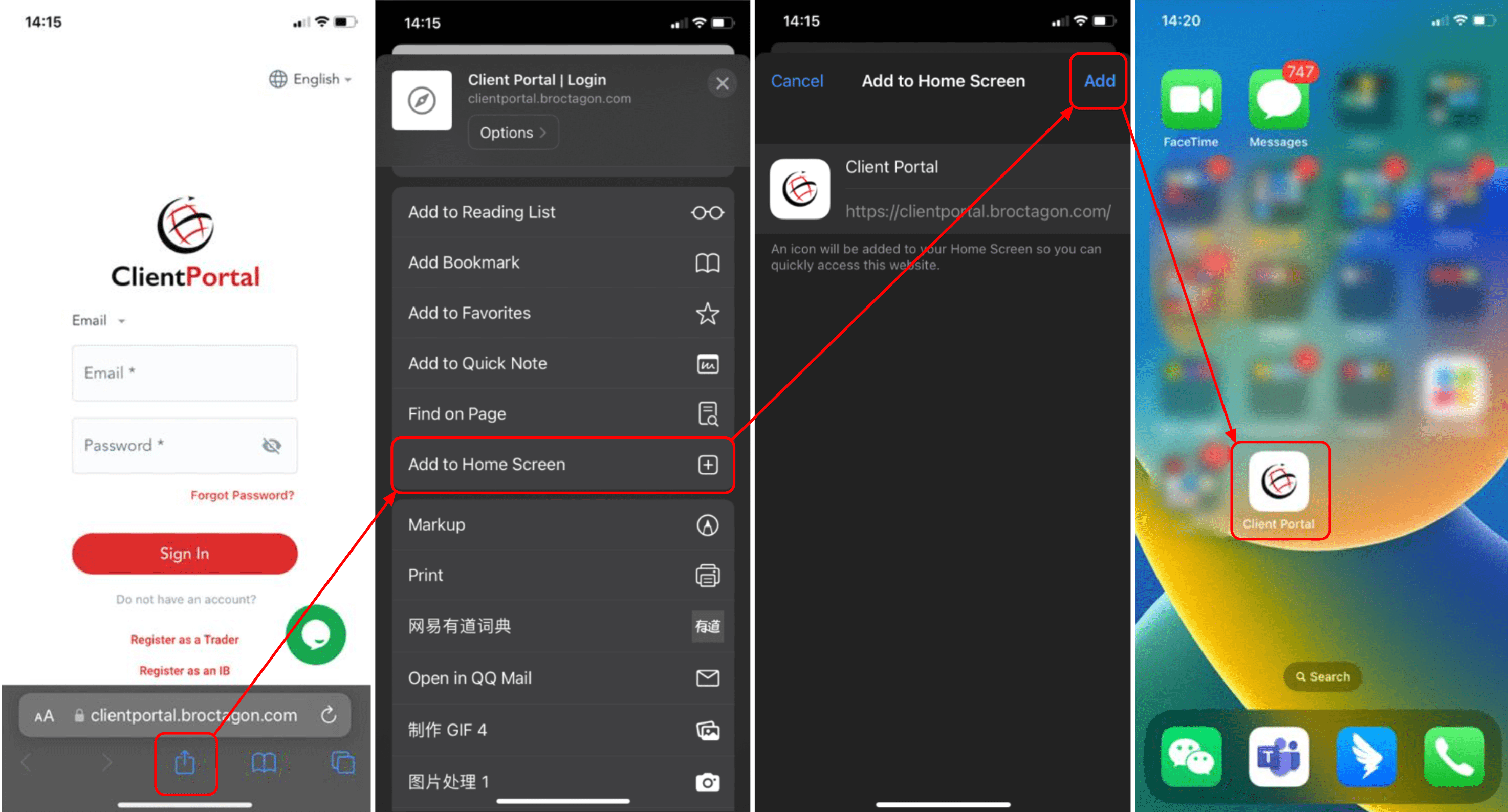

For Apple iOS Devices

- Safari browser: The installation window cannot be set to automatically pop up. Users can click the “Share” button and select “Add to Home Screen” from settings

- Chrome and Edge browsers: Similarly, the installation window cannot be set to automatically pop up. The PWA cannot be added to the desktop through these browsers, as iOS system does not allow this permission to third-party applications.

- OPPO, Xiaomi: The installation window pops up, and PWA can be installed on the desktop.

- HUAWEI HarmonyOS: The installation window pops up, users can manually add it to their desktop.

Dynamic KYC Forms

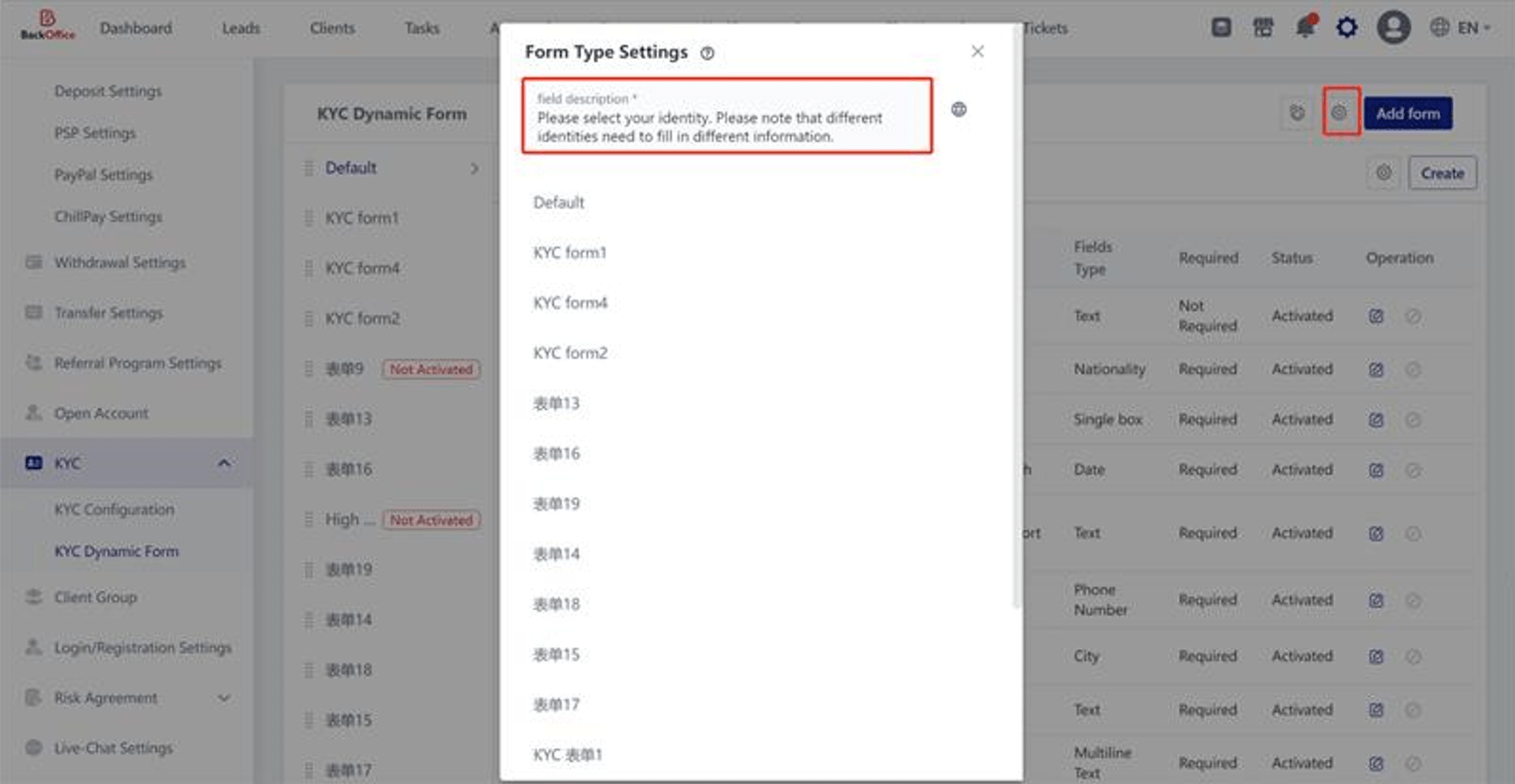

We have also introduced dynamic KYC form settings to introduce a more seamless and efficient onboarding process for different categories of clients that may require different sets of KYC information.

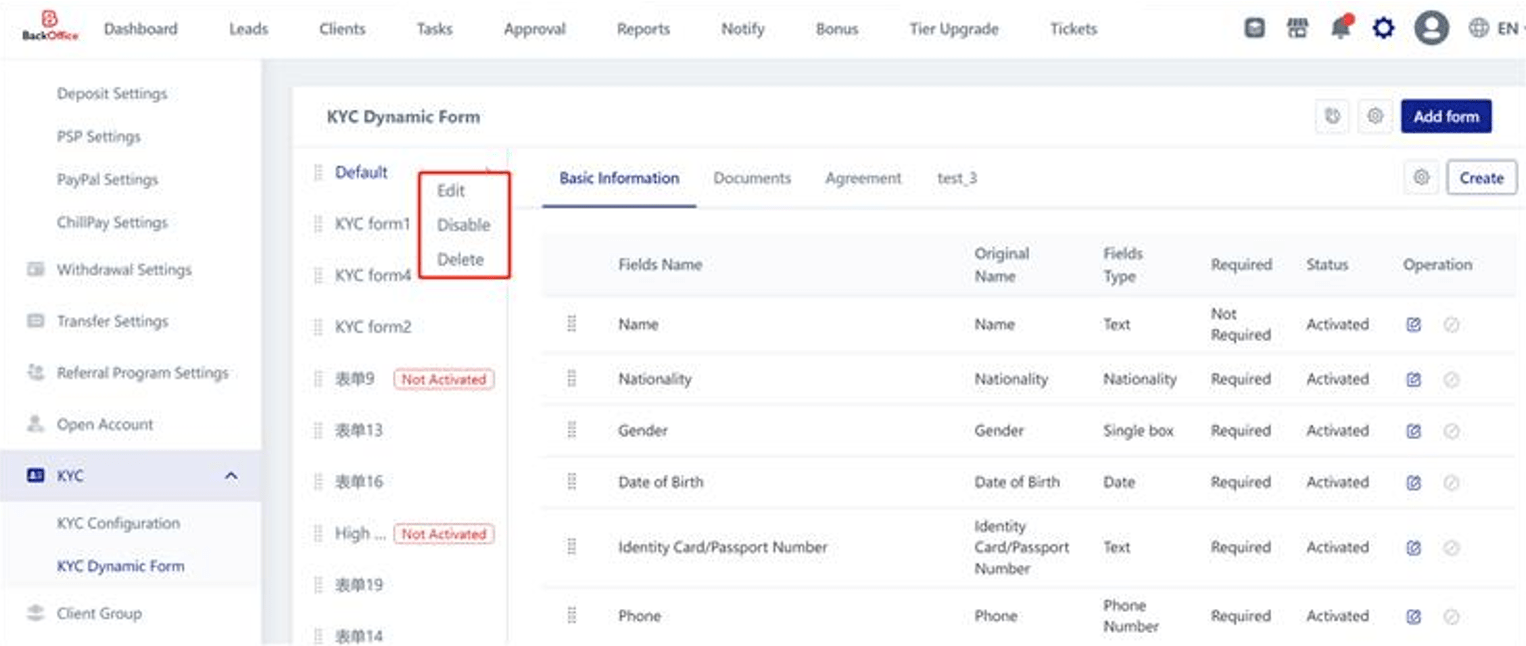

- Admins can now add multiple KYC forms under the ‘KYC Settings’ in the ‘KYC Dynamic Form’ tab.

- Field descriptions can now be added on the ‘Form Type Settings’ page to provide clarity for forms and their functions for internal teams.

- Admins can edit, disable, or delete the forms from the same page.

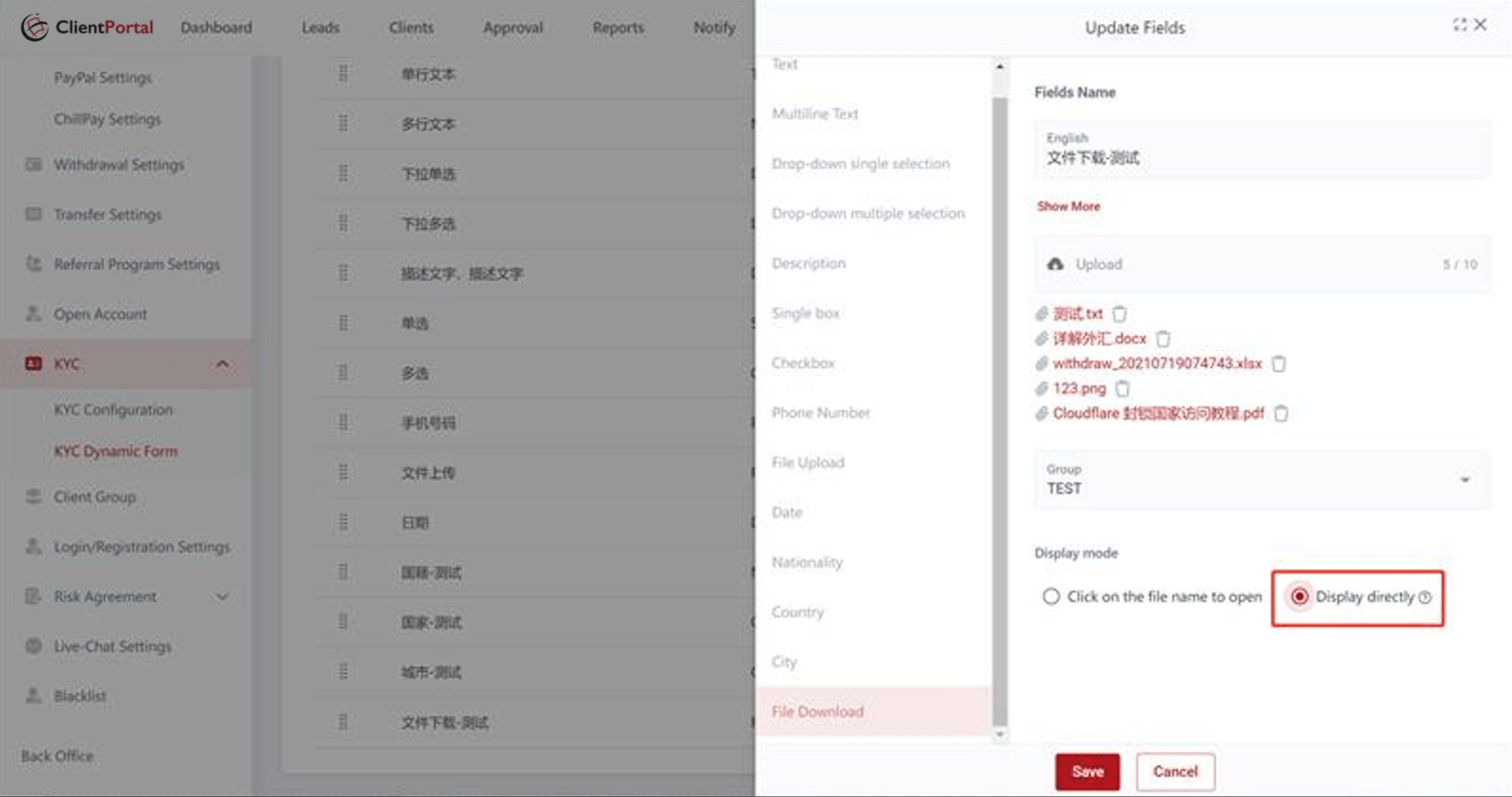

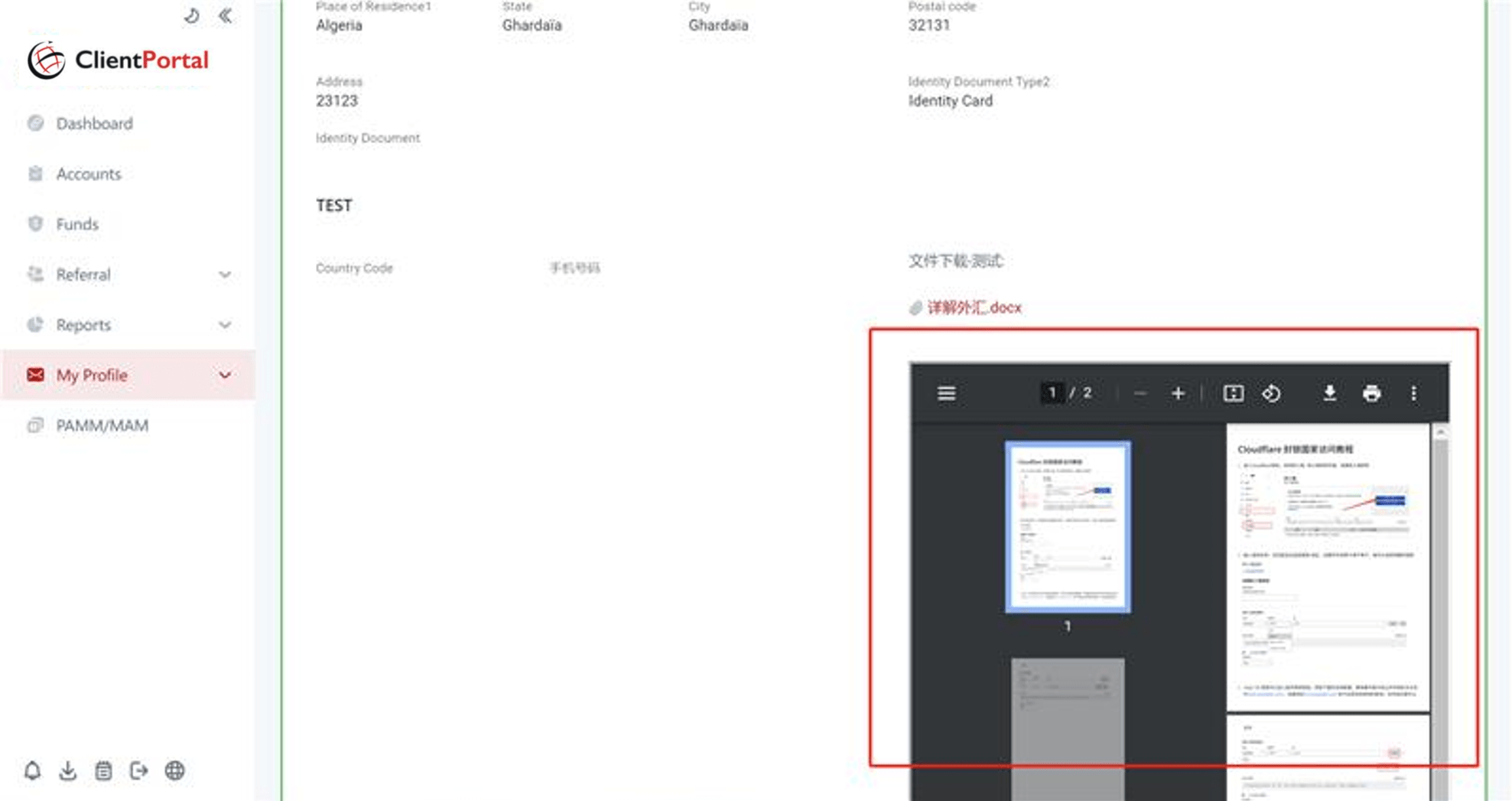

- We have added a preview function in the ‘Display Mode’ for documents uploaded to ‘KYC Dynamic Form’. The only formats not supported are .txt, .xlsx and .docx.

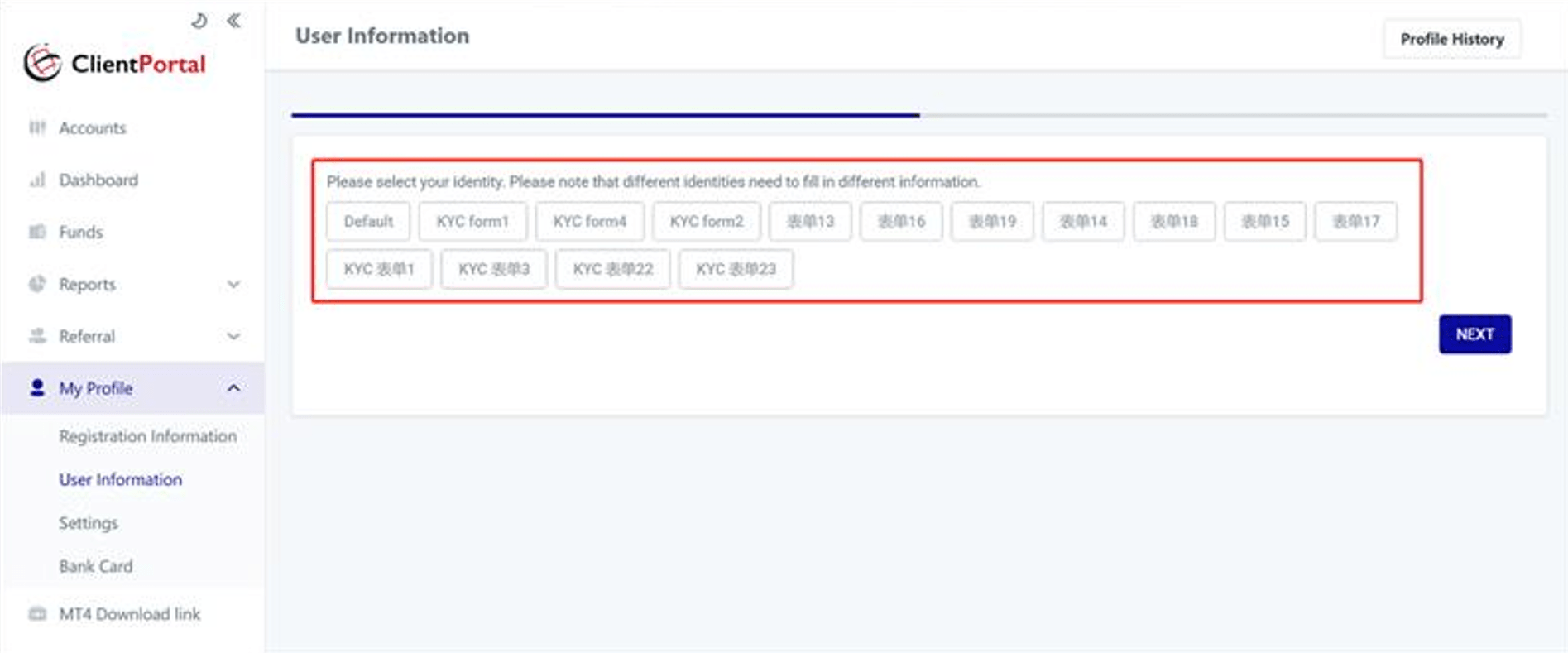

- On the client portal, users will get the option to select the relevant KYC form before submitting it.

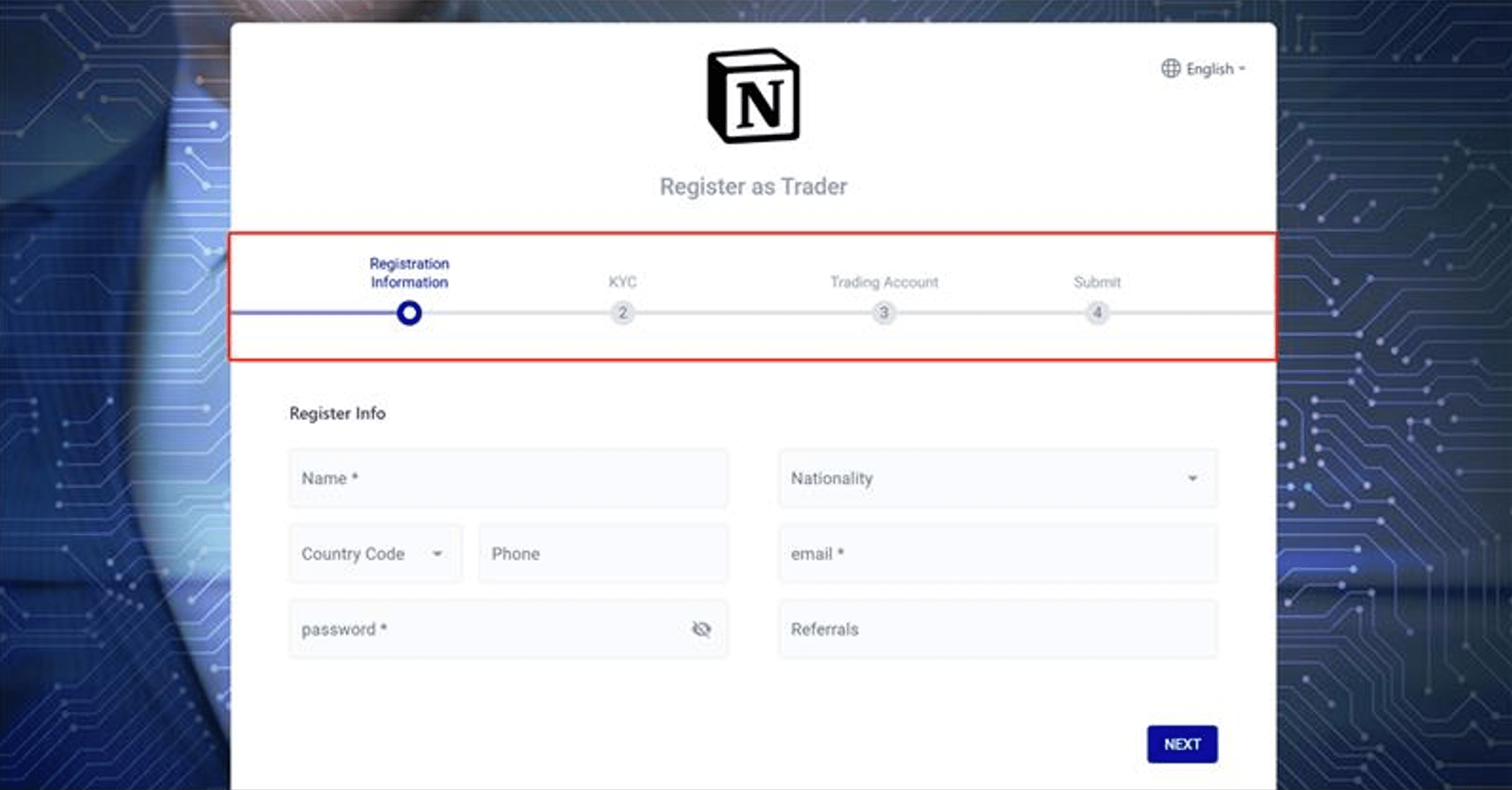

- The trader registration process is optimized to 4 steps to greatly reduce sign-up friction.

Client Management

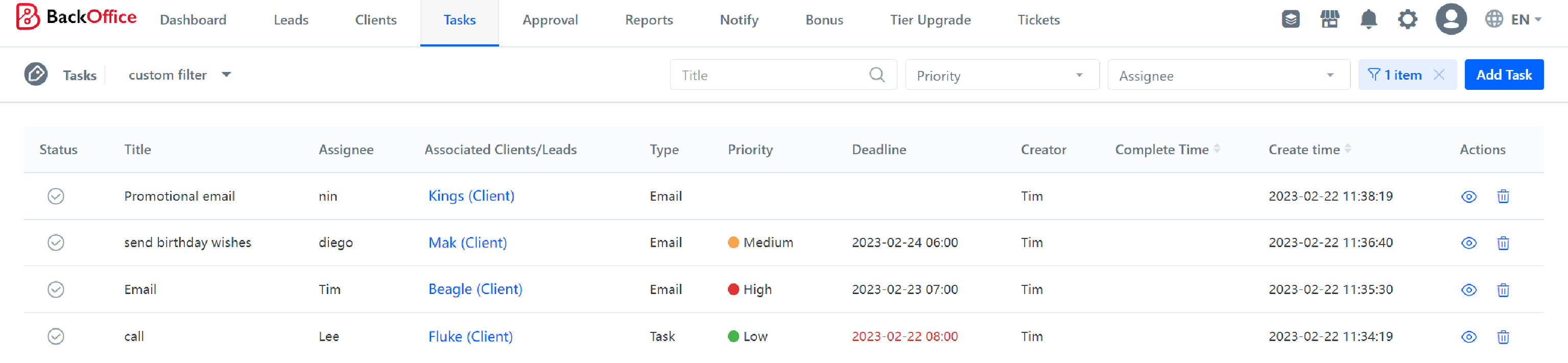

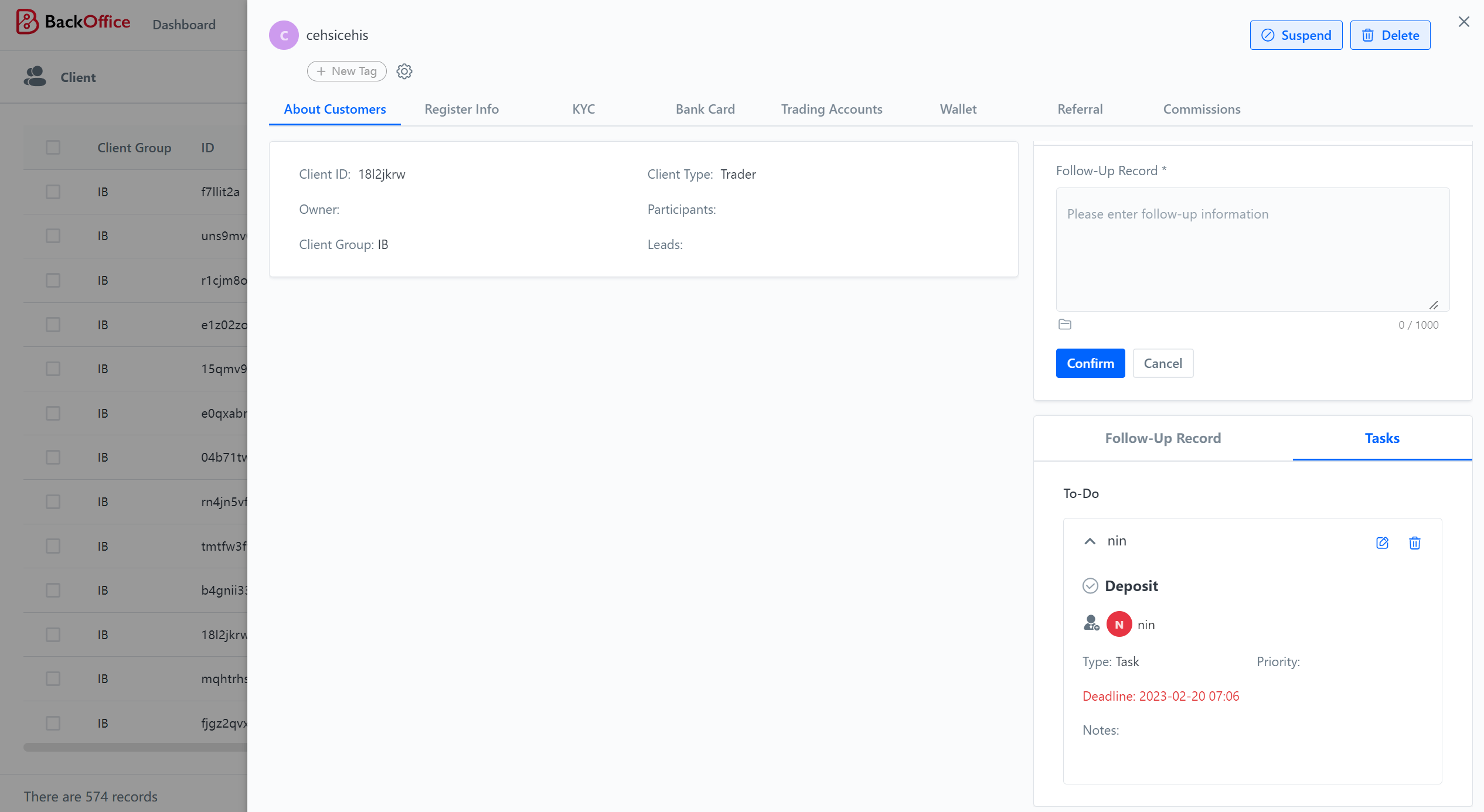

A new ‘tasks’ function has been added to allow brokers to better manage clients and structure their internal processes by creating tasks and to-do lists.

- Here is the new ‘Tasks Settings’ page, which shows an overview of all pending tasks assigned, follow-up needed for clients and their priority status.

- Tasks will also show up on a specific client’s page, and admins can add new tasks where needed.

- Tasks can also be set to follow up on a ‘Leads’ page, so that no potential leads are lost.

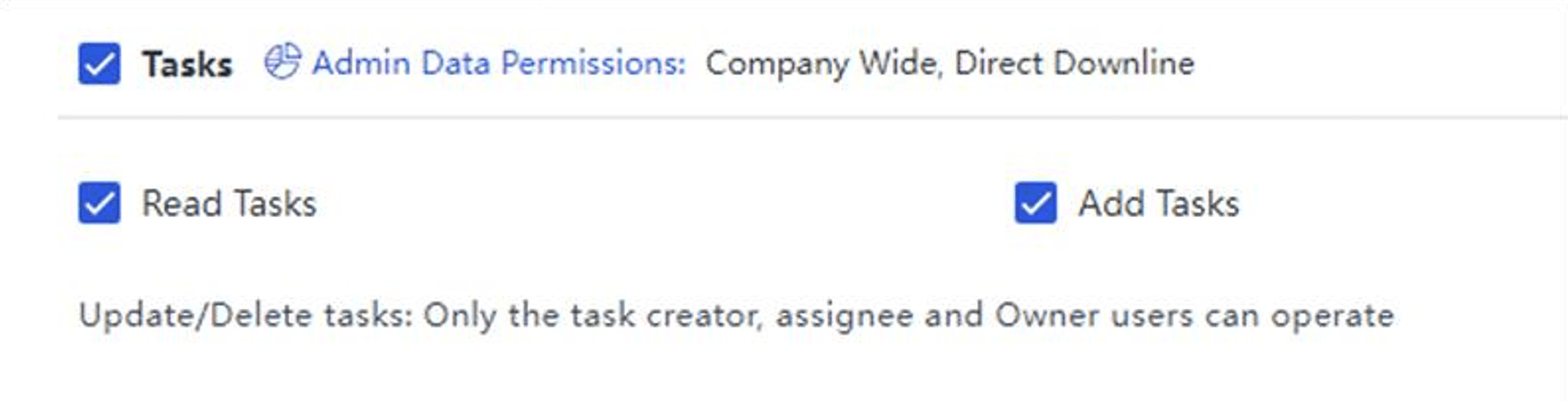

- Permissions can be configured for different admin levels such as ‘Read Tasks’ and ‘Add Tasks’. Types of admin-data permissions include:

- Company Wide: View all tasks assigned to company-wide on the list, and client and lead details pages.

- All Referred Clients: View tasks assigned to all subordinate users on the list, including client and lead details pages.

- Directly Referred Clients: View tasks assigned to direct subordinate users on the list, including client and lead details pages.

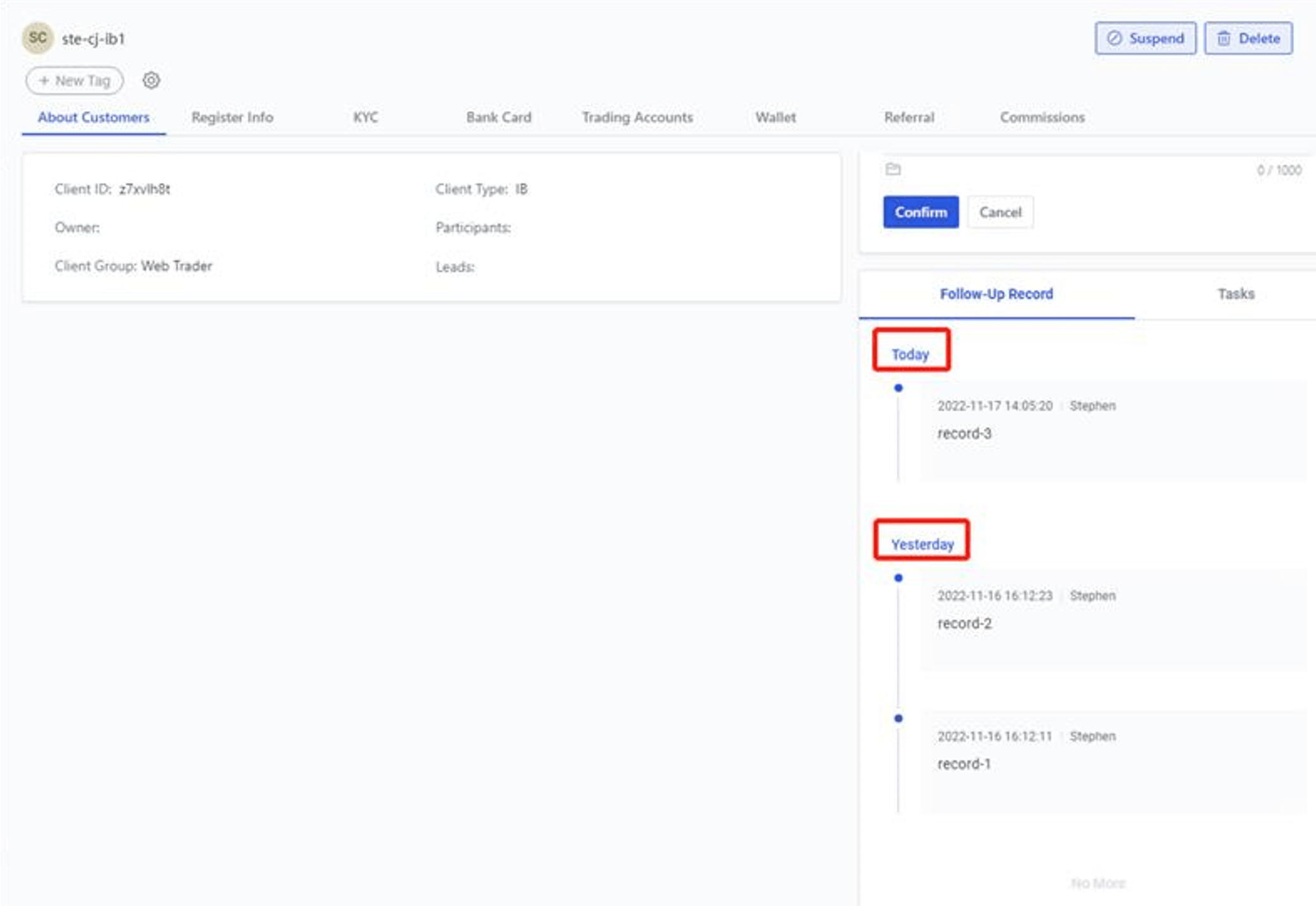

- Time stamps have been added to ‘Follow-up Record’ to allow client follow-ups to be better managed.

Automated System Tags

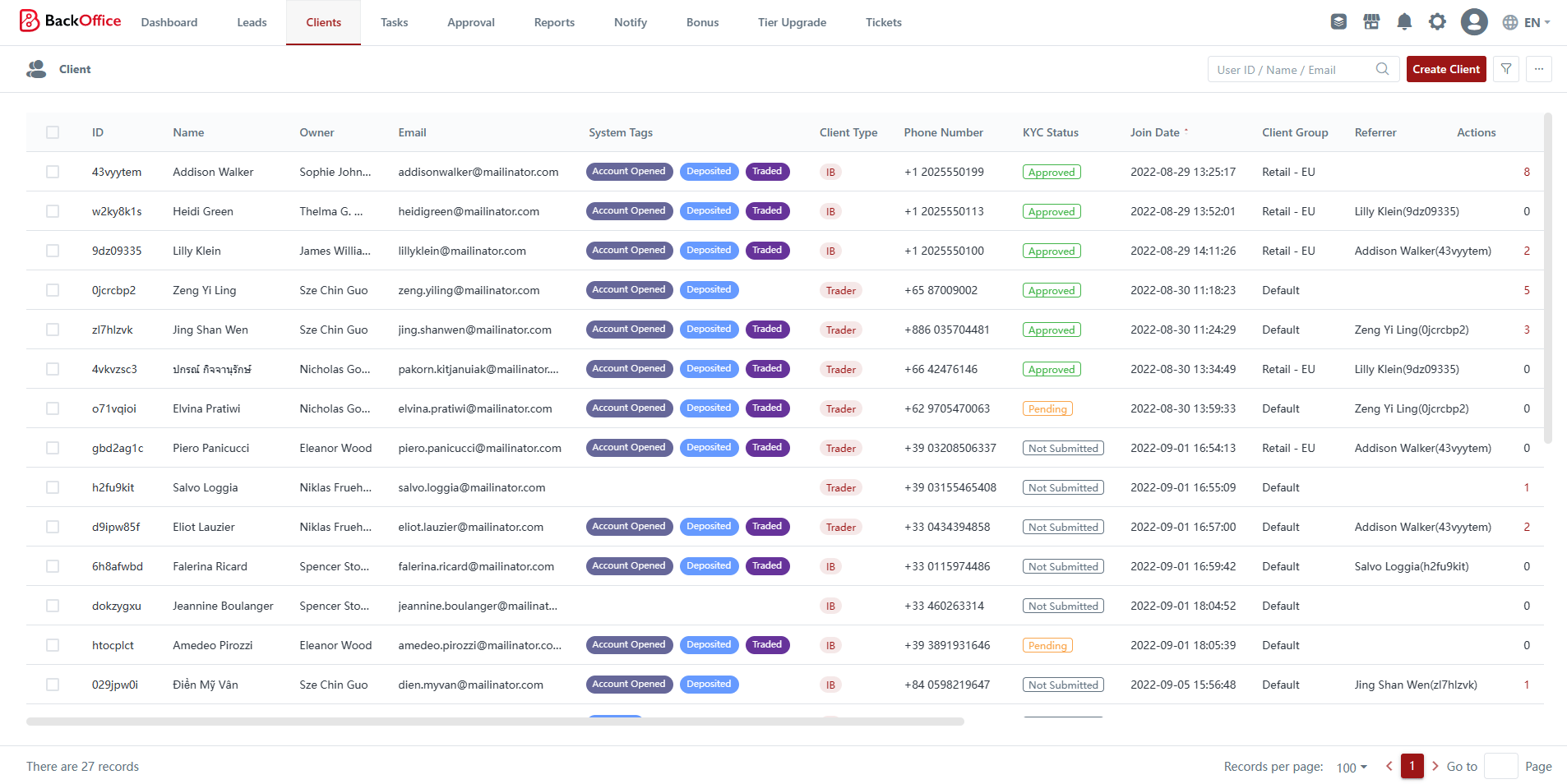

For certain event-trigged actions, the CRM system can now tag these actions automatically, allowing admins to sort and view account actions clearly.

- ‘Deposited’: The trading account or wallet has made its first deposit

- ‘Account Opened’: The trading account has been opened or bound to a client

- ‘Traded’: The bound trading account has a opened a position or created a trade history

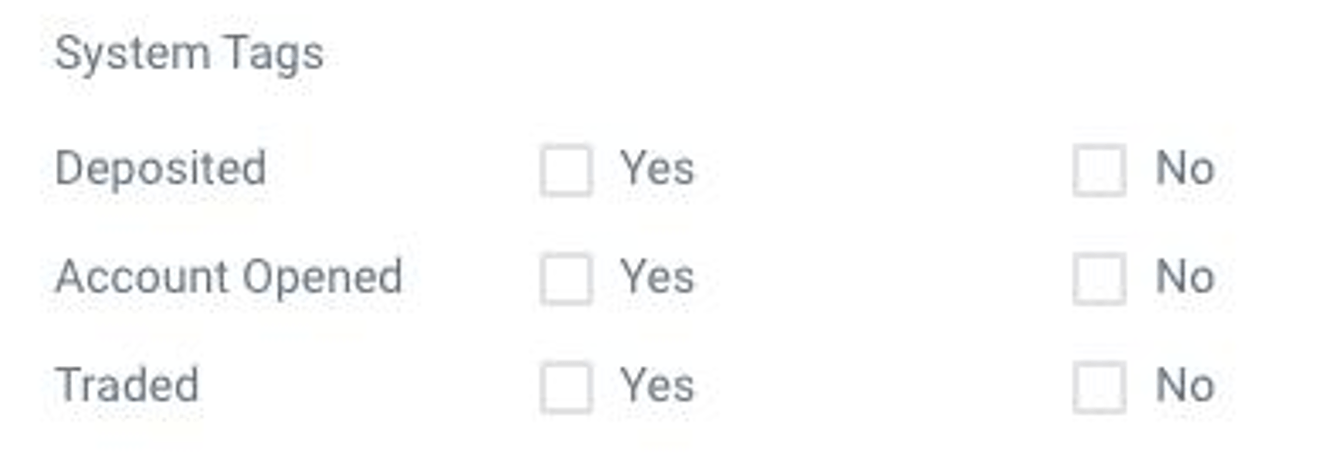

These system tags are also added as a new field in the filters for the ‘Client’ list, where admins can check and filter accounts that have performed specific actions, in order to follow up with them.

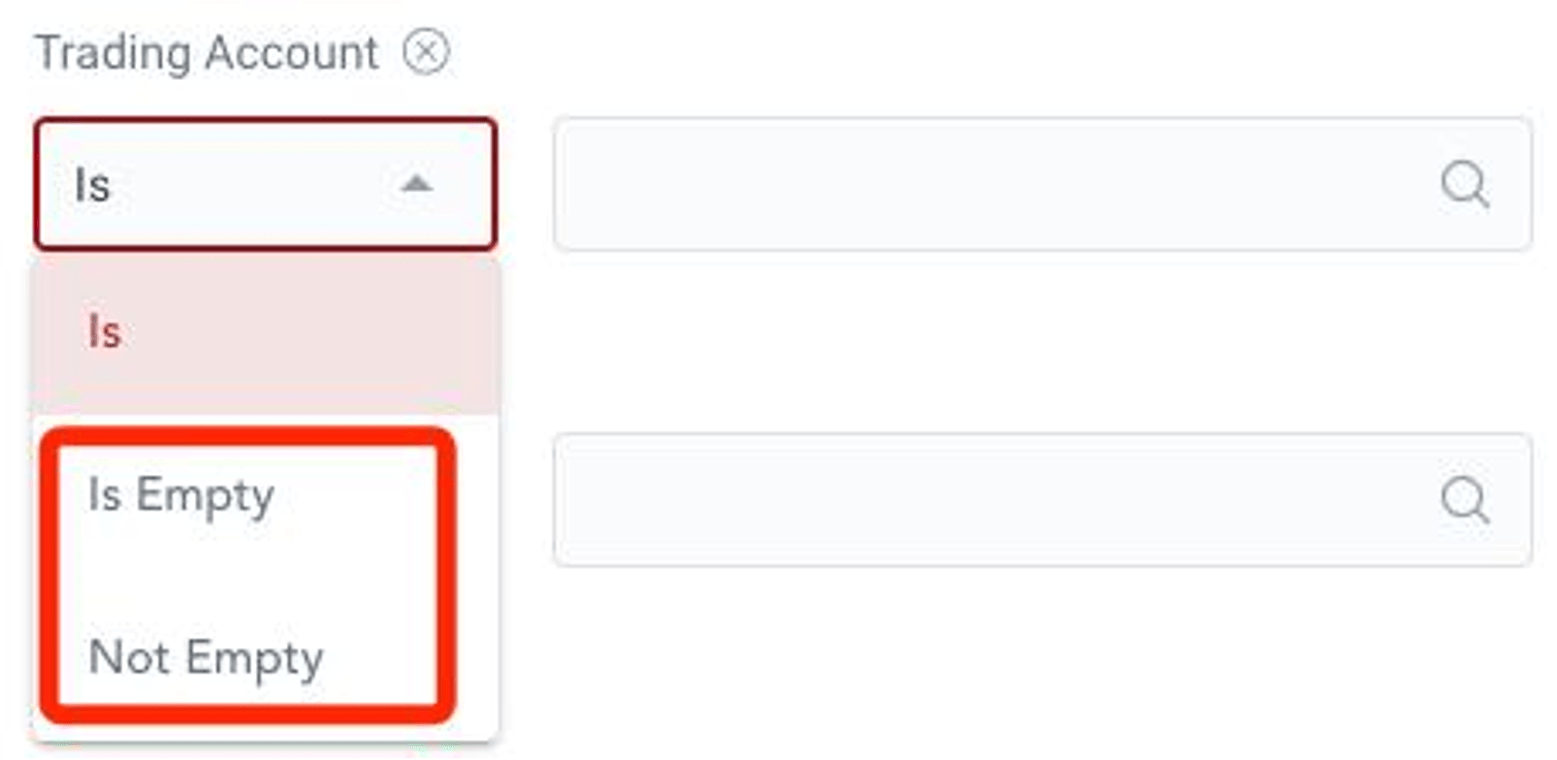

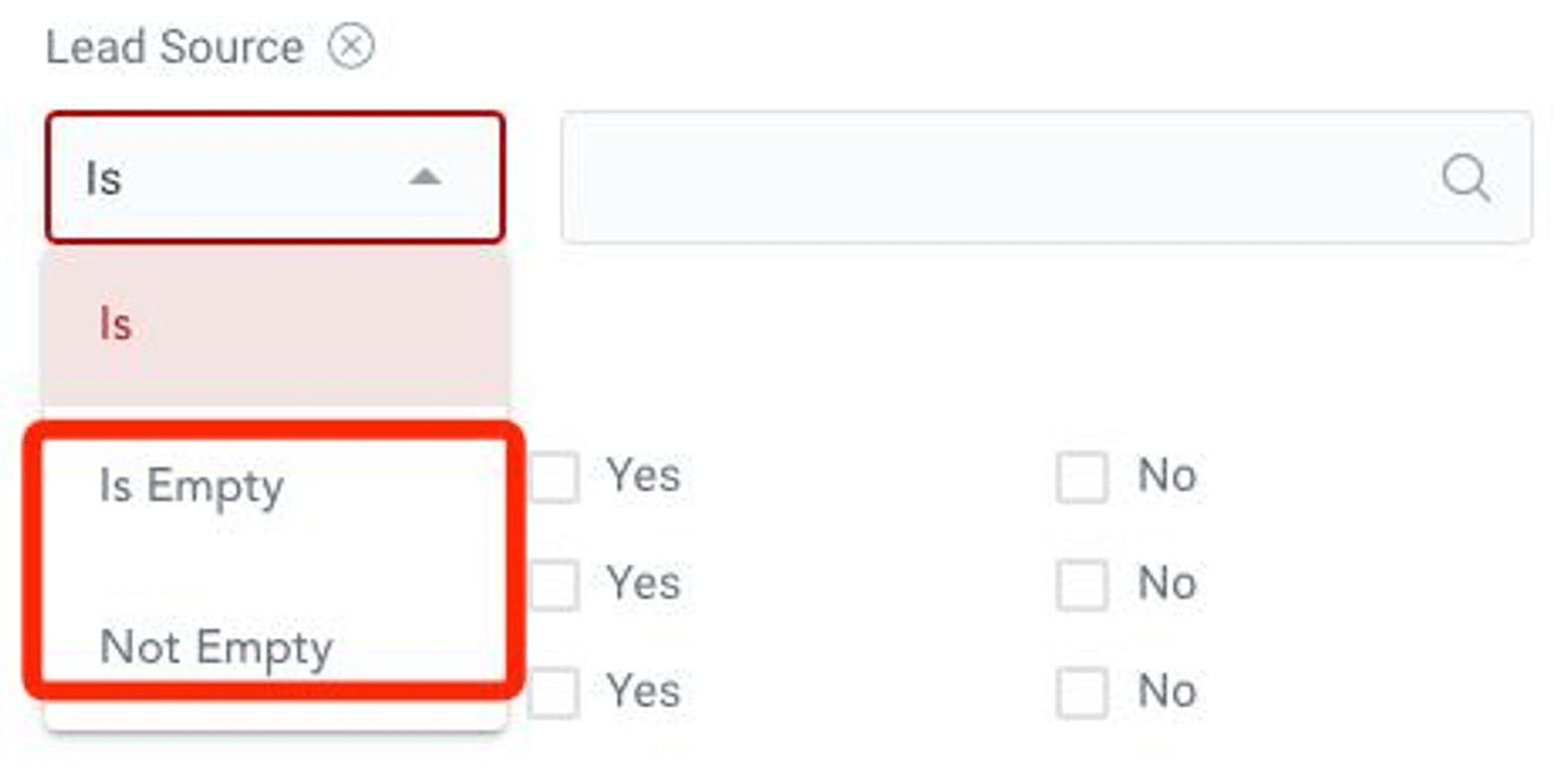

The filtering system has also been enhanced to filter by ‘Trading Account’ and ‘Lead Source’.

Deposit Settings

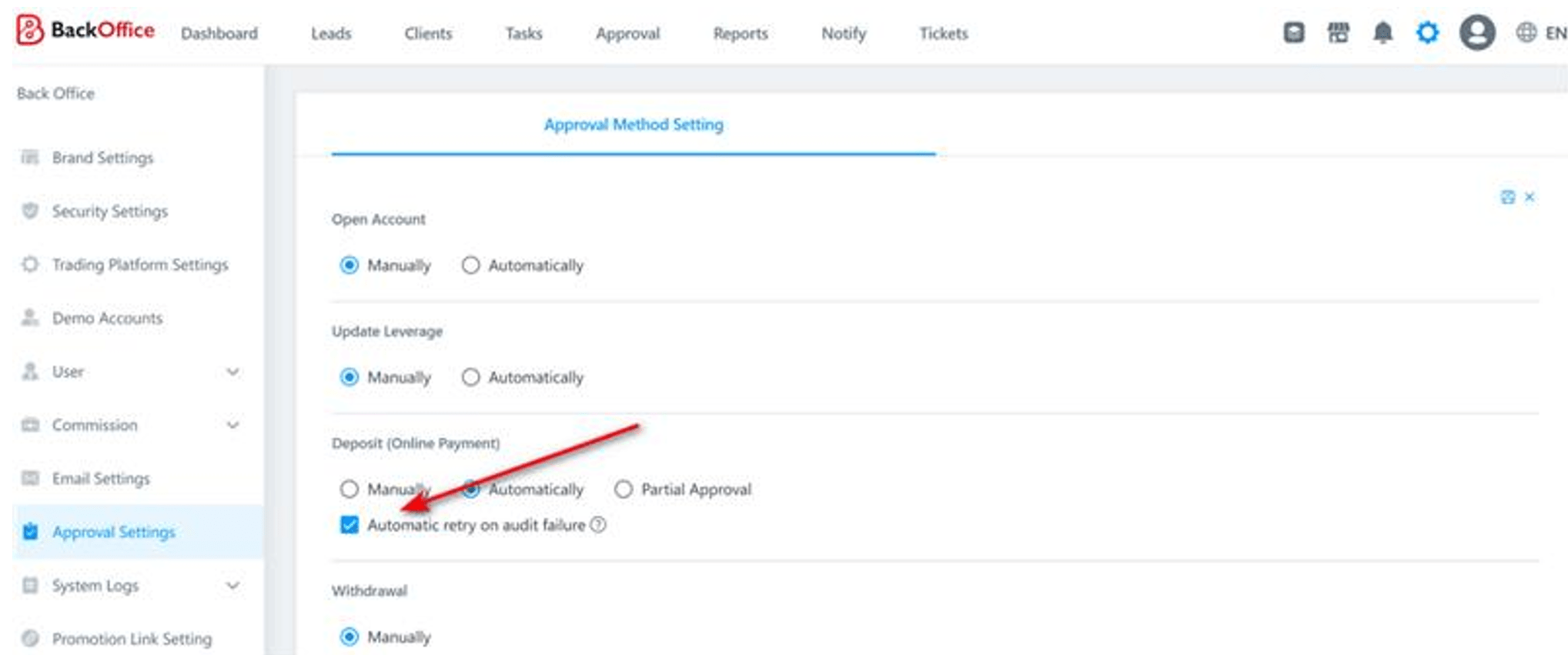

We have added an automatic retry function in the event of a deposit auto-approval failure. Admins can trigger this function by checking “Automatic retry on audit failure” to allow the system to automatically retry failed approval requests.

Caution: When the system automatically retries deposit approval, it checks the trading platform’s database for the corresponding deposit records. However, in abnormal situations, if the database fails to sync the correct result, this will result in duplicate deposits. Brokers will then have to manually withdraw the incorrect funds or consider disabling this function. It is highly recommended that brokers using this function continuously perform account reconciliation to detect duplicate deposits.

- Retry settings: If the option ‘Automatic’ or ‘Partial Approval’ has been selected, and the ‘Automatic retry” box is checked, the system will perform a deposit retry on the failed records every 30 minutes for records within the hour.

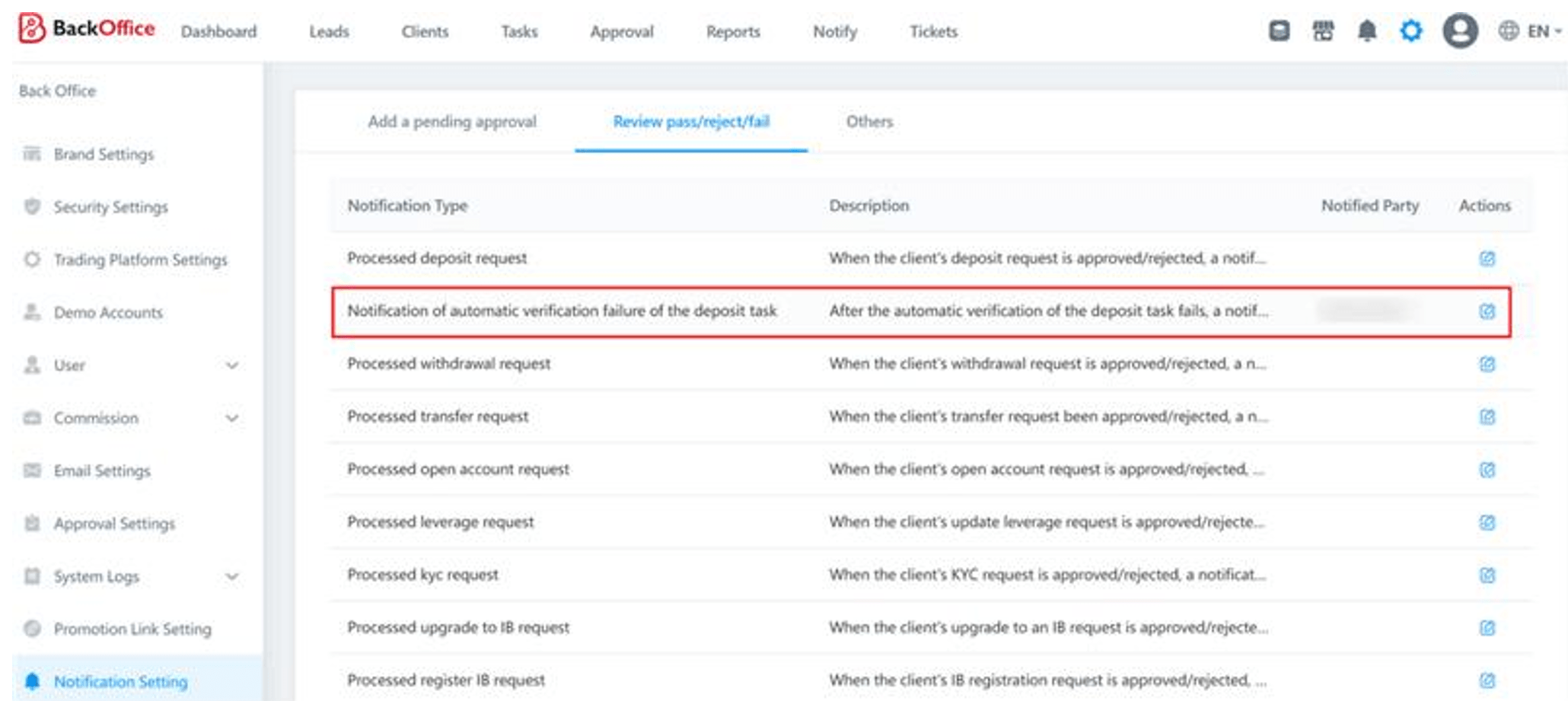

- Notification settings: Admins can configure settings to send notifications to selected parties in the event of an automatic verification failure.

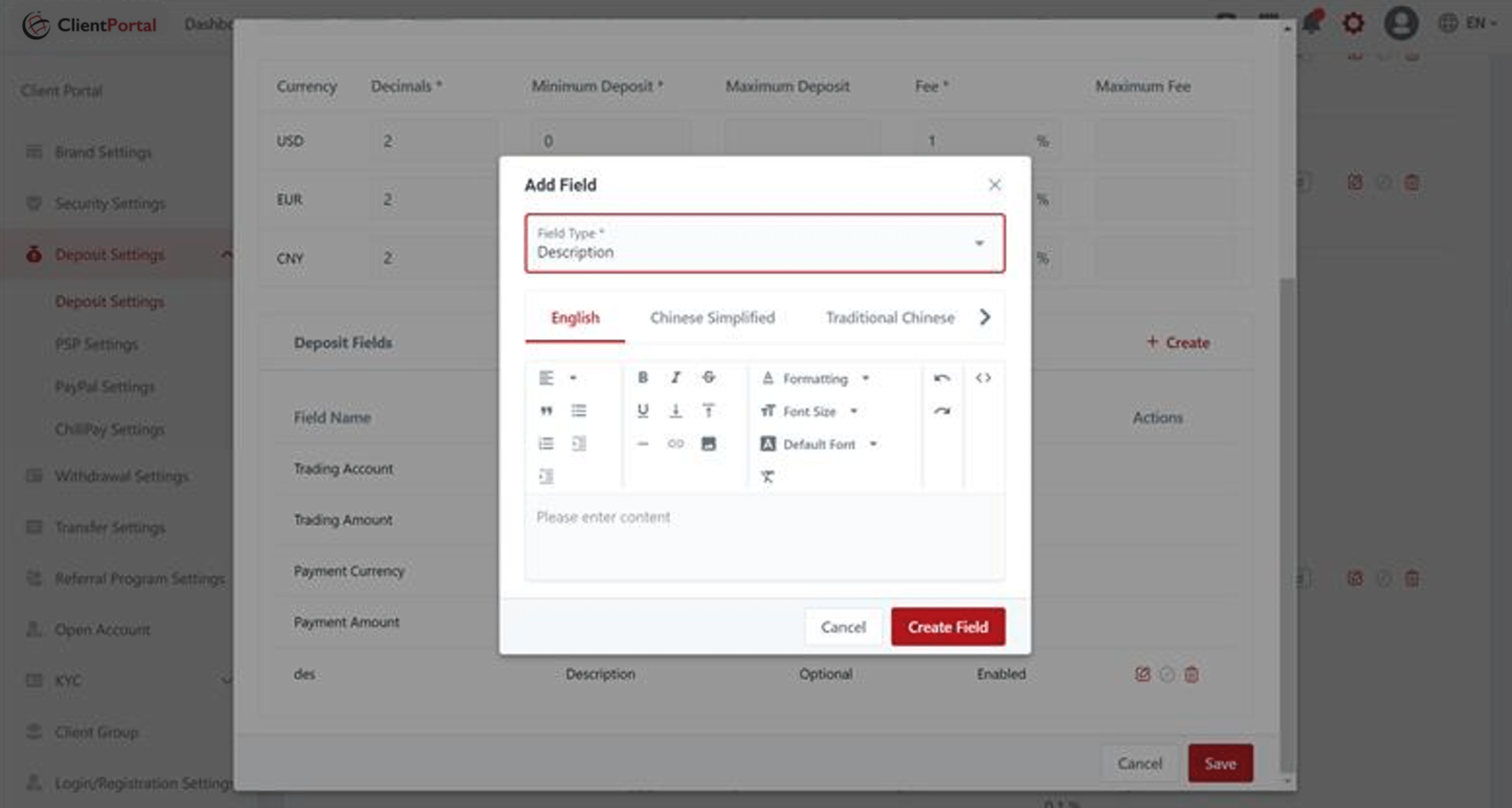

- A description field has been added to online deposit method in ‘Deposit Settings’.

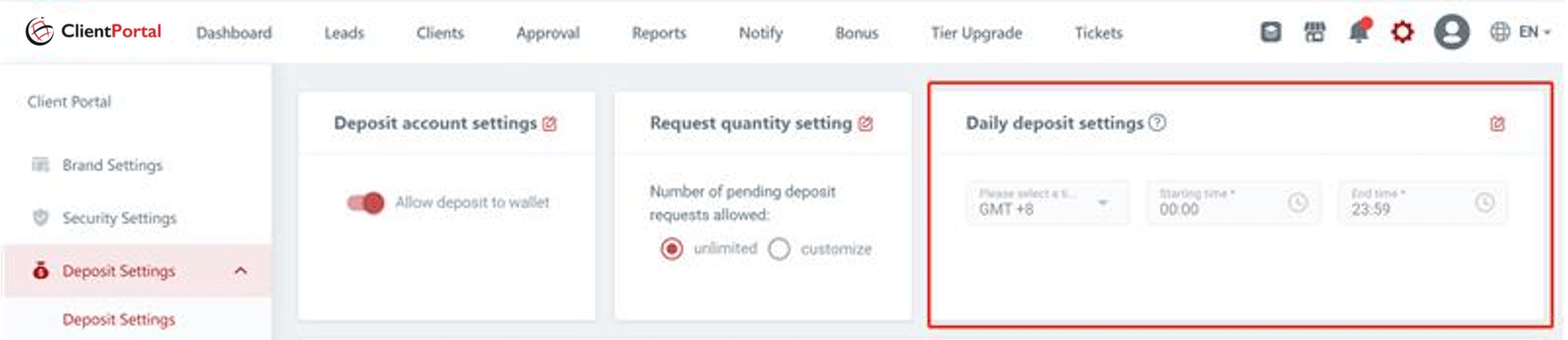

- Users can now configure a time range according to time zones for their ‘Daily Deposit Settings’.

Automated Affiliate Tier Upgrade

As the core of the AXIS CRM, the multi-tier affiliate system has received another major upgrade. With the new automated tier upgrade function, affiliate promotions can now be self-triggered upon criteria fulfilment, allow brokers and IBs to manage their affiliate networks much more efficiently.

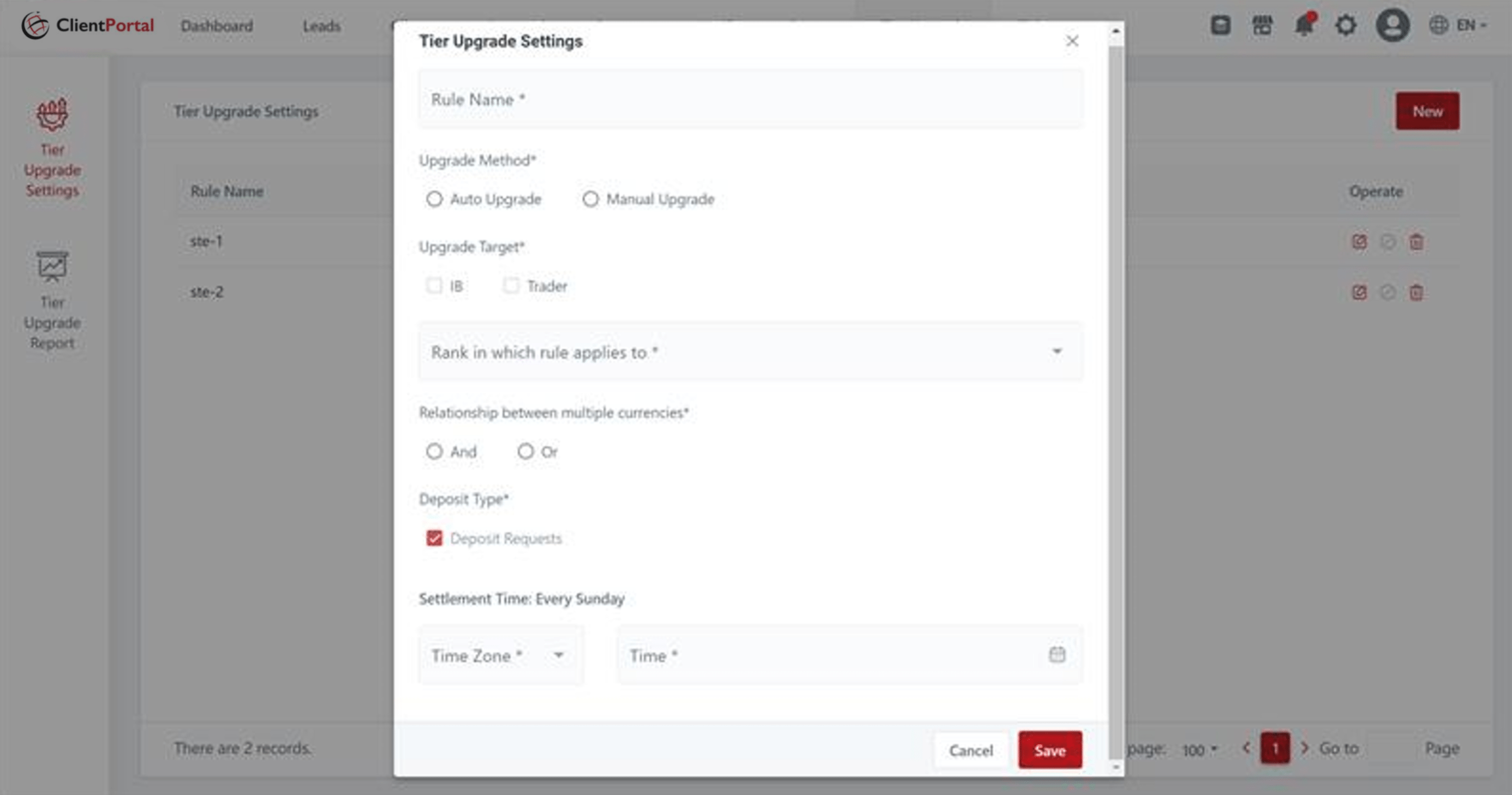

- Tier Upgrade Settings: Affiliate network tiers can now be upgraded automatically via a sophisticated rule-setting algorithm. Simply create a new rule and set the relevant parameters in which a client’s tier should be upgraded. When these criteria are met, the upgrade happens automatically with no manual administrative process required.

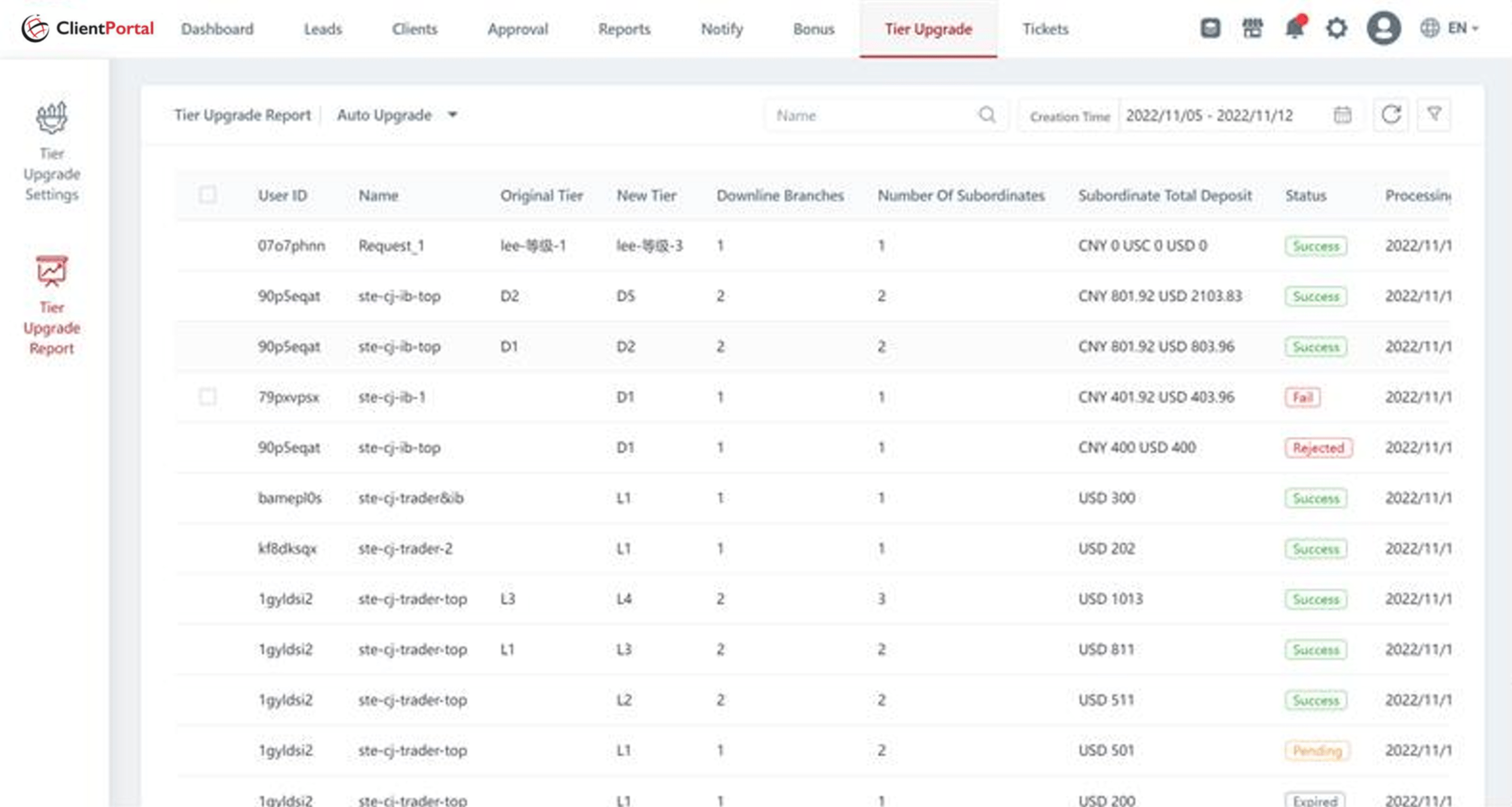

- Tier Upgrade Reports: Reports can be generated for an in-depth overview of clients and their current tiers, network hierarchy, their new upgraded tiers and more.

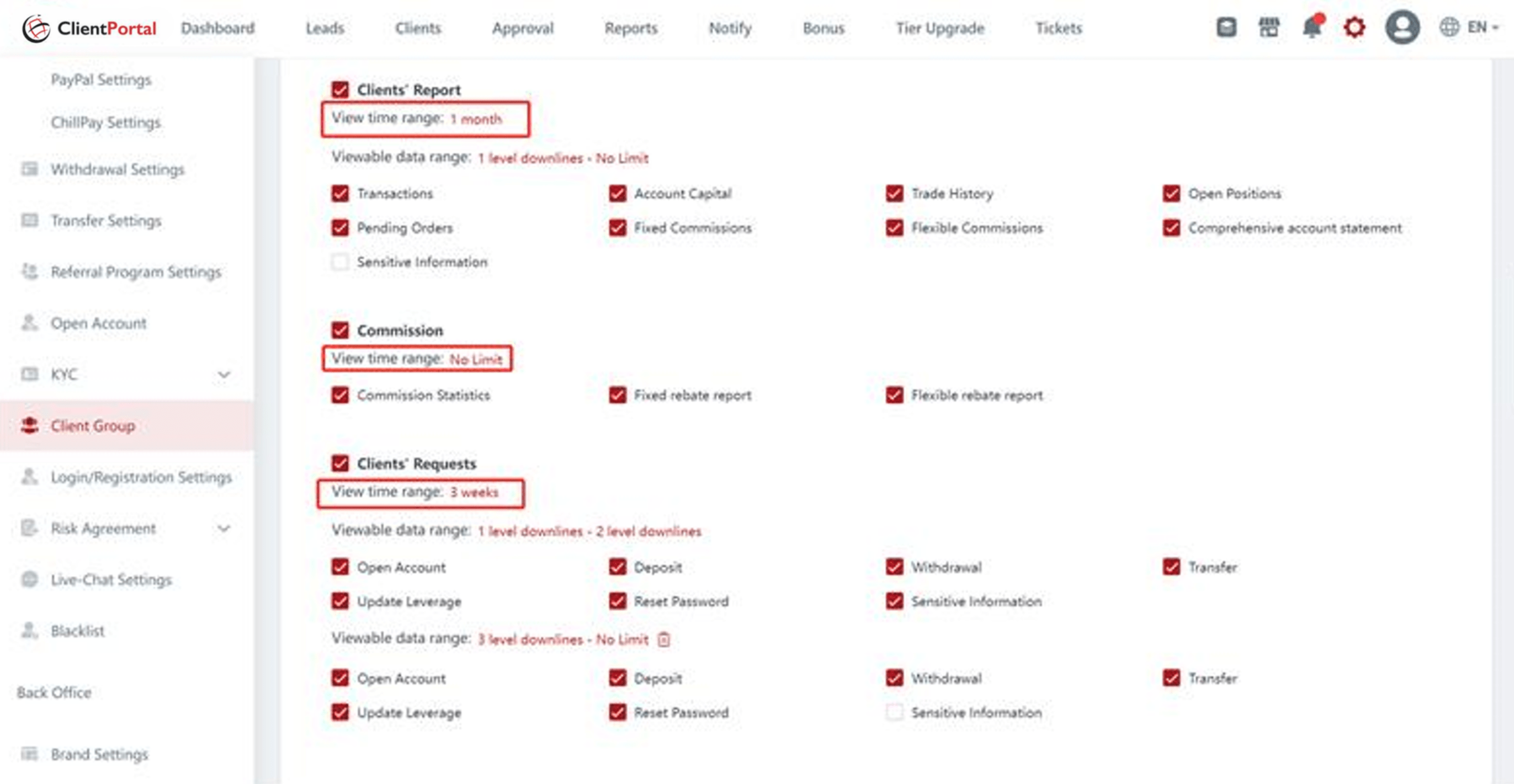

- A time range function has been added for which client reports can be viewed. Limits can be set for a number of weeks or months, and further segregated by levels of referred clients.

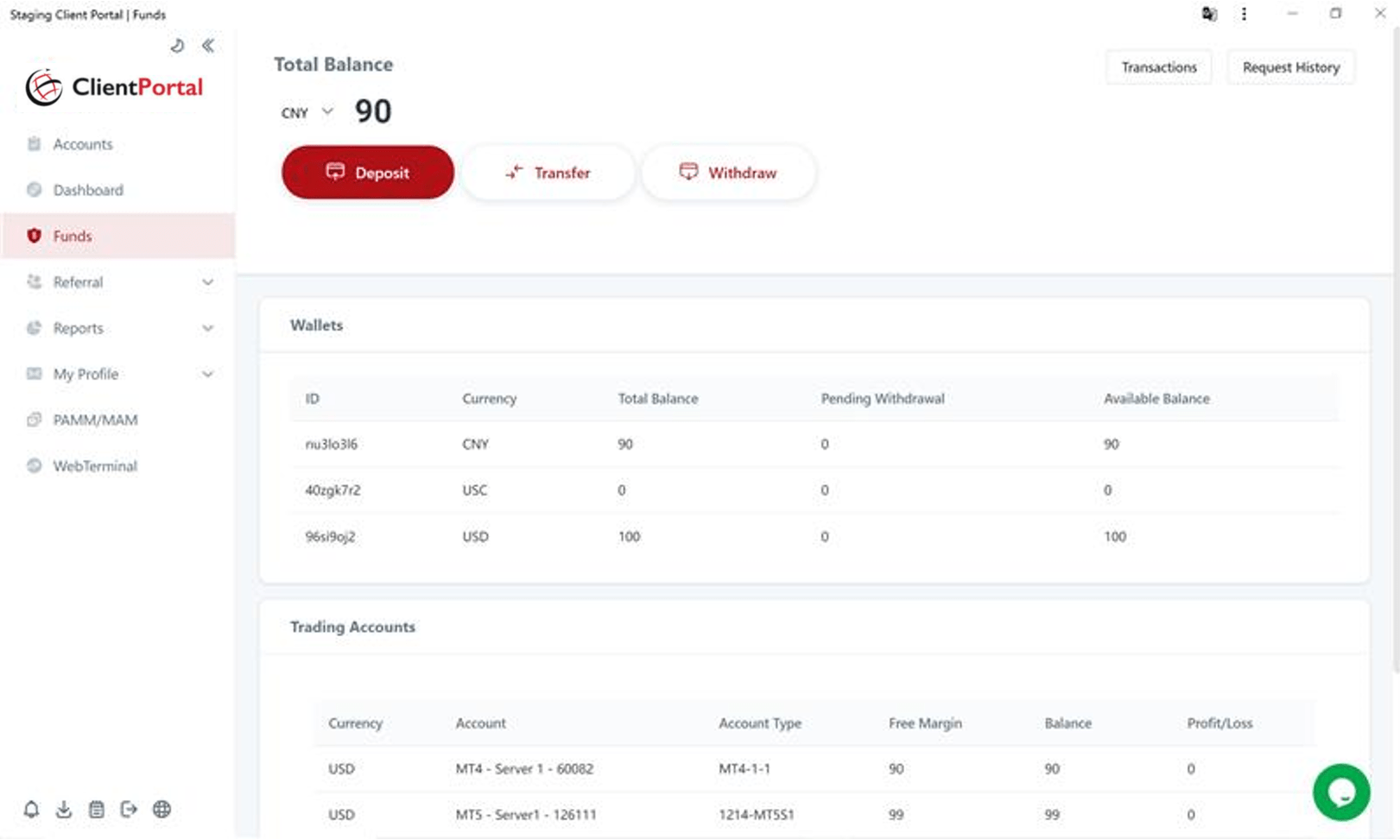

Client Portal

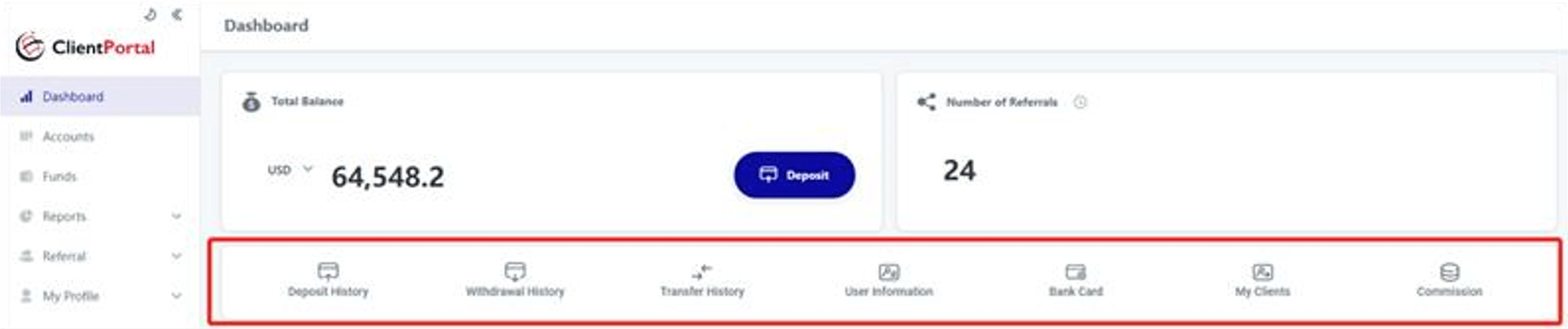

- Client Dashboard

(i) For quicker navigation, shortcuts to frequently-used functions have been added to the dashboard, so that clients can click on the icons to access them.

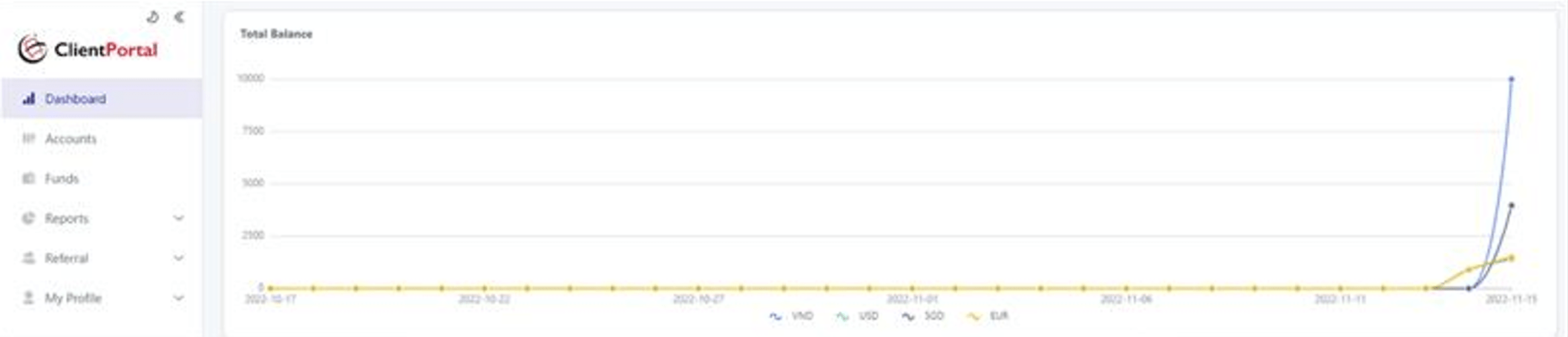

- (ii) An overview chart of the user’s ‘Total Balance’ in the last month can also be viewed from the dashboard.

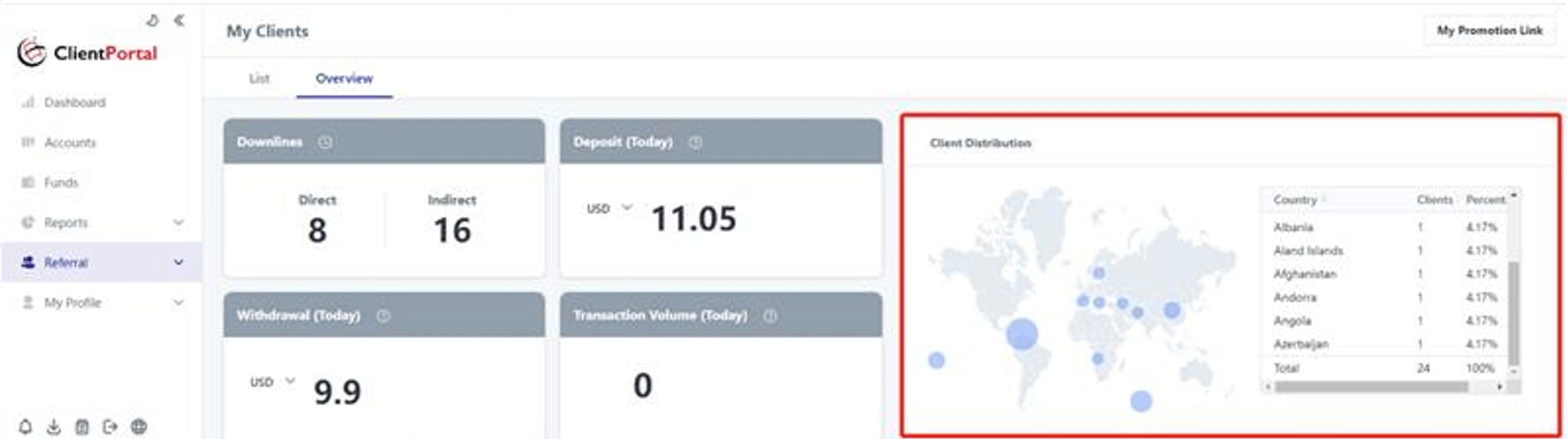

- My Clients

Client data has been streamlined with a detailed ‘Client Distribution’ table, sorting number and percentage of clients by country.

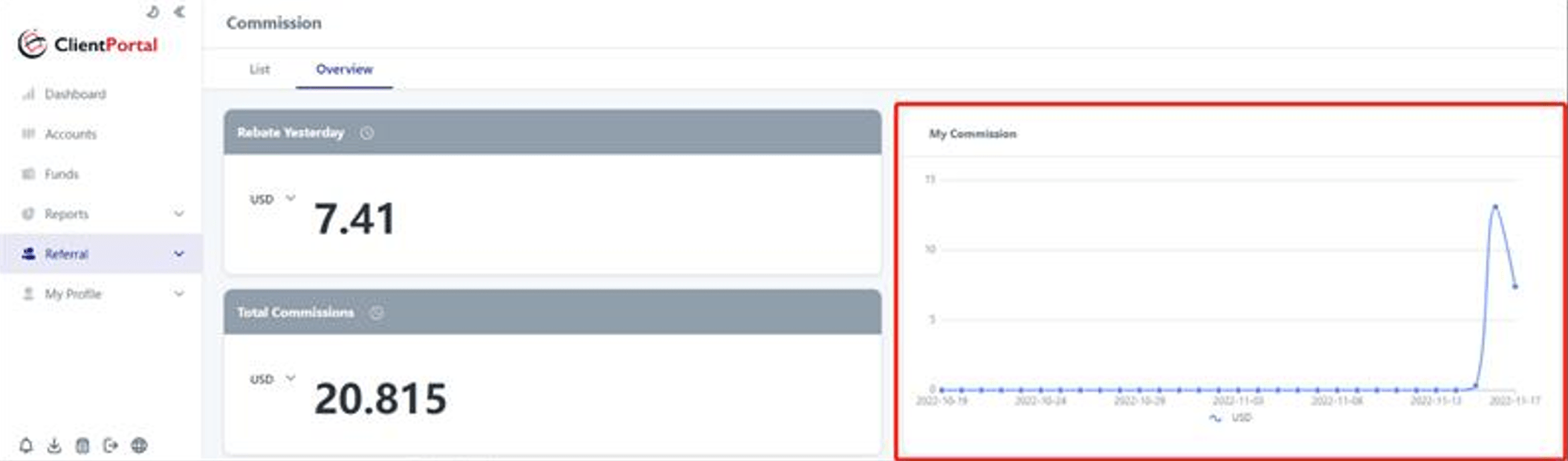

- Commission

An overview chart of the user’s ‘Commission’ in the last month can be viewed from the Referral tab.

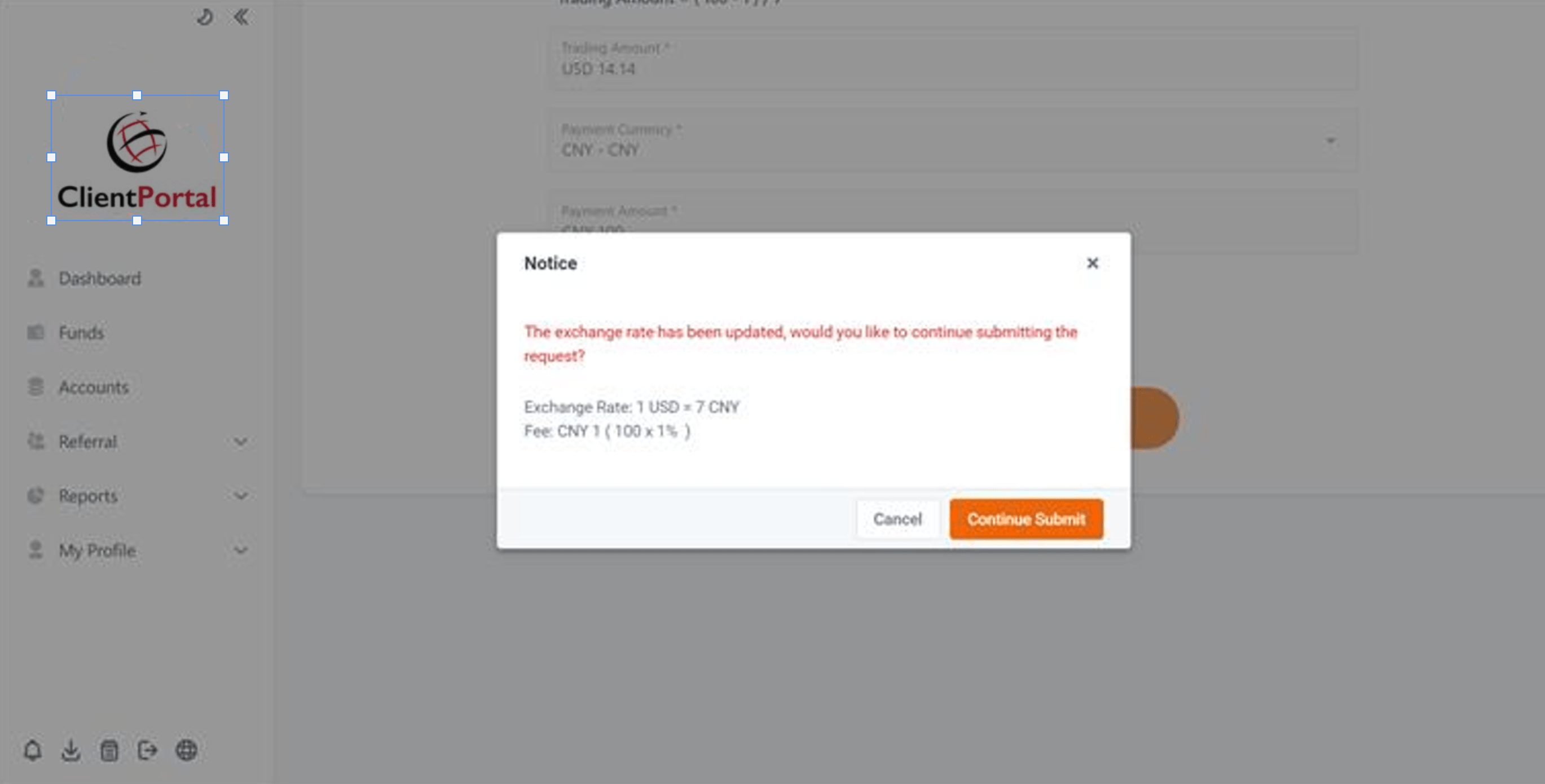

- Exchange Rate

If the exchange rate has been changed, a prompt will now appear when clients attempt to make a deposit, transfer, or withdrawal, to keep them informed and updated.

About Broctagon Fintech Group

Broctagon Fintech Group is a leading multi-asset liquidity and FX technology provider with over 15 years of global presence across China, Hong Kong, Malaysia, India, Thailand, and Armenia. We deliver performance-driven, bespokesolutions to more than 350 clients in over 50 countries, offering institutional-grade liquidity, brokerage and prop trading solutions.