What is CFD Trading and How Does It Work?

What is CFD Trading?

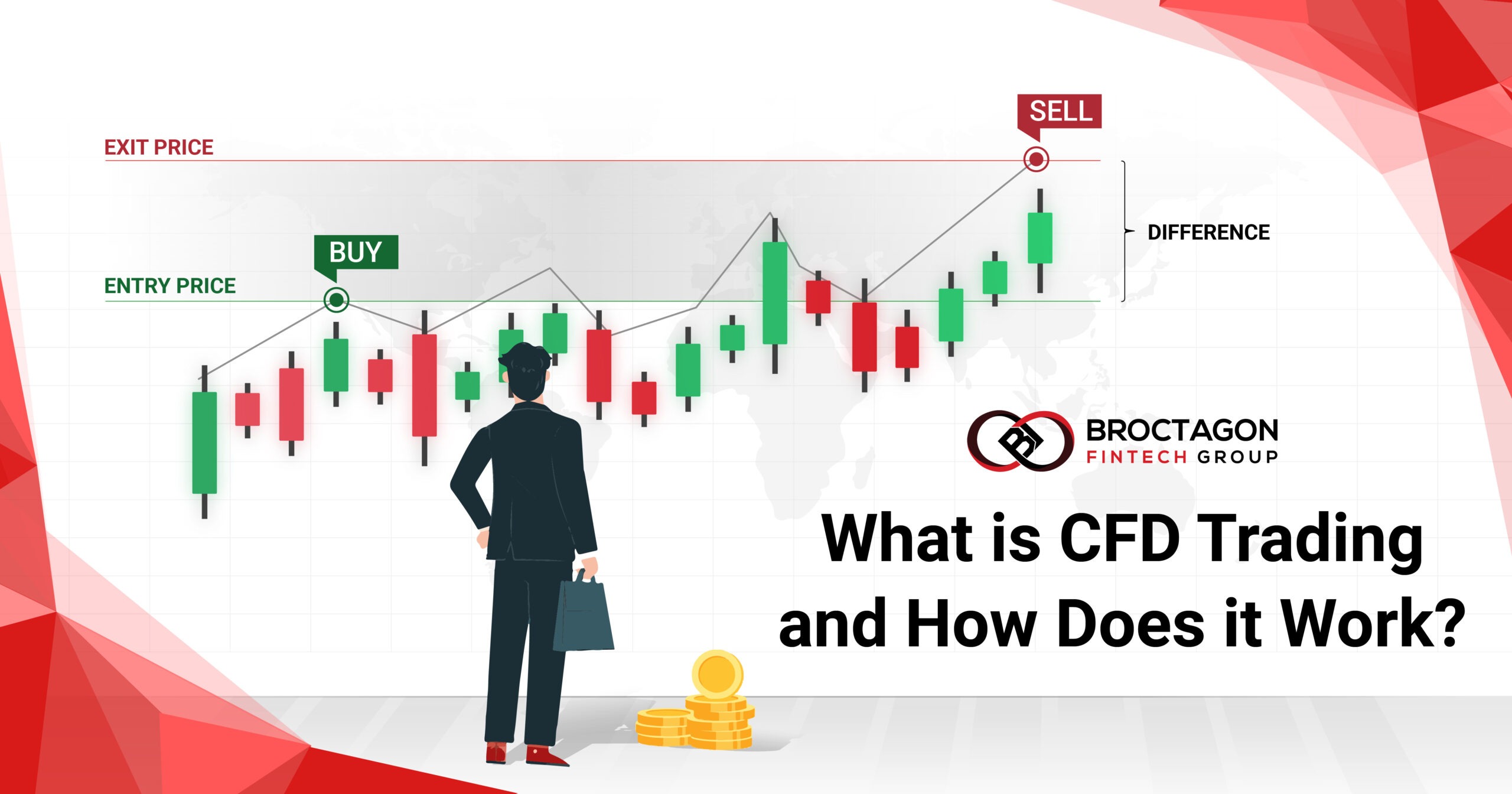

Contracts for Differences (CFDs) are contracts between investors and financial institutions in which investors take a position on the future value of an asset. CFDs is a popular form of derivative trading that allows individuals to speculate on the price movements of various financial instruments without owning the underlying assets.

It is a flexible and accessible trading method that has gained significant popularity among traders and investors. Trading CFDs offers several major advantages that have increased the instruments’ enormous popularity in the past decade. It was first popularized by Forex trading, which is limited to currencies, CFD trading opened up opportunities for traders to trade many more types of assets, and to go long and short. Traders can trade commodities, indices, futures, and even stocks using CFDs. Regardless of the currency pairs, lot sizes are uniform in all forex markets. For CFDs, however, traders can trade a wide range of contract sizes across different asset classes.

How Does CFD Trading Work?

In CFD trading, participants enter into a contract with a forex broker to exchange the difference in the value of an asset between the time the contract is opened and closed. A CFD investor never actually owns the underlying asset but instead receives revenue based on the price change of that asset. Potential benefits of trading CFDs include the ability to utilize leverage, to take advantage of both market directions by buying or short-selling, round-the-clock trading, and no ownership requirements. CFD trading also provides the flexibility to hedge positions, allowing traders to protect their portfolios against adverse market movements.

CFD trading has many advantages, including:

- Access to a wide range of markets and asset classes: Trade forex, commodities, indices, futures, stocks and even cryptocurrencies without holding the underlying asset. This is especially advantageous for cryptocurrencies as it fully removes the hassle of storing private keys and fully mitigates any risk of hacks.

- Ability to trade on both rising and falling markets: Traders can go long (buy) if they believe the price will rise or go short (sell) if they anticipate a price decline, essentially taking advantage of bear, bull, or even sideway ranging market conditions.

- Leverage to amplify potential profits: Traders can trade on margin, paying only a deposit for a much larger position, essentially using a small capital to reap large potential rewards. However, do note that high leverage can be a double-edged sword if not utilized with care, exposing traders’ entire capital to risk.

- Flexibility in trading timeframes: CFDs can be used in a ‘day trading’ approach by short term investors looking for quick turnarounds on fast-moving markets and assets, or for longer-term trades, down to holding a winning position or not so often taking a position that is aimed to be kept for weeks or months.

- Increased market exposure: Traders get the opportunity to capitalize on global market opportunities across thousands of financial assets.

These advantages make CFD trading a popular choice among traders looking for diverse trading options, and potential profit opportunities in various financial instruments.

What Types of Assets Can Be Traded?

CFDs (Contracts for Difference) provide traders with the opportunity to trade a wide range of assets. Here are some of the common types of assets that can be traded using CFDs:

- Forex Currencies: CFDs enable traders to participate in the foreign exchange market, commonly known as Forex. Major currency pairs, such as EUR/USD, GBP/USD, or USD/JPY, as well as numerous minor and exotic currency pairs.

- Shares: Traders gain access to global securities markets including USA, HK, Japan, UK, EU, and gain exposure to thousands of conglomerates from a wide array of industries.

- Indices: CFD trading allows traders to trade on entire stock market indices, such as the S&P 500, FTSE 100, or DAX 30. It offers diversified investment opportunities in global markets.

- Commodities: CFDs offer the opportunity to trade on the price of popular commodities and ‘stable’ metals and investments like gold, silver, oil, natural gas, copper, and agricultural products, without the need to store the actual physical product.

- Cryptocurrencies: With the growing popularity of digital currencies, many Forex Brokers now offer CFD trading on cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and others. This allows traders to take advantage of the price volatility in the cryptocurrency market and trade through their brokerages, without the need to go through the hassle and learning process of setting up separate accounts for crypto wallets, remembering key phrases, buying crypto assets, and more.

- Futures Contracts: Traders can also trade futures contracts such as Bonds, T-Notes and perpetual and expiration futures contracts. Futures are the most liquid way to trade commodities and traders who want to trade large amounts will find the futures market beneficial.

Advantages of Offering CFDs

Forex Brokers who decide to offer CFDs to their traders can expand their offerings and set up a more competitive and attractive business, as this offers more investment opportunities for traders with different trading styles, strategies, and risk appetites beyond trading spot forex.

Here are some key advantages:

Market Demand: CFD trading has gained significant popularity among traders and investors due to its flexibility, and accessibility. By offering CFD trading, Forex Brokers can cater to the demands of their clients who seek leveraged trading and want to speculate on the price movements of various financial instruments without owning the underlying assets.

Diversification of Product Offerings: By providing CFD trading, Forex Brokers can expand their product offerings beyond traditional asset classes such as forex. This allows them to attract a broader range of traders who wish to hedge and expand their portfolios.

Increased Trading Volume: CFD trading involves leverage, which allows traders to control larger positions with a smaller amount of capital. Higher leverage can attract traders who want to make larger trades. As a result, brokers can benefit from increased trading volumes, and transaction fees.

Commission and Spread Revenue: As FX Brokers typically earn revenue from the spreads (the difference between the bid and ask prices) they offer to traders, CFD trading provides the opportunity for brokers to generate income through spreads on a wider range of assets, including stocks, indices, commodities, and currencies.

Regulatory Advantages: Depending on the jurisdiction, CFD trading may offer certain regulatory advantages compared to other financial instruments. Forex Brokers may choose to provide CFD trading to take advantage of favourable regulations that facilitate trading activities and attract international clients with reputable regulation authorities.

Choosing the Right CFD Liquidity Provider

While there are many benefits for FX Brokers to provide CFD trading, it’s important to understand that there are risks involved, such as market volatility, potential conflicts of interest, and regulatory compliance requirements. Therefore, brokers must choose the right CFD liquidity and technology solutions provider to carefully manage these risks and ensure they have robust systems and controls in place to protect their clients and their own business interests.

Pricing Model and Transparency: Understand the liquidity provider’s pricing model and fee structure. Look for transparency in pricing, including spreads, commissions, and any additional charges. The provider should provide clear information on costs, enabling traders to accurately assess the overall trading expenses and evaluate the competitiveness of their pricing.

Range of Tradable Instruments: Consider the variety of CFD instruments offered by the liquidity provider. Assess whether they provide access to the asset classes, markets, and specific instruments that align with your trading strategy and objectives. Look for a diverse range of assets, including stocks, indices, commodities, currencies, and cryptocurrencies, to cater to different trading preferences.

Liquidity Depth and Execution Quality: Evaluate the liquidity provider’s ability to offer competitive bid-ask spreads and sufficient liquidity across a range of CFD instruments. The provider should have access to deep liquidity pools and reliable execution systems to ensure efficient trade execution with minimal slippage.

Broctagon Liquidity: Over 1,800 Assets To Choose From

As a top-tier liquidity provider with a decade of experience providing deep, multi-asset liquidity, Broctagon provides more than 1,800 instruments with a whole range of asset classes. With our proprietary aggregator technology, we are ever-increasing our assets offered, providing enhanced market depth and razor-thin spreads in a frictionless marketplace. We facilitate direct access to a large, highly diversified liquidity pool with aggregated pricing, with instant execution, no slippage, and no rejections. Dual-licensed in both Europe and Asia, we offer direct institutional access to prime liquidity and competitive leverage with liquidity solutions tailored for your brokerage.

About Broctagon Fintech Group

Broctagon Fintech Group is a leading multi-asset liquidity and FX technology provider with over 15 years of global presence across China, Hong Kong, Malaysia, India, Thailand, and Armenia. We deliver performance-driven, bespokesolutions to more than 350 clients in over 50 countries, offering institutional-grade liquidity, brokerage and prop trading solutions.