What is Smart Order Routing?

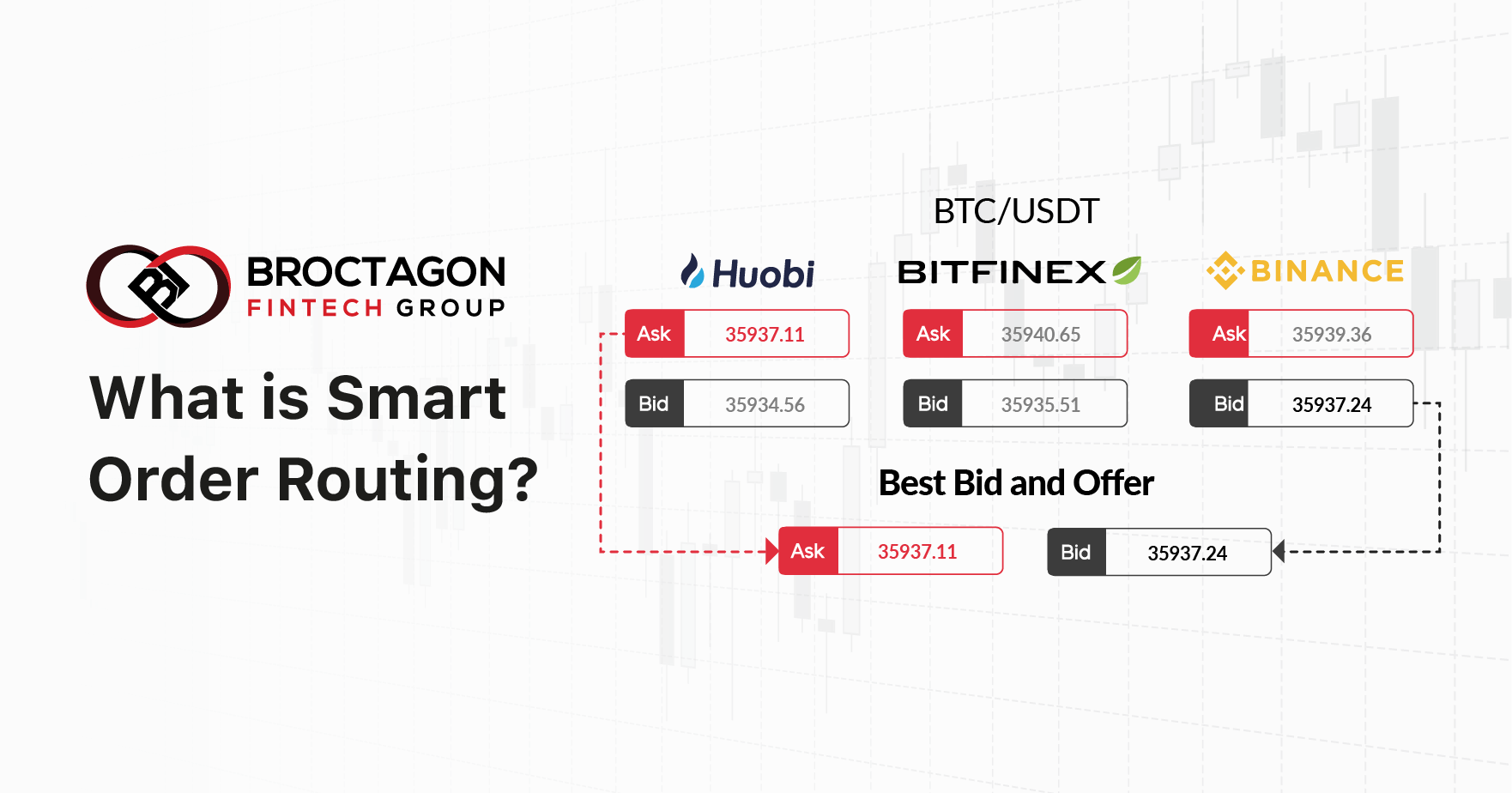

Smart Order Routing (SOR) is an automated order processing mechanism, designed to take the best available opportunity across a variety of different trading platforms.

The rise in the number of different trading platforms and multilateral trading facilities (MTFs) contributes to a surge in liquidity volatility as the same asset is exchanged in multiple venues, causing the price and quantity to vary between each platform. SOR helps to counter, or even gain, from liquidity fragmentation. SOR is carried out by smart order routers; systems designed to analyse the state of the venues and position orders in the best possible way to achieve the best ask/bid prices.

The Beginnings of Smart Order Routing in Traditional Exchanges

Before the current routers started gaining attention, Direct Order Turnaround or DOT were the original versions of SOR. However, it could only guide orders to one destination within the institutional buy-side. Stock exchanges would have to manually search and compare data from different venues on their own.

However, in 2007–2008, smart order routers started to gain widespread attention in Europe, with the primary goal for capturing liquidity at various venues. The SOR systems were enhanced and this helped stock exchanges to cope with high-frequency trading, enjoy reduced latency and incorporate smarter algorithms. After its spike in popularity, SOR improved the overall efficiency of order routing by choosing the most suitable execution prices.

The implementation of SOR enables exchanges to get the best prices from multiple market platforms automatically, hence optimizing the best outcome of all trade orders and drastically reducing the need for exchanges to source for prices manually.

Smart Order Routing in Crypto Exchanges

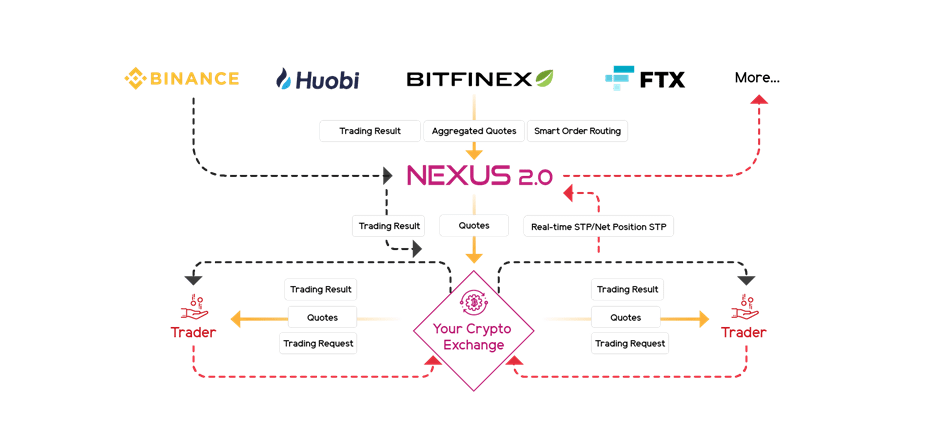

Although cryptocurrencies were initially created as an alternative peer-to-peer electronic cash system to replace fiat and legacy payment services, the limits of scalability and levels of volatility prevents it from being adopted at a mass scale. Compared to traditional markets, the crypto market is still in its nascent stage. Currently, apart from centralized marketplaces, cryptocurrencies can be traded on various trading venues, including decentralized exchanges. The flip side to this flexibility is the liquidity fragmentation that occurs when the prices and volumes of the same coins differ on different platforms. Similar to stock exchanges, SOR can be implemented to solve these fragmentation issues in crypto through NEXUS 2.0, Broctagon’s proprietary liquidity aggregation engine.

How SOR in NEXUS 2.0 works

NEXUS 2.0 connects your Crypto Exchange to the aggregated liquidity pool of the industry’s largest exchanges such as Binance, Huobi, Bitfinex and more. By tackling liquidity fragmentation through SOR, the NEXUS liquidity network sets the foundational infrastructure for inter-exchange liquidity – a parallel to interbank FX liquidity.

The automation provided through NEXUS 2.0 matching engines helps to process orders at the best price available in real time. Upon trade confirmation, orders are automatically allocated to the best-priced exchange through real-time/net position STP (Straight Through Processing) functionality to ensure instant communication between relevant counterparties.

What this means for exchanges is that their traders will effectively trade across multiple exchanges through a single avenue. They will have round-the-clock access to the fairest trades at the best market prices, regardless of illiquid market circumstances.

Discover how NEXUS 2.0 streams liquidity in real-time for the best prices through a demo. Simply indicate your timing preference here: https://bit.ly/TeresaBroctagon

For more information on Broctagon’s offerings, head to https://broctagon.com/nexus/

About Broctagon Fintech Group

Broctagon Fintech Group is a leading multi-asset liquidity and FX technology provider headquartered in Singapore, with over 15 years of global presence across China, Hong Kong, Malaysia, India, Thailand, and Armenia. We deliver performance-driven, bespoke solutions to more than 350 clients in over 50 countries, offering institutional-grade liquidity, brokerage and prop trading solutions, as well as enterprise blockchain development.