What Is Liquidity Aggregation and It’s Important for Your Crypto Exchange

Liquidity in cryptocurrencies is important, but unlike the Forex market, there is a notorious lack of liquidity in the crypto market. The need for liquidity aggregation is therefore really crucial to bring crypto to the level of trading and activity like in the forex market. In this article, we’ll understand why liquidity is important and how liquidity aggregation will supercharge your orderbook and boost trading activity on your exchange.

What is Liquidity?

In financial markets, liquidity refers to how quickly an investment can be sold without negatively impacting its price. The more liquid an investment is, the more quickly it can be sold, and the easier it is to sell it for fair value or current market value. More liquid assets generally trade at a premium and illiquid assets trade at a discount. Illiquid assets make for unattractive investments as traders do not wish to be stuck with an asset they are unable to sell.

Why is Liquidity Important?

High liquidity in a financial asset marketplace is important as it gets the best prices for buyers and sellers. A buoyant marketplace with a high level of trading activity tends to create an equilibrium market price that is acceptable for all.

Ample liquidity also ensures that prices are stable and not prone to large swings resulting from large trades which could affect cryptocurrency prices while fuelling increased volatility and risks for the general market. In a liquid market, prices are stable enough to withstand large orders because of the large number of market participants and their orders. Liquidity also allows for greater technical analysis accuracy since price and charting formation in a liquid market is more developed and precise.

The Problem with Liquidity in Crypto

Liquidity in cryptocurrency means the ease with which a digital currency or token can be converted to another digital asset or cash without impacting the price and vice-versa. Liquidity is important for all tradable assets including cryptocurrencies. Low liquidity levels mean that market volatility is present, causing spikes in cryptocurrency prices. High liquidity, on the other hand, means there is a stable market, with few fluctuations in price. Crypto liquidity however, is notoriously low, and even more so for low cap cryptocurrencies.

What is Liquidity Aggregation?

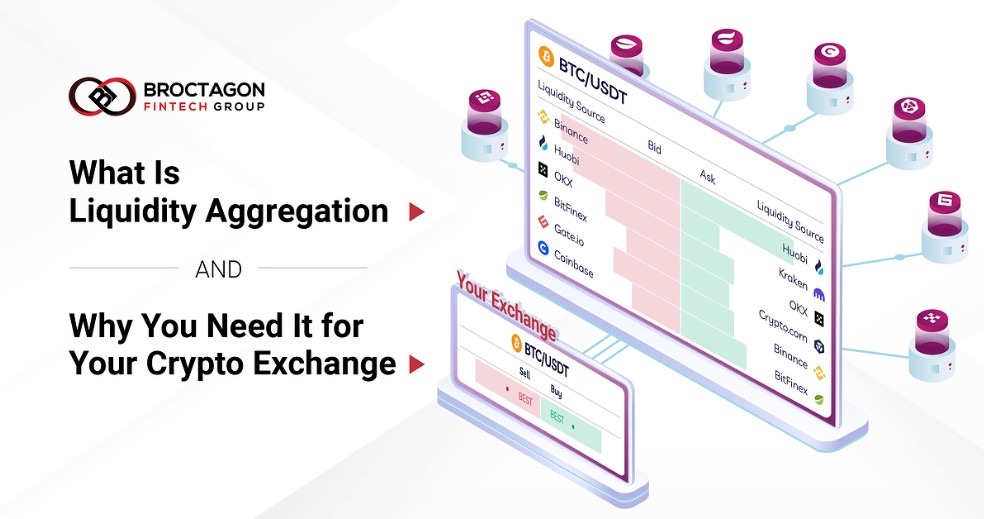

Liquidity aggregation is especially important for a cryptocurrency exchange. It is the process of gathering buy and sell orders from different sources and directing them to a given executing party. This is done from multiple sources to minimize the risks from using a single liquidity provider. With liquidity aggregation, a crypto exchange can thrive more with more buy and sell orders to prevent stagnancy.

Why Do Crypto Exchanges Need Liquidity Aggregation?

The cryptocurrency market is extremely volatile, and various platforms may offer different prices for the same asset, say BTC. For example, exchanges A, B, C all offer BTC at prices ranging from $15,000 to $18,000. A trader wants to buy BTC, but there are only orders with prices higher than $17,800 at the moment. The trader has two options: raise their buying price or go to a different exchange to search for a better price. With liquidity aggregation, an exchange can gather buy and sell orders at favorable prices from the multiple exchanges and provide them to the trader. This helps crypto exchanges retain their trader base by remaining competitive with robust liquidity.

NEXUS Liquidity Aggregator & STP Engine

With Broctagon’s proprietary liquidity aggregation engine NEXUS, stream the world’s largest inter-exchange liquidity pool into your exchange, complete with Straight-Through-Processing (STP) execution via Smart Order Routing (SOR). The NEXUS Link Module consists of a centralized exchange (CEX) liquidity aggregator that combines the order books of all connected makers, allowing you to add more than 1000+ crypto pairs to your product offering instantly.

With Order Book Streaming, the aggregated order books of selected crypto pair are pushed directly into your exchange, populating your order books automatically in addition to your local organic orders.

Your order books will be equivalent or better than any single top-tier exchange.

- Global price discovery with executable price feed

- Best Bid/Ask with top of book prices

- Aggregated full Market Depth for high volume absorption and minimal slippage

Offer any trending crypto pair instantly without the need to build an organic book from scratch.

- Add more than 1000 tokens/coins to your offering

- Product list expands dynamically with liquidity makers

- Trending tokens/coins are immediately available

Our API-agnostic infrastructure allows you to integrate NEXUS with zero inertia within a fast turnaround time averaging 4 Days.

About Broctagon Fintech Group

Broctagon Fintech Group is a leading multi-asset liquidity and FX technology provider headquartered in Singapore, with over 15 years of global presence across China, Hong Kong, Malaysia, India, Thailand, and Armenia. We deliver performance-driven, bespoke solutions to more than 350 clients in over 50 countries, offering institutional-grade liquidity, brokerage and prop trading solutions, as well as enterprise blockchain development.