Decentralized Exchanges (DEX) and Automated Market Maker (AMM) Platforms

1. Decentralized Exchanges and Automatic Market Makers

A decentralized exchange (also known as a DEX) or and Automated Market Maker (AMM) is a peer-to-peer marketplace where cryptocurrency traders may transact directly with one another. DEXs and AMMs enable disintermediation of financial transactions, thus not needing any centralized party or centralized order book for trading between different crypto-pairs. The mots prominent DEXs, such as Curve Finance, Uniswap, and Sushiswap, are based on the Ethereum blockchain and are part of a growing suite of decentralized finance (DeFi) technologies that allow users to access a wide range of financial services directly from a comptaible crypto wallet. DEXs are flourishing, with $217 billion in transactions passing through them in the first quarter of 2021. There were more than two million DeFi dealers in April 2021, up tenfold from May 2020.

Decentralized Exchanges are composed of smart contracts. They employ “liquidity pools” in which investors lock assets in exchange for interest-like returns, to ease trades and set the values of multiple cryptocurrencies against each other algorithmically.

DEX transactions are settled on the blockchain immediately. DEXs are designed with open-source code, allowing anybody with a desire to understand how they function.

2. What we offer

Our team offers the creation of custom DEX and AMM protocols designed to accommodate your particular use cases and business objectives. Based on your needs, we can cherrypick the most cutting-edge features from the exisiting protocols and go several steps beyond by introducing innovative features which can position your product in the market, making it unique.

3. Notable DEXs and AMMs

Curve is a liquidity pool decentralized exchange based on Ethereum and numerous EVM blockchains. Curve is designed for extremely efficient stablecoin trading and low risk, supplemental fee income for liquidity providers without an opportunity cost.

Curve has a total of about USD 9 billion locked across its different liquidity pools,

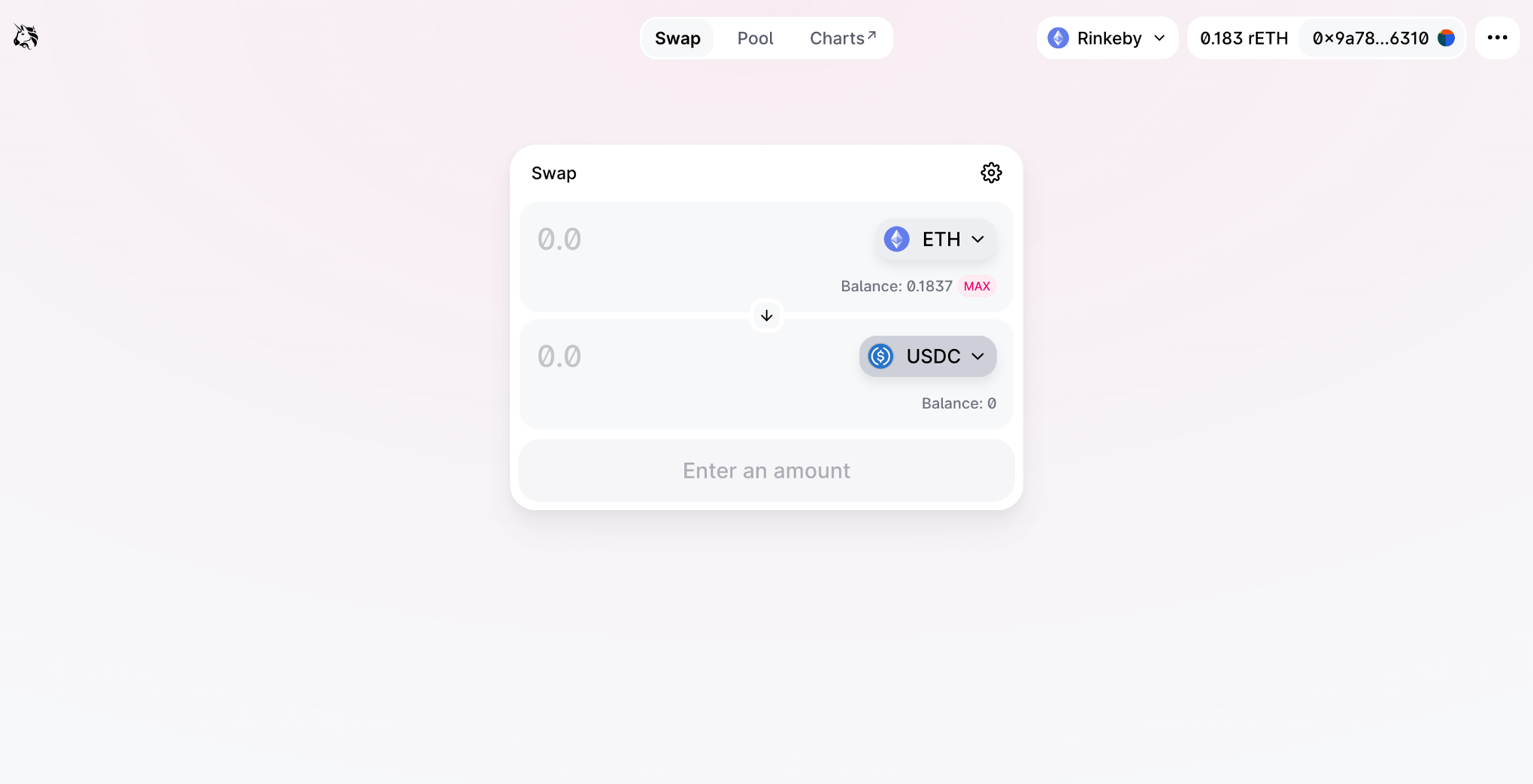

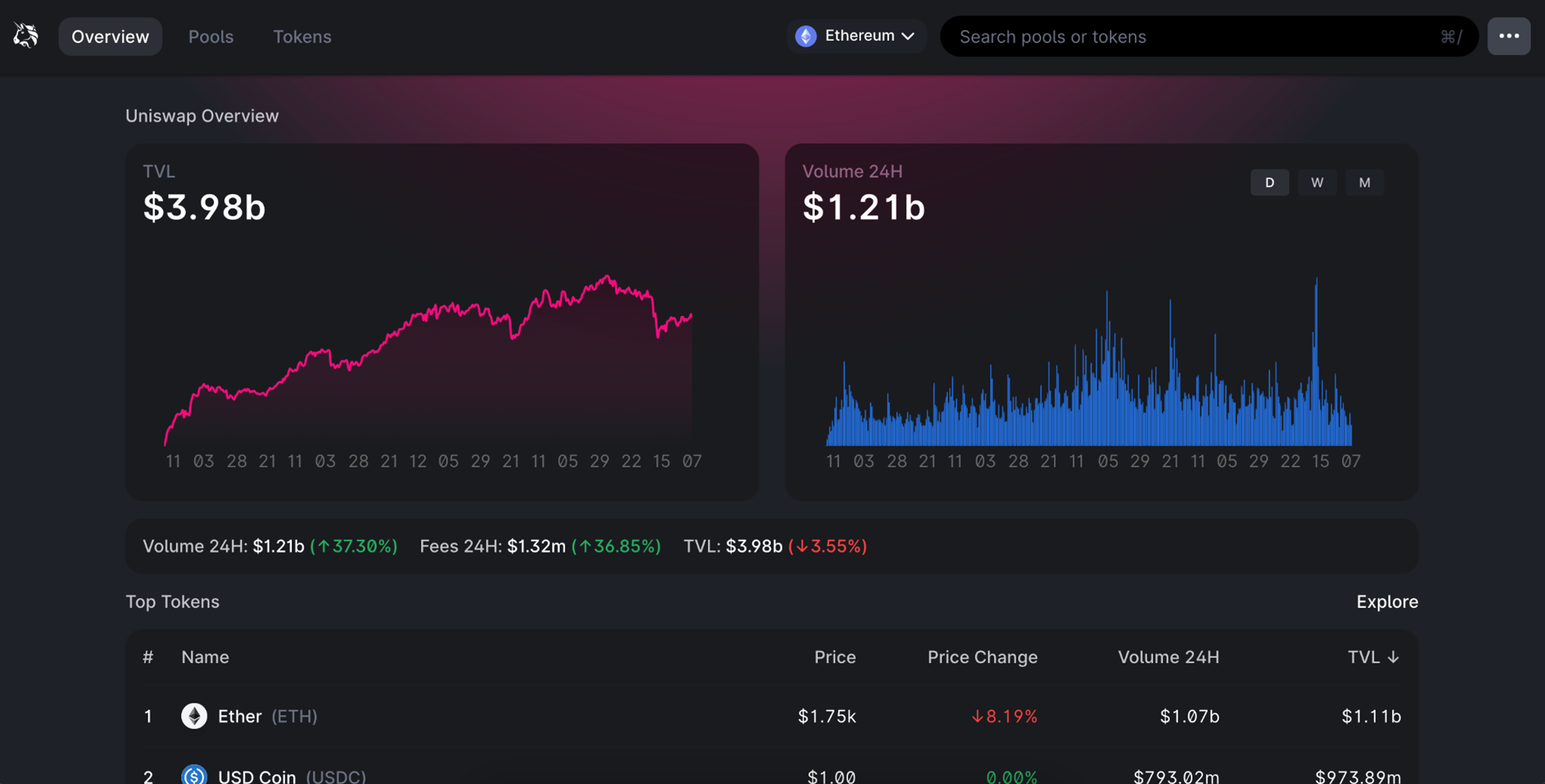

The Uniswap and Sushiswap protocols are peer-to-peer platforms designed for exchanging cryptocurrencies (ERC-20 Tokens) on the Ethereum blockchain. The protocol is implemented as a set of persistent, non-upgradable smart contracts; designed to prioritize censorship resistance, security, and self-custody and to function without any trusted intermediaries who may selectively restrict access.

Uniswap and Sushiswap have a total of about USD 6 billion and USD 2 billion locked, respectively, across their different liquidity pools

Pancake Swap operates with a similar model to Uniswap; however, the platform is based on the Binance Smart Chain. Pancake Swap has a total of about USD 3.88 billion locked across its different liquidity pools.

Contact Us

Contact us for the development of your custom DEX & AMM platform

4. Advantages of Using Blockchain for Lending Platforms

Big Variety of Tokens

DEXs offer a virtually limitless range of tokens, as there is no vetting process in generating a liquid pool for any token. This means any community member or any project ma create a iquidity pool for their desired token.

Security

No Counterparty Risk

There is no counterparty risk in the case of DEXs as there is no centralized intermediary that needs to be trusted b the users.

Permissionless

Since DEXs are permissionless, and thus they don’t check the user’s identity. Anyone that has a cryptocurrency wallet is able to trade tokens in a DEX. Thus, there are no KYC/AML requirements for users in DEXs.

Liquidity Provider Rewards

Transparency

DEXs have transparent liquidity levels in the platform and algorithmic pricing.

Decentralized Governance

Contact Us

Contact us for the development of your custom DEX & AMM platform

5. Integration of Blockchains

We can assist having the DEX/AMM deployed in a wide variety of EVM compatible blockchains and L2s:

Ethereum

Avalanche

Polygon

Binance Smart Chain

Fantom

Optimism