Supercharge Your Exchange Liquidity

Connected to:

![]()

Live Price Quotes

Live Price Quotes

Spot Digital Asset Liquidity for Exchanges

| Instrument | Symbol | Liquidity Source | Sell | Spread | Buy | Liquidity Source |

|---|

| Instrument | Symbol | Liquidity Source | Sell | Spread | Buy | Liquidity Source |

|---|

| Instrument | Symbol | Liquidity Source | Sell | Spread | Buy | Liquidity Source |

|---|

*Note: Yellow boxes indicate a negative spread and arbitrage opportunity.

These Aggregated Buy/Sell Prices Will be Immediately Reflected in Your Orderbook.

What Does For Your Exchange

Boost Your Order Book

For The Most Competitive Offerings

With NEXUS 2.0, your Order Book will now reflect the aggregated price quotes from a globally sourced liquidity pool. Your traders will experience unprecedented market depth and liquidity.

NEXUS 2.0

NEXUS 2.0

WITHOUT NEXUS 2.0

WITH NEXUS 2.0

STP Orders via SOR

For Execution Excellence

The NEXUS 2.0 Matching Engine automatically selects the best BID and ASK prices across all connected exchanges to be executed via Smart Order Routing (SOR). Your traders will always get the best prices available.

Enhance Trading Experience

Stay Ahead of Competition

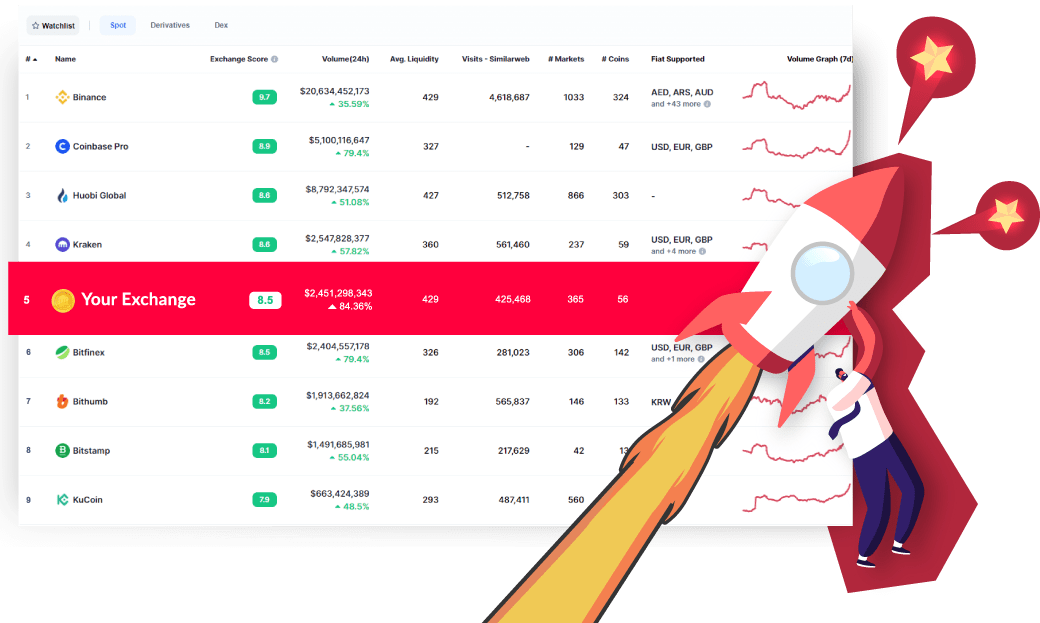

NEXUS 2.0 levels the playing field, allowing Your Exchange to offer similar or better conditions than any single top exchange.

- Higher quote frequency resulting in more detailed charts

- Multiple liquidity tiers allow large orders to be executed without price slippage

- Ultra-tight spreads keeps trading cost low for traders

NEXUS 2.0

NEXUS 2.0

The Future of Digital Asset Liquidity –

A Parallel to Interbank FX Liquidity

We’re just 1 API Away

Scale The Rankings of CoinMarketCap with

Schedule a Demo