Liquidity Aggregator & STP Engine

Stream the world’s largest inter-exchange liquidity pool into your exchange, complete with Straight-Through-Processing (STP) execution via Smart Order Routing (SOR).

Add more than 1000+ crypto pairs to your product offering instantly.

Key Functions

Liquidity Aggregation

The NEXUS Link Module consists of a centralized exchange (CEX) liquidity aggregator that combines the order books of all connected makers, currently representing more than 85% of global CEX liquidity.

Liquidity Network

Order Book Streaming

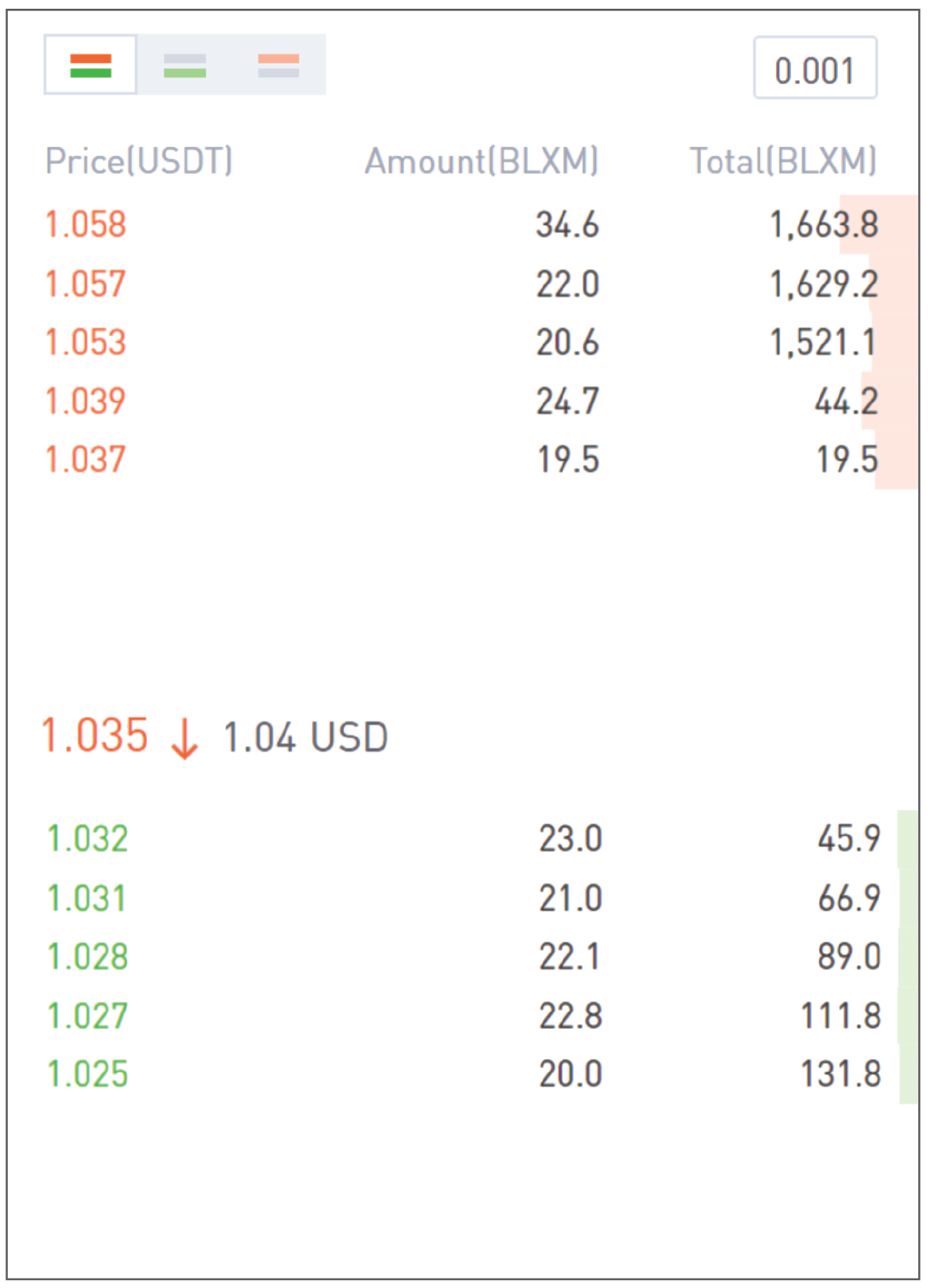

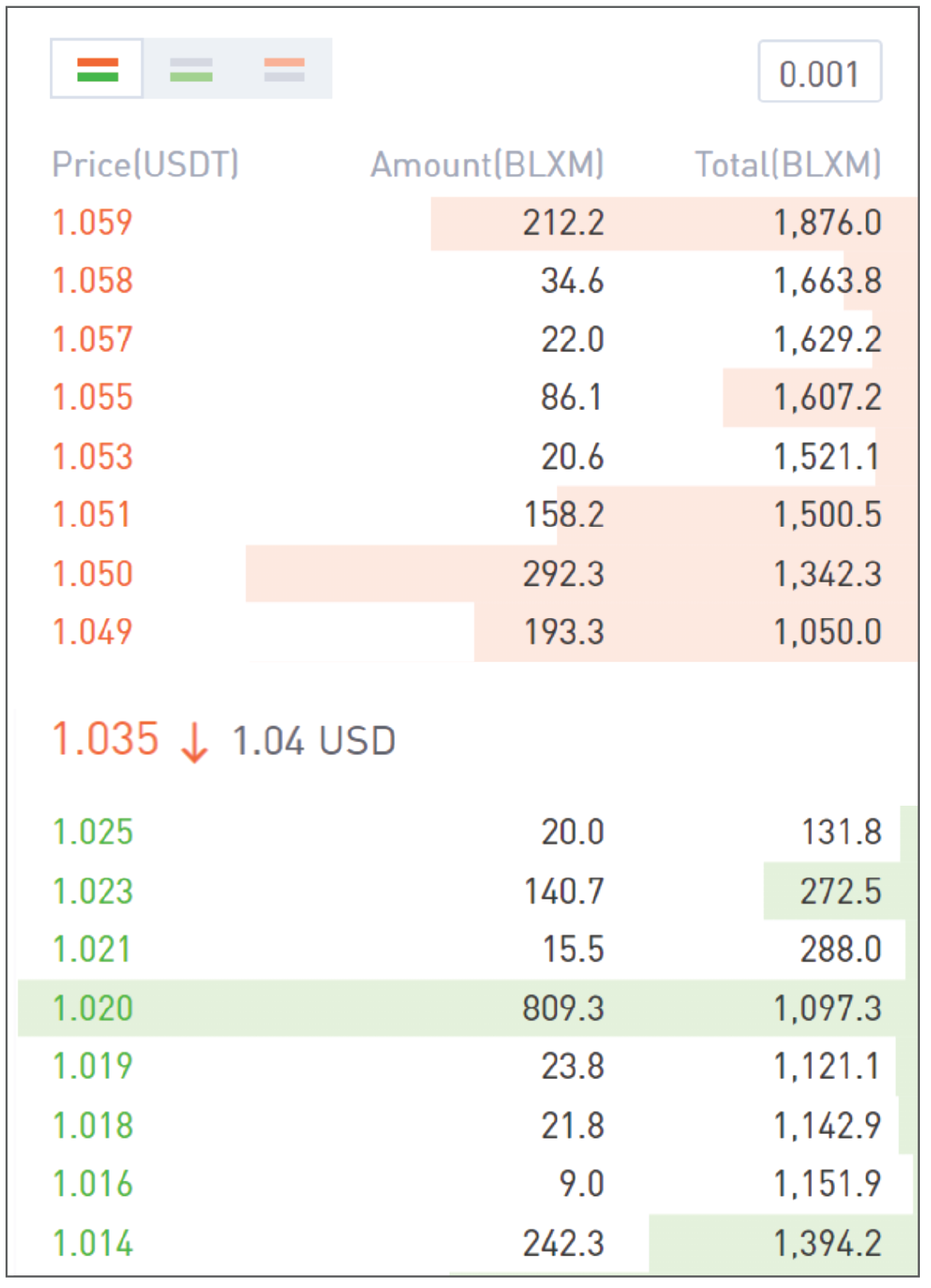

The aggregated order books of selected crypto pair are pushed directly into your exchange, populating your order books automatically in addition to your local organic orders.

STP Execution Upstream

Streamed global orders that are matched can be Straight-Through-Processed (STP) via Smart Order Routing (SOR) to the origin liquidity maker.

Advantages to Your Exchange

Supercharged Order Books

Your order books will be equivalent or better than any single top-tier exchange.

- Global price discovery with executable price feed

- Best Bid/Ask with top of book prices

- Aggregated full Market Depth for high volume absorption and minimal slippage

Widest & Latest Product Range

Offer any trending crypto pair instantly without the need to build an organic book from scratch.

- Add more than 1000 tokens/coins to your offering

- Product list expands dynamically with liquidity makers

- Trending tokens/coins are immediately available

More Revenue Opportunities

Experience enhanced business performance as you bring greater trading conditions to your clients.

- More transaction volume and revenue for matching orders beyond your local order book

- Increase your markups to price quotes with negative bid/ask spreads made available

- Increased trading volumes captured on your exchange for better ranking and exposure

Enhanced Charts

Detailed charts improves accuracy of charting tools, overall user experience and confidence.

- Expanded order book with more transactions

executed creates more data points on your charts - Highly detailed chart K-lines as a reflection of global price discovery

STP Order Flow

Tech Infrastructure

In addition to top Crypto Exchanges, the NEXUS 2.0 liquidity aggregator is also connected to Prime Brokers.

Full Offering

FX & Crypto CFD Liquidity for Brokers and Financial Institutions (including Metals, Commodities, Shares, Indices)

Spot Crypto Liquidity, Order book and STP for Crypto Exchanges

Pricing Engine for Crypto OTC

NEXUS is capable of processing >100,000 orders/sec with strict price/time priority matching algorithms

NEXUS is connected to upstream exchanges through direct leased lines for low latency robust execution

We can connect to any exchange your token is listed on

Our API-agnostic infrastructure allows us to integrate with zero inertia within a fast turnaround time averaging 4 Days.

NEXUS 2.0 Crypto Liquidity Suite

Liquidity Aggregator

& STP Engine

Automated Market Maker

& Risk Management

Chart Synthesis

Liquidity Management