Brokerage. Blockchain. Buzz.

Welcome, find all things buzzing on board at Broctagon’s blog! Here you’ll find the latest in blockchain news, exciting event highlights, insightful thought leadership in forex and crypto, and more. Be the first to know all about our events and most innovative tech updates – all in one space.

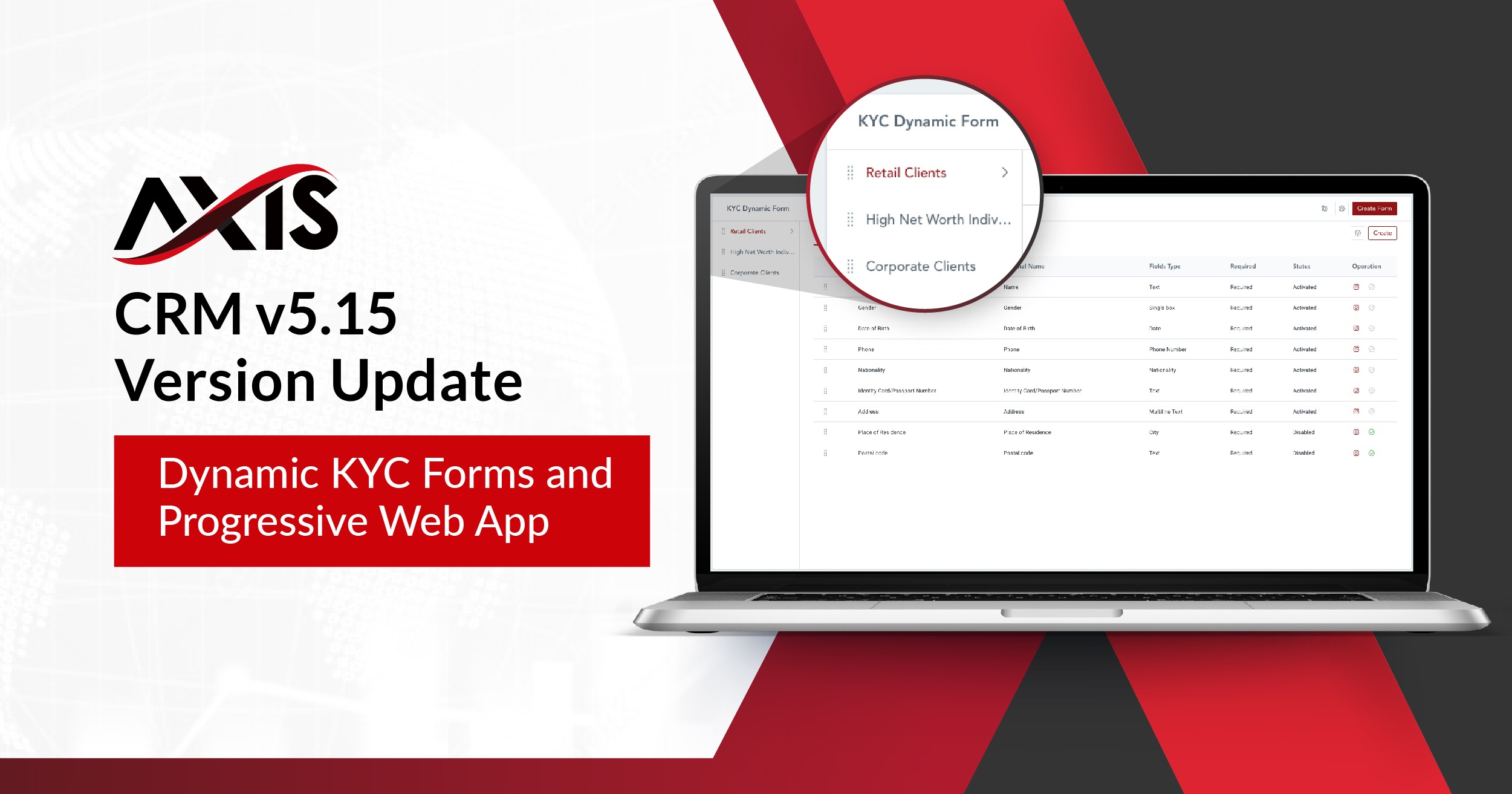

In this latest version update AXIS CRM V5.15, we are pleased to announce the launch of a game-changer for FX brokerages using AXIS – the Progressive Web App (PWA) client portal. We also introduced other updates that would improve dynamic customization and control for brokers to onboard new users. Progressive Web App (PWA) We have launched the progressive web app (PWA) for brokers, introducing a stunning combination of rich functionality and the smooth user experience associated with native apps, while also offering seamless compatibility. The PWA will mimic navigation and interactions of a native app, allowing brokers to implement dynamic functionalities without requiring any complication installation process. The PWA will bring a host of advantages to brokerages and their clients: Full Responsiveness and Browser Compatibility: PWAs work with all browsers and are compatible with any device, delivering the same experience to tablet and mobile users as well. The PWA is built according to progressive enhancement, a web design strategy that provides functionality and content regardless of types of browsers while delivering more sophisticated page versions to users whose newer browsers can support them. Connectivity Independence: Progressive web applications can work both offline and on low-quality networks and delivers basic functionality regardless of connectivity. Easy Updates and Installation: Apps can be shared through a URL instead of having to download it only from the app store. The installation is simple, traders can now install the client portal desktop app from their browsers. Here’s how you share the PWA for different operating systems and devices: For Apple iOS Devices Safari browser: The installation window cannot be set to automatically pop up. Users can click the "Share" button and select "Add to Home Screen" from settings Chrome and Edge browsers: Similarly, the installation window cannot be set to automatically pop up. The PWA cannot be added to the desktop through these browsers, as iOS system does not allow this permission to third-party applications. For Android Devices For Chrome and Edge browsers: Different mobile phone brands may behave differently. The following brands have been tested: OPPO, Xiaomi: The installation window pops up, and PWA can be installed on the desktop. HUAWEI HarmonyOS: The installation window pops up, users can manually add it to their desktop. Dynamic KYC Forms We have also introduced dynamic KYC form settings to introduce a more seamless and efficient onboarding process for different categories of clients that may require different sets of KYC information. Admins can now add multiple KYC forms under the ‘KYC Settings’ in the ‘KYC Dynamic Form’ tab. Field descriptions can now be added on the ‘Form Type Settings’ page to provide clarity for forms and their functions for internal teams. Admins can edit, disable, or delete the forms from the same page. We have added a preview function in the ‘Display Mode’ for documents uploaded to ‘KYC Dynamic Form’. The only formats not supported are .txt, .xlsx and .docx. On the client portal, users will get the option to select the relevant KYC form before submitting it. The trader registration process is optimized to 4 steps to greatly reduce sign-up friction. Client Management A new ‘tasks’ function has been added to allow brokers to better manage clients and structure their internal processes by creating tasks and to-do lists. Here is the new ‘Tasks Settings’ page, which shows an overview of all pending tasks assigned, follow-up needed for clients and their priority status. Tasks will also show up on a specific client’s page, and admins can add new tasks where needed. Tasks can also be set to follow up on a ‘Leads’ page, so that no potential leads are lost.Permissions can be configured for different admin levels such as ‘Read Tasks’ and ‘Add Tasks’. Types of admin-data permissions include: Company Wide: View all tasks assigned to company-wide on the list, and client and lead details pages. All Referred Clients: View tasks assigned to all subordinate users on the list, including client and lead details pages. Directly Referred Clients: View tasks assigned to direct subordinate users on the list, including client and lead details pages. Time stamps have been added to ‘Follow-up Record’ to allow client follow-ups to be better managed. Automated System Tags For certain event-trigged actions, the CRM system can now tag these actions automatically, allowing admins to sort and view account actions clearly. These events are: ‘Deposited’: The trading account or wallet has made its first deposit ‘Account Opened’: The trading account has been opened or bound to a client ‘Traded’: The bound trading account has a opened a position or created a trade history These system tags are also added as a new field in the filters for the ‘Client’ list, where admins can check and filter accounts that have performed specific actions, in order to follow up with them. The filtering system has also been enhanced to filter by ‘Trading Account’ and ‘Lead Source’. Deposit Settings We have added an automatic retry function in the event of a deposit auto-approval failure. Admins can trigger this function by checking “Automatic retry on audit failure” to allow the system to automatically retry failed approval requests. This function allows the system to automatically attempt re-approval in the event that the MT connection is unstable and causes deposit auto-approval to fail initially. Caution: When the system automatically retries deposit approval, it checks the trading platform’s database for the corresponding deposit records. However, in abnormal situations, if the database fails to sync the correct result, this will result in duplicate deposits. Brokers will then have to manually withdraw the incorrect funds or consider disabling this function. It is highly recommended that brokers using this function continuously perform account reconciliation to detect duplicate deposits. Retry settings: If the option ‘Automatic’ or ‘Partial Approval’ has been selected, and the ‘Automatic retry” box is checked, the system will perform a deposit retry on the failed records every 30 minutes for records within the hour. Notification settings: Admins can configure settings to send notifications to selected parties in the event of an automatic verification failure. A description field has been added to online deposit method in ‘Deposit Settings’. Users can now configure a time range according to time zones for their ‘Daily Deposit Settings’. Automated Affiliate Tier Upgrade As the core of the AXIS CRM, the multi-tier affiliate system has received another major upgrade. With the new automated tier upgrade function, affiliate promotions can now be self-triggered upon criteria fulfilment, allow brokers and IBs to manage their affiliate networks much more efficiently. Tier Upgrade Settings: Affiliate network tiers can now be upgraded automatically via a sophisticated rule-setting algorithm. Simply create a new rule and set the relevant parameters in which a client’s tier should be upgraded. When these criteria are met, the upgrade happens automatically with no manual administrative process required. Tier Upgrade Reports: Reports can be generated for an in-depth overview of clients and their current tiers, network hierarchy, their new upgraded tiers and more. A time range function has been added for which client reports can be viewed. Limits can be set for a number of weeks or months, and further segregated by levels of referred clients. Client Portal Client Dashboard(i) For quicker navigation, shortcuts to frequently-used functions have been added to the dashboard, so that clients can click on the icons to access them. (ii) An overview chart of the user’s ‘Total Balance’ in the last month can also be viewed from the dashboard. My ClientsClient data has been streamlined with a detailed ‘Client Distribution’ table, sorting number and percentage of clients by country. CommissionAn overview chart of the user’s ‘Commission’ in the last month can be viewed from the Referral tab. Exchange RateIf the exchange rate has been changed, a prompt will now appear when clients attempt to make a deposit, transfer, or withdrawal, to keep them informed and updated. Sign Up Free Trial Book a Demo

- 22.02.2023

- All

- READ MORE

In the foreign exchange (FX) market, liquidity providers and brokers work together to facilitate trading. Liquidity providers supply the market with tradable currency pairs and provide pricing information. Brokers, on the other hand, connect traders with liquidity providers and execute trades into the market, on their behalf.

- 15.02.2023

- All

- READ MORE

Liquidity providers play a crucial role in financial markets and exchanges to ensure a seamless execution of trades, and to provide buyers and sellers with the ability to buy and sell at any time. By providing liquidity to the market, liquidity providers help reduce volatility, ensure that prices remain stable, and minimize the risk of slippage - the difference between the expected trade price and the actual price.

- 10.02.2023

- All

- READ MORE

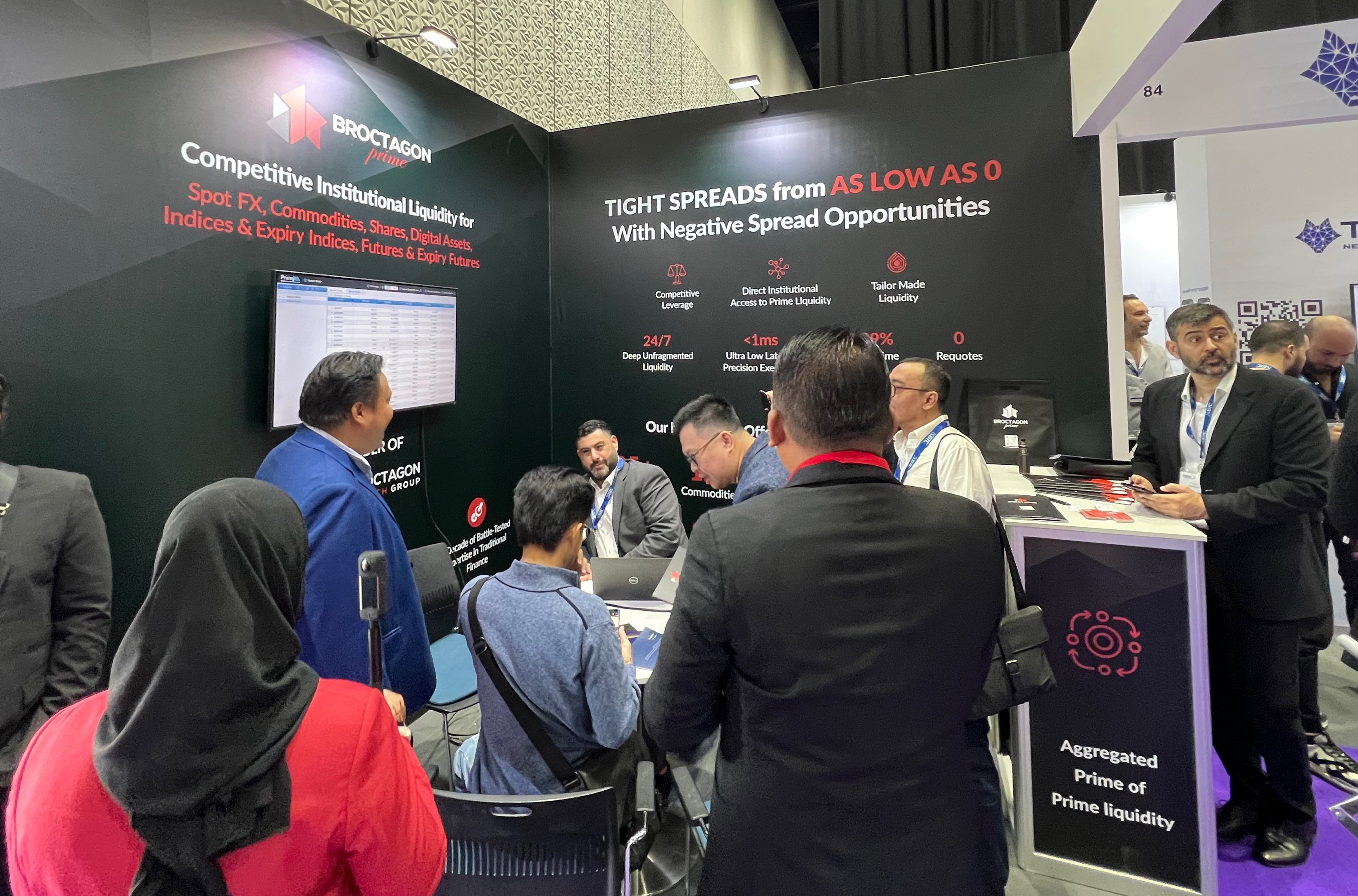

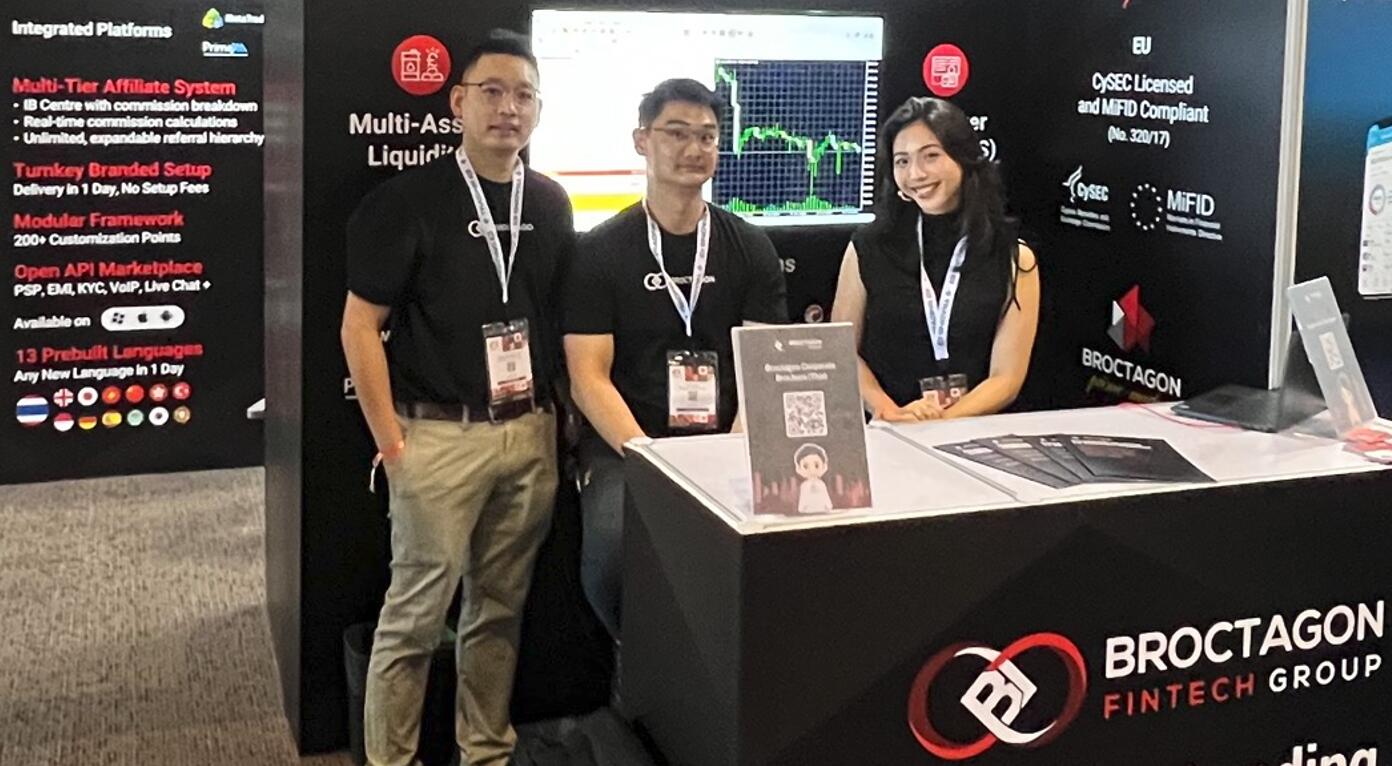

Broctagon was at the largest event of the B2B fintech industry, the first of the year, iFX Expo Dubai 2023. We were at Booth 85 from January 17-18, at the Dubai World Trade Centre, Za’abeel Hall 6. It was an extremely busy and fruitful two days at the Broctagon booth with overwhelming interest from the crowd over our competitive liquidity offering boasting tight spreads from as low as 0, unique customizability and wide range of instruments. We are grateful for all the new partnerships forged as well as the support of existing clients. Don't miss our expo-exclusive signup An expo highlight is our flagship product - AXIS - a highly-customizable powerful, modular CRM complete with an IB-centric module that boasts some of the most advanced affiliate marketing tools for rapid market expansion. For a limited time during the expo, we are offering prospective clients a risk-free signup to experience the spectacular features of AXIS, no setup or migration fees needed! Brokers who schedule a demo with us during the iFX Expo period (either virtual or in-person). Schedule a Consultation Schedule a meetup to find out about our performance-driven and bespoke solutions that will help your brokerage take the competitive edge. Scheduled a Consultation Scheduled a Consultation Past iFX Expos As veteran partners of iFX Expo, here’s a recap on our participation in last year's iFX expos around the world, sharing our expertise on building a competitive forex business with brokers globally.

- 19.01.2023

- All

- READ MORE

It's the first event of the new year! Start off the year with new inspiration as we once again convene at the leading global B2B fintech event, iFX Expo Dubai 2023! Join us in the UAE for a 2-day event where industry pioneers share and shape the next big idea in FX innovation.

- 15.01.2023

- All

- READ MORE

2022 welcomed roaring new ideation and innovation as the world came back from the 2020 pandemic year, with fintech events around the globe revived in full force again. Broctagon was honoured to be part of many global meetups and sharing unique business insight with friends and partners all over the world once again.

- 30.12.2022

- All

- READ MORE

Broctagon Fintech Group's Asian liquidity arm, Broctagon Prime Markets is now a licensed digital financial service provider under the Labuan International Business and Financial Centre (Labuan IBFC), Malaysia. This licence is a testament to Broctagon's excellence in digital asset liquidity, highlighting the regulatory emphasis and compliance to the AML/CFT and market conduct requirements of DFS businesses.

- 29.12.2022

- Broprime Markets

- READ MORE

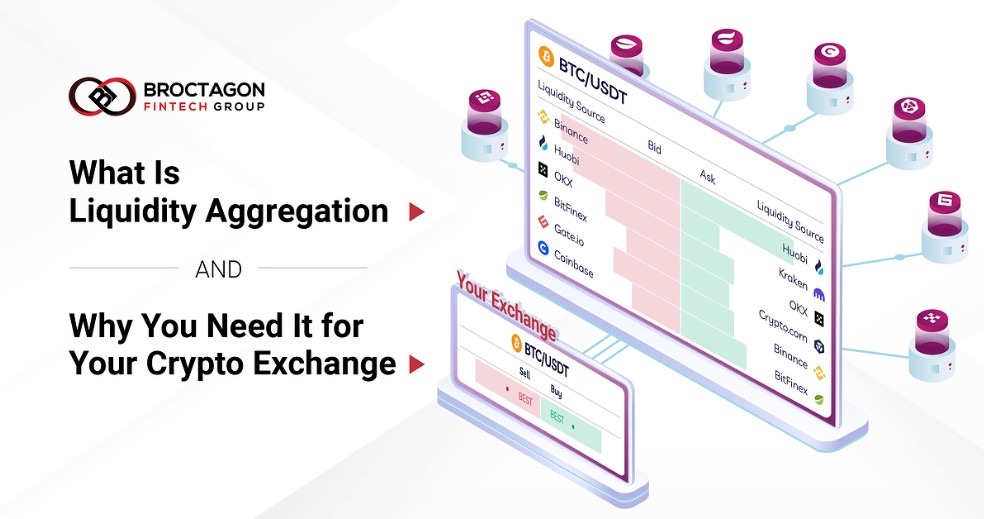

Liquidity in cryptocurrencies is important, but unlike the Forex market, there is a notorious lack of liquidity in the crypto market. The need for liquidity aggregation is therefore really crucial to bring crypto to the level of trading and activity like in the forex market. In this article, we’ll understand why liquidity is important and […]

- 30.11.2022

- Liquidity

- READ MORE

It all started from tinkering with his uncle’s MS-DOS personal computer when Ted was just in primary school. Today, Ted Quek is Broctagon's CTO (Chief Technology Officer) and Co-founder, a company that is a licensed multi-asset liquidity and technology provider headquartered in Singapore with global presence serving clients across 50 countries.

- 24.11.2022

- All

- READ MORE

Brokerages with Broctagon's AXIS CRM can now reward their traders better with an improved, highly-configurable system for new client acquisition.

- 10.09.2020

- Products

- READ MORE

Broctagon has launched NEXUS' Native Altcoin Liquidity Management, allowing exchanges to regulate the demand and supply of their native altcoins.

- 02.09.2020

- Products

- READ MORE

Singapore-based Broctagon Fintech Group has upgraded its NEXUS 2.0 liquidity aggregator technology, with the launch of Native Altcoin Liquidity Management.

- 02.09.2020

- In The Press

- READ MORE

Brokerages with AXIS can now bring greater convenience and flexibility to their traders experience on the platform, now with the added capability to accept over 40+ cryptocurrency deposit types.

- 02.06.2020

- Products

- READ MORE

Covid 19 has heavily impacted the the crypto markets within the past few months. Learn how to hypercharge your exchange liquidity during the bearish run.

- 14.05.2020

- Products

- READ MORE

Halving might boost Bitcoin price due to its added scarcity, giving it a positive trend, says Broctagon CEO Don Guo in his analysis to CoinDesk.

- 04.05.2020

- In The Press

- READ MORE

Broctagon Fintech Group has pledged a donation of 58,000 surgical masks, in support of Contribute SG’s initiative, to the healthcare professionals and frontline workers fighting in the field of the Coronavirus Disease 2019 (COVID-19).

- 18.04.2020

- News

- READ MORE

Multi-asset liquidity provider Broctagon has launched NEXUS 2.0, a new service designed to tackle the issue of crypto exchange price disparity. | Coin Rivet

- 11.12.2019

- In The Press

- READ MORE

Broctagon was present at the recently-concluded Saigon Financial Education Summit (SFES), held at Ho Ch Minh City, Vietnam, on September 21st 2019.

- 24.09.2019

- Awards

- READ MORE

- 04.01.2024

- All

- READ MORE

- 09.11.2023

- All

- READ MORE

- 02.11.2023

- All

- READ MORE

As the coronavirus starts to impact global growth prospects, how will cryptocurrencies hold up? Bitcoin could be perceived as a safe haven asset. | Bloomberg

- 02.03.2020

- In The Press

- READ MORE

The red dragon has been making some interesting regulatory moves over the past couple of months, seen from its crypto crackdown and launch of the DCEP.

- 05.12.2019

- Thought Leadership

- READ MORE

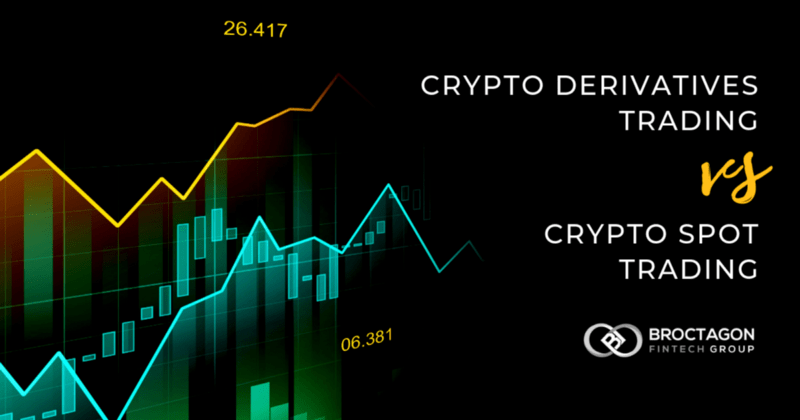

For those looking to predict and profit from moves in crypto trading, simply following mainstream activity isn’t enough to keep them ahead of the game.

- 27.07.2019

- Thought Leadership

- READ MORE

Cryptocurrencies have emerged as an exciting asset class for investors. As a trading asset in its infancy stage, spot trading has traditionally accounted for majority of crypto trading.

- 24.06.2019

- Thought Leadership

- READ MORE

The cryptocurrency will be released in the first half of 2020, with great excitement from the community as many see it as a great potential to disrupt many industries.

- 19.06.2019

- Thought Leadership

- READ MORE

Historically, professional traders are subject to ever-shifting regulatory climates, especially traders with a preference towards leveraged products.

- 07.06.2019

- Thought Leadership

- READ MORE

Initial Exchange Offerings are addressing the market need by overcoming some of the limitations associated with first-generation token sales and driving the market ahead.

- 10.05.2019

- Thought Leadership

- READ MORE

As we discuss its position as a frontier in technology, blockchain — with all its applications and hype as the ‘future of money’ — does not come without a cost

- 22.04.2019

- Thought Leadership

- READ MORE

It's ironic that blockchain can save the planet due to it's energy-intensive nature, but with the right adoption, it just might.

- 18.03.2019

- Thought Leadership

- READ MORE

- 13.07.2023

- All

- READ MORE

- 05.07.2023

- All

- READ MORE

- 23.06.2023

- All

- READ MORE

- 15.02.2023

- All

- READ MORE

The NEXUS can provide liquidity needed to make the market a fairer place for all, allowing smaller exchanges to have a truly competitive offering. | Finance Magnates

- 11.12.2019

- In The Press

- READ MORE

Given the potential of digital assets, this move could be check-mate for China in the trade war against the US, says Don Guo, CEO of Broctagon Fintech Group. | Block Tribune

- 02.12.2019

- In The Press

- READ MORE

Broctagon offers Islamic compliant gold and oil trade offerings backed by physical gold, and by tying the prices of oil futures from exchanges around the world without any positive or negative swaps. | Forbes

- 06.11.2019

- In The Press

- READ MORE

Blockchain is beneficial to many industries, but businesses find it tough to integrate. Broctagon identified the need for Blockchain-as-a-Service. | Forbes

- 23.10.2019

- In The Press

- READ MORE

Calling it "another huge blow to Facebook's digital currency project", Don Guo, Broctagon's CEO, said the decision came as "no surprise". | The Independent

- 07.10.2019

- In The Press

- READ MORE

“Digital currencies are coming into the mainstream and international competition is heating up," Don Guo, Broctagon's CEO responds to China's 'new Bitcoin'. | The Indepedent

- 30.08.2019

- In The Press

- READ MORE

“Libra’s launch is undoubtedly an exciting move for the industry. This would be a huge step towards crypto going mainstream.” | Bloomberg

- 28.06.2019

- In The Press

- READ MORE

Singapore-based Broctagon is a fast-growing technology provider that merges traditional finance with the innovations of blockchain technology, offering complete forex solutions, end-to-end blockchain services, deep institutional multi-asset liquidity.

- 17.05.2019

- In The Press

- READ MORE

Broctagon would be working alongside trading technology firm TradAir to provide cryptocurrency liquidity akin to the foreign exchange (FX) market. | Finance Magnates

- 14.01.2019

- In The Press

- READ MORE